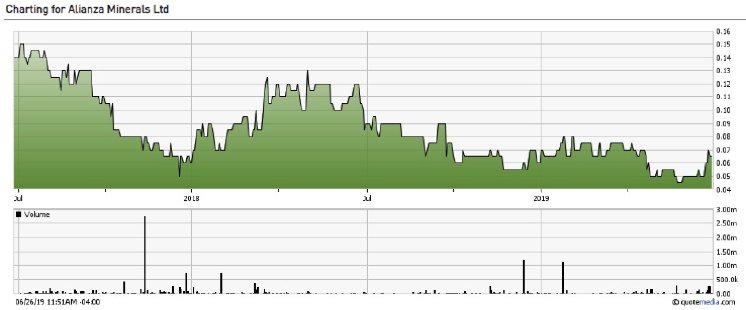

Fortunately, sentiment turned positive after gold started a strong upward move, even to the tune of a breakout, after it breached a longstanding resistance (US$1360-1380/oz), causing everybody to have a more positive stance. As silver didn’t follow gold as aggressively, the Alianza share price didn’t react, but this changed quickly after the financing and the Coeur LOI were announced.

Let’s have a closer look at Alianza’s activities.

The financing is a combination of flow through (4,166,666 shares @6c) and non-flow through (10,000,000 units @5c including a 3 year full warrant exercisable at 10c), adding C$500k for exploration and working capital and C$250k for Yukon exploration. The financing is expected to close within 2 weeks, and finder’s fees of 7.5% in cash/warrants will be paid to eligible parties. These terms indicate the harshness of the current investment climate in mining, as in better times just 5% in cash is normal.

8% is about the highest I have come across in 2015, so Alianza management did good to raise some cash at all nowadays. It is not that they really needed the fresh cash for exploration, but they are working on six projects now, four of them being funded by JV partners, so they wanted to expand on their own exploration program for Haldane, and expand on investor relation programs to increase investor awareness further, with newsflow incoming.

On June 20, 2019, Alianza signed a Letter of Intent (LOI) with Coeur Explorations, a wholly owned subsidiary of Coeur Mining, to explore the road-accessible Tim Property in southern Yukon Territory. Exploration at the Tim Property is targeting high-grade silver-lead-zinc mineralization similar to that being currently mined by Coeur at its Silvertip mine located 12 km to the south of the Tim Property. Coeur was a logical suitor for an eventual JV, as there were apparently so many similarities between Tim and Silvertip, that the owners at the time literally rolled the dice when to decide which property to drill first. Alianza and Coeur are obviously hoping for Tim to become another orebody for feed at Silvertip. Let’s wait and see.

Coeur can earn a 51% interest in the property by funding C$3.5 million in exploration over 5 years and making staged cash payments totalling C$275,000. Coeur can elect to complete the option to earn 80% in the property by funding a positive feasibility study in the following three years and making annual payments of C$100,000. Coeur is the operator here. I estimate the budget of a FS for this project in the range of $5-8M, so it is an interesting JV for Alianza.

Exploration for Tim is targeting high-grade silver-lead-zinc Carbonate Replacement Mineralization (CRM), similar in style to that found at Coeur Mining’s Silvertip Mine, located 12 km to the south. Alianza also received a small YMEP (Yukon Mining Exploration Program) grant for the Tim project. Under this program, the Yukon government provides funding to support mineral exploration activities for 50% of eligible expenditures to a maximum of $40,000.

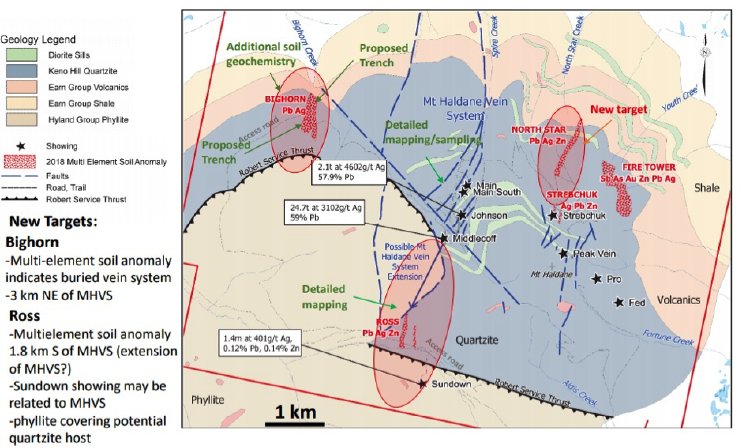

For Haldane, the 2018 field program identified a new silver vein target at the Bighorn Anomaly, 2.5 km from known mineralization at the MHVS (Mount Haldane Vein System) targets where work extended the potential strike length to over 3.5 km. Trenching and/or drilling are planned for these targets, and good results will upgrade the project for further work which may be funded by a partner. I contacted CEO Jason Weber about the program, and he provided me with this map with additional comments in green:

According to Jason Weber, this is setting up and refining the drill hole locations for Phase II (later in August). Alianza has planned detailed mapping and trenching at the Bighorn anomaly to define potential mineralized structures and controls. Also, additional soil sampling will be completed to the west of the Bighorn anomaly.

Besides this, detailed mapping at the Ross anomaly is planned in order to define controlling structures and refine the location of the offset fault on the Robert Service Thrust (see low right on map). This too will aid in the location of drillholes for the phase II drill program. Additional detailed mapping and sampling will be done in the MHVS main area. This includes old trenches, where again, structural mapping will be stressed.

As management doesn’t expect veins to outcrop at surface (although they hope to get lucky), they are looking for signs of faults (that if having the right orientation, may host target veins) and any altered float material that may be weathered from vein structures. These may manifest themselves as breaks in slope, linear gullies (TCI: large ditches) etc. Any information the geologists can gather in this way can be compiled to infer structure location and therefore to help refine drill hole locations.

Another interesting development was the JV with Hochschild from March 4, 2019. They have optioned three Nevada sediment-hosted gold properties from Alianza. The BP and Bellview properties are located in the southern extension of the Carlin Trend, while the Horsethief property represents an off-trend gold target located 26 km east of Pioche, NV. The Horsethief property is considered the most prospective by Alianza, and already was the focus of attention. Hochschild seems to think in the same direction. They can earn a 60% interest in each property by making the following exploration expenditures:

- over 4.5 years totalling US$2.5 million at BP and totalling US$3.5 million at Bellview and

- over 5.5 years totaling US$5 million at Horsethief.

Here are the full terms of the option agreements of the Hochschild JV, per the news release:

1.Horsethief Property

Hochschild can earn a 60% interest in the Horsethief Property by conducting US$5 million in exploration on the property over a 5.5 year period, with a committed minimum expenditure of US$500,000 in the first 18 months and a minimum US$500,000 in each subsequent year. Within 60 days of acceptance of the first option, Hochschild may elect to undertake a second option to earn an additional 10% (total 70%) in the property by funding a further US$5 million in exploration over 3 years (minimum US$500,000 in exploration per year).

2.Bellview Property

Hochschild can earn a 60% interest in the Bellview Property by conducting US$3.5 million in exploration on the property over a 4.5 year period, with a committed minimum expenditure of US$100,000 in the first 18 months and a minimum US$500,000 in each subsequent year. Within 60 days of acceptance of the first option, Hochschild may elect to undertake a second option to earn an additional 10% (total 70%) in the property by funding a further US$3.5 million in exploration over 3 years (minimum US$500,000 in exploration per year).

3.BP Property

Hochschild can earn a 60% interest in the BP Property by conducting US$2.5 million in exploration on the property over a 4.5 year period, with a committed minimum expenditure of US$100,000 in the first 18 months and a minimum US$500,000 in each subsequent year. Within 60 days of acceptance of the first option, Hochschild may elect to undertake a second option to earn an additional 10% (total 70%) in the property by funding a further US$2.5 million in exploration over 3 years (minimum US$500,000 in exploration per year).

Alianza will be the operator. Hochschild will reimburse Alianza for 2018 property taxes and permit costs, totalling approximately US$41,600.

Conclusion

Alianza Minerals is successful so far in following the hybrid prospect generator model, as they raised over C$1.5M since December 2018, and signed two deals with Hochschild and Coeur, two household silver names in the space. The foundation seems to be solid, now it is time to build on it, by own and JV exploration work, preferably drilling as soon as possible. After target refining, drilling at Haldane will finally start in August of this year, and I am looking forward to it. According to Jason Weber, drilling funded by Hochschild could start in .Q4 2019, Coeur is defining targets this year and will look into drilling next year.

As a reminder, I view the 100% earn-in flagship project Haldane as a prospective high grade silver exploration opportunity, and I’m very interested if they can hit some really high grade intercepts, as has happened in many places at and around Haldane in the past. The projects funded by Hochschild and Coeur should generate newsflow as well this year, so it will be a busy year for Alianza Minerals, hopefully with good news for investors.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Alianza Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.alianzaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

written by the https://www.criticalinvestor.eu/