Cash and investments stand at a solid $3.59M, its outstanding portfolio of projects consists of their flagship gold/lithium project Belleterre (which contains the historic Belleterre Mine which produced 750koz Au @10.7g/t and 95koz Ag between 1936 and 1959), the Skyfall nickel project and the Foothills phosphate/rutile project, all located in a very safe jurisdiction (Quebec), a strong management team and cornerstone investor base including Osisko Mining are all arguments that support the investment thesis. Management has big plans for 2024 on the exploration front for all projects, and it is anticipated that strong drill results and positive metal price movements are potential catalysts which could drive the price higher throughout 2024.

1. Introduction

Not often do you see a junior explorer consolidating prospective grounds in the backyard of Osisko companies the way Vior Inc. (TSXV:VIO)(FRA:VL51) has. This Montreal based explorer has assembled some impressive property packages, most notably their flagship Belleterre gold/lithium project and Skyfall nickel project (on trend with Osisko’s Windfall gold project). Belleterre contains a wildcard, being a 20km LCT pegmatite belt in the south, waiting to be explored further when lithium sentiment improves again. Last but not least Vior fully owns the Foothills project in Quebec, where sampling programs earlier this year revealed over 16.5kms of massive phosphate horizons at excellent grades.

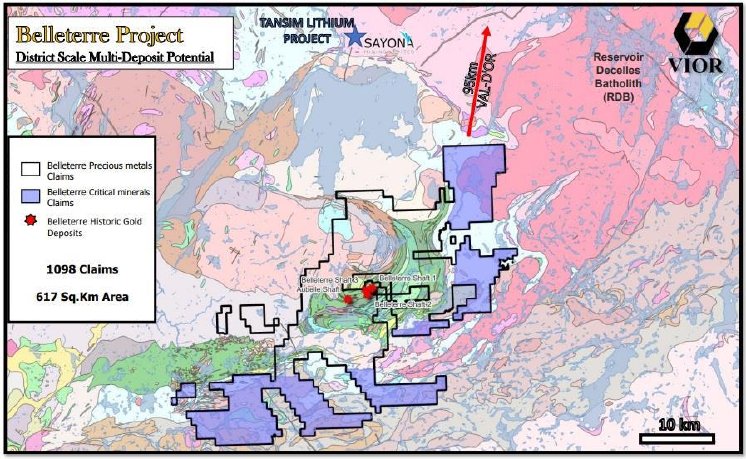

So far, Belleterre has been consolidated into an impressive 617 sq km land package (1098 claims), after Vior concluded a big consolidation venture with Osisko Mining Inc. for acquiring/optioning the complete historic Belleterre mining camp, owning most of it 100%. Later on Belleterre was expanded to current size by acquiring many claims to the south and east for LCT pegmatite potential.

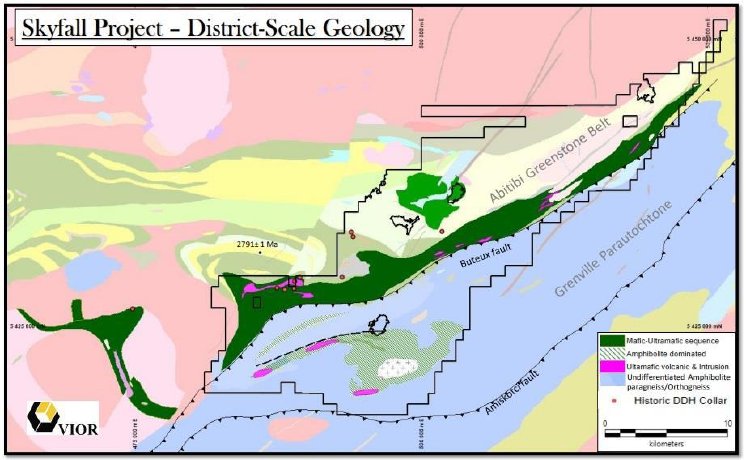

Originally, the Skyfall project was another gold project, but extensive fieldwork justified a switch to nickel focus. SOQUEM is earning into a 50% interest of the 538km2 property, and is committed to spending C$2.5M on the project. CEO Fedosiewich stated this about their upcoming plans for Skyfall: “We will undertake another 4 to 6 week field program, beginning early/late Spring 2024, and then look to generate some good drill targets. Drilling will likely begin in Q4 2024 and/or Q1 2025.”

Vior also has an equity investment of 3.64M shares in Ridgeline Minerals Corp (TSXV:RDG), currently valued at rock-bottom prices, worth C$388k. Ridgeline is exploring 4 highly prospective gold/copper/silver projects in Nevada, ranging from Carlin type to CRD, and cooperating with Nevada Gold Mines on two projects ( US$30M earn-in on Swift, US$10M earn-in on Carlin-East, targeting high grade, Tier I >5Moz Au deposits).

There are 104.06M shares outstanding (fully diluted 117.33M), 5.4M warrants and several option series to the tune of 7.9M options in total, the majority priced at C$0.21 to $0.30 for warrants & C$0.10 to $0.22 for options, expiring in 2024 and 2027. Vior has a current market capitalization of C$14M based on the December 21, 2023 share price of C$0.135.

The current cash position of Vior is a healthy C$3.59M as mentioned, and the company recently topped up the treasury with a small raise of C$352k flow-through @ C$0.17, as they received interest from investors. On top of this, it recently optioned out their Mosseau Gold project to Harvest Gold, providing Vior with some short term cash and Harvest shares, potentially accounting over 5 years for C$2M in cash, 12M Harvest shares and C$3M in exploration expenditures, and a 1% NSR. I view this deal as a testament to the quality of the assets in Vior’s portfolio, as this was just their 5th most important, and shelved project.

Additional hard dollars is always a good thing, and goes a long way as the all-in cost of diamond drilling in the lower Abitibi region of Quebec is extremely cheap at approx. C$170/m. In addition in case you are not familiar with this, there are also significant tax incentives for flow through capital raises dedicated to exploration in Quebec.

Management holds no less than 14% of the current shares outstanding (CEO Fedosiewich holds approx. 10%), close strategic holders own approx. 22%, and the company also enjoys approx. 18% institutional ownership (including SIDEX, a Quebec sponsored junior exploration fund, FTQ, the labour sponsored pension fund and 2 other regional Quebec based funds). Osisko Mining owns a 13.6% non-diluted position. This leaves a free float of just 32.4%.

2. Management

President and CEO Mark Fedosiewich: 35 years of experience in investments and mining. Former First Vice President of CIBC, very extensive business network.

Chairman Claude St-Jaques: Founder of Vior, Mazarin and Virginia Gold Mines, also has a strong network. Very close to the Osisko team.

Eric Desaulniers: Founder, President & CEO of Nouveau Monde Graphite, geologist P.Geo, MSc.

Executive VP : Laurent Eustache: Professional geologist with 15 years of progressive experience including Agnico-Eagle Mines , Aurizon Gold Mines and as former Portfolio Manager at SIDEX ($100M + AUM).

3. Projects

Vior owns a portfolio of 7 projects, however, it’s exploration focus is clearly on the Belleterre, Skyfall and Foothills projects as mentioned. The Company also views the Ligneris project as a strategic asset in the portfolio as it comprises a near district scale gold rich VMS target and is located near Amex’ Perron project. A disciplined approach and strategy has been deployed to acquire their recent projects, and these need to comply with the following strict criteria:

- Safe and mining-friendly mining jurisdictions

- In close proximity to an existing mine, historic mine or an advanced project

- Good infrastructure nearby and easy accessibility

- Project potential to go from an early to a more advance exploration stage

Belleterre Project

The current focus for Vior is clearly locked on their flagship Belleterre property. After consolidating further (blue zones for lithium/critical mineral claims), the company has assembled a district-scale 617km2 land package with a strike length of 55km.

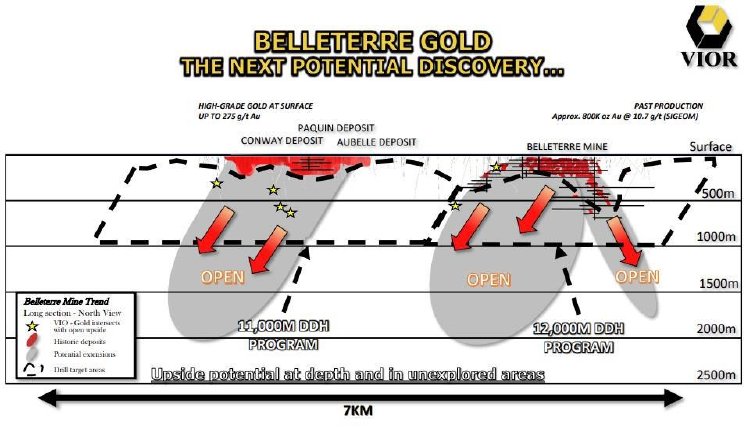

This land package has never been consolidated on this scale before, is located on a Greenstone Belt with favorable mafic volcanics, includes the historic high grade Belleterre Gold Mine (produced 750koz Au @10.7g/t and 95koz Ag between 1936 and 1959), has good infrastructure and has several gold milling facilities with available capacity nearby, and the entire area is very underexplored ever since. Adding to this, previous drilling did not exceed 250 meters.

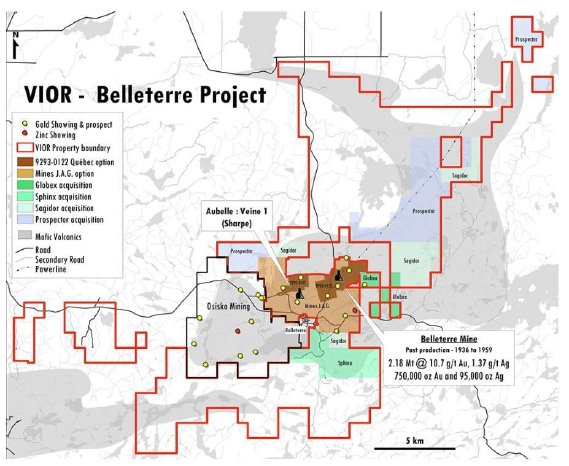

The Belleterre project is, aside from the majority of the claims already 100% owned by Vior, largely subject to 3 Option agreements: with JAG Mines Ltd, 9293-0122 Quebec Inc. and Osisko Mining Inc. The Option with JAG allows Vior to acquire 100% of this specific land package for C$2.3M in cash and/or shares, and C$2M in exploration expenditures, over the course of 4 years, with C$2M of the C$2.3M in cash or shares scheduled for the last year, representing very little payment obligations until June 31, 2025. JAG holds the equivalent of a 1% NSR over the property.

The purchase option with 9293-0122 Quebec Inc, which covers the Belleterre Gold Mine and its direct surroundings, allows Vior to purchase a 100% interest, by paying C$2.1M in cash and/or shares before 2023 year end or thereabouts, and with no exploration expenditures. There will be no royalty involved on these claims. This purchase option was arranged during the main consolidation acquisition phase for the Belleterre project, when numerous other claims were acquired from other parties. Most of these parties were granted a 1% NSR, and Globex was granted a 2% gross metal royalty. The various claims can be seen on this older map.

The option agreement with Osisko Mining allows Vior to acquire up to 75% of Osisko’s current interest in their Belleterre properties (see above at the map claims Osisko in black). 51% can be acquired by issuing C$225k in shares over 3 years and by incurring C$1.25M in exploration expenditures before August 2024. Vior has the right to acquire another 24% by incurring another C$1.75M in exploration expenditures within 3 years after exercising the 51% option. No royalty is part of this deal, unless the interest of one of the JV partners drops below 10%.

The most impressive feat for me is that Vior managed to consolidate this entire district play right under the nose of Osisko Mining, as Osisko was obviously interested. Maybe Osisko didn’t have the best negotiation position with all the vendors, as a rising gold price and a big name probably drives up prices to the point that Osisko decided to wait, and focus on other projects. A small stake in the project, and an equity stake in Vior might prove to be an interesting alternative for Osisko.

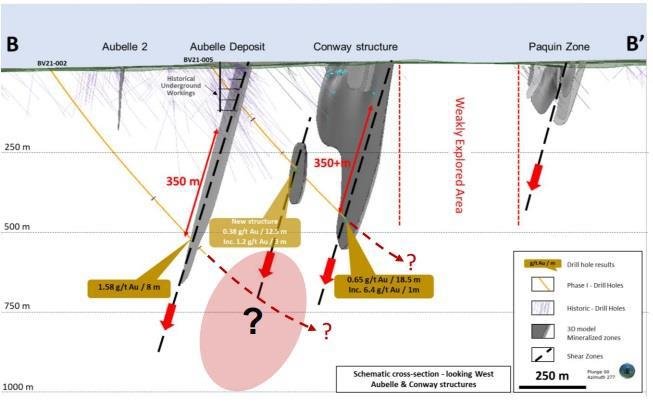

That’s about it for ownership, let’s have a quick look at exploration. Sampling programs have been quite successful, as for example a 2021 program saw 20 out of 38 samples returning gold values above 10g/t Au, with the three highest grade samples coming in at 274.9g/t Au, 121.3g/t Au and 77.4g/t Au. Since the Belleterre project has shown many more excellent sampling results since, but not equally strong drill results yet, the yet to be planned Phase III drill program will prove whether economic gold mineralization is present at Belleterre or not.

As a reminder, Phase II results reported modest results for the targeted 12W vein structure, with best intercepts quoting 1.35m @ 12.87g/t Au and 1.1m @ 4.15g/t Au, being part of a completed 4,000m Phase II drill campaign. In turn this was following up on a 3,587m Phase I drill program, which was highlighted by a 0.5m @ 55g/t Au intercept.

Although both programs didn’t exactly return stellar results, which was also reflected in the share price (which wasn’t immune to ongoing negative stockmarket sentiment either this year), keep in mind they were both completed at a very early stage in Vior’s systematic exploration process of an extensive project with lots of targets still to be tested. Management is aiming at mineralization at depth, since this is the general makeup of Abitibi deposits in the region, and recent drilling demonstrated wider mineralized intercepts at depth, suggesting more gold-bearing structures down below.

Skyfall project

The second most important project for Vior is the Skyfall project, also located in Quebec. This is an equally large land package of 538km2, and 100% owned by Vior. It is located adjacent to the East of the Windfall deposit (6M+ oz Au resource, owned by Osisko Mining), and the Gladiator and Barry deposits (combined 2Moz Au resource, owned by Bonterra). This project is subject to an option agreement with SOQUEM, highlighted by the following terms:

- SOQUEM will have the option to acquire a 50% undivided interest in the Skyfall Nickel project, with VIOR owning the other 50% and being the operator

- SOQUEM will finance exploration work commitments totalling C$2.5 million over a two-year period

- SOQUEM will make cash payments to VIOR totalling C$350,000 over a two-year period

Desktop research by Vior geologists showed that a combination of geochemistry, mag surveys, lithogeochemistry and sampling represented nickel/chromite/magnesium potential, as samples generated up to 0.17%Ni, 0.25%Cr and 23% MgO, which are very good numbers for just surface samples as they already come close to economic drill hole results. Of course, just sampling doesn’t forecast much but this information was sufficient for SOQUEM to act on it, so I’m looking forward to their exploration plans in 2023. As an example, fellow junior Inomin Mines (MINE.V) went completely ballistic from 10c to 72c on heavy volume earlier this year when they reported a few drill holes with one containing 252m @ 0.16%Ni, 0.33%Cr and 20.6%MgO, so this could give you an impression of the potential here. Besides this, for reference, economic nickel deposits globally range from 0.20% to 1.4%Ni.

Vior completed field exploration on Skyfall, consisting of prospection, mapping, stripping, channel sampling and more till sampling, and has flown a 3,000km VTEM survey earlier this year.

Foothills project

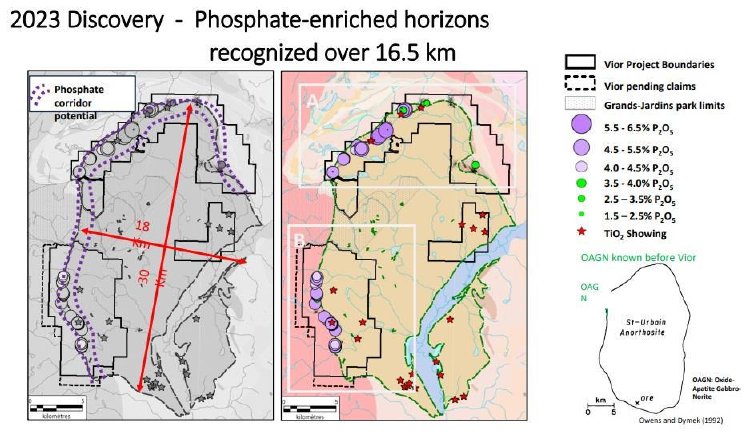

Vior’s third project of significance is Foothills, also located in Quebec, measuring 285km2 in size for 532 claims. After a sampling program that lasted 10 days and rendered 139 outcrop samples, it became clear that there might indeed be lots of phosphate present at Foothills. The geologists identified 2 large zones with lots of outcropping phosphate, in total 16.5km long, and 67 of the 139 samples resulted in values of 4-6.3% P2O5 (phosphate), which actually is already economic grade, and comparable to peer projects.

The size of the sampled areas is very substantial, and when doing a wild, armwaving estimate assuming typical but potentially very conservative width and depth, a 12,000 x 100 x 50m x 2.75T/m3 would generate a hypothetical 165Mt envelope. For comparison: First Phosphate (CSE:PHOS) has a 49Mt resource, and Arianne Phosphate (TSXV:DAN) 472Mt reserves (total resources including satellite deposits over 1Bt, making it the largest undeveloped deposit worldwide). Management is looking to follow up with another comprehensive field program, which will include channel sampling, and is looking begin a first drill program sometime in Q4, 2024, maybe earlier but this depends on various moving parts.

4. Key points

- Vior is focusing all of its energy on three impressive district-scale land packages, being Belleterre which surrounds a historic former high grade mine, Skyfall, the newfound nickel prospect, and Foothills, the newfound phosphate project

- The company is working together with Osisko Mining on Belleterre, and SOQUEM on Skyfall, and benefits a lot from their expertise on the projects/region

- The region has been very underexplored even though it hosts a historic gold mine and many gold showings. Management believes that, after two drill programs and lots of mapping/sampling, there is significant exploration potential at Belleterre. Skyfall and Foothills are even less explored, but the geological conditions are very favorable.

- A 30,000m drill program is designed for Belleterre, and should start in H1, 2024, further specifications of this program will follow in January 2024.

- Vior is not only working with Osisko Mining, but also financially backed by them, and a few powerful Quebec institutions. Adding to this are the CEO and Chairman with their large networks in mining finance, so raising money has never been a problem.

- Vior management is very much aligned with shareholders, as CEO Mark Fedosiewich owns approximately 10% of outstanding shares.

- A wildcard for Vior is their early investment in Ridgeline Minerals, which could provide lots of cash in case of a re-rating, in case of exploration success in Nevada.

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Vior Inc. is a sponsoring company. All facts are to be checked by the reader. For more information go to www.vior.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.