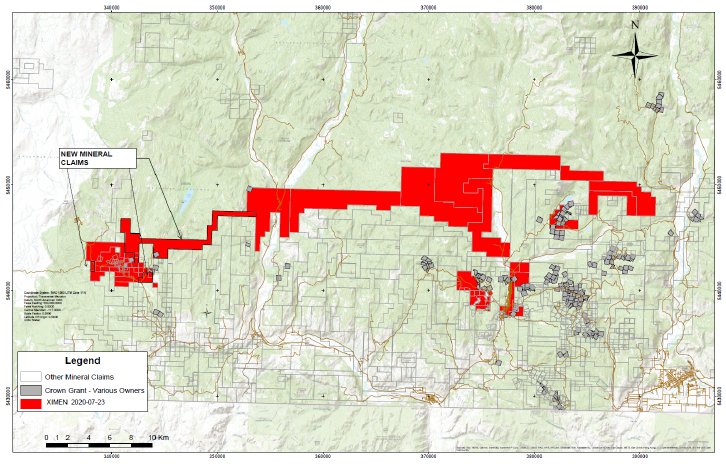

The Company continued to acquire additional mineral properties throughout the past two months and recently staked additional claims. Three mineral claims were recently acquired that adjoin Ximen’s Amelia gold mine property. One claim (42.3 Hectares) was purchased from an individual on the west side of the Amelia property and 2 claims (1500.7 Hectares) were acquired through the BC mineral tenure online system. The claims also adjoin the Amelia property and connect to Ximen’s main group of Greenwood claims.

The new claims cover several mineral occurrences, including Pictou, Stan, Elk, Ho and Jolly Creek Chrome. The Pictou covers a 6m wide shear zone from which values up to 209 grams per tonne silver have been obtained historically, according to the BC Minfile.

The company also wishes to announce that it recently closed the private placement previously announced on June 19, 2020 for gross proceeds of $2,000,000. The non-brokered private placement consisted of 4,444,444 million units at a price of $0.45 per unit. Each Unit consists of one common share and one transferable common share purchase warrant. Each whole warrant will entitle the holder to purchase, for a period of 24 months from the date of issue, one additional common share of the Issuer at an exercise price of $0.75 per share.

The placement closed in two tranches. The first tranche of 2,524,169 units has a hold expiry date of October 26, 2020 and the final tranche of 1,920,276 has a hold expiry date of November 24, 2020.

The net proceeds from the Offering will be used by the Company for exploration expenses on the Company's British Columbia mineral properties and general working capital.

About Ximen Mining Corp.

Ximen Mining Corp. owns 100% interest in three of its precious metal projects located in southern BC. Ximen`s two Gold projects The Amelia Gold Mine and The Brett Epithermal Gold Project. Ximen also owns the Treasure Mountain Silver Project adjacent to the past producing Huldra Silver Mine. Currently, the Treasure Mountain Silver Project is under a option agreement. The option partner is making annual staged cash and stocks payments as well as funding the development of the project. The company has recently acquired control of the Kenville Gold mine near Nelson British Columbia which comes with surface and underground rights, buildings and equipment.

Ximen is a publicly listed company trading on the TSX Venture Exchange under the symbol XIM, in the USA under the symbol XXMMF, and in Frankfurt, Munich, and Berlin Stock Exchanges in Germany under the symbol 1XMA and WKN with the number as A2JBKL.

This press release contains certain "forward-looking statements" within the meaning of Canadian securities This press release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, including statements regarding the receipt of TSX Venture Exchange approval and the exercise of the Option by Ximen. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective," "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the possibility that the TSX Venture Exchange may not accept the proposed transaction in a timely manner, if at all. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state in the United States in which such offer, solicitation or sale would be unlawful.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.