The factors responsible for the price increase remain in place. On the one hand, this is the supply and demand side, which should support the price. On the other hand, supply in London is tight, political uncertainties in the US remain, and geopolitical crises are present. A further deficit is expected in the current year. The Silver Institute expects global silver demand to remain constant in 2026. Even if demand from the jewelry industry and for silverware weakens, strong investments by private investors should easily offset this.

Industrial demand for silver is expected to decline by 2 per cent. Although the photovoltaic sector is growing, silver, which has become expensive, is being partially replaced by other materials. However, there is rising demand for the precious metal from data centres, artificial intelligence and the automotive industry. The Silver Institute forecasts a whopping 20 percent increase in physical investment, bringing it to a three-year high. This is attributed to the exceptional price development of silver and the current uncertainty among investors. Physical investment is expected to grow in the West and also in India.

On the supply side, global production is expected to increase by 1.5 percent to 820 million ounces of silver. In contrast, a deficit of 67 million ounces is expected in 2026. Global ETP stocks are high (1.31 billion ounces) and demand for bars and coins is strong. Investments in silver companies should therefore be auspicious.

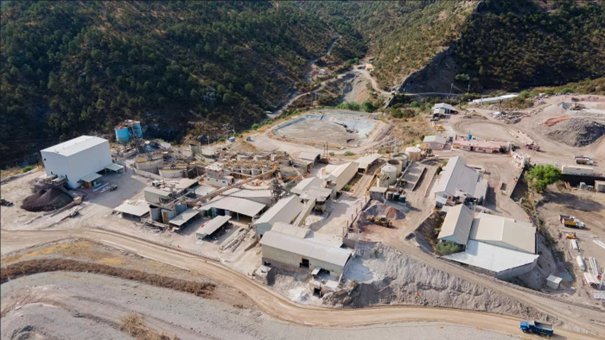

Endeavour Silver - https://www.commodity-tv.com/ondemand/companies/profil/endeavour-silver-corp/ - owns three producing mines. The company's projects are located in Mexico and Peru. For 2026, the company forecasts production of 14.6 to 15.6 million ounces of silver equivalent.

As a royalty company, Vizsla Royalties - https://www.commodity-tv.com/ondemand/companies/profil/vizsla-royalties-corp/ - offers corporate diversification and owns two NSR royalties. One is a 2% interest in the Panuco property in Mexico, which is a primary, high-grade silver resource. The other is a 3.5% interest in the Silverstone concessions.

Current company information and press releases from Vizsla Royalties (- https://www.resource-capital.ch/en/companies/mag-silver-corp/ -) and Endeavour Silver (- https://www.resource-capital.ch/en/companies/endeavour-silver-corp/ -)

Further information is also available in our new precious metals report at the following link: https://www.resource-capital.ch/en/reports/view/precious-metals-report-2025-11-update/

Sources:

https://silverinstitute.org/global-silver-investment-to-remain-strong-in-2026-against-the-backdrop-of-a-sixth-consecutive-annual-market-deficit/;

https://www.resource-capital.ch/en/reports/view/precious-metals-report-2025-11-update/

In accordance with Section 85 of the German Securities Trading Act (WpHG) in conjunction with Article 20 of Regulation (EU) 2016/958 (MAR), we hereby disclose that authors/employees/affiliated companies of SRC swiss resource capital AG may hold positions (long/short) in issuers discussed. Remuneration/relationship: IR contracts/advertorial: Own positions (author): none; SRC net position: less than 0.5%; issuer's stake in SRC ≥ 5%: no. Update policy: no obligation to update. No guarantee for the translation into German. Only the English version of this news release is authoritative.

Disclaimer: The information provided does not constitute any form of recommendation or advice. We expressly draw attention to the risks involved in securities trading. No liability can be accepted for any damage arising from the use of this blog. We would like to point out that shares and, in particular, warrant investments are generally associated with risk. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the accuracy of all content. Despite the utmost care, I expressly reserve the right to errors, particularly with regard to figures and prices. The information contained herein comes from sources that are considered reliable, but does not claim to be accurate or complete. Due to court rulings, the content of linked external sites is also our responsibility (e.g., Hamburg Regional Court, in its ruling of May 12, 1998 - 312 O 85/98), as long as we do not expressly distance ourselves from them. Despite careful content control, I assume no liability for the content of linked external sites. The respective operators are solely responsible for their content. The disclaimer of SRC swiss resource capital AG, which is available at https://www.resource-capital.ch/de/disclaimer-agb/, applies additionally.