Key Objectives of the Company's Strategic Plan

Over the next 12 months, Tudor Gold expects to complete the following objectives:

- Continue the ongoing exploration and definition drilling program in Q3 2024 and report on results;

- Advance the metallurgical program and provide the results of this test work in 2024;

- Proceed with preliminary permitting and environmental requirements; and,

- Complete a Preliminary Economic Assessment by Q2 2025.

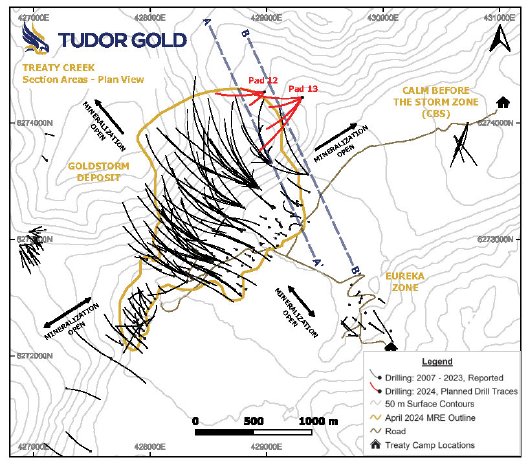

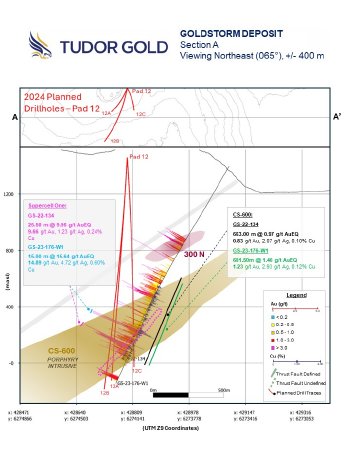

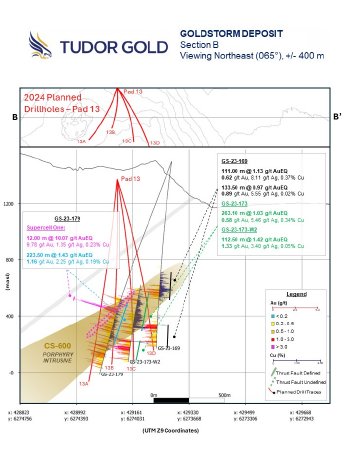

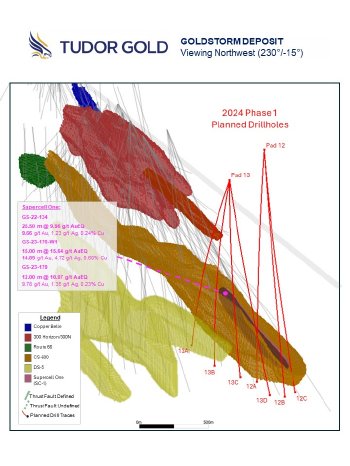

On May 9, 2024, Tudor Gold initiated a 10,000-meter (m) diamond drilling program at the Goldstorm Deposit, with the primary goal of expanding and upgrading the Mineral Resource Estimate released early this year (April 8, 2024 news release). To date, approximately 4,000 m of drilling, including two drill holes, have been completed on schedule. The first hole GS-24-181 intersected fine to medium-grained visible native gold at 810.5 m. It is believed that this mineralization could be associated to the 300N mineral domain and possibly represents a series of parallel high-grade structures similar to Supercell One (SC-1). Click on the following link to view a photo of the core.

The current drilling program is concentrated on step-out and in-fill drilling within the high-grade SC-1 system, a gold-dominant, quartz-sulfide, breccia-hosted structural corridor. This system remains open to the northwest, north, and east (February 1, 2024 news release). The Company plans to further explore this higher-grade zone with continued drilling. Results from the recently completed drill holes will be shared as soon as assay data is received.

Previous drilling results from SC-1 in 2022 and 2023 include the following high-grade gold intercepts:

- Hole GS-23-176-W1:00 m @ 15.64 grams/tonne (g/t) gold equivalent (AuEQ) (14.89 g/t gold (Au), 4.72 g/t silver (Ag), 0.60% copper (Cu))

- Hole GS-22-134: 50 m @ 9.96 g/t AuEQ (9.66 g/t Au, 1.23 g/t Ag, 0.24% Cu)

- Including 50 m @ 20.86 g/t AuEQ (20.61 g/t Au, 1.50 g/t Ag, 0.20% Cu) - Hole GS-23-179: 00 m @ 10.07 g/t AuEQ (9.78 g/t Au, 1.35 g/t Ag, 0.23% Cu)

Metallurgical Studies on the Goldstorm Deposit

The Company is confident that further metallurgical testing will continue to improve on the Goldstrom Deposit. As previously reported (February 20, 2024 news release), flotation testing demonstrated that the CS-600 domain can produce a quality copper concentrate with significant quantities of gold.

The ongoing phase of metallurgical test work on the Goldstorm Deposit is progressing well and is focused on improving the outcomes achieved in the previously reported program conducted by Blue Coast Research Ltd. (BCR), under the supervision of Tad Crowie, P. Eng of JDS Energy & Mining Inc. This phase of testing is expected to provide information to be used in a Preliminary Economic Assessment and includes comminution, follow up flotation tests, alternate forms of oxidation, and leaching tests to recover copper and gold.

Preliminary Economic Assessment and Environmental Studies

The initiation of a Preliminary Economic Assessment (PEA) for Treaty Creek’s Goldstorm Deposit is expected to begin in the next quarter, with the Company aiming to complete this study by Q2 2025. The PEA is anticipated to detail a phased production strategy focusing on exploiting high-grade areas or supercells of the Goldstorm Deposit to maximize the internal rate of return (IRR). To ensure accuracy of the PEA, the Company will continue to optimize the project and develop a comprehensive strategy to facilitate the permitting process for implementing the best mining methods and phased production strategy. Efforts will also be made to define precise cost estimates to ensure that projected capital expenditures align with prefeasibility study standards, strengthening the project's economic viability and credibility. Additionally, the PEA is expected to establish work programs to guide the Company towards subsequent stages, including a detailed prefeasibility study to be completed in the future.

Continued environmental studies are being conducted to assist in the economic evaluation and permitting process for the Treaty Creek Project.

Quality Assurance and Control

Ken Konkin, P.Geo, President and CEO, Tudor Gold, is the Qualified Person, as defined by National Instrument 43-101, responsible for the Project. Mr. Konkin has reviewed, verified, and approved the scientific and technical information in this news release.

About Treaty Creek and the Goldstorm Deposit

The Treaty Creek Project hosts the Goldstorm Deposit, comprising a large gold-copper porphyry system, as well as several other mineralized zones. As disclosed in the “NI-43-101 Technical Report for the Treaty Creek Project”, dated April 5, 2024 prepared by Garth Kirkham Geosystems and JDS Energy & Mining Inc., the Goldstorm Deposit has an Indicated Mineral Resource of 27.87 million ounces (Moz) of AuEQ grading 1.19 g/t AuEQ (21.66 Moz gold grading 0.92 g/t, 2.87 billion pounds (Blbs) copper grading 0.18%, 128.73 Moz silver grading 5.48 g/t) and an Inferred Mineral Resource of 6.03 Moz of AuEQ grading 1.25 g/t AuEQ (4.88 Moz gold grading 1.01 g/t, 503.2 Mlb copper grading 0.15%, 28.97 Moz silver grading 6.02 g/t), with a pit constrained cut-off of 0.7 g/t AuEQ and an underground cut-off of 0.75 g/t AuEQ. The Goldstorm Deposit has been categorized into three dominant mineral domains and several smaller mineral domains. The CS-600 domain largely consists of nested pulses of diorite intrusive stocks and hosts the majority of the copper mineralization within the Goldstorm Deposit. CS-600 has an Indicated Mineral Resource of 15.65 Moz AuEQ grading 1.22 g/t AuEQ (9.99 Moz gold grading 0.78 g/t, 2.73 Blbs copper grading 0.31%, 73.47 Moz silver grading 5.71 g/t) and an Inferred Mineral Resource of 2.86 Moz AuEQ grading 1.20 g/t AuEQ (1.87 Moz gold grading 0.79 g/t, 475.6 Mlb copper grading 0.29%, 13.4 Moz silver grading 5.63 g/t). The Goldstorm Deposit remains open in all directions and requires further exploration drilling to determine the size and extent of the Deposit.

About Tudor Gold

TUDOR GOLD CORP. is a precious and base metals exploration and development company with claims in the Golden Triangle of British Columbia (Canada), an area that hosts producing and past-producing mines and several large deposits that are approaching potential development. The 17,913-hectare Treaty Creek Project (in which TUDOR GOLD has a 60% interest) borders Seabridge Gold Inc.’s KSM property to the southwest and Newmont Corporation’s Brucejack property to the southeast.

ON BEHALF OF THE BOARD OF DIRECTORS OF

TUDOR GOLD CORP.

"Ken Konkin"

Ken Konkin

President and Chief Executive Officer

For further information, please visit the Company's website at www.tudor-gold.com or contact:

Chris Curran

Vice President of Investor Relations and Corporate Development

Phone: (604) 559 8092

E-Mail: chris.curran@tudor-gold.com; or

Patrick Donnelly

Vice President of Capital Markets

Phone: (604) 559 8092

E-Mail: patrick@tudor-gold.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including the completion and anticipated results of the key objectives in the Company’s strategic plan, and planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the Company’s strategic plan and planned exploration activities will be completed in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s plans or expectations include risks relating to the actual results of current exploration activities, fluctuating gold prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Company with securities regulators.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.