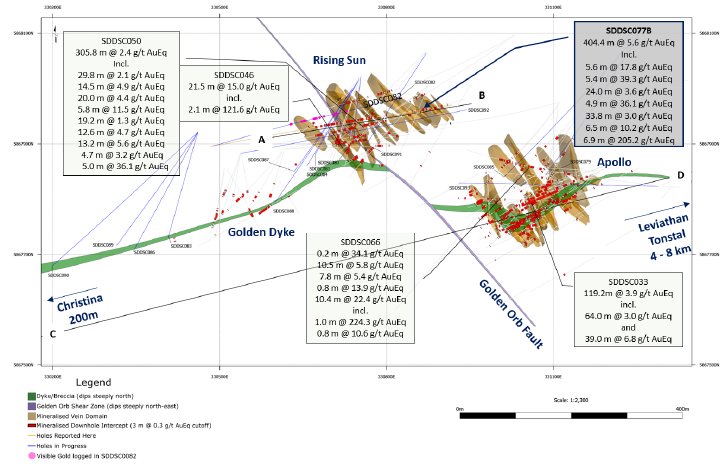

SDDSC077B drilled 404.4 m @ 5.6 g/t AuEq (5.1 g/t Au, 0.3 %Sb) from 374.0 m (uncut), and traverses 13 individual high-grade vein sets (Figures 3-6). Seven intervals have >100 g/t Au (up to 2,670 g/t Au), 20 intervals at >15 g/t Au and 20 intervals have >5% Sb (up to 55.8% Sb). It is the best hole drilled to date on the project, a spectacularly wide and high-grade intersection of gold-antimony mineralization.

SDDSC078 demonstrated the up-dip extension and continuation of five high grade zones towards the surface and SDDSC068 demonstrated the scale of the Sunday Creek system with a 500 m down-dip extension below prior drilling from the Apollo area.

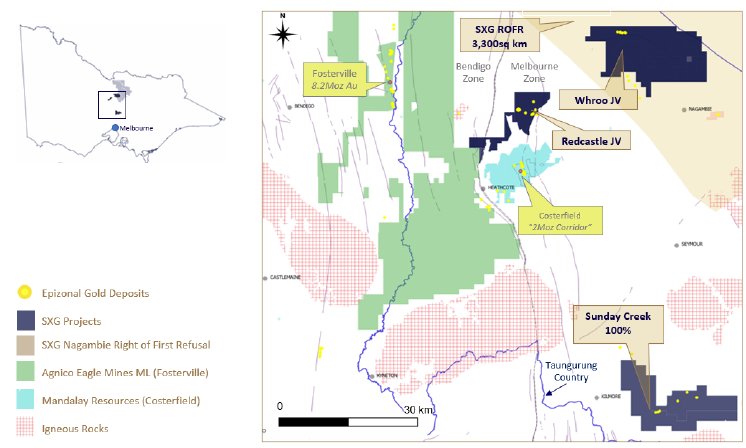

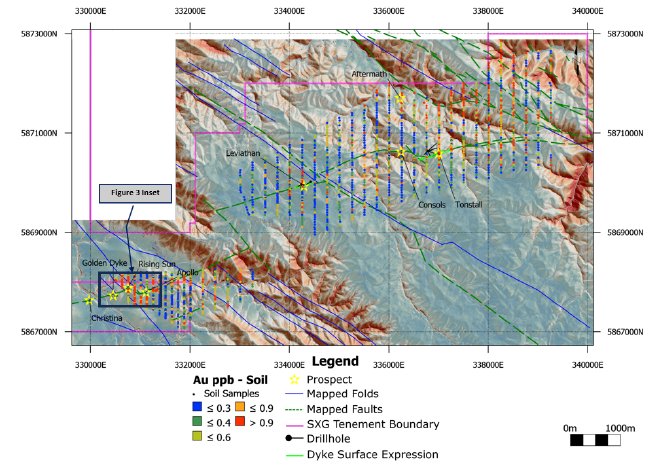

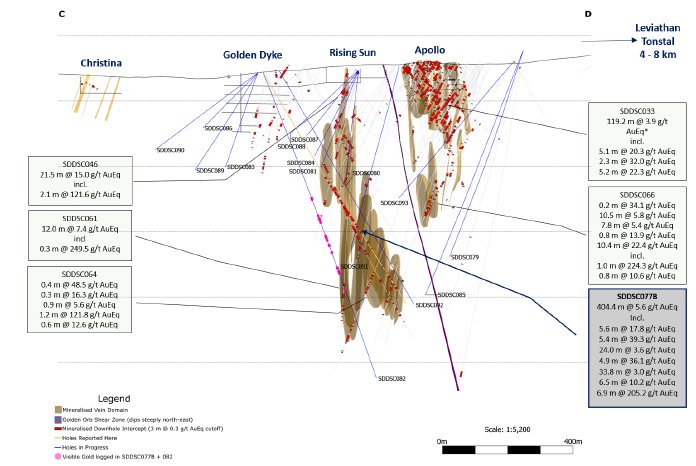

Sunday Creek is 100% owned by Southern Cross Gold (“SXG”), which is an ASX listed company owned 51% by Mawson. Four rigs continue to drill both in the main drill area where eleven holes (SDDSC079-81, 83-90) are currently being geologically processed and chemically analyzed, with four holes (SDDSC082, 91-93) in drill progress (Figures 5-6) and up to 7.5 km along strike at the Tonstal, Consols and Leviathan prospects where twelve holes (SDDTS001-7, SDDCN001 and SDDLV001-4) for 2,383 m (including two redrilled collars) have now been completed with results expected in the coming weeks (Figure 2).

Noora Ahola, Mawson Interim CEO, states: “With the release of SDDSC077B, SXG’s 100% owned Sunday Creek project solidifies its status as one of the best new gold discoveries in the world today. Thirteen individual high-grade vein sets with seven >100 g/t Au intervals and 20 >15 g/t Au over 400 m of strike speaks volumes on the quality of project. Hitting intercepts such as 0.4 m @ 2,670 g/t gold was the remaining factor that elevates Sunday Creek into the same league as the other globally high-grade epizonal gold deposits that exist in Victoria.

“Along with recently reported holes SDDSC068 & 78, these holes confirm SXG’s strategy to demonstrate grade, volume and scale at the project drilling both up and down dip of previously reported fantastic holes such as SDDSC050 and SDDSC066.

“SXG recently announced a planned 26,000 m drill campaign to April 2024 and is fully funded and permitted to execute on its strategy across its 11 km mineralized trend at Sunday Creek. It has a total of 24 holes that are pending release from both the main drill area and its regional targets up to 7,500 m to the northeast. We expect a steady stream of positive results to come out of Australia.”

Results Discussion

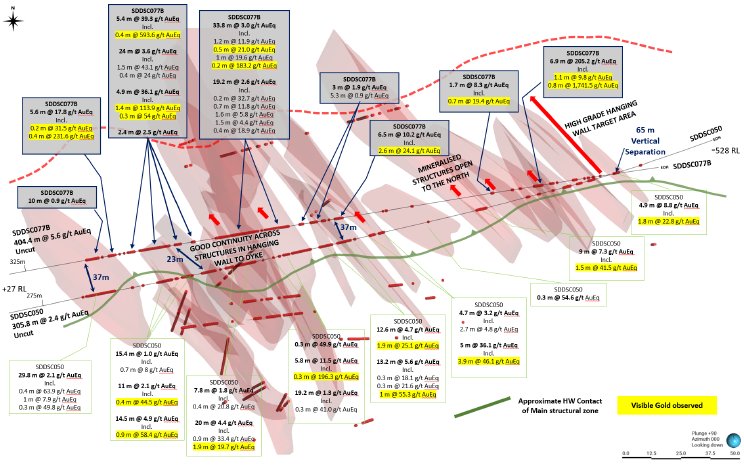

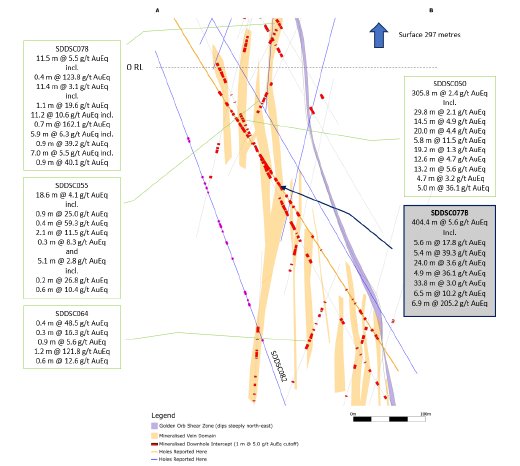

Drill hole SDDSC077B 404.4 m @ 5.6 g/t AuEq (5.1 g/t Au, 0.3% Sb) from 374.0 m (uncut) was designed to demonstrate continuity of mineralized structures between 25 m to 65 m spacing around hole SDDSC050 (305 m @ 2.4 g/t AuEq reported 20 November 2022) at Rising Sun. SDDSC077B (cumulative 2,272 AuEq g/t x m) exceeded SDDSC050 (cumulative 852 AuEq g/t x m), the previous best hole, by almost three times.

SDDSC077B hole intersected 13 zones of mineralization from 375 m to 787 m down hole depth with visible gold noted in 28 individual restricted zones. SDDSC050 also traversed across the same 13 vein structures intersected in SDDSC077B with between 25 m to 60 m distance separating the two holes.

SDDSC077B drilled parallel to the host breccia dyke but at a high angle to the predominant NW high-grade mineralization trend, and therefore, the true thickness of the mineralized interval is interpreted to be approximately 60-70% of the sampled thickness. Cumulatively the hole recorded a 2,272 g/t AuEq x m intersection. Seven intervals had >100 g/t Au (up to 2,679.8 g/t Au), 20 intervals at >15 g/t Au and 20 intervals with >5% Sb (up to 55.8% Sb) were intersected. Uncut, the hole graded 404.4 m @ 5.6 g/t AuEq (5.1 g/t Au, 0.3 %Sb) from 374.0 m.

Figure 4 shows the plan view of drill holes SDDSC050 and SDDSC070. Spatial separation of the holes is shown along their traces. The figure demonstrates the continuity of mineralized structures, especially in the dyke hanging wall, and shows the opportunity to extend the high grades into the dyke hanging wall.

Highlights from SDDSC077B include:

- 6 m @ 17.8 g/t AuEq (14.1 g/t Au, 2.4% Sb) from 392.2 m, including:

- 2 m @ 31.5 g/t AuEq (31.4 g/t Au, 0.0% Sb) from 392.2 m

- 4 m @ 231.6 g/t AuEq (182.0 g/t Au, 31.4% Sb) from 394.2 m

- 4 m @ 39.3 g/t AuEq (38.0 g/t Au, 0.8% Sb) from 407.7 m, including:

- 4 m @ 593.6 g/t AuEq (574.0 g/t Au, 12.4% Sb) from 407.7 m

- 0 m @ 3.6 g/t AuEq (3.2 g/t Au, 0.2% Sb) from 417.0 m, including:

- 5 m @ 43.1 g/t AuEq (39.7 g/t Au, 2.1% Sb) from 422.1 m

- 4 m @ 24.0 g/t AuEq (17.3 g/t Au, 4.2% Sb) from 428.2 m

- 9 m @ 36.1 g/t AuEq (20.1 g/t Au, 10.1% Sb) from 445.2 m, including:

- 4 m @ 113.9 g/t AuEq (66.6 g/t Au, 29.9% Sb) from 445.2 m

- 3 m @ 54.0 g/t AuEq (12.1 g/t Au, 26.5% Sb) from 449.7 m

- 8 m @ 3.0 g/t AuEq (2.4 g/t Au, 0.4% Sb) from 478.0 m, including:

- 2 m @ 11.9 g/t AuEq (10.8 g/t Au, 0.7% Sb) from 486.6 m

- 5 m @ 21.0 g/t AuEq (20.9 g/t Au, 0.0% Sb) from 491.9 m

- 0 m @ 19.6 g/t AuEq (10.1 g/t Au, 6.0% Sb) from 498.5 m

- 2 m @ 183.2 g/t AuEq (168.0 g/t Au, 9.6% Sb) from 500.9 m

- 3 m @ 6.1 g/t AuEq (5.5 g/t Au, 0.4% Sb) from 506.6 m

- 5 m @ 10.2 g/t AuEq (2.8 g/t Au, 4.7% Sb) from 573.0 m, including:

- 6 m @ 24.1 g/t AuEq (6.3 g/t Au, 11.3% Sb) from 574.0 m

- 9 m @ 205.2 g/t AuEq (204.5 g/t Au, 0.4% Sb) from 733.8 m, including:

- 1 m @ 9.8 g/t AuEq (9.5 g/t Au, 0.2% Sb) from 737.1 m

- 8 m @ 1,741.5 g/t AuEq (1,736.4 g/t Au, 3.3% Sb) from 739.9 m

- Including 0.4 m @ 731.2 g/t AuEq (731.0 g/t Au, 0.1% Sb) from 739.9 m

- Including 0.4 m @ 2,679.8 g/t AuEq (2,670 g/t Au, 6.2% Sb) from 740.3 m

SDDSC068 was drilled 500 m down-dip of SDDSC066 (10.5 m @ 5.8 g/t AuEq, 7.8 m @ 5.4 g/t AuEq, and 10.4 m @ 22.4 g/t AuEq) and successfully targeted high-grades including 0.5 m @ 23.8 g/t Au from 1,010.4 m within a broader zone of mineralization including 13.3 m @ 1.6 g/t Au from 1,009.8 m at Apollo. Visible gold was noted.

For further information on holes SDDSC068, 73-74, 76, 78, please visit SXG’s website at www.southerncrossgold.com.au.

Pending Results and Update

With four diamond drill rigs operating at site, SXG’s plan is to drill an additional 26,000 m by April 2024, with 19,626 m drilled so far in 2023.

Demonstrating Volume: Eleven holes (SDDSC079-81, 83-90) are currently being geologically processed and chemically analyzed, with four holes (SDDSC082, 91-93) in drill progress (Figure 5).

Demonstrating Scale: Twelve holes (SDDTS001-7, SDDCN001 and SDDLV001-4) for 2,383 m (including two redrilled collars) have now been completed at the Leviathan – Consols – Tonstal regional area between 3,500 m to 7,500 m along strike from the main drill area. Results are expected in the coming weeks (Figure 2).

Demonstrating Grade: Preliminary visual geological logs of SDDSC082, drilled 100 m below hole SDDSC077B at Rising Sun intersected multiple zones of mineralization with visible gold noted in certain restricted zones. Assays are pending (Figures 5-6).

Further discussion and analysis of the Sunday Creek project by Southern Cross Gold is available on the SXG website at www.southerncrossgold.com.au.

Figures 1-6 show project location, plan, longitudinal and cross-sectional views of drill results reported here and Tables 1–3 provide collar and assay data. The true thickness of the mineralized intervals reported are interpreted to be approximately 60-70% of the sampled thickness. Lower grades were cut at 0.3 g/t Au lower cutoff over a maximum width of 3 m with higher grades cut at 5.0 g/t Au cutoff over a maximum of 1 m width, unless otherwise stated.

Technical Background and Qualified Person

The Qualified Person, Michael Hudson, Executive Chairman and a director of Mawson Gold, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed, verified and approved the technical contents of this release.

Analytical samples are transported to the Bendigo facility of On Site Laboratory Services (“On Site”) which operates under both an ISO 9001 and NATA quality systems. Samples were prepared and analyzed for gold using the fire assay technique (PE01S method; 25 gram charge), followed by measuring the gold in solution with flame AAS equipment. Samples for multi-element analysis (BM011 and over-range methods as required) use aqua regia digestion and ICP-MS analysis. The QA/QC program of Southern Cross Gold consists of the systematic insertion of certified standards of known gold content, blanks within interpreted mineralized rock and quarter core duplicates. In addition, On Site inserts blanks and standards into the analytical process.

MAW considers that both gold and antimony that are included in the gold equivalent calculation (“AuEq") have reasonable potential to be recovered at Sunday Creek, given current geochemical understanding, historic production statistics and geologically analogous mining operations. Historically, ore from Sunday Creek was treated onsite or shipped to the Costerfield mine, located 54 km to the northwest of the project, for processing during WW1. The Costerfield mine corridor, now owned by Mandalay Resources Ltd contains two million ounces of equivalent gold (Mandalay Q3 2021 Results), and in 2020 was the sixth highest-grade global underground mine and a top 5 global producer of antimony.

SXG considers that it is appropriate to adopt the same gold equivalent variables as Mandalay Resources Ltd in its Mandalay Technical Report, 2022 dated 25 March 2022. The gold equivalence formula used by Mandalay Resources was calculated using recoveries achieved at the Costerfield Property Brunswick Processing Plant during 2020, using a gold price of US$1,700 per ounce, an antimony price of US$8,500 per tonne and 2021 total year metal recoveries of 93% for gold and 95% for antimony, and is as follows: ???? = ?? (?/?) + 1.58 × ?? (%).

Based on the latest Costerfield calculation and given the similar geological styles and historic toll treatment of Sunday Creek mineralization at Costerfield, SXG considers that a ???? = ?? (?/?) + 1.58 × ?? (%) is appropriate to use for the initial exploration targeting of gold-antimony mineralization at Sunday Creek.