Pan Canadian Lithium holds the mining claims to highly prospective lithium projects located in Saskatchewan and Ontario, Canada. The claims cover a total of 49,248 hectares and were identified using regional lake sediment samples obtained from provincial geochemical data that were highly anomalous with lithium pathfinder elements. Targa believes that the projects display significant potential for lithium bearing pegmatites.

Highlights

- Targa is acquiring a portfolio of lithium exploration projects in world-class mining jurisdictions totalling 49,248ha.

- Pan Canadian Lithium holds two projects in Saskatchewan never before explored for lithium, including district-scale White Metal Project, with local known lithium occurrences.

- Pan Canadian Lithium also holds two projects in Ontario with year-round road access and local rail line, located in same geological belt as other known lithium deposits.

The Projects

Pan Canadian Lithium owns a 100% interest in four exploration projects with two located in each of the provinces of Saskatchewan and Ontario.

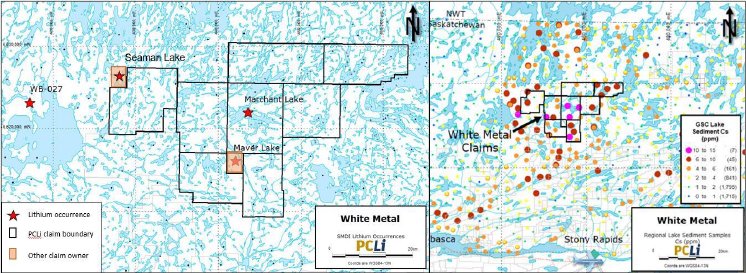

White Metal Project

The White Metal Project, located 40km north of Stony Rapids in northern Saskatchewan, consists of eight contiguous mineral concessions totalling 38,765ha. The claims cover the highest concentration in Saskatchewan of regional lake sediment samples from the Geological Survey of Canada dataset that are anomalous for cesium, rubidium, and tantalum, elements considered pathfinders for lithium mineralization.1 Several noted pegmatites from the Saskatchewan Mineral Deposit Index are also located on or adjacent to the White Metal Project with anomalous lithium concentrations up to 271ppm.2

With historical exploration activities in the region primarily focused on uranium, White Metal represents a district-scale opportunity to explore for lithium mineralization in a mining-friendly jurisdiction.

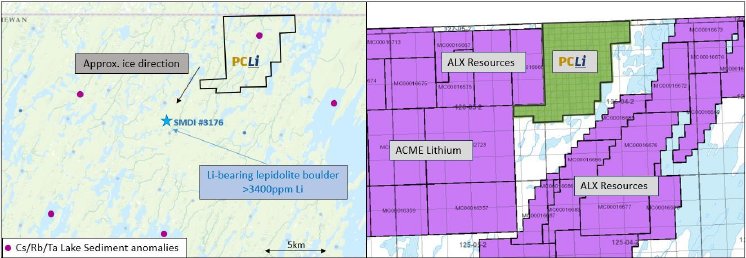

Prince Albert Project

The Prince Albert Project, located in northeast Saskatchewan, covers 2,895ha of prospective geology including a band of metasediments and metavolcanic rocks in close proximity to a granite intrusion. Boulders with lithium contents over 3,400ppm have been found several kilometers to the southwest by other explorers, potentially in the down-ice glacial direction from Prince Albert.3 The Prince Albert Project is adjacent to other active lithium exploration projects held by ACME Lithium and ALX Resources.

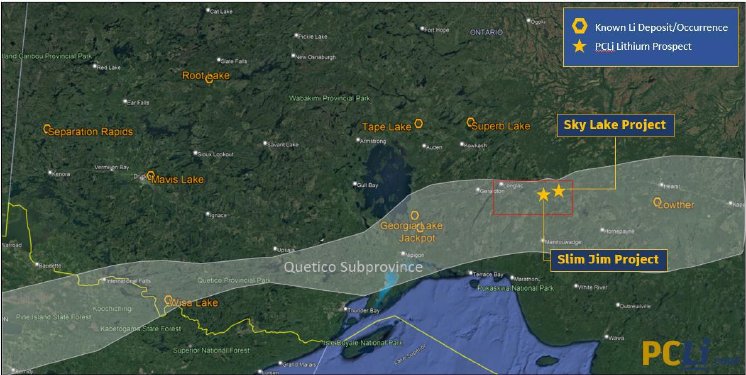

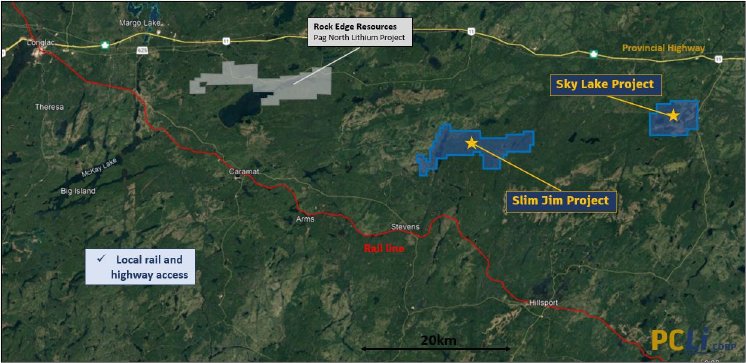

Slim Jim and Sky Lake Projects

The Slim Jim and Sky Lake projects are located in the Quetico Subprovince in northwestern Ontario. The Quetico Subprovince is host to several known lithium pegmatite deposits and occurrences, most notably the Georgia Lake and Jackpot deposits and the Wisa Lake and Hearst/Lowther occurrences.

Both the Slim Jim and Sky Lake projects have good local infrastructure with year-round road access from the nearby provincial highway and are near a rail line. The projects are approximately 115km northeast of Marathon, Ontario and 60km east of the community of Longlac.

The Slim Jim Project covers 4,746 ha of mostly metasediments along the boundary of a muscovite-bearing granite intrusive with noted pegmatite. Local lake sediment samples across the Slim Jim Project have elevated values of lithium, cesium, rubidium, and tantalum4. The majority of the Slim Jim Project area has never been mapped in detail and lies within the 4km “Goldilocks Zone” for LCT-type pegmatite emplacement around the parental granite.5 Several faults also run through the Slim Jim Project and could present favorable pathways for pegmatite intrusion.

The Sky Lake Project is located about 16km east of Slim Jim and is 2,842ha in size. The Sky Lake Project is centered on a cluster of lake sediment samples with anomalous lithium, cesium, rubidium, and tantalum and has a fault structure running north-south through the project4. A muscovite-bearing peraluminous granite unit is exposed just south of the Sky Lake claim boundary and beryliferous and tourmaline/garnet-bearing pegmatites have been observed approximately 6km north of the Sky Lake Project.6 Sky Lake is also covered with a network of logging roads, making for easy access and low-cost future exploration work.

Acquisition Agreement

Pursuant to the Acquisition Agreement, the Company will issue 5,766,666 common shares in the capital of the Company (the “Consideration Shares”) to the shareholders of Pan Canadian Lithium (the “Vendors”). Upon completion of the Acquisition and other transactions previously announced by the Company, the Vendors will own approximately 9.9% of the issued and outstanding shares in the capital of the Company, on a non-diluted basis.

The Consideration Shares will be subject to a four-month hold period pursuant to applicable Canadian securities laws. The Acquisition is subject to standard closing conditions for transaction of this nature. Subject to the satisfaction of the closing conditions, the Acquisition is expected to close on or about May 19, 2023.

All parties to the Acquisition are arm’s length to the Company. No finder’s fee is payable in respect of the Acquisition.

At closing of the Acquisition, Targa will also acquire Pan Canadian's positive cash position of approximately $240,000.

Incoming CEO

Upon closing of the Acquisition, Cameron Tymstra, currently the Chief Executive Officer of Pan Canadian Lithium, will join the Targa management team as Chief Executive Officer. Mr. Tymstra is currently President and CEO of Tarachi Gold Corp., a Mexico-focused gold exploration company and has worked in mining and mineral exploration throughout the Americas for the past 15 years. He holds a degree in mineral engineering from the University of Toronto and a Master’s in mining management from the South Dakota School of Mines.

Jon Ward will continue working on the Targa management team following closing of the Acquisition in his new role as Vice President of Corporate Development and will remain a director on Targa’s board.

Cameron Tymstra, CEO of Pan Canadian Lithium, commented: “On behalf of Pan Canadian Lithium shareholders, we are very pleased to be combining our portfolio of lithium exploration assets with Targa’s exciting projects in Quebec and Manitoba. I am eager to be joining the executive team at Targa and looking forward to working with Mr. Ward and the rest of the team as we explore our newly combined assets this year.”

References

- GSC Lake Sediment Analyses – Saskatchewan Government. November 2019. https://geohub.saskatchewan.ca/...::gsc-lake-sediment-analyses-1/about

- Saskatchewan Mineral Deposit Index – Merchant Lake (SMDI #3302), Seaman Lake (#3304), Maver Lake (#3303), WB027 (#3321). https://applications.saskatchewan.ca/...

- Saskatchewan Mineral Deposit Index – SDMI #3176. https://applications.saskatchewan.ca/...

- MRD064 – Lake Sediment and Water Quality Data from the Nakina-Longlac Area, Northwestern Ontario: Operation Treasure Hunt – Area B. 2000, Ontario Geological Survey, Open File Report 6035.

- Bradley, D.C., McCauley, A.D., and Stillings, L.M., 2017, Mineral deposit model for lithium-cesium-tantalum pegmatites: U.S. Geological Survey Scientific Investigations Report 2010-5070-O, p. 28.

- Breaks et al. 2002, Fertile and Peraluminous granites and related rare-element pegmatite mineralization, Superior Province, northeastern Ontario; in Summary of Field Work and Other Activities 2022. Ontario Geological Survey, Open File Report 6100, p.6-1 to 6-42.

Targa Exploration Corp. (CSE: TEX | FRA: V6Y) is a Canadian exploration company engaged in the acquisition, exploration, and development of mineral properties with headquarters in Vancouver, British Columbia.

Technical Information

The scientific and technical content of this news release has been reviewed and approved by Lorne Warner P.Geo., who is a "qualified person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Pan Canadian Lithium’s properties.

Contact Information: For more information and to sign-up to the mailing list, please contact:

Jon Ward, President and Chief Executive Officer

Tel: +1(604) 355-0303

Email: jon@inventacapital.ca

Website: www.targaexploration.com

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward‐Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward‐looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: completion of the Acquisition; exploration and development of the Company’s properties.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Targa, future growth potential for Targa and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of lithium and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Targa’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Targa’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Targa has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company's mineral exploration activities in Canada; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding mineral resources and reserves; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in Targa’ management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Targa has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Targa does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.