The company only recently managed to raise C$1.00M after announcing this in August 2023, spread out over two tranches, and is preparing now for a new 2024 exploration season for their flagship Haldane Silver project in the Yukon.

It seems like a good time to interview President & CEO Jason Weber, discussing the various topics that might interest investors, from past, present to future developments, and hear him elaborate on why Silver North might be a good exploration bet this year.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

When looking at the 3 year chart below, it can be seen that the Silver North stock received fresh interest when the name change and roll-back were executed in August 2023. This didn’t last too long however, as the financing took a long time to materialize, with only a first C$815k tranche closed on October 19, 2023, too late to do the planned autumn exploration because of the upcoming winter break in the Yukon, and not enough to complete a full drill program at Haldane.

As Silver North traded at C$0.22-0.25 at the time, the two tranches consisted of C$0.20c common shares with a half 3y C$0.30c warrant, and C$0.20 Flow Through (FT) shares. The second tranche of C$185k was closed just in time at December 27, 2023, as the deadline for FT taxation purposes is December 31, 2023. Especially the FT discount (at least in October) didn’t come from strength, as usually for taxation reasons FT is issued at a 20-40% premium. This was somewhat surprising to me, considering the strong backing they enjoy from the likes of Fruchtexpress and Pacific Opportunity Capital, but more on this in a minute.

With C$0.7M in the treasury nowadays, Silver North seems to have at least a bit of a financial base for 2024, and as CEO Jason Weber is an exploration geologist, I expect the company to go out drilling as fast as possible in the spring. As I’m curious about his plans, but also wanted to hear more context about events leading up to the current status, it was time to sit down with CEO Weber and discuss Silver North in more detail.

The Critical Investor (TCI): Hi Jason, good to speak to you again. Silver North has seen quite a bit of events last year, most importantly in my view leaving the longtime prospector generator model, but it also experienced an important non-event, as the company wasn’t able to do any exploration in the second half of 2023, as the funds weren’t there in time. Could you explain to the audience why the financing took so long, effectively delaying the plans for autumn drilling until after the winterbreak?

Jason Weber (JW): It is no secret that the junior financing market was incredibly weak through the second half of 2023. Unfortunately, we at Silver North were not immune to what was facing most junior explorers through this period, but we were able to get some funds in the treasury to get a leg up on next year’s program at Haldane.

TCI: Could you give us some names of well-known investors or institutionals that participated in this financing?

JW: We actually worked very hard to bring in new groups to the story which together with management and current insiders filled out the two tranches of the financing.

TCI: Let’s get back to the strategy change for a bit. You told me the last time we got together that you felt that Haldane, and by extension, the entire company was not getting the recognition for the silver discoveries made to date (and the potential for new ones) especially considering that the project is located in one of the world’s highest grade silver districts with over 100 years of production history.

As a silver focused junior explorer, the company can more efficiently direct its efforts in unlocking the value at Haldane with a much simpler and streamlined story for investors. You also felt strongly that the outlook for silver was very positive, especially when one considers the vital role silver plays in the transition to a green economy in everything from solar panels to electric vehicle. I fully agree with your arguments. Isn’t it the case for many if not all prospect generators that it is hard for investors to recognize the value of various, sometimes many minority interests, often operated by third parties?

JW: Yes it is very unfortunate, because I think the prospect generator business model can be extremely lucrative for shareholders, however it is also one of the most challenging business models to execute. To elaborate a bit more on this: with prospect generating you are always pitching your projects to producers, based on their technical merits without much available data, akin to geological concepts or ideas. Producers have very knowledgeable geologists and certain thresholds for size, grade etc, and you must develop a level of trust before they will take on an early stage project, so it can be pretty difficult sometimes to get them on board. On the other hand if you succeed it is a considerable stamp of approval of course. I also think that you have to constantly evaluate your projects and their potential value. If the greatest return can be obtained by funding exploration with your own treasury (and therefore maintaining full exposure to the value of the project) you must take that approach – which is what we recognized with Haldane.

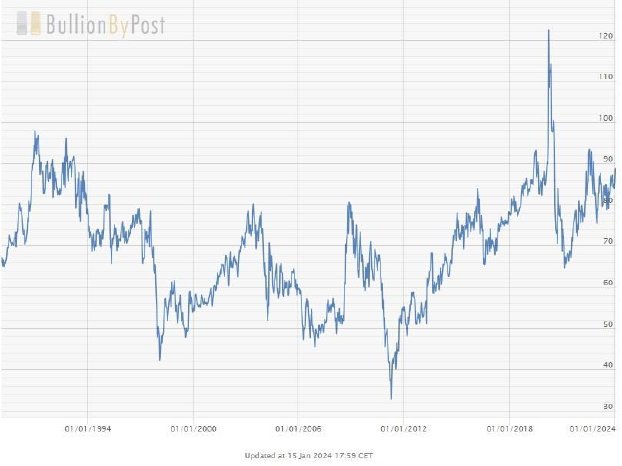

TCI: And to your second point: for some reason silver doesn’t seem to get the love gold does, as the gold/silver ratio is skewing towards gold again:

I haven’t seen silver going up on the EV boom notwithstanding that artificial Reddit spike in 2020, and gold is trading relatively higher since 2013 or so. Could there be specific reasons for this you think?

JW:I disagree, I think we have seen silver move with gold, perhaps with just more volatility than gold. I hesitate to say that silver isn’t going up on the EV boom, I think the arguments one makes for silver and its industrial usage are long term. The last six months are a very short period, and a volatile one at that – I am looking at the outlook for silver as positive long term. I do believe that we are seeing the earliest stages of a recovery in the silver price and that volatility we have seen is part of that.

TCI: With the Alliance still holding the Stateline and Klondike properties, and having seen numerous suitors looking at the properties last year, could you enlighten us with the current state of affairs for the Alliance and these two projects? As I recall you told me there was a lot of interest, and both projects have solid targets to explore.

JW: Again, with the weakness in the financing markets for juniors, potential partners are finding it difficult to raise funds for exploration. That has delayed the process of signing up new partners. Silver North is trying to divest Stateline and Klondike, as we manage these projects. Volt Lithium (previously Allied Copper), who partnered with the Alliance on Klondike and Stateline, has already paid for our current holding costs and exploration expenditures so there is no financial risk for us right now.

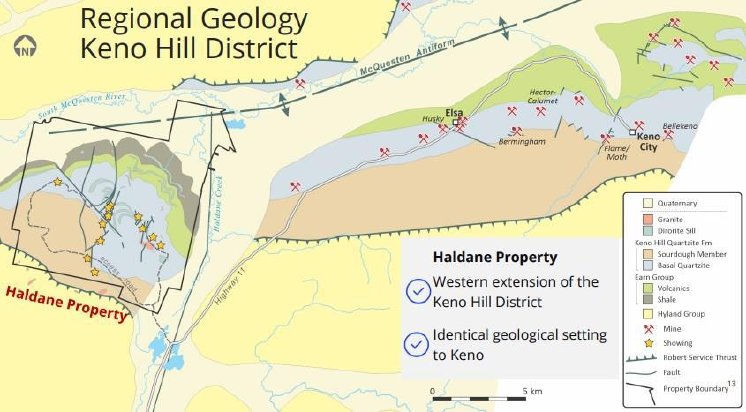

TCI: Let’s move over to Silver North’s flagship project, Haldane in the Keno Hill District, in the Yukon and very close to the former Alexco properties (now owned by Hecla). As a reminder for investors, you had an extensive exploration program planned for the autumn of 2023.

On a sidenote: I have always loved the geological thesis behind this project, as the host rocks of Haldane clearly resemble the geological makeup of the rocks that host the abundance of high grade silver mines and deposits the Keno Hill Silver District is famous for, with the two zones separated by layer of overburden - glacial till and glacial fluvial sediments in the valley bottoms. According to CEO Weber, the orientation of the rock units at Haldane varies from the rest of the district, so it might be that a later fault exists between the two areas. He also thinks that the grey quartzite may actually be present in certain areas of the overburden-filled valleys (light yellow) considering the quartzite and silver-lead-zinc occurrences showing up on the north side of the valley.

He also believes the quartzite continues below the orange-brownish Sourdough unit, so there is a lot of exploration potential. In general, he has seen enough evidence to believe glaciers have scraped off the weathered rocks in the broad valley that dominates the district, exposing mineralized zones directly in the quartzite, which could be found, explored and mined easily by the early prospectors. As Mount Haldane towered above the glacier, the weathered rocks are still intact, causing Silver North to drill through this weathered layer, with hopefully the same highgrade silver beneath it, resembling the rest of the Keno Hill district. This has been born out at Silver North’s West Fault discovery, where the initial shallow drill intersections intersected lower silver grades in well-developed, but highly weathered veins, where deeper intersections hit the same style of veins with high grade silver mineralization.

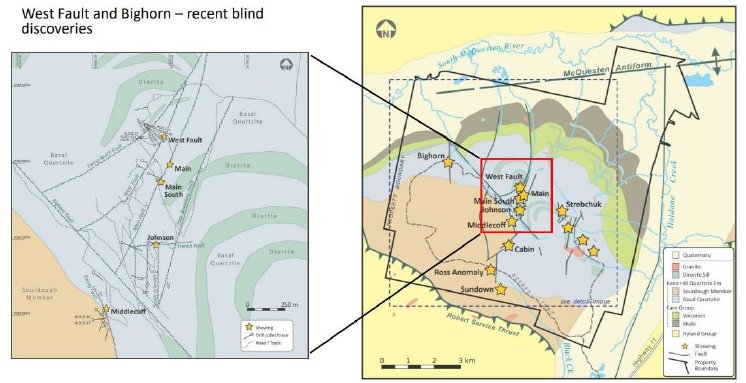

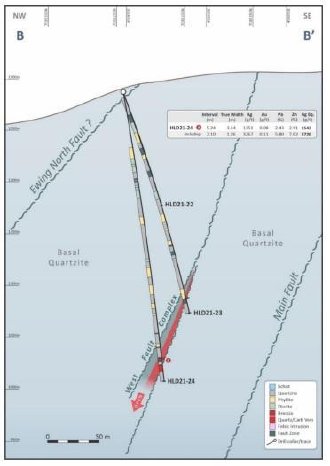

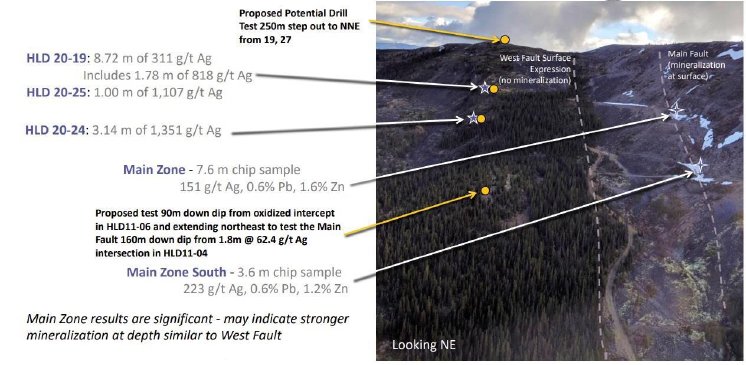

Silver North was planning to fly airborne electromagnetic and magnetic surveys to help map lithologies, refine target structures (strike extensions and offsets) and potentially identify new target structures that may be silver bearing. This work would be followed up by trenching where applicable and diamond drilling. Drilling will target the extensions down plunge on the West Fault target where high-grade silver mineralization has been identified over an area 100 meters by 90 meters in size, and on two structural levels within the West fault structure.

Drilling would aim to build on previous intersections at West fault including 3.14m @ 1,315g/t silver, 2.43% lead, and 2.91% zinc (true widths), with grades and width increasing at depth. At least four holes were planned to test the extensions of this mineralization on 50m stepouts.

Drilling was also planned for the Bighorn target located 3 kilometers to the northwest of the West Fault. The Bighorn target was identified from soil geochemical sampling that returned anomalous values for lead and silver in soils. The only drill hole at this target returned 125.7 grams per ton silver and 4.39% lead over 2.35 metres from previously unrecognized vein structures. Trenching and groundwork in 2022 programs was able to refine targeting at Bighorn, and additional drilling will test this target for its potential to host wide, high grade silver mineralization. Additional drilling will also target the Main and Middlecoff targets, and any targets generated from the geophysical data and trenching.

Could you tell us if this exploration plan is still intact, if not what the adjustments are, and a global timeline for all this?

JW:That is still the plan. It is important to remember that we have an abundance of targets here. As the financing market improves we are able to test more targets, or drill more holes at each of the targets we want to test. Ideally we would like to commence drilling at the end of May, when the spring break up has ended and ours roads are dry and firm, so a completed financing before this would be convenient of course. We have cash to start up drilling, but we need more for a full program.

TCI: As drilling so far only returned a few economic intercepts, could you indicate to the audience what the potential is here, and why you believe this? Are you aiming at something like Keno Hill style intercepts of say 10m @ 7,500g/t Ag or an average reserve grade of 600-700g/t Ag?

JW: Absolutely, we are targeting deposits on the scale and grade of what Hecla and all its predecessors have mined in this district. Our West Fault drilling has shown that Haldane hosts both high grade and wide zones of mineralization indicating that the property can host deposits of the size our neighbour is mining. We also have very thick occurrences of the Keno Hill Quartzite – meaning we have great depth potential for mineralization. Some of those extremely high grades you quote from Hecla occur deeper than what previous workers in the district thought possible.

These recent deep intersections are extremely positive for the district and for Haldane itself. Amongst the various vein structures identified to date, we have in excess of 12 km of combined vein strike length potential to explore. We’ve only tested less than 600 metres of that! And now we know that anything we find can be continuous to depths not historically recognized. This is why we are so excited to have this project – it is a greenfields exploration opportunity in a prolific silver district – such a rare scenario.

TCI: Sure the exploration potential is there. So you figure the most potential for economic mineralization might be at depth, which is of course more costly to drill out?

JW: Sure deeper holes cost you more money, but in our case we can approach targets laterally along strike as well, and as we move down the hill sides, perhaps we won’t have as deep a weathering profile to deal with and therefore fewer metres required.

TCI: Regarding timelines, overall progress is fairly slow with a handful of drill results for most of the seasons each. Targeting deep mineralized potential doesn’t make this any easier. Could this be a reason for investors to look elsewhere, and have you switching to more drastic measures like a roll-back? Do you have something in mind to make things more compelling and attractive for investors, maybe also during the winter break?

JW: I think this was the basis for making the transition to Silver North and focusing on Haldane. With that focus we will be targeting larger programs, testing more targets with drilling and moving the project forward more efficiently.

TCI: Besides own exploration, another important regional development is ongoing next door as we know. At the moment, Hecla Mining just reached full production at their nearby Keno Hill silver mine, achieving 1.5Moz Ag for 2023, having solved the mining/milling issues that plagued new acquisition Alexco. The AISC is forecasted to be US$13.50-16.75/oz Ag, which is decent at a current silver price of US$23.03/oz Ag, and will likely come down more this year, as Hecla aims at ramping up to full production, which could come in at an estimated 2.5-3 Moz Ag/pa. Could you explain to investors how this development could exactly be a positive for Silver North? Should we think of existing infrastructure, or eventual ore trucking to the Keno Hill Mine?

JW: This is extremely positive for Silver North. One of the concerns investors may have had previously was that the deposits in the Keno District could not be mined economically with Alexco having issues when ramping up. With Hecla changing that narrative we will benefit with investors from this, attributing greater value to what we find, whether it is a standalone silver project or is trucked to existing facilities.

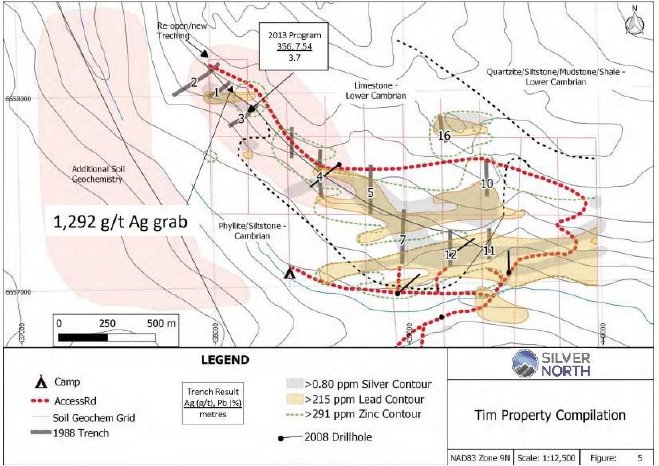

TCI: The second most important project for Silver North is the Tim Silver project, also in the Yukon. Coeur Mining, which has optioned the Tim Silver project, hasn’t been very active since 2021, as the exploration permit took more time than initially anticipated.

On December 21, 2023, Coeur and Silver North announced a slight adjustment to their option agreement to incorporate the permitting delays, giving Coeur more time to spend their exploration expenditures.

As a reminder, Coeur can earn a 51% interest in the Tim Property by completing all exploration expenditures and cash payments due by December 31, 2026, which will total at least C$3.55M and C$425,000 in cash payments. Coeur can bring its interest up to 80% by making additional cash payments of C$100,000 per year, completing a positive feasibility study and informing Silver North by December 16, 2028, of Coeur’s intention to develop a mine on the property. Coeur is the project operator and is currently compiling the data from previous programs and refining targets for the 2024 diamond drilling program at Tim.

Could you tell me more, if you have any idea at least, about this upcoming program regarding amount of meters & holes, cost per meter all-in, timelines?

JW: I don’t have anything concrete to discuss regarding the 2024 program at Tim, other than Coeur is committed to a $700,000 program and drilling will be a big part of that. With their existing infrastructure at Silvertip, only 19 km away by road, they expect the drilling costs to be relatively low. We expect the initial tests to be fairly shallow as they will likely test down dip from surficial showings.

The Coeur team has been quite successful expanding the resources they have a Silvertip in recent campaigns and have identified many similarities at Tim to the Silvertip deposits. Needless to say they are eager to apply the knowledge and expertise gained at Silvertip to make a new high grade silver discovery at Tim. We will be meeting with the Coeur team in the near term to get a better idea on the individual targets they are testing, the number of holes and depths, as well as projected start dates.

TCI: As Silver North has other projects as well, I wondered what the status of these projects was. For example, the company has been actively seeking a partner for their fully owned Twin Canyon gold project in Colorado since a year now, a project which also has seen its fair share of prioritizing drill targets, and a drill permit for a 13 hole, 3,950m RC drill program, being granted a year ago.

Besides this, Silver North has other projects in its portfolio, like in Nevada and Peru, and is actively looking to divest those or find partners for them. Could you give a quick update on these projects?

JW: Potential partners are finding it difficult to raise funds for exploration these days. I expect that as this changes we’ll see increased urgency from potential partners to get deals completed on these projects.

Having said this, we have trimmed down our portfolio in Nevada, dropping projects so we don’t retain further financial obligations on projects there.

TCI: This seems like a comprehensive update for investors. Do you have anything else to add here Jason, maybe ideas for M&A etc?

JW: One aspect of the difficult markets is that there are some really interesting silver projects that are available right now. We have evaluated a number of potential acquisitions that would be complementary projects to our current portfolio. We have shortlisted our favourites and where there is potential for a reasonable deal, we will work to build our silver portfolio.

Conclusion

Although negative junior mining sentiment has made an impact in 2023, I do believe Silver North Resources made the right decision by abandoning the prospect generator model, and instead focusing clearly on a fully owned flagship project like Haldane. They have raised enough cash to commence exploration this spring and summer, which hopefully could generate some solid results, bringing the share price at different levels, enabling the company to raise more with less dilution.

Besides this, partner Coeur is preparing to commence drilling in the spring at the Tim Silver project, and who knows they will find another Silvertip, as back in the day exploration between the two properties reportedly was determined by a coin flip, as potential looked so similar. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Silver North Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.silvernorthres.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.