It cannot be emphasized enough: the demand for silver will rise, mainly due to the demand from the photovoltaic industry. While mine production is expected to increase somewhat, new discoveries are limited, and mine production also faces various challenges. However, according to forecasts, even a slight increase in production is unlikely to keep up with demand. This naturally supports the prices of the precious metal.

Now, silver is experiencing a significant breakout from its sideways phase, and rightfully so. Analysts anticipate long-term increases in silver prices. The previous all-time high of $50 US dollars per ounce will likely serve as a kind of cap for now. In 2023, silver demand exceeded supply for the third consecutive year.

Regarding investment demand, stronger global economic growth will boost it. One area that will further fuel silver demand is electromobility and the increased use of autonomous driving functions. More electronics in vehicles inevitably consume more silver. Not to mention the rising number of home batteries for storing solar energy. The number of these storage units is expected to increase exponentially. Approximately 155 tons of silver were used for the production of home batteries in Germany in 2022. For investors, the globally increasing demand for silver presents a great opportunity.

Especially mining companies focusing on silver like Endeavour Silver or Discovery Silver should be on the right track in the coming years.

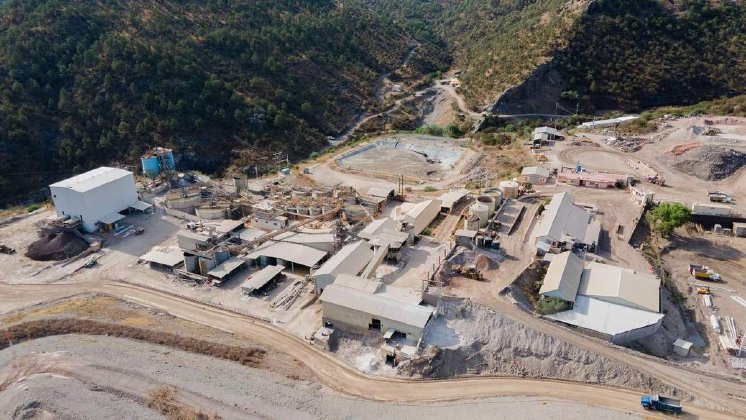

Endeavour Silver - https://www.commodity-tv.com/ondemand/companies/profil/endeavour-silver-corp/ - is already a successful silver producer and owns silver projects in Mexico as well as in Nevada and Chile.

Discovery Silver - https://www.commodity-tv.com/ondemand/companies/profil/discovery-silver-corp/ - has silver-zinc-lead projects in northern Mexico, including the highly promising Codero project in Chihuahua.

For current company information and press releases from Discovery Silver (- https://www.resource-capital.ch/de/unternehmen/discovery-silver-corp/ -) and Endeavour Silver (- https://www.resource-capital.ch/de/unternehmen/endeavour-silver-corp/ -).

According to §34 WpHG, I would like to point out that partners, authors, and employees may hold shares in the companies mentioned and therefore a possible conflict of interest may exist. No guarantee for the translation into German. Only the English version of this news applies.

Disclaimer: The information provided does not constitute any recommendation or advice. The risks involved in securities trading are expressly pointed out. No liability can be assumed for damages resulting from the use of this blog. I would like to point out that stocks and especially options trading are generally associated with risks. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the correctness of all content. Despite careful content control, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained comes from sources that are considered reliable, but does not claim to be correct and complete. Due to legal judgments, the contents of linked external pages are to be answered for (e.g. Landgericht Hamburg, in the judgment of May 12, 1998 - 312 O 85/98), as long as no explicit distance is taken from them. Despite careful content control, no liability is assumed for the content of linked external pages. The respective operators are solely responsible for their content. The disclaimer of Swiss Resource Capital AG also applies additionally: https://www.resource-capital.ch/de/disclaimer-agb/.