Eskay Creek 2023 DFS Highlights:

- After-tax net present value (“NPV”)(5%) of C$2.0 billion at a base case of US$1,800 gold and US$23 silver

- Industry-leading after-tax internal rate of return (“IRR”) of 43% and an after-tax payback of 1.2 years on pre-production capital expenditures (“CAPEX”)

- Life of mine (“LOM”) all-in sustaining cost (“AISC”) of US$684/oz gold equivalent (“AuEq”) sold

- Proven and Probable Mineral Reserves for open-pit mining of 39.8 million tonnes (“Mt”) containing 3 million ounces (“Moz”) gold and 88.0 Moz silver (4.6 Moz AuEq)

- Years 1-5: Average annual production of 455,000 oz at 5.5 g/t AuEq and average annual after-tax free cashflow of C$474 million

- Years 1-10: Average annual production of 370,000 oz at 4.2 g/t AuEq and average annual after-tax free cashflow of C$365 million

- Estimated pre-production CAPEX of C$713 million, yielding a compelling after-tax NPV:CAPEX ratio of 8:1

Conference Call Webcast and Dial in Details:

Webcast URL with Audio - https://services.choruscall.ca/links/skeenaresources202311.html

Participant Telephone Numbers – Canada/US 1-800-319-4610, International Toll +1-604-638-5340

Definitive Feasibility Study Presentation - https://skeenaresources.com/investors/2023-definitive-feasibility-study-presentation/ *presentation will be available on the morning of November 15, 2023

If you would like to ask a question, please dial in. All callers should dial in 5-10 minutes prior to the scheduled start time and simply ask to join the call. If you are unable to join the call, a replay will be made available here following the completion of the call.

Randy Reichert, Skeena’s President & CEO, commented, “This Definitive Feasibility Study was a critical de-risking step for the Company in the development of Eskay Creek. In this Study, we had multiple breakthroughs in metallurgy, increased Mineral Reserves by approximately 20% and continued to increase the Project value for our shareholders. This study is robust and engineered to construct Eskay Creek.”

The Company’s Executive Chairman, Walter Coles, added “Randy and the team have done a phenomenal job of improving the Project. With our base case after-tax NPV surpassing C$2.0 billion, Eskay Creek stands out as a rare potential Tier 1 gold mining project, located in a politically stable jurisdiction. Excitingly, we see additional opportunities to increase Reserves and mine life, while continuing to advance the project through permitting, project financing, construction and production in 2026. We’re frustrated by the massive valuation gap between non-revenue generating mine developers and junior gold producers. However, we recognize that rapidly advancing Eskay Creek toward production and generating cash flow is the obvious path to delivering tremendous shareholder value.”

Eskay Creek Definitive Feasibility Study

The DFS for Eskay Creek was completed by Global Resource Engineering (“GRE”) and Sedgman Canada Limited (“Sedgman”), a CIMIC Group Company. The Study demonstrates a robust Project with industry-leading economics for a conventional open-pit mining and milling operation. The DFS is a continuation of the September 2022 Feasibility Study (“FS”) with key updates including an updated Mineral Reserve statement, optimized mine plan and improved metallurgy.

Summary of Key Results and Assumptions in the DFS

Realized Improvements & Optimizations

The 2023 DFS incorporates several key enhancements and de-risking strategies relative to the 2022 FS including:

- Increase in the Mineral Reserve estimate and an extended mine life to 12-years

- Remodelled orebody based on a more selective mining approach with a smaller block size

- Pre-production mining accelerated to create a larger ore stockpile at startup, de-risking initial production and improving ability to blend for optimal concentrates

- Metallurgical testwork completed that supports a simplified flowsheet and results in a 43% reduction of mass pull with no material change in recovery to concentrate

- Lower concentrate tonnes at higher grade result in increased payables and decreased transport and smelter treatment costs

- Updated capital costs to reflect a plan that is executable, technically proven and significantly de-risked with an additional year of engineering and studies

- On-site permanent camp brought forward in plan and relocated away from mine infrastructure to improve workforce attraction and retention, promote employee well-being and to ensure adequate camp space during construction

Gold Price (US$/oz)

1,800

Silver Price (US$/oz)

23

Exchange Rate (US$/C$)

0.74

Discount Rate (%)

5

Contained Metals

Contained Gold (koz)

3,340

Contained Silver (koz)

87,970

Mining

Strip Ratio (Waste: Ore)

8.0:1

Total Material Mined (excluding rehandle) (Mt)

357.7

Total Ore Mined (Mt)

39.8

Processing

Processing Life (years)

12

Processing Throughput (Mtpa)

3.0 (Yr 1 – 5)

3.5 (Yr 6 –12)

Average Diluted Gold Grade (g/t)

2.6

Average Diluted Silver Grade (g/t)

68.7

Production

Gold Recovery (% to Concentrate)

83

Silver Recovery (% to Concentrate)

91

LOM Gold Production (koz)

2,800

LOM Silver Production (koz)

81,140

LOM AuEq Production (koz)

3,937

LOM Average Annual Gold Production (koz)

230

LOM Average Annual Silver Production (koz)

6,674

LOM Average Annual AuEq Production (koz)

324

Operating Costs Per Tonne

Mining Cost (C$/t Mined)

3.00

Mining Cost (C$/t Milled)

26.74

Processing Cost (C$/t Milled)

19.11

G&A Cost (C$/t Milled)

5.65

Water Treatment Cost (C$/t Milled)

2.48

Total Operating Costs (C$/t Milled)

53.98

Other Costs

Transport to Smelter (C$/dmt Concentrate)

154

Au Refining Costs (C$/oz)

34.50

Ag Refining Costs (C$/oz)

1.67

Treatment Costs (C$/dmt Concentrate)

175

Royalty (Net Smelter Return (“NSR”) %)

2

Cash Costs and All-in Sustaining Costs

LOM Cash Cost (US$/oz Au) net of silver by-product

130

LOM Cash Cost (US$/oz AuEq) co-product

567

LOM AISC (US$/oz Au) net of silver by-product

296

LOM AISC (US$/oz AuEq) co-product

684

Capital Expenditures

Pre-production Capital Expenditures (C$M)

713

Expansion Capital Expenditures (C$M)

9

Sustaining Capital Expenditures (C$M)

561

Closure Expenditures (C$M)

175

Economics

After-Tax NPV (5%) (C$M)

2,003

After-Tax IRR

42.9

After-Tax Payback Period (years)

1.2

After-Tax NPV / Initial Capex

2.8

Pre-Tax NPV (5%) (C$M)

3,107

Pre-Tax IRR (%)

53.1

Pre-Tax Payback Period (years)

1.1

Pre-Tax NPV / Initial Capex

4.4

Average Annual After-tax Free Cash Flow (Year 1-5) (C$M)

474

Average Annual After-tax Free Cash Flow (Year 1-12) (C$M)

317

LOM After-tax Free Cash Flow (C$M)

3,038

- Cash costs are on an ounce payable basis and are inclusive of operating mining costs, processing costs, site G&A costs, royalties, smelting, refining, and transports costs

- AISC are on an ounce payable basis and include cash costs plus sustaining capital and closure costs

- All dollar ($) figures are presented in CAD unless otherwise stated. Base case metal prices used in this economic analysis are US$1,800/oz Au and US$23.00 Ag. These prices are based on 3-year trailing average prices.

- Pre-production capital expenditure of C$713M is exclusive of initial working capital, primarily C$43.3M of pre-production mining operating costs associated with establishing initial ore stockpile inventory

The Company’s current Mineral Resource Estimate (“MRE”) with an effective date of June 20, 2023, forms the basis of the DFS. Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

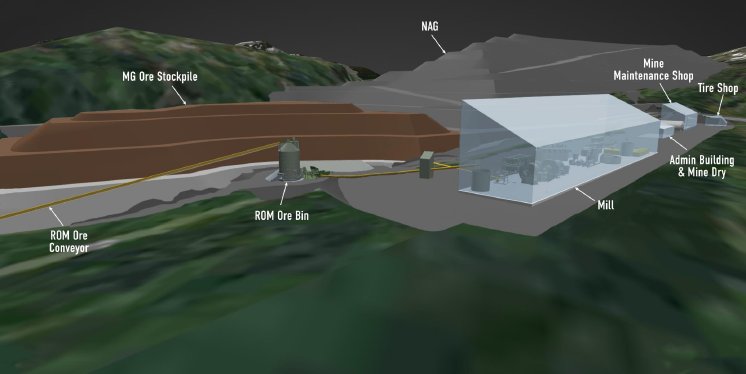

Mining Overview

Eskay Creek is planned to be an open-pit operation using conventional mining equipment. Pit designs were developed for the north and south pit areas. The initial phases were designed for the purpose of obtaining a technical sample and necessary non-acid generating waste material (“NAG”) to create supporting infrastructure. Open-pit mining follows down slope of the ridge where the deposit is located. The north pit will consist of 10 phases, while the south pit will be developed as a single phase.

Mining will be executed on 10 metre benches using a combination of 400 and 200 ton excavators and ore will be mined selectively on three sub-benches (flitches) using 200 ton excavators. Application of selective mining techniques in ore resulted in substantial improvements to mined ore grade, compared to non-selective ore mining that was contemplated in the 2022 FS mine plan. Selective mining techniques were evaluated by reducing the resource model block size from 10x10x10 metre to 5x5x5 metre to accurately model reduced ore dilution by operating 200 ton excavators in ore to reduce the smallest mining unit. The mining fleet was increased compared to the 2022 FS plan to provide higher mining rates in the no-snowfall months to compensate for anticipated lower production rates during the winter months.

The DFS outlines an average production profile of 455,000 AuEq oz in the first five years of operation. It is anticipated that Skeena will have a substantial stockpile developed ahead of mill start-up. The run-of-mine (“ROM”) and low-grade stockpile areas were increased in size to allow higher mining rates in no-snowfall months and to provide adequate space for blending feed to the mill.

The mine schedule plans for delivery of 39.8 Mt of mill feed grading 2.6 g/t Au and 68.7 g/t Ag (3.6 g/t AuEq) over the 12-year life of mine. Waste tonnage from the pits totalling 317.9 Mt will be placed into either NAG or potentially acid generating waste (“PAG”) storage facilities. The overall forecast strip ratio is 8.0:1.

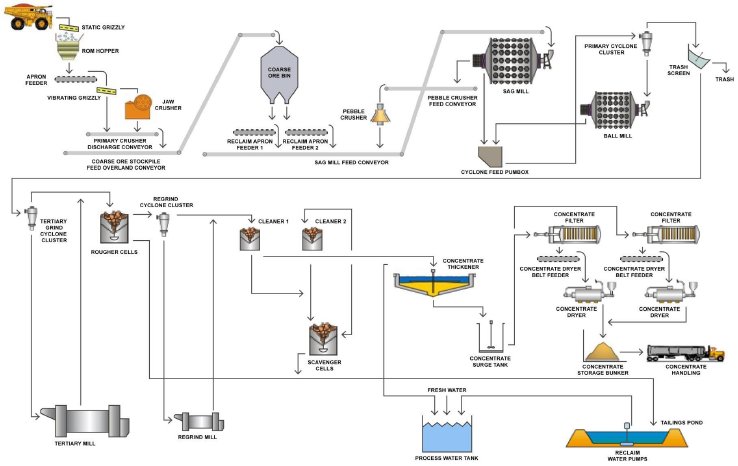

Metallurgy and Processing

Metallurgical tests were conducted through 2023 in support of the DFS to optimize the flowsheet and to increase grades of payable metals in the concentrate.

Metallurgical Optimization

As part of the DFS, metallurgical testing was conducted on composite samples that represented a range of 15-35% Mudstone with the balance as Rhyolite, matching the expected range to be produced by the mine.

An alternative flowsheet compared to the 2022 FS was tested with the purpose of simplifying the process flowsheet. The new testwork program evaluated a range of primary grinds and determined that 40 µm is optimal prior to rougher flotation. Following rougher flotation, regrinding rougher concentrate to approximately 10 µm was determined to provide the best flotation results.

The additional metallurgical testing has shown excellent results in producing a higher-grade gold and silver concentrate with lower concentrate volumes, compared to previous testing. Recoveries for gold were largely unchanged at 83%, slightly conservative based on test results, and silver recoveries increased from 88% to 91%, as compared to the 2022 FS.

The outcome of producing a higher-grade concentrate led to a substantial cost reduction of an estimated C$400 million pre-tax over LOM in both treatment charges and transportation costs in comparison to the 2022 FS. In addition to decreasing costs, the higher-grade concentrate also provides an opportunity for the base metals content to be payable, and some previous penalty elements are now neutral and do not incur penalties.

Processing Overview

The process flowsheet in the DFS has been simplified and de-risked from that which was developed for the 2022 FS. In Years 1 through 5, 3.0 million tonnes per annum (“Mtpa”) will be processed. A pebble crusher will be added in Year 3 to maintain production when harder ore is processed in Year 4. An expansion will be completed in Year 5 to increase processing capacity to 3.5 Mtpa, when harder and lower grade ore is processed starting in Year 6. Only minor upgrades will be required to the processing plant equipment list, as most of the major equipment items, such as the mills, are pre-sized for this higher throughput and harder ore. Mill-motor footprints will be capable of having larger electrical motors installed at that time.

ROM material will be trucked from the open-pits and either stockpiled or directly fed into the primary crusher. Primary crushing remains unchanged from the 2022 FS; however, the location was re-assessed due to the increase of ROM ore stockpile capacity to 17.5 Mt. Crushed material will now report to a new ore bin with approximately 7 hours storage capacity. Emergency overflow and reclaim will be located adjacent to the ore bin.

The ROM ore is considered relatively competent with bond rod and ball mill work indices between 14.1 kWh/t in the early years of the mine life up to 24 kWh/t later in the mine life as the 22 Zone material is more competent. Larger semi-autogenous grinding (“SAG“) and ball mills will be installed in initial construction to minimise any major disruptive expansion works when the throughput is increased to 3.5 Mtpa in Year 6. To achieve the target primary P80 (80% passing) particle size of 40 μm, the comminution circuit will consist of a 6.1 MW SAG mill with an 8.5 metre diameter by 4.9 metre effective grinding length (“EGL”), a 7.9 MW ball mill with a 6.4 metre diameter by 9.8 metre EGL and a tertiary stirred mill with 6 MW of installed power.

Ground material will be processed through a flotation circuit consisting of roughers, cleaners, and cleaner-scavengers. The rougher concentrate will be re-ground to a target P80 10 μm prior to cleaning to produce a combined gold-silver concentrate. Flotation concentrate will be thickened, filtered and if necessary dried, and trucked to a nearby port for loading onto ships for transportation to third-party smelters worldwide.

NAG waste rock will be stored in a Mine Rock Storage Area (“MRSA”), to be located immediately to the west of the open pits. The MRSA has been designed to manage up to 167 Mt of NAG waste rock.

Tailings, PAG waste rock and site contact water, including contact water from the MRSA and open‑pits, will be stored in the existing permitted Tailings Storage Facility (“TSF”). Waste materials and contact water will be managed in the TSF through construction of two embankments at the north and south end of the TSF. The embankments will be constructed in stages, throughout the life of mine, to store the 39 Mt of tailings and up to 153 Mt of PAG waste rock sub-aqueously to prevent acid generation and metal leaching.

Concentrate Marketing Studies

A new marketing report for the Eskay Creek concentrate was completed by Paul Bushell from Deno Advisory in October 2023, which considered the higher-grade concentrate specification resulting from recent mill flowsheet optimizations. Preliminary terms for concentrate sales have been provided by smelters and traders which are included in the 2023 DFS. The decrease in mass yield and corresponding increase in grade of gold and silver within the concentrate has resulted in a substantial increase in percent payables and a decrease in concentrate transport costs compared to the 2022 FS.

It should be noted that Deno Advisory has identified periods with sufficient concentrate grade for payable antimony, zinc, and lead. While the 2023 DFS does not consider revenue from metals other than gold and silver, revenue from secondary metals and overall concentrate value optimization remains an opportunity that will be evaluated in detail prior to commencement of operations.

Capital Costs

The initial capital cost of C$713M (US$524M) represents a 20% increase compared to the 2022 FS estimate. Increases in initial capital are primarily attributed to de-risking, unanticipated changes, and cost inflation. The primary increase areas are summarized below:

- Inclusion of a water treatment plant resulting from water quality modelling predictions (+C$31M)

- On-site permanent camp brought forward in plan to accommodate peak headcounts (+C$21M)

- Camp operations & travel cost increases due to escalation and higher headcounts (+C$15M)

- Redesigned mill building that is more robust in high-snowfall environment and capable of future expanded throughput (+C$9M)

- Owner’s team, sustainability, engineering, procurement and construction management, and other costs (+C$45M)

Operating Costs

Mining operating costs decreased 19% to C$3.00/t mined. This improvement primarily results from changes to exclude equipment leasing principal costs and capitalized stripping costs which were moved into sustaining capital costs as referenced in Table 6 above. In addition, operating efficiencies were realized by increasing the mining rate to 357.7 Mt over 10 years from 253.4 Mt mined over eight years in the FS.

Process operating costs increased 13% to C$19.11/t milled due to higher grinding, higher reagent consumption, and increased labour rates. Site G&A operating costs increased by 35% to C$5.65/t milled, primarily due to increased labour rates and higher camp and travel costs.

The 2023 DFS includes a new operating cost category for water treatment, which is estimated at C$2.48/t milled and includes labour, consumables, power, and lease payments relating to the water treatment plant. Overall, site operating costs increased by 5% from C$51.24/t milled to C$53.98/t milled.

The LOM Cash Cost is US$567/oz AuEq and the LOM AISC is US$684/oz AuEq, both stated on a co-product basis per payable ounce.

Sustaining Capital Costs

Sustaining capital costs over the LOM increased to $561M. The increase from the 2022 FS is primarily a result of moving the principal portion of payment on equipment leasing charges from operating to sustaining costs along with capitalizing more waste stripping over the LOM. As well, additional costs are included for larger containment structures for the TSF to accommodate the increase in tailings and PAG waste rock resulting from the increase in Mineral Reserves.

Financial Analysis

At a US$1,800/oz gold price, US$23/oz silver price, and a C$:US$ exchange of C$0.74, the Project generates an after-tax NPV(5%) of C$2.0 billion and IRR of 43%, based on an effective cash tax rate of 34%. Payback on initial capital is 1.2 years.

Environmental and Permitting Considerations

Eskay Creek has entered the BC Environmental Assessment Process and will follow the Federal Substitution Process. The Project is currently in the application development phase of the BC Environmental Assessment Process. Construction and operating permits can be granted in accordance with Provincial and Federal regulations once the Environmental Assessment process is complete. The mine currently has existing permits from the previous Eskay Creek mine operation. Skeena will apply for permit amendments that will support allowable activities such as the replacement of old infrastructure and civil works projects. The Company is also developing an application for permits to authorize the extraction of a bulk sample.

Eskay Creek is projected to be one of lowest greenhouse gas (“GHG”) emission open-pit gold mines worldwide, emitting an average of 0.19 t CO2e/oz AuEq produced. Several factors contribute to this low number, such as the high-grade nature of the deposit and access to hydropower near the site.

Skeena is committed to a further reduction in GHG emissions and is actively investigating initiatives to further reduce emissions, which include:

- Electrification of mobile equipment where commercially feasible

- Electrification of stationary mine equipment, such as mine dewatering pumps, pit lighting, etc.

- Conversion of the heating of the main facilities such as buildings, camps, administrative, mine offices, plant, and lab buildings from propane to electric

Community Relations

The Project is located within the unceded territory of the Tahltan Nation and the asserted traditional territory of the Tsetsaut/Skii Km Lax Ha Nation.

Eskay Creek has maintained a longstanding relationship with the Tahltan Nation. Previous operators maintained agreements with the Tahltan Central Government (“TCG”), which included provisions for training, employment, and contracting opportunities. The Company has been working in Tahltan Territory since 2014 and has developed a strong working relationship with the TCG. Skeena maintains formal agreements with the TCG which guide communications with Nation members, permitting, capacity, and environmental practices. Skeena is currently engaged in Impact Benefit Agreement negotiations with the TCG. In addition, the Company signed the first ever

consent-based decision‑making agreement with the Tahltan Nation in June 2022. It is a significant step forward by all parties to implement the principles of the United Nations Declaration on the Rights of Indigenous Peoples.

Skeena has ongoing engagement with Tsetsaut/Skii Km Lax Ha, who have expressed interest in business and contracting opportunities associated with the Project.

The proposed gold-silver concentrate from Eskay Creek will be transported to a nearby port via Highway 37/37A. It will pass-through Nass and Nass Wildlife Areas (as defined in the Nisga’a Final Agreement) of the Nisga’a Nation and through the territory of the Gitanyow Nation. Skeena has established an agreement with the Gitanyow Hereditary Chiefs for participation in the Wilp Sustainability Assessment Process (“WSAP”). The WSAP is the Gitanyow Nation’s process to assess the potential impacts of traffic from the Project. Skeena has also entered into an information sharing and confidentiality agreement with the Nisga’a Lisims Government and is currently working towards an assessment process that meets section 8(e) and 8(f) of Section 10 in the Nisga’a treaty, which is a requirement outlined in the Process Order issued by the British Columbia Environmental Assessment Office.

Future Project Opportunities and Value Enhancements

The 2023 DFS supports the robust economics of Eskay Creek as a potential tier one operation.

Additional opportunities and next steps include:

- Improved smelter terms and reduced mine operating costs as outlined in this Study will be used to re-evaluate deeper gold and silver mineralization in the 2023 resource model, to potentially contribute additional ore tonnes to future mine plans

- Ongoing evaluation of geotechnical and hydrogeological conditions within the Reserve pit design are anticipated to support steepening of slopes within various lithological units. Revised slope design parameters will be incorporated into future pit designs, which may yield reduced stripping costs and/or enhanced economic appraisals of deep gold and silver mineralization

- Further investigation of concentrate value optimization through revenue from base metals (lead, zinc, antimony), reducing transport, refining, and treatment costs, and ultimately maximizing net smelter returns

- Completion of an initial engineering study on Snip in H1 2024 to evaluate the potential economic benefit of supplementing Eskay Creek mill feed with clean high-grade mineralization from Snip

Skeena also announces that its Board of Directors (the “Board”) has approved the adoption of a Shareholder Rights Plan ("Shareholder Rights Plan") pursuant to a Shareholder Rights Plan Agreement entered into with Computershare Investor Services Inc., as Rights Agent, dated November 14, 2023 (the “Effective Date”). The purpose of the Shareholder Rights Plan is to ensure, to the extent possible, that all shareholders of Skeena are treated fairly in connection with any take-over offer or bid for the shares of Skeena.

The Shareholder Rights Plan is subject to the acceptance of the Toronto Stock Exchange and the New York Stock Exchange. While the Shareholder Rights Plan is effective as of the Effective Date, it is subject to ratification by Skeena’s shareholders at a meeting of shareholders to be held within the next six months (the “Meeting”), failing which it will terminate. If ratified by shareholders of Skeena at the Meeting, the Shareholder Rights Plan will remain in effect for a term of three years following such ratification. The Shareholder Rights Plan is similar to rights plans adopted by other Canadian companies and ratified by their shareholders.

A copy of the complete Shareholder Rights Plan will be available under Skeena’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

About Skeena

Skeena Resources Limited is a Canadian mining exploration and development company focused on revitalizing the Eskay Creek and Snip Projects, two past-producing mines located in Tahltan Territory in the Golden Triangle of northwest British Columbia, Canada. The Company released a Definitive Feasibility Study for Eskay Creek in November 2023 which highlights an after-tax NPV5% of C$2.0B, 43% IRR, and a 1.2-year payback at US$1,800/oz Au and US$23/oz Ag.

On behalf of the Board of Skeena Resources Limited,

Walter Coles Randy Reichert

Executive Chairman President & CEO

Contact Information

Investor Inquiries: info@skeenaresources.com

Office Phone: +1 604 684 8725

Company Website: www.skeenaresources.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Qualified Persons

In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Scott Fulton, P.Eng., Vice President, Construction & Engineering, is the Qualified Person for the Company and has prepared, validated, and approved the technical and scientific content of this news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting activities on its projects.

Ben Adaszynski, P.Eng., Manager Project Development North America for Sedgman Limited Canada, is an independent Qualified Person as defined by NI43-101 and has reviewed and approved the contents of this news release that relate to mineral processing and metallurgical testing, processing, and process and infrastructure capital and operating cost estimation.

Jim Fogarty, P.Eng., Senior Engineer, Knight Piésold Ltd, is an independent Qualified Person as define by NI43-101 and has reviewed and approved the contents of this news release that relate to the tailings and PAG waste rock storage facility (TSF), mine haul roads, MRSA, and site wide water management.

Terre Lane, Principal Mining Engineer, Global Resource Engineering, is an independent Qualified Person as defined by NI43-101 and has reviewed and approved the contents of this news release that relate to the Mineral Resource estimate, Mineral Reserve estimate, mine plan, mine capital and operating cost estimation, financial analysis and marketing.

Hamid Samari, QP., Principal Geologist, Global Resource Engineering, is an independent Qualified Person as defined by NI43-101 and has reviewed and approved the contents of this news release that relate to the deposit, geological setting, and mineralization, deposit type, exploration, drilling, sample preparation, analyses and security, and data verification.

Cautionary note regarding forward-looking statements

Certain statements and information contained or incorporated by reference in this press release constitute “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and United States securities legislation (collectively, “forward-looking statements”). These statements relate to future events or our future performance. The use of words such as “anticipates”, “believes”, “proposes”, “contemplates”, “generates”, “progressing towards”, “in search of”, “targets”, “is projected”, “plans to”, “is planned”, “considers”, “estimates”, “expects”, “is expected”, “often”, “likely”, “potential” and similar expressions, or statements that certain actions, events or results “may”, “might”, “will”, “could”, or “would” be taken, achieved, or occur, may identify forward-looking statements. All statements other than statements of historical fact are forward-looking statements. Specific forward-looking statements contained herein include, but are not limited to, statements regarding the results of the 2023 DFS and 2022 FS, mineral processing, processing capacity of the mine, anticipated mine life, based on Proven and Probable Mineral Reserves, potential increases in Mineral Reserves and mine life, concentrate sales, estimated project capital and operating costs, potential reductions in process plant capital and operating costs, sustaining capital costs, results of test work and studies, planned environmental assessments, permit amendments and applications, GHG emissions, water treatment, the transportation of concentrates, the future price of metals, metal concentrates, and exchange rate forecasts, future exploration and development, the evaluation of mineralization, geotechnical and hydrogeological conditions and design parameters, the timing and completion of an initial engineering study on Snip, the adoption of the Shareholder Rights Plan, acceptance of the Shareholder Rights Plan by the Toronto Stock Exchange and the New York Stock

Exchange, ratification of the Shareholder Rights Plan by Skeena’s shareholders, termination of the Shareholder Rights Plan and the protection afforded by the Shareholder Rights Plan. Such forward-looking statements are based on material factors and/or assumptions which include, but are not limited to, the estimation of Mineral Resources and Mineral Reserves, the realization of Mineral Resource and Mineral reserve estimates, metal prices, exchange rates, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory and shareholder approvals, environmental risks, title disputes and the assumptions set forth herein and in the Company’s MD&A for the year ended December 31, 2022, its most recently filed interim MD&A, and the Company’s Annual Information Form (“AIF”) dated March 22, 2023. Such forward-looking statements represent the Company’s management expectations, estimates and projections regarding future events or circumstances on the date the statements are made, and are necessarily based on several estimates and assumptions that, while considered reasonable by the Company as of the date hereof, are not guarantees of future performance. Actual events and results may differ materially from those described herein, and are subject to significant operational, business, economic, and regulatory risks and uncertainties. The risks and uncertainties that may affect the forward-looking statements in this news release include, among others: the inherent risks involved in exploration and development of mineral properties, including permitting and other government approvals; changes in economic conditions, including changes in the price of gold and other key variables; changes in mine plans, significant legal developments adversely impacting shareholder rights plan generally and other factors, including accidents, equipment breakdown, bad weather and other project execution delays, many of which are beyond the control of the Company; environmental risks and unanticipated reclamation expenses; and other risk factors identified in the Company’s MD&A for the year ended December 31, 2022, its most recently filed interim MD&A, the AIF dated March 22, 2023, the Company’s short form base shelf prospectus dated January 31, 2023, and in the Company’s other periodic filings with securities and regulatory authorities in Canada and the United States that are available on SEDAR+ at www.sedarplus.ca or on EDGAR at www.sec.gov.

Readers should not place undue reliance on such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made and the Company does not undertake any obligations to update and/or revise any forward-looking statements except as required by applicable securities laws.

Cautionary note to U.S. Investors concerning estimates of Mineral Reserves and Mineral Resources

Skeena’s Mineral Reserves and Mineral Resources included or incorporated by reference herein have been estimated in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) as required by Canadian securities regulatory authorities, which differ from the requirements of U.S. securities laws. The terms “Mineral Reserve”, “Proven Mineral Reserve”, “Probable Mineral Reserve”, “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) “CIM Definition Standards – For Mineral Resources and Mineral Reserves” adopted by the CIM Council (as amended, the “CIM Definition Standards”). These standards differ significantly from the mineral property disclosure requirements of the U.S. Securities and Exchange Commission in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”). Skeena is not currently subject to the SEC Modernization Rules. Accordingly, Skeena’s disclosure of mineralization and other technical information may differ significantly from the information that would be disclosed had Skeena prepared the information under the SEC Modernization Rules.

In addition, investors are cautioned not to assume that any part, or all of, Skeena’s mineral deposits categorized as “Inferred Mineral Resources” or “Indicated Mineral Resources” will ever be converted into Mineral Reserves. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and a great amount of uncertainty as to their economic and legal feasibility. Accordingly, investors are cautioned not to assume that any “Inferred Mineral Resources” that Skeena reports are or will be economically or legally mineable. Under Canadian securities laws, estimates of “Inferred Mineral Resources” may not form the basis of feasibility or prefeasibility studies, except for a Preliminary Economic Assessment as defined under NI 43-101.

For these reasons, the Mineral Reserve and Mineral Resource estimates and related information presented herein may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder.