Based on the production figures for 2022, the Grasberg gold-copper mine in Indonesia in the province of Papua tops the list of the world's largest gold mines. It was discovered back in 1936 and is located 4,100 meters above sea level. It produced about 1,798,000 ounces of gold last year. Most of the gold came out of the mine in 2001, about 3,500,000 ounces of gold saw the light of day. The second largest gold mine is located in Uzbekistan, it produced about 1.7 million ounces of gold.

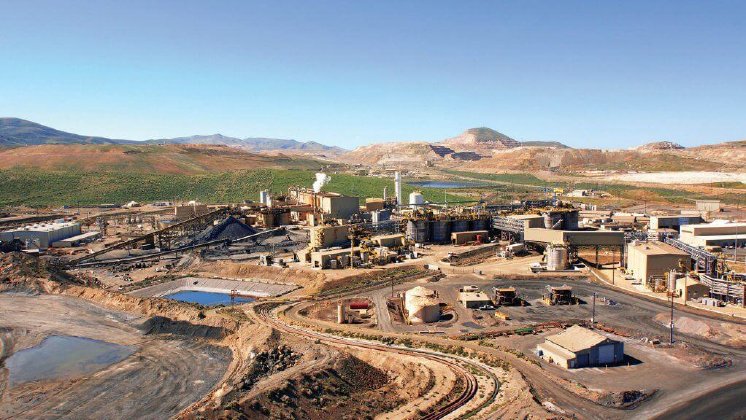

The reserves and resources are still said to be more than 150 million ounces of gold. The third largest gold production volume came from Nevada Gold Mines' Carlin property in 2022. It is in the Carlin trend and represents the largest gold mining operation in the U.S. (just over 1.5 million ounces of gold). It is followed in the rankings by the Olimpiada mine, located in Russia. Just over one million ounces of gold were produced in 2022, less than in the previous year due to lower ore grades.

It is followed by the Boddington mine in Western Australia, then mines in the Democratic Republic of Congo, Canada (Ontario) and Nevada (USA). Ninth place goes to the Dominican Republic, and tenth place goes to a mine in Mali, on the border with Senegal. Inflation and crises such as the war in Russia make gold more attractive. As an investor, you can buy physical gold or invest in gold mining companies. A special possibility are participations in royalty companies, because a diversification, i.e. a spreading of risks is included.

Two companies from this sector that have completed the first quarter of 2023 very successfully are Osisko Gold Royalties and Gold Royalty - https://www.commodity-tv.com/ondemand/companies/profil/gold-royalty-corp/ -.

The latter company is active in North, Central and South America and also pays dividends. Osisko Gold Royalties - https://www.commodity-tv.com/ondemand/companies/profil/osisko-gold-royalties-ltd/ - focuses on North America.

Current corporate information and press releases from Gold Royalty (- https://www.resource-capital.ch/en/companies/gold-royalty-corp/ -) and Osisko Gold Royalties (- https://www.resource-capital.ch/en/companies/osisko-gold-royalties-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/