The strategic partnership brings together two groups with a common focus on exploration, discovery and development in the Abitibi greenstone belt. Maple is contributing its Douay Project and Agnico is contributing its Joutel Project, a property that hosted its past-producing Telbel mine. Together, the groups plan to advance on exploration to test new targets and expand the known mineralization. Data review, compilation and re-interpretation of the adjacent properties together under modern approaches offer unique opportunities to evaluate the camp as a whole.

Highlights of the Transaction are summarized below:

- Agnico to contribute its 39 km² Joutel Project, which hosted Agnico's past-producing Telbel mine (reclamation area and associated liabilities are excluded from the JV);

- Agnico to make strategic investment at a premium to bring basic share ownership to 12.8% and partially-diluted ownership to 19.9%;

- Agnico to solely fund C$18 million in exploration over a four-year term;

- Agnico and Maple to jointly fund an additional C$500,000 in exploration of VMS targets on the western portion of the Douay Project;

- Agnico to contribute its technical expertise to the JV through Joint Operatorship;

- Agnico to support Maple Gold in its pursuit of third-party project financing for the development phase; and

- On formation of the JV, Maple Gold and Agnico will each be granted a 2% NSR on the property that they contribute to the JV, each with aggregate buyback provisions of $40 million.

Mr. Hornor added, "The strategic investment brings Maple Gold's cash balance to more than C$12 million which, when combined with the C$18 million in JV funding, results in a strong capital position to be directed at exploration, development and new corporate growth opportunities. The strength of Maple Gold's balance sheet, along with the strategic partnership with Agnico and their support with future project financing, will put us in a strong position to create shareholder value."

Maple Gold and Agnico share a common vision for realizing the potential at the consolidated Douay-Joutel Project. The companies believe that a modern approach to exploration has the potential to lead to new gold discoveries and expanded mineral resources. The established gold resource at Douay (RPA 2019) and opportunities to expand the system's known footprint with step-out drilling along with aggressive regional exploration has the potential to deliver a series of exploration successes across the consolidated property package.

Transaction Details

Subject to the terms and conditions of the Binding Term Sheet, Agnico and Maple Gold have agreed to negotiate in good faith and use commercially reasonable efforts to enter into a joint venture agreement (the "JV Agreement") within three (3) months of signing the Binding Term Sheet.

Property Package

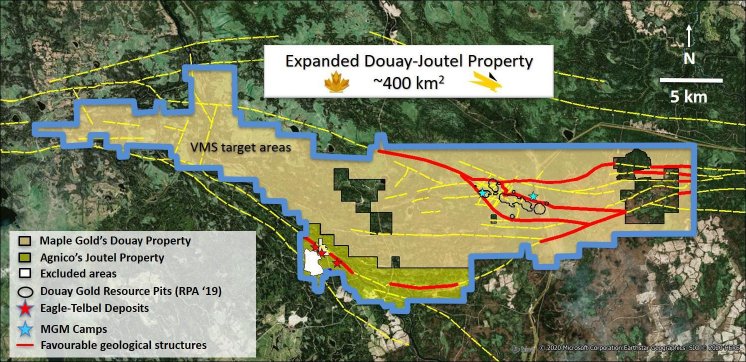

Figure 1: Douay and Joutel Property Package

The Douay and Joutel projects are adjacent properties located in the Abitibi region of Quebec, with the Joutel Project hosting Agnico's past-producing Telbel mine. Both Douay and Joutel have multiple styles of mineralization, including deep controlling structures, which are generally favorable for exploration and the discovery of mineralized systems.

JV Funding

Agnico will fund an aggregate of C$18 million of JV expenses over a four-year period as outlined below:

- C$4 million by the first anniversary of the JV Agreement;

- C$8 million by the second anniversary of the JV Agreement;

- C$13 million by the third anniversary of the JV Agreement; and

- C$18 million by the fourth anniversary of the JV Agreement.

Each of Agnico and Maple Gold will retain a 2% net smelter return royalty on the property that they contribute to the JV (each, the "Contributed Property NSR"). The first 1% of each Contributed Property NSR may be repurchased at any time by the non-holding party for $15 million and the second 1% of each Contributed Property NSR may be repurchased at any time by the non-holding party for $25 million. In addition, transfer of each Contributed Property NSR will be subject to a right of first refusal.

Technical Expertise

In addition to funding JV expenses and contributing the Joutel Project to the JV, Agnico will also support the JV with access to Agnico's technical expertise as an explorer, developer and operator with decades of experience in the Abitibi region of Quebec.

Development Phase Financing

In connection with the process of considering financing alternatives, Agnico has agreed to use commercially reasonable efforts to investigate third-party financing for the JV and to provide commercially reasonable support and assistance to Maple in connection with Maple's pursuit of Maple's share of financing for the development phase of the JV.

Strategic Investment

In conjunction with the Binding Term Sheet, Agnico has also agreed to acquire, by way of private placement, approximately 25.84 million units ("Units") of Maple Gold at a price of approximately C$0.24 per Unit for gross proceeds of approximately C$6.2 million (the "Financing"). Each Unit is comprised of one common share of Maple Gold (a "Common Share") and one common share purchase warrant of Maple Gold (a "Warrant"). Each Warrant entitles the holder to acquire one Common Share at a price of C$0.34 for a period of three years following the closing date of the Financing. Upon closing of the Financing, Maple Gold will have more than C$12 million in cash.

Prior to the Financing, Agnico owned 4.4% of Maple Gold’s issued and outstanding Common Shares. On closing of the Financing, Agnico will own 34.6 million Common Shares and approximately 25.84 million Warrants, representing approximately 12.8% of the issued and outstanding Common Shares and 19.9% of the issued and outstanding Common Shares on a partially-diluted basis. The securities issued to Agnico will be subject to a four month hold period, in accordance with applicable securities laws.

The Warrants provide that, beginning two years from the date of issue, if the price of the Common Shares on the TSX Venture Exchange exceeds C$0.60 per Common Share for at least 20 consecutive trading days, Maple Gold shall have the right to accelerate, by notice to Agnico, the expiry date of the warrants to 30 calendar days after the date of such notice (such that Agnico may either exercise all or a portion of the Warrants in such 30 day period, or failing such exercise, any unexercised Warrants would expire).

Concurrently with the Financing, Agnico and Maple Gold have entered into an investor rights agreement (the "Investor Rights Agreement") that provides, among other things, Agnico with certain rights in the event it maintains minimum ownership thresholds in the Company, including: (i) the right to participate in equity financings; and (ii) the right (which Agnico has no present intention of exercising) to nominate one person to Maple Gold's board of directors. In addition, pursuant to the Binding Term Sheet, Agnico has agreed to a two-year standstill with respect to the acquisition of additional securities in Maple Gold, other than acquisitions pursuant to Agnico's rights under the Investor Rights Agreement.

Fort Capital Partners has acted as advisor to Maple Gold with respect to capital markets strategy and the Financing. Completion of each of the JV and the Financing is subject to the approval of the TSX-Venture Exchange.

Qualified Person

The scientific and technical data contained in this press release was reviewed and prepared under the supervision of Fred Speidel, M. Sc., P. Geo., Vice-President Exploration of Maple Gold. Mr. Speidel is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Speidel has verified the data related to the exploration information disclosed in this press release through his direct participation in the work. For a complete description of protocols, please visit the Company's QA/QC page on the website.

For more information on Agnico Eagle: https://www.agnicoeagle.com

About Maple Gold

Maple Gold Mines Ltd. controls the 357-square-kilometre Douay Gold Project located within the prolific Abitibi Greenstone Gold Belt in northern Quebec, Canada. The Project has an established National Instrument 43-101 gold resource (RPA 2019) of 422,000 ounces in the Indicated category (8.6Mt grading 1.52 g/t Au) and 2.35 million ounces in the Inferred category (71.2Mt grading 1.03 g/t Au) with significant potential for resource expansion and new discoveries. The Project benefits from exceptional infrastructure access and the Company is currently focused on carrying out aggressive exploration programs to expand and update the known resource. For more information, please visit www.maplegoldmines.com.

Forward Looking Statements:

This press release contains "forward-looking information" and "forward-looking statements" (collectively referred to as "forward-looking statements") within the meaning of applicable Canadian securities legislation in Canada, including statements about the completion of the JV and Financing and use of proceeds of the Financing. Forward-looking statements are based on assumptions, uncertainties and management's best estimate of future events. Actual events or results could differ materially from the Company's expectations and projections. Investors are cautioned that forward-looking statements involve risks and uncertainties. Accordingly, readers should not place undue reliance on forward-looking statements. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Maple Gold Mines Ltd.'s filings with Canadian securities regulators available on www.sedar.com or the Company's website at www.maplegoldmines.com. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.