All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Omai Gold Mines’ resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Omai or Omai’s management. Omai Gold Mines has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

Omai Gold Mines remains dedicated in drilling out as many targets as they can, not just being focused on filing in and expanding Wenot and Gilt Creek. CEO Ellingham told me they are really after a gamechanging discovery, as they believe it should be looming there somewhere, considering all the data so far.

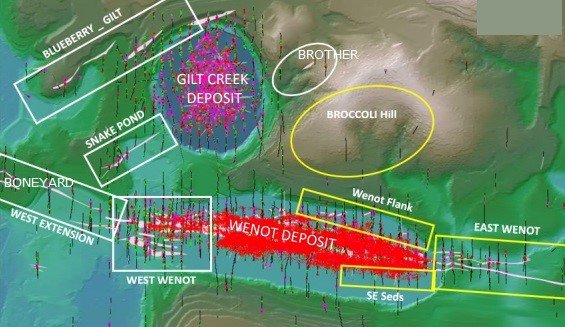

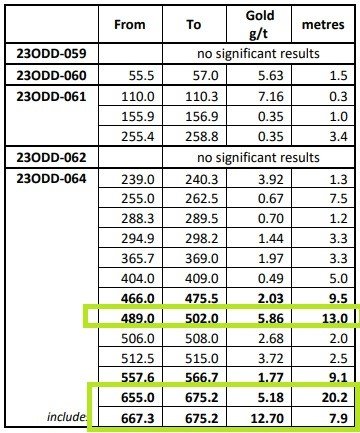

The following table with the latest results is testament to this, as for example hole 064 was drilled at Wenot itself, but others like 059 targeted the Boneyard magnetic low, 060 and 061 aimed at Broccoli Hill, and 062 focused on the Brother target, north east of Gilt Creek, where they haven’t had the luck of finding Wenot-type intersections yet:

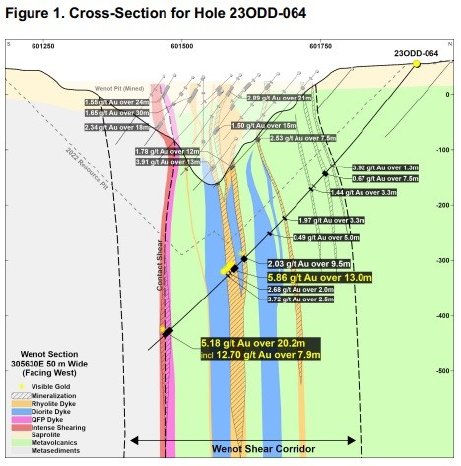

Please be aware hole 064, drilled in the middle of the Wenot deposit and with a total length of 713m, was drilled under a 45 degree angle, so real depth for the 13m @ 5.86g/t Au intercept is probably around -330m. As CEO Ellingham told me the maximum open pit depth of Wenot could likely be established around the the 400 to 425 levels without impacting strip ratio and thus economics too much, it will be clear the encountered mineralization in hole 064 provides interesting clues about a pretty economic underground part of a future operation.

Especially the Rhyolite and QFP dykes seem to represent increasing grades and thicknesses, providing evidence for very deep running mineralized lenses. This made me wonder if the QFP dyke already has seen other drilling between -175m and -430m, and if Omai, considering the latest results at hole 064, is contemplating to drill directional holes from 064, to explore potential at even greater depths, for example up to -600m? CEO Ellingham stated: “Given the Wenot deposit has a 2.5 km strike length and is still open along strike, it is not a priority to drill Wenot to a -600m depth. Furthermore, we dont have the drill for directional drilling. This is very expensive and also takes time. Even our 700m holes take about 2 weeks to complete. We dont have the time or budget to do a lot of deeper holes. Best use of our time and money is increasing near surface resources....drilling in areas we believe will increase grade and decrease strip to make the economics as strong as possible in the upcoming PEA.”

Furthermore, CEO Ellingham was obviously pleased with hole 064:

“Similar to our excellent drill results from a couple of weeks ago, these new results again confirm the significant expansion potential for the Wenot deposit, to depth as well as along the flanks. Hole 23ODD-063 results previously released show a very wide 42-75 m zone of gold mineralization at the west end of the deposit, from a 110m to 290 metre depth, with evidence it extends to surface. Hole 23ODD-064 is located 1.25 kilometres east of hole 063, again demonstrating the continuity of the multiple shear-hosted gold zones that extend along a minimum 2.5 km strike.”

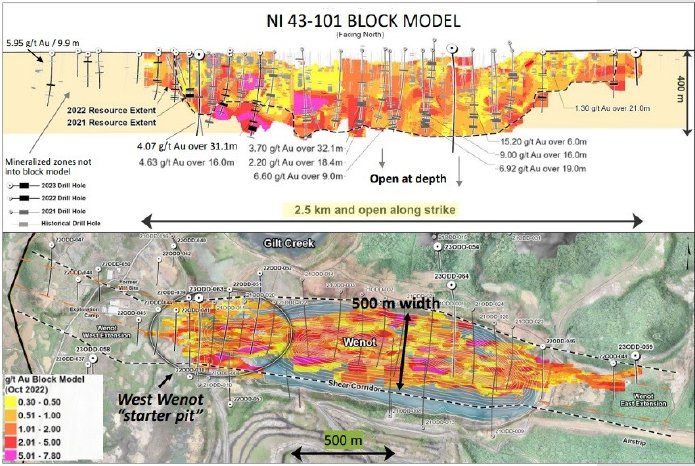

“In the first half of the year, we pursued some of the nearby exploration targets and we remain confident that there are additional gold deposits on this well endowed Omai gold property. However, given the large NI 43-101 Mineral Resource Estimate1 established late last year, we believe our drill budget is best focused on: 1) testing some of the undrilled gaps within the Wenot deposit model, 2) expanding the western “starter pit” area, and 3) providing evidence of the bluesky potential for the Wenot deposit at depth. Results to date are already expected to positively impact the resources as we move forward to an updated mineral resource estimate to be followed by a decision on a preliminary economic assessment (“PEA”) later this year.”

So it seems an updated resource estimate could be expected before the PEA, but after talking to CEO Ellingham things have slightly adjusted since: “The ongoing 5,000m drill program is being expanded to approximately 7,000 metres which is expected to be completed in early September. An updated resource will be considered based on the results of the Wenot drilling, and will only be done as part of the PEA. We expect to make a definitive decision on a PEA upon completion of the current drilling. Our preliminary internal work suggests that we will proceed to complete a PEA.”

As CEO Ellingham stated in my last article, she continues to estimate a potential 10-15% increase for the Wenot resource target, but is also focused on adding ounces and boosting grade in the most important areas that would see early mining, which is West Wenot.

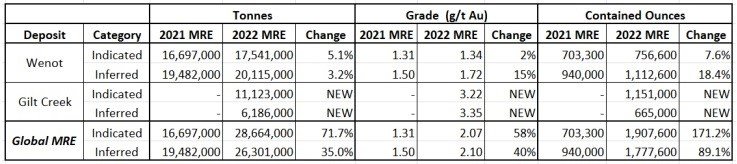

The current total resource stands at 3.7Moz Au, with 1.87Moz Au of this in the Wenot deposit. A 10-15% increase on Wenot would imply bringing Wenot up to 2.0-2.1Moz Au, ample for a sizeable open pit development project. This could implicate a 3.9-4.0Moz Au total resource, and as resource drilling since the last NI43-101 has been confined to Wenot, hopefully converting some Inferred to Indicated there as well.

Omai Gold Mines has an estimated C$2M left in the treasury nowadays per the latest news release, which will last until the updated NI43-101 comes out at the end of this year, likely causing the company to tap the markets around that period. As the share count stands at 377.85M O/S, there is no doubt the 400M threshold will be crossed, which is a substantial number. CEO Ellingham maintains there is no need for a consolidation. As the share price dropped to levels as low as 4c due to heavy and unknown selling in the last few weeks, pressure is adding, but she insists her large shareholders and backers never would like to see a roll-back, as they all believe in the upside of the stock, so it is business as usual, waiting for sentiment in juniors to turn and retail buying coming back with it.

With a market cap of just C$18.89M, the 3.7Moz Au of Omai result in a EV/oz ratio of only 4.56, which is extremely low, and the expected slight increase of the resource will lower this ratio even more. In comparison, fellow Guyana developers Reunion Gold (4.24Moz @ 1.91g/t Au, EV/oz 121), G2 Goldfields (1.2Moz @ 9.1g/t Au, EV/oz 107) and taken over GoldX with the Toroparu deposit (7.4Moz @ 0.91g/t Au at the time of acquisition, estimated EV/oz at 2021 buyout of C$315M was 42.6 and not a very economic deposit I might add) have much, much higher valuations.

Current open pit grades and strip ratio at Wenot indicate a pretty economic project according to my estimates, and I do feel that Gilt Creek could very well increase its cut-off grade to 2g/t Au, so the average grade would just surpass 4g/t Au (still 1.5Moz Au), indicating much better economics to the average investor. As a reminder, average recoveries from the historic Omai gold mine were excellent at 92-93% so this will very likely not be an issue either.

Remember that for example Reunion will need to build a road, and the road to Toroparu was going to cost US$250M. At Omai, there is already road access, with half of the distance to Georgetown already paved and the rest is underway as part of a government contract. Omai Gold Mines also has a cleared site and existing 350 acre tailings, that an initial review suggests can be used for the first few mining years prior to a need to raise the tailings dams. The PEA will look further into these subjects according to CEO Ellingham. It seems the development of Omai might very well be faster and less capital intensive.

Dewatering the pits at Wenot and Gilt Creek doesn’t pose any problems either according to CEO Ellingham, as the gold is hosted in quartz veins and shears with no deleterious elements, the pit water is accumulated rain water and preliminary water surveys suggest no treatment would be required. Dewatering operating pits and underground mines is normal course for most mines, it is low cost, low tech and not unusual, particularly for the development at past-producing mines, so as the Guyana government is very supportive, the difference in valuations with peers is unexplainable in my view at least.

Conclusion

Why Omai Gold Mines is trading at current EV/oz ratios below 5 is a mystery to me, especially when looking at Guyana peers Reunion, G2 Goldfields and former GoldX. Granted, Reunion and adjacent G2 Goldfields are more economic, and would form an excellent joint take over target, but by far not justifying an EV/ratio which is on average a staggering 26 times higher. Maybe investors aren’t convinced of the strip ratio and thus economics yet, so Omai Gold Mines better comes out as soon as possible with a PEA. This is planned for Q2 2024, and there is not much doubt in my mind that the Omai project could generate at the very least after-tax NPV numbers of multiple hundreds of millions US Dollars. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Omai Gold Mines is a sponsoring company. All facts are to be checked by the reader. For more information go to www.omaigoldmines.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.