Located in the northern and eastern regions of Quebec, the Projects comprise of 3,488 active claims, covering an area of approximately 165,916 hectares. The Company believes that the Projects hold great potential for spodumene-bearing lithium pegmatites. The Projects were discovered and selected by Shawn Ryan, one of Canada’s most prominent prospectors, who employed his extensive knowledge and experience in interpreting regional lake sediment geochemical data, as well as gravity and surficial anomaly maps to identify the most prospective projects.

Jon Ward, President and CEO of Targa, commented: “We are thrilled to announce our acquisition of three large pegmatite bearing lithium exploration projects from Shawn Ryan and his syndicate. This strategic move expands our portfolio of prospective lithium projects in Quebec and strengthens Targa's position in the lithium exploration space underscoring our commitment to becoming a leading explorer of lithium in North America. We look forward to commencing exploration of these high-potential projects and continuing to deliver value for our shareholders. We are also excited to extend our collaboration with Shawn Ryan, who staked our Shanghai project in the Yukon, and are eager to utilize his skills and knowledge to fully realize the untapped potential of this underexplored region.”

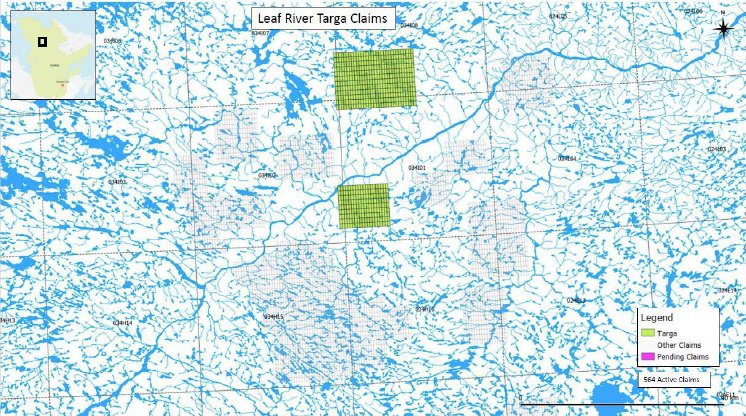

Leaf River Project

The Leaf River Project consists of two individual claim blocks that include 564 active claims totaling 25,636 hectares located within the Nunavik region of northern Quebec and 140 km from the community of Tasiujaq located on the western side of the Ungava Bay.

The claim blocks were staked to cover highly anomalous lake sediment geochemistry in lithium, caesium, and rubidium. Both claim blocks hold many samples that are over the 99th percentile for all three elements in the Quebec wide lake sediment dataset. These highly anomalous samples sit on or near regional magnetic lineaments (structures) that have been recognised at other projects (e.g. Patriot Battery Metals’ Corvette Li projects) to be associated with the distribution of spodumene bearing pegmatites. The geology was lightly mapped in 1998 showing a mix of northwest trending geological units such as amphibolite, diorite, gabbro, granodiorite and monzogranites.

In consideration for the Leaf River Project, Targa will (a) pay to Wildwood cash consideration of $130,000, payable as to 50% on the closing date and 50% following completion of an equity financing by Targa for gross proceeds of at least $1,000,000 (a “Qualifying Financing”); (b) issue to the Sellers an aggregate of 1,500,000 common shares in the capital of Targa (“Common Shares”); and (c) grant to Shawn Ryan a 1% net smelter return royalty on the Leaf River Project.

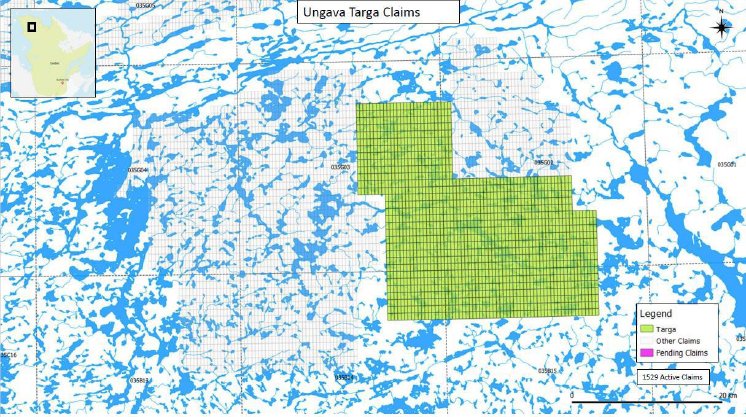

Ungava Project

The Ungava Project in the Raglan South District consists of 1,529 active claims totaling 63,865 hectares and is located within the Nunavik region of northern Quebec in the Ungava peninsula with the closest town of Salluit located 120 km northwest of the project and the Raglan Nickel Mine 75 km northeast of the claim block.

The claim block was staked to cover a cluster of anomalous LCT lake sediment anomalies, exhibiting significant enrichment in lithium, caesium, and rubidium, with numerous samples displaying values well above the 99th percentile for all elements in the Quebec government data base.

There has been limited mapping over the claim block, however five pegmatites have been mapped and are located next to the 99% lithium lake sediment anomalies, these samples have never been sampled for LCT potential.

In consideration for the Ungava Project, Targa will: (a) pay to Wildwood cash consideration of $350,000, payable as to 50% on the closing date and 50% following completion of a Qualifying Financing; (b) issue to the Sellers an aggregate of 3,500,000 Common Shares; and (b) grant to Shawn Ryan a 1% net smelter return royalty on the Ungava Project.

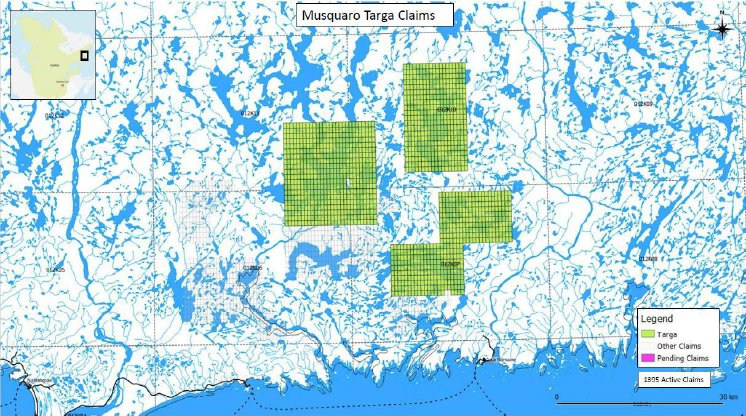

Musquaro Lake Project

The Musquaro Lake Project consists of three individual claims blocks with 1,395 active claims totaling 76,415 hectares located within the Côte-Nord region of eastern Quebec. The Musquaro Project is situated 60 km northeast of the Natashquan community.

The project area is characterized by the presence of over 96 mapped individual pegmatites and were staked to cover a highly anomalous population of lake sediment geochemistry anomalies in lithium, caesium, and rubidium. Many of these anomalies displayed lithium concentrations of more than 99% (37.3+ ppm). The claims also have multiple samples with cesium and rubidium values exceeding 99% (3.7 ppm caesium, and 65 ppm rubidium).

In consideration for the Musquaro Lake Project, Targa will: (a) pay to Wildwood cash consideration of $150,000, payable as to 50% on the closing date and 50% following completion of a Qualifying Financing; (b) issue to the Sellers an aggregate of 2,500,000 Common Shares; and (c) grant to Shawn Ryan a 1% net smelter return royalty on the Musquaro Lake Project.

The Transaction is subject to regulatory approval. All Common Shares issued to the Sellers will be subject to a four month hold period which will expire on the date that is four months and one day from the closing of the Transaction (the “Closing”). In addition, the Sellers have agreed to a voluntary escrow arrangement whereby one-third of the Common Shares will be released from escrow every four months after Closing, with the first such release date to occur on the date that is four months from Closing.

Source: Data was sourced from the Government of Quebec Ministry of Natural Resources and Forestry SIGÉOM Spatial Reference Geomining information System.

About Targa Exploration

Targa Exploration Corp. (CSE: TEX | FRA: V6Y) is a Canadian exploration company engaged in the acquisition, exploration, and development of mineral properties with headquarters in Vancouver, British Columbia.

Qualified Person

The scientific and technical content of this news release has been reviewed and approved by Lorne Warner P.Geo., who is a "qualified person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Contact Information: For more information and to sign-up to the mailing list, please contact:

Jon Ward, President and Chief Executive Officer

Tel: +1(604) 355-0303

Email: jon@inventacapital.ca

Website: www.targaexploration.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward‐Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward‐looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: exploration and development of the Company’s properties, commencement of exploration activities on the Projects, and expected closing of the Company’s acquisition of the Projects.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Targa, future growth potential for Targa and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of lithium and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Targa’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Targa’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Targa has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company's mineral exploration activities in Canada; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding mineral resources and reserves; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in Targa’ management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Targa has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Targa does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.