- Introduction

Notwithstanding this, last year in August 2019 the federal government of Canada finally granted permission on the EIA, making Goliath Gold one of only very few mining projects in Canada to achieve this milestone. As a consequence of this, and a rising gold price since the summer of 2019, the company could raise $2.8M fairly quickly in November 2019, and management is shifting gears for a Pre Fea sibility Study (PFS) at the end of Q1 or start of Q2, 2020.

In this analysis I will discuss several important aspects, and the potential impact on valuation if things go as planned.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

- The company

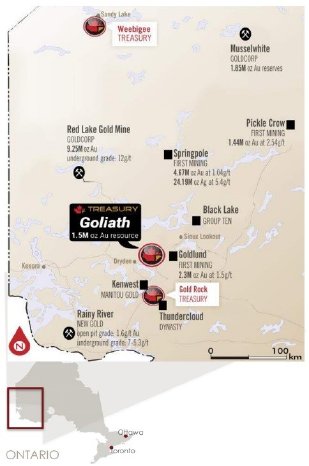

As can be seen, already permitted mines are too far away from most undeveloped deposits in the area, so Goliath Gold could provide meaningful milling/processing capacity in the future, as it is far ahead in the permitting process. Hydro power, natural gas, the Trans-Canadian Highway and CP Rail are close by so infrastructure at this part of Ontario is excellent.

A detail that stood out for me is the great variety of deposits, although this particular part of the Greenstone Belt in this area of Ontario is mostly known for its deep and high grade Red Lake Gold Mine, which is also surrounded by other deposits not pictured above (for example Madsen, owned by Pure Gold). It seems that the Rainy River Mine, owned by New Gold comes close to the type of deposit Goliath is shaping up so far, being a combination of open pit and underground mining.

The Goliath Gold project is located in North West Ontario, near a city called Dryden. In the most recent Fraser Institute Survey of Mining Companies (2018), Ontario is ranked 30 out of 83 jurisdictions regarding the Policy Perception Index, which indicates an average climate for mining ventures. The article will discuss the Goliath Gold project, and only briefly mention the other, more early stage projects. Besides Goliath Gold, the company has a fully owned exploration subsidiary called Goldeye Exploration Ltd., which in turn owns Weebigee-Sandy Lake, located near Sandy Lake in Northwestern Ontario. Goldeye owns two additional properties in Ontario, which are Gold Rock and Shining Tree-Fawcett.

Treasury Metals is led by two men: CEO Greg Ferron and Non-Executive Chairman Marc Henderson, who also is one of the largest individual shareholders of the company. I met them both at different occasions, and they come across as very serious and knowledgeable. Ferron is the former VP Corporate Development who replaced the former CEO Chris Stewart, who left in August 2018 in order to become the COO at McEwen Mining, a well-known mid tier gold producer. Greg is more of a finance guy, with a background in financial analysis as an analyst and various roles at the TSX. Marc Henderson is the more experienced and successful of the two, having led Laramide Resources since 1995, a familiar uranium junior, and also was President and CEO of Aquiline Resources, a silver junior which was sold to Pan American Silver in 2009 for C$626M, which resulted in a large pay day for Henderson.

Ferron and Henderson are supported by Mark Wheeler, Director and supervising projects, with experience at the Quebrada Blanca open pit mine of Teck, and the Williams underground mine in Ontario, and Adam Larsen, who is the exploration manager for Goliath for the last 8 years, and before this was exploration geologist at the Musselwhite Mine owned by Goldcorp. Other interesting persons on the Board of Directors are Bill Fisher, former Chairman of Aurelian Resources, which was sold for $1.2B to Kinross in 2008, and Flora Wood, currently director of Altius Minerals and Aethon Minerals.

Treasury Metals has its main listing on the main board of the TSX, where it’s trading with TML.TO as its ticker symbol. With an average volume of about 163.146 shares per day, the company’s trading pattern is liquid at the moment, and I expect this to improve further when the resource update and PFS are released.

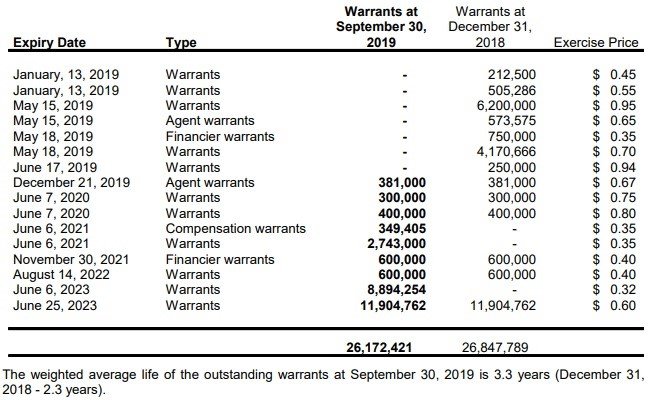

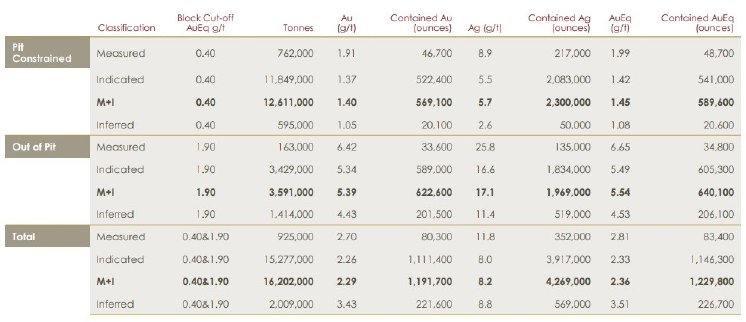

The company currently has 169.38M shares outstanding (fully diluted 200.22M), 25.57M warrants and several option series to the tune of 5.275M options in total. Here are the breakdown tables taken from the latest financials, starting with the warrants: Figure 3

As can be seen, the bulk of the warrants has an expiry date 3.5 years from now, and amounts and exercise prices aren’t something to materially impact the number of outstanding shares. Here are the options: Figure 4

It seems to me that management has a nice incentive to at least increase the share price to levels well above 40c. In my mind Treasury would still be undervalued at these gold prices, as I try to explain later on.

A current share price of C$0.26 results in a market cap of C$44.89M. Management has decent skin in the game, as they hold 11% together with the Board. Institutionals hold about 30%, which means roughly 41% is in relatively tight hands. About 45% of the equity is held by European investors, which is rare in Canadian junior land. According to CEO Ferron when asked about this, Treasury management sold a company called Aquiline to Pan American and several of the same investors reinvested in Treasury Metals as a result of that successful outcome. We have continued to work closely with a number of European funds, family offices and HNW investors who continue to add to their positions. The Europeans also like the location of the project in Ontario, Canada and access to skilled labor and infrastructure. The recent permitting success was also a welcome development for them.

The company is tracked by 2 brokerage analysts from Haywood and PI.

The company currently has about C$3M in the treasury, and a convertible debt of C$4.5M, carrying an 8% interest. The debenture is held by two of the largest equity holders in the company, Extract Capital and DSC, which are supportive. Treasury had the commitment to spend C$2.2M on exploration in 2019, which they achieved.

I also looked into the compensations of management, and it appears Treasury is run fairly lean. According to Ferron, they have reduced the payroll mainly on the technical team by over C$1M over the past year. They kept the key exploration, engineering and permitting teams intact. All of the corporate office staff is half time and works with Laramide Resources for 50%. This includes CFO, Controller, Office Manager, and A/P clerk.

The share price of Treasury Metals looks like this: Figure 5. Share price; 3 year time frame

As most gold developers gradually sold off during the neutral to negative sentiment during 2018 and 2019, so did Treasury, bottoming out in the 20c range. After the granting of the environmental permit in August 2019, there was a meaningful uptick, supported by a rising gold price, but this wore off pretty quickly as well, as investors started looking for ways to make a quicker buck.

One of the groups that didn’t mind this little sell-off was a Belgian-French group of investors, buying more during the peak of tax loss selling season, in mid December 2019. They were mostly the reason the share price peaked at 30c again, and after their buying pressure subsided, it dropped again conveniently low to 25-26c at the moment, which I regard as an excellent entry point as it is close to multiyear supports, with big catalysts coming up.

- Goliath Gold Project

Treasury acquired the project back in 2008 after the company was listed as a spinout from Laramide Resources, and mineralization was already discovered here in the nineties. The Goliath Gold project has already seen 3 PEAs over the years, in 2010, 2012 and 2017. The mining method of the first 2 PEAs was focused on an open pit only, now the focus is on the underground part. As the deposit comes to surface it certainly makes sense to include a starter pit.

The Environmental Impact Statement application was already filed in 2012 but saw delays for various reasons. The EIS really got moving from 2015 to 2019, when it was granted in August of that year. As mentioned earlier, this was a huge threshold for the project, as it is very difficult to get such an approval. The process requires years of public and community meetings, and environmental reviews. According to management, construction permits will take much less time, within 12 months. As part of that, they will start submitting key applications like hydro energy this quarter.

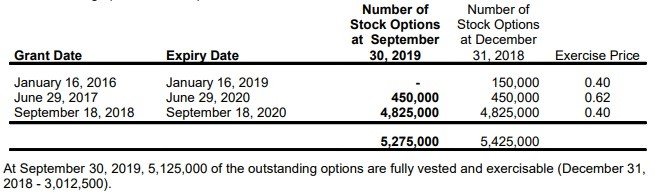

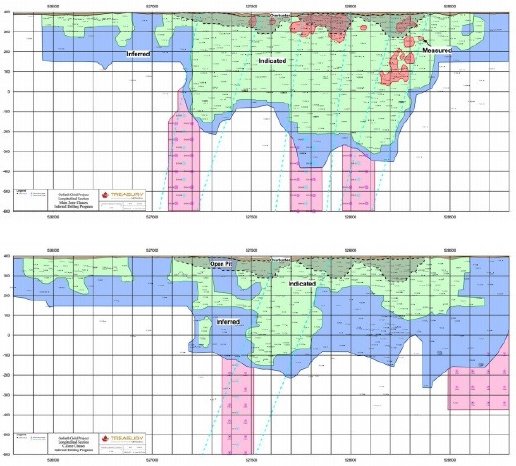

The current Goliath resource stands at 1.46Moz AuEq, consisting of 83koz Au Measured, 1.14Moz Au Indicated and 220koz Au Inferred, with an average grade of 1.40g/t Au M&I for the open pit component, and 5.39g/t Au for the underground component. There is a small silver part to the tune of 4.2Moz Ag M&I, resulting in a resource increase of 110koz AuEq. So 92.5% of the resource is gold, which is a good thing for gold mine financiers who don’t like too much revenues coming from metals with other fundamentals, recoveries and pricing mechanisms.

Management expects to improve on these resource numbers with the ongoing infill and stepout drill program, after a downhole IP Survey confirmed expansion potential at depth and along strike. They are aiming at a few hundred thousand ounces of gold more, with the capability to improve economics. Besides this, infill drilling is needed to convert most of the M&I resource into Probable Reserves.

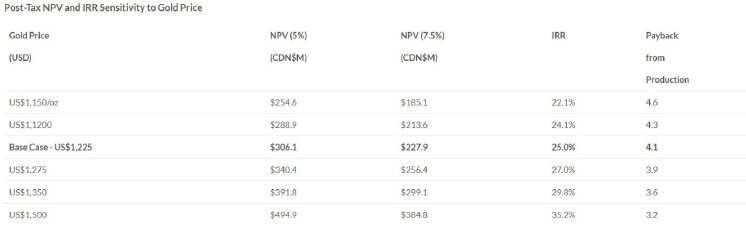

The company is also in the process of completing a PFS soon. Management expects PFS economics to be close to or even improving (lower capex figures) on 2017 PEA figures, which are very solid. The operation will be a combination of open pit and underground mining. The after-tax NPV5 is C$306M, the after-tax IRR is 25% at a gold price of just US$1225/oz, while the current gold price is sideranging around $1550/oz lately. Keep in mind the current market cap of Treasury is just C$45M, which is about 1/10th of the current NPV5. The initial capex is low at C$133M, in addition to this an eventual capex financing package will likely include C$20M for a reclamation bond. This is the PEA sensitivity for Goliath: Figure 8

It will probably clear that the project has great leverage to the gold price, as at $1,500/oz the post-tax NPV5 will be C$494.9M, and the IRR will be 35.2%. The threshold for financiers to fund capex has always been roughly a post-tax IRR of 20% for gold projects at a gold price of US$1,200/oz. As Goliath has a post-tax IRR of 24.1% at US$1,200/oz Au, things are looking solid. Of course we are talking about PEA economics here with a large margin of error, but as management indicated several times to me, they wouldn't be surprised if PFS economics would come in just as robust. If the PFS indeed delivers according to these ideas, Goliath would become pretty interesting as a take over target, as 1Moz+ Au deposits with good PFS/FS economics, environmental permit granted and exploration upside are very rare these days. Let's have a quick look at the deposit and exploration plans for Goliath now.

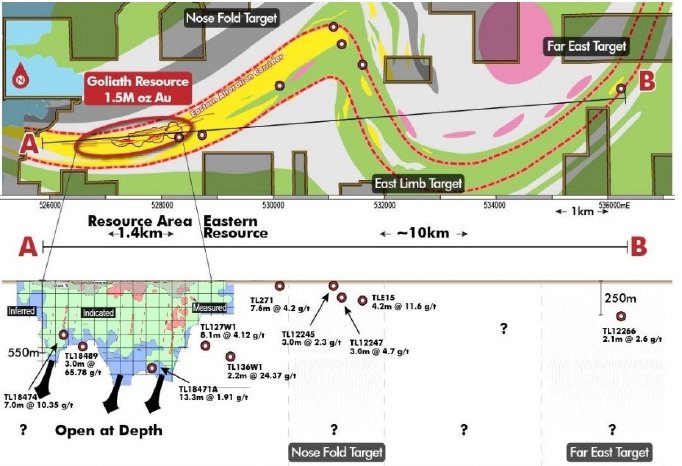

The Goliath Gold project is part of a large folded structure, and only 1.5km of a 10km trend has been explored thoroughly: Figure 9

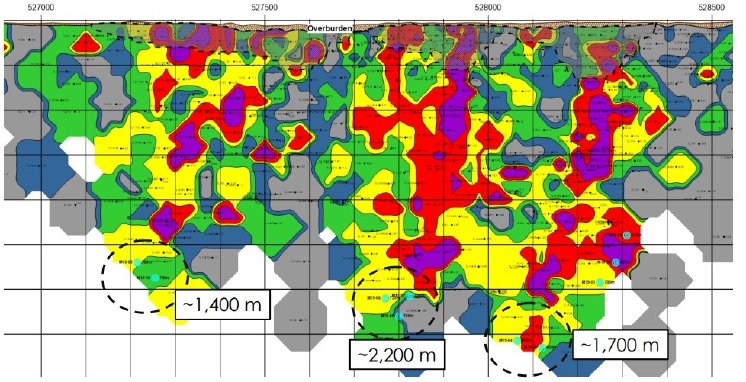

As the deposit is located in typical Red Lake Greenstone, with a lot of deep dipping mineralization, it is no coincidence that management is also focusing on drilling more at depth. Deposits like Red Lake or Madsen run down for 1-2 kilometers. Notwithstanding this, Goliath also has established extensive strike length so far, and also has significant mineralization near surface, which also makes it very interesting as far as future expansion potential goes.

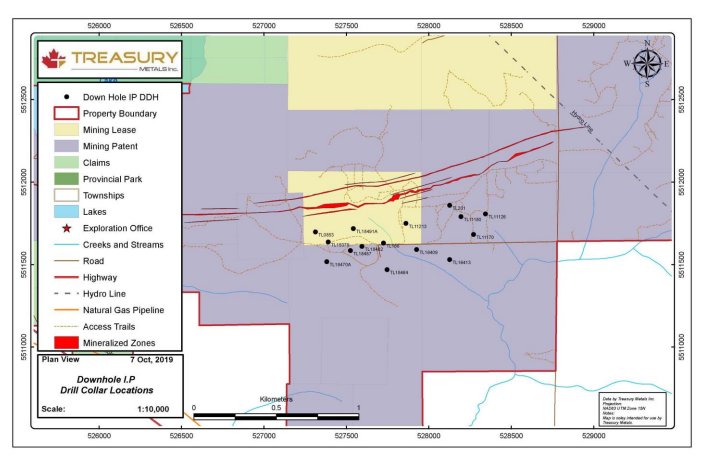

The red zones are the outlined mineralized zones, vein type, starting at surface and steeply dipping. The drill hole collars in the map used for a down hole IP survey indicate that the veins dip under an angle, towards the south. This is why the drill holes, also angled towards the veins, are located relatively far away from the mineralized zones. The next 3D model further below explains this a bit more.

Of course there is never such thing as a free lunch, as vein type deposits require lots of drilling, and Goliath already has seen lots of it as the mineralization is more or less continuous, but complex as the nature of the geology is fractured and folded. Notwithstanding this, the company managed to convert the existing data into a sizeable and economic resource, and have a good handle on geology now, using lots of magnetic/resistivity survey information as well.

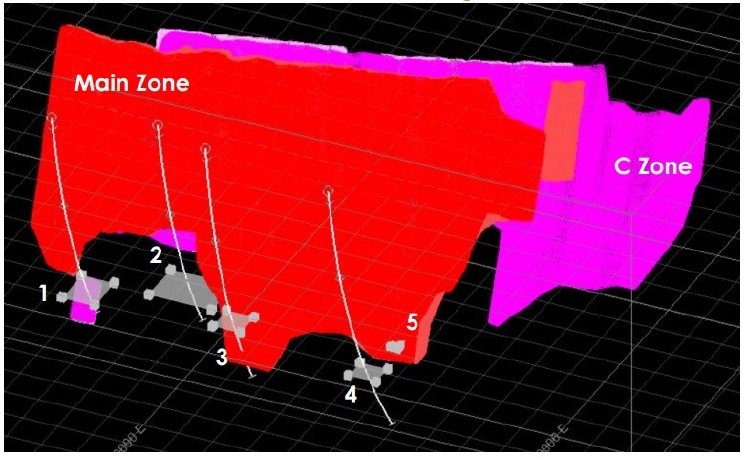

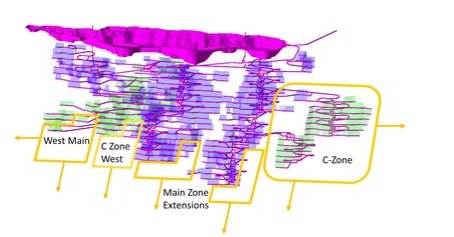

The shape of the Goliath deposit is more or less conceptualized by a set of steeply dipping lenses, that have significant strike and go deep, as can be seen at this 3D model: Figure 11

The company also included a first 3D model of a probable mine plan in the latest news release, discussing exploration programs, and this shows the combination of targets and open pit& underground mining best: Figure 12

The current exploration programs are targeting 3 subjects:

- extending known mineralization at depth: 5,000m will drill test select down-dip targets identified in the recent downhole IP Survey by recent underground mine scheduling modelling work, and further expansion potential of the high-grade Main Zone and C Zone Central ore shoots down dip.

- infill drilling known mineralization in order to convert resources into reserves for the PFS: 5,000m targeting the conversion of underground Inferred resource blocks to the Indicated category within the C Zone East resource area where several significant gold intersections have been found. Another 1,500m will also be focused on upgrading specific areas of the Main Zone shoots to the Measured classification for inclusion as potential estimate ounces for the initial mine life years and for grade control purposes.

- step out drilling along strike in order to establish expansion potential, or even district scale potential: 3,500m will be dedicated to exploration drilling of on strike extensions across the full Goliath Property. Of particular interest is the northeast fold nose area, results from the soil gas hydrocarbon program and follow-up to holes drilled on the far east of the property, 11 km along strike from the current resource. This drill hole encountered approximately 100 metres (drilled length) of felsic volcanics and portions with gold mineralization similar to those found in the resource area.

This is heavily conceptualized, as mineralization seems to be concentrated in many pods and zones, as can be seen here in this long section: Figure 14

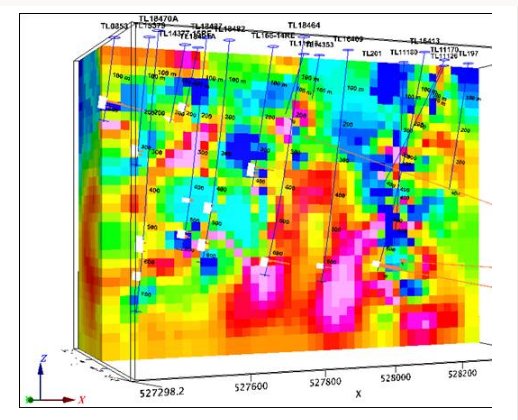

These targets were the results of a downhole IP survey, which was 3D visualized in the following way: Figure 15

The black lines are existing drill holes, the white rectangles existing gold mineralization.The image is not very straightforward to interprete, as I noticed when reading conclusions provided by the company:

"From the combined 3D Gradient and Cross-hole block model, generally it appears that the middle and lower gold zones are associated with conductivity lows. The upper west zone is associated with moderate conductivity. On the other hand from the 3D chargeability model, the gold zones are associated with chargeability high and high-low contacts.

Generally, based on the observations of the profile plots of the Pole-dipole, Gradient and Cross-hole data, the gold zones appear to be associated with moderate to high resistivity values on average (500 Ohm.m to 11, 000 Ohm.m). However, the upper west gold zone is associated with low to moderate resistivity."

I was wondering what the correlations were between established mineralization and the IP survey, and if management could extrapolate future drilling targets based on this, and how. When talking to VP Exploration Adam Larsen about these subjects, he explained it extensively to me. This could be a bit too technical for some, but Adam tried to describe it in the most understandable way possible:

"The coloured blocks are part of the 3D chargeability block model, in which they have sliced it at that particular northing to be able to see the drillholes where they generally intersect the zone/mineralization.

My expertise is not in Geophysics so I may be a bit limited to how much depth I can go into the interpretation, but generally the survey found that our mineralization is associated with Conductivity Lows and Chargeability Highs. There are areas where this varies and Gold is associated with moderate conductivity, but we also see some variability in the sulfide content/ across the deposit which could account for that. Additionally, these signatures seem to continue down dip and along strike, suggesting that the deposit extents reach further than what we have currently tested. This does not necessarily mean that the rock carries the same grade/width of Gold as the main resource, but is a good indication that the host rock is there and has the potential to be mineralized.

When interpreting the model/images, to my understanding, it is difficult to infer size as higher intensity signals will ‘overprint’ or ‘bleed’ further than less intense signals. It is more useful to help identify patterns or trends which may correlate with the current understanding of the geology which will guide the development of drilling targets.

Generally the survey ‘sees’ around 150-250m past the last drillhole surveyed in that direction. Because of the lack of data points and distance from the instrument, the edges of the model tend to taper off even if the zones are still present.

The signal received from anything will be reduced with distance. From what I understand, a further away, strong conductor may look similar in one direction to a moderate conductor which is closer in another direction. This is part of the complexity to interpretation which highlights the importance of experienced geophysicists looking at the data. However, the 3D inversion modelling helps with where things are located spatially.

The responses read and modelled in the survey can and do show variations between mineralized and non-mineralized rock, but due to the scale, limitations of resolution, and the narrow nature of the deposit, it isn’t as ‘black and white’ as one would hope. We are continuing to work with the Geophysicists who worked on the survey to plan our drillholes to best test the target areas identified."

So instead of interpreting the huge pink blobs as large targets, things appear to be more nuanced, and the actual targets are the white rectangles in the 3D model, displaying the red and pink lenses. At the moment, drill programs are on its way to shed light on current assumptions. The first results already have been published, and were in line with expectations, nothing special but sufficient. All 10 holes hit mineralization, and the highlights look like this:

- TL19-505: 7.4 g/t Au over 6.3 m including 10.13 g/t Au over 4.0 m in the Main Zone.

- The Eastern C Zone exploration target – TL19-503: intersected 14.8 g/t Au over 7.0 m including 101.0 g/t over 1.0 m.

- TL19-502: 5.2 g/t Au over 7.0 m in the Main Zone.

- Targeting the Eastern C Zone - TL19-506: 14.6 g/t Au over 1.0 m, 11.8 g/t over 1.0 m, and 8.13 g/t over 1.0m intersecting in a newly discovered lens of high-grade mineralization east of the existing resource area. The C Zone intersected a wide, lower grade halo of gold mineralization (6.8 m @ 1.35 g/t).

- TL19-507: 6.2 g/t Au over 4.0 m in the Main Zone.

- TL19-508: 4.1 g/t Au over 5.4 m including 9.7 g/t Au over 2.0 m in the Main Zone.

- TL19-510: 4.25 g/t Au over 5.0 m in the Main Zone.

- Peer comparison

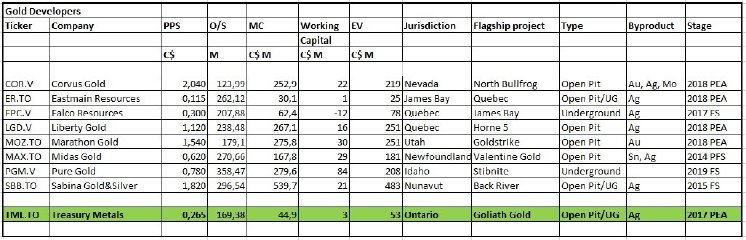

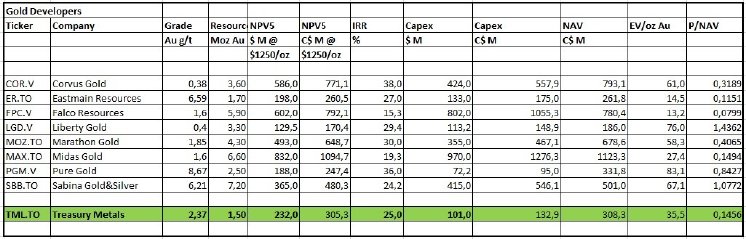

I picked a number of well-known companies, all having at least a PEA, all of them in Canada or the USA, gold-focused, and as Treasury has a fairly unique combination of a small part open pit and largely underground, I rounded up a group with various mining methods, from underground to open pittable deposits or the coveted combination of open pit and underground, as can be seen in these two tables: Figure 16

And: Figure 17

It will be clear, as every company is unique with its own unique set of circumstances, that one shouldn’t outright compare to the next peer. But it will also be clear that Treasury has a very low capex which is always attractive to financiers, a NPV5 that is a good deal larger than capex, and the IRR post-tax is solidly above the usual 20% financier threshold at a gold price which is about $300/oz lower than current.

Besides this, the EV/oz metric of the company is, for a quality project on the low side at 35, and could easily move towards 50-55 after the PFS comes out and resources increase. With regard of the P/NAV metric a rule of thumb is that a project close to production moves towards a value of 1, meaning the market cap eventually equals NPV5. As I see companies like Sabina, Liberty and Pure Gold around or even over this number, with Sabina for example still a long way from capex financing, there is serious re-rating potential for Treasury Metals in my opinion for possibly a double or even a triple before the end of this year.

- Conclusion

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Treasury Metals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.treasurymetals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.