British Columbia experienced a gold rush in the 19th century and there are still numerous gold companies there today.

British Columbia is about three times the size of Germany. In 1858, the Fraser Canyon gold rush began. When the first gold was found at the confluence of the Thompson River and the Nicoamen River, gold seekers came in droves. The colony of British Columbia was established. Today, Barkerwille, where a historic replica of a gold rush town beckons, can be visited. After the Fraser Canyon Gold Rush came the Klondike Gold Rush and the Cariboo Gold Rush in British Columbia. The main town there was Barkerville. At that time Barkerville became the largest town north of San Francisco and it was named after the most successful gold prospector Billy Barker. Today Barkerville is a tourist attraction.

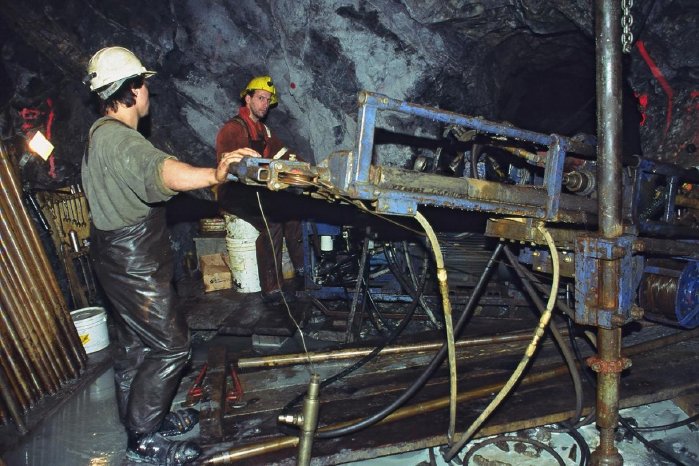

And Canada, in particular British Columbia still stands for gold production. The largest gold mines are located in Quebec, Nunavut and Ontario. The fifth largest mine is in British Columbia. The renowned Fraser Institute annually examines the mining friendliness of countries. In terms of mineral potential, British Columbia ranks tenth out of 77 mining jurisdictions. When mineral potential and policies are combined, British Columbia ranks 17th, according to the Fraser Institute. A better investment policy could still ensure a better ranking. Nevertheless, British Columbia is a rewarding place for gold companies.

For Ximen Mining - https://www.youtube.com/watch?v=iAFsCRWMf3w -, for example. The land around its flagship project, the Kenville Mine, has been expanded several times. Otherwise, the company is trying to become a major gold producer with acquisitions and exploration efforts.

CanaGold - https://www.youtube.com/watch?v=hySy_ddpBlI - is undertaking drilling at its New Polaris gold project in northwestern British Columbia. Recent drilling, for example, returned just over 20 grams of gold per ton of rock. Previously, gold was produced there with an average grade of about ten grams of gold per ton of rock.

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/