Summary

- Very experienced team (exploration and mine building), Technical Advisor and significant shareholder Peter Megaw

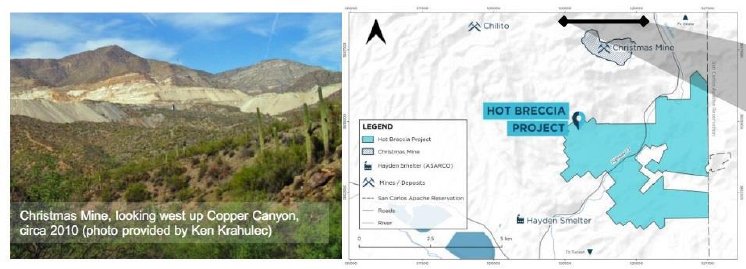

- Underexplored 1,420ha greenfield Hot Breccia project in Arizona, adjacent to former Christmas Mine and nearby the colossal Resolution deposit

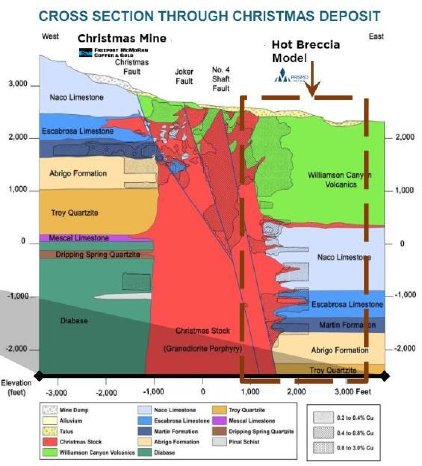

- Prismo Metals management believes Hot Breccia could represent the same geological concept as the Resolution deposit at depth, combined with evidence pointing towards mineralization directly on the other side of an intrusion, separating Hot Breccia from the Christmas deposit

- This evidence encompasses information about sampling, mapping, stratigraphy and mineralization at depth

- Known historic intercepts include 26m @ 0.54%Cu, 20m @ 1.4%Cu, 8m @ 1.73% Cu plus 5m @ 1.4% Cu, but most data on grades from historic drilling are missing.

- Geological data implies copper mineralization underneath a 400m thick volcanic layer, as a result of vertical displacement of the Christmas stratigraphy alongside the aforementioned intrusion

- Drill permits for Hot Breccia are about to be issued

- Prismo Metals is raising C$1.1M at the moment, followed shortly by a C$3M PP to finance Hot Breccia drilling

- Introduction

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

- The company

Prismo Metals is led by a very experienced team of mining professionals, as there are CEO and co-founder Alain Lambert (raised over C$1B for pubcos throughout his career), President Steve Robertson (instrumental in exploring and building the Red Chris Mine), VP Exploration, former CEO and co-founder Craig Gibson PhD (instrumental in discoveries of the Ana Paula, Dolores, and Paredones Amarillos precious metals deposits in Mexico) and co-founder and Technical Advisor Peter Megaw PhD. This last person probably doesn’t need any introduction, but for those who aren’t that familiar with the mining industry here is a quick one: Peter Megaw is the geologist who discovered the Juanicipio deposit (nameplate production since Q4, 2023, MAG Silver/Fresnillo JV) and the Platosa Mine (Excellon Resources) in Mexico and considered an expert in the field of carbonate replacement deposits (CRD). The discovery of Juanicipio earned him the 2017 Thayer Lindsley award, the most prestigious award for geologists in the mining industry. He is very familiar with the region, as he lived and worked there for over 40 years.

Prismo Metals has its main listing on the CSE, where it’s trading with PRIZ.CSE as its ticker symbol. With an average volume of about 55,089 shares per day, the company is trading fairly below the radar for now, but my expectation is this will change rapidly when good drill results could confirm a discovery. A current share price of C$0.21 results in a market cap of C$8.55M. The share structure is very tight at 44.6M shares outstanding with a tiny market cap of just C$7.4M, and 29.6 % ownership by insiders, founders and advisors, so there is a lot of skin in the game. Vizsla Silver (TSXV: VZLA, C$580M market cap) owns 9% as a strategic investor, as they are direct neighbours and exploration partner at Palos Verdes.

Prismo Metals currently has about C$1.2M in the treasury, including marketable securities of Vizsla Silver. The company is raising cash at the moment, which will allow Prismo to resume drilling at its Palos Verdes silver project. This will be followed by a larger C$3M financing shortly as soon as the drill permit for Hot Breccia is granted to fund the drill program at Hot Breccia. The chart of Prismo Metals looks like this:

Share price; 3 year time frame (Source: CEO.CA)

Prismo Metals ran up pretty high at the end of 2022 on strong Panuco exploration news by neighbour Vizsla Silver, with own compellingly looking visuals released for Palos Verde, drill results coming up and silver in an uptick. In the first four months of 2023, Prismo was awaiting drill permits to continue exploration in Mexico and the share price started to grind down again, reinforced by increasingly negative market sentiment in 2023. With copper and gold recently breaking all-time highs (and currently in something of a correction which not many expect to last very long), with silver slowly following suit, the share price is cautiously looking up again as Prismo Metals is raising cash for drilling both their promising Hot Breccia copper project and Palos Verdes silver project for now, to the tune of C$1.1M @ C$0.17 in a non-brokered private placement, with a half 2 year warrant @ C$0.25, which is expected to close at June 18, 2024.

- Projects

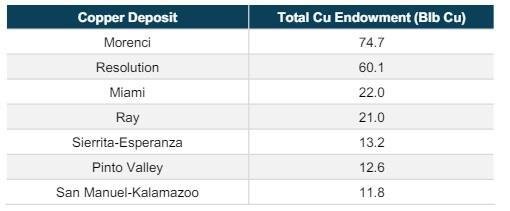

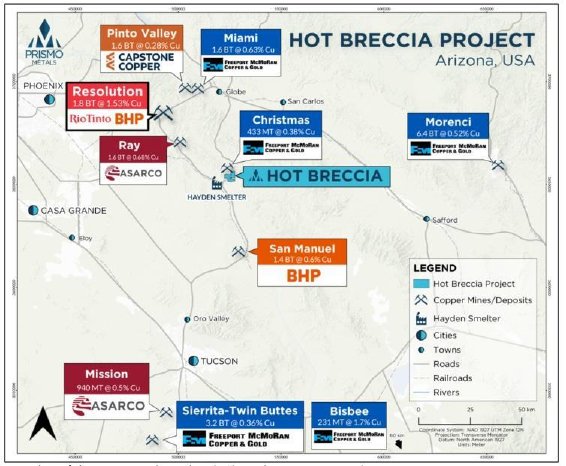

The Hot Breccia copper project is surrounded by lots of copper mines, and as such the area enjoys lots of infrastructure, including a smelter under care and maintenance of Gruppo Mexico (since 2019) and a concentrator (still operating at 20% of capacity). Most of the deposits consist of large porphyries:

Hot Breccia is located next door to the historic Christmas Mine, and not too far away from one of the largest higher grade (>1% Cu) copper deposits in the world: Resolution, which is for example twice as large as the Grasberg deposit in Indonesia regarding copper.

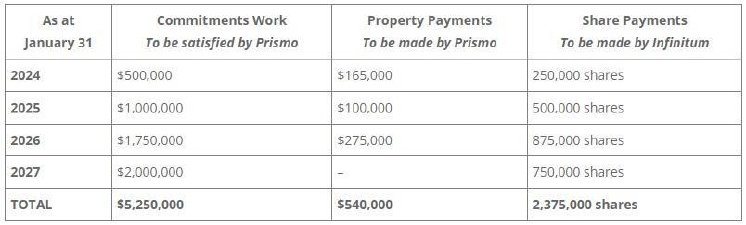

The Hot Breccia project is subject to an earn-in agreement between Prismo Metals, Infinitum Copper (INFI.V) on one hand, and Walnut Mines (private) on the other hand, according to which Prismo stands to acquire 75%, after it already paid C$350k in cash and issued 500k shares to Infinitum:

Prismo Metals recently made an arrangement with Walnut to issue 832,571 shares @ C$0.17 (>C$141k) for a 2023 exploration expenditures shortfall of C$95k, and additional equity ownership for the postponement of a C$100k option payment in January 2024.

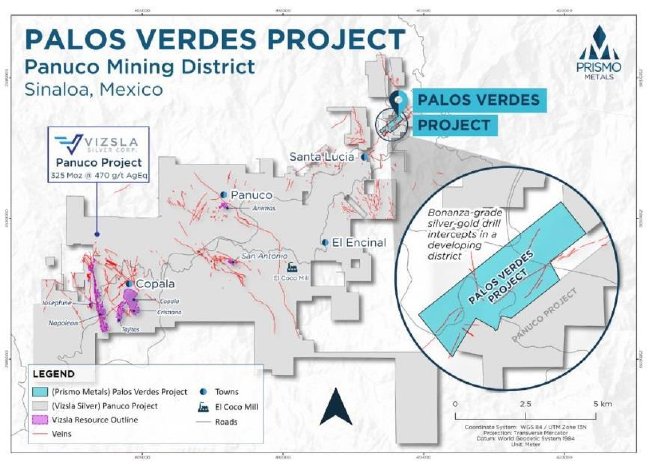

Prismo is also earning in on the former flagship Palos Verdes Project (currently explored together with strategic partner Vizsla Silver, which has a first right of refusal), a 22.8-hectare property located in the historic Pánuco-Copala silver-gold district in southern Sinaloa, Mexico. Prismo has an option to acquire 100% of Palos Verdes, with such exercise expected in November 2024. According to CEO Lambert, should Prismo get to 10-15Moz AgEq at Palos Verdes, it is quite likely that Vizsla will buy the Palos Verdes property. The unknowns are 1. when and 2. at what price. As for price per oz Ag, President Steve Robertson refers to Vizsla Silver itself, which currently trades at around C$1.7/oz AgEq. You can calculate your own hypothetical estimates of potential proceeds. Anything close to these estimates would obviously be a gamechanger for Prismo, but it is up to Vizsla at this point of course.

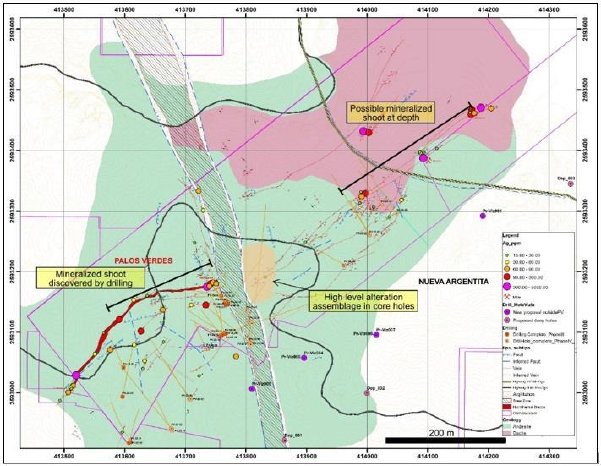

Over 6,000m of drilling (33 holes) by Prismo Metals so far delineated a mineralized envelope called the Palos Verdes vein, and generated robust results, highlighted by the following holes:

- PV-23-25: 0.5m @ 11,520g/t Ag and 0.3m @ 512g/t Ag

- PV-23-24: 0.7m @ 1,234g/t Ag and 1.2m @ 302g/t Ag

- PV-23-20: 0.9m @ 189g/t Ag

- PV-23-32: 0.3m @ 450.2g/t Ag

- PV-23-33: 0.35m @ 112.7g/t Ag, 0.3m @ 105.6g/t Ag and 0.75m @ 253.4g.t Ag

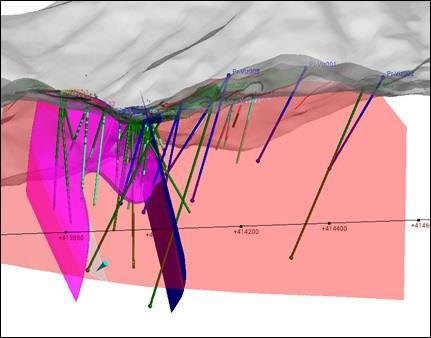

View of subsurface at Palos Verdes, looking northerly, with the Palos Verdes vein projection in red and the high-grade mineralized shoot in magenta, apparently truncated by the NW fault, blue.

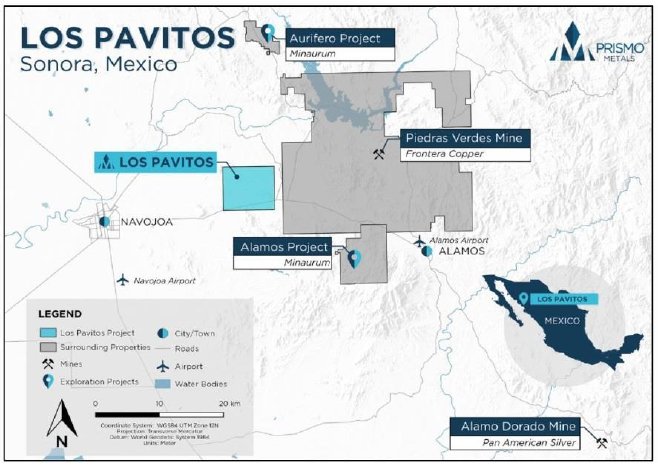

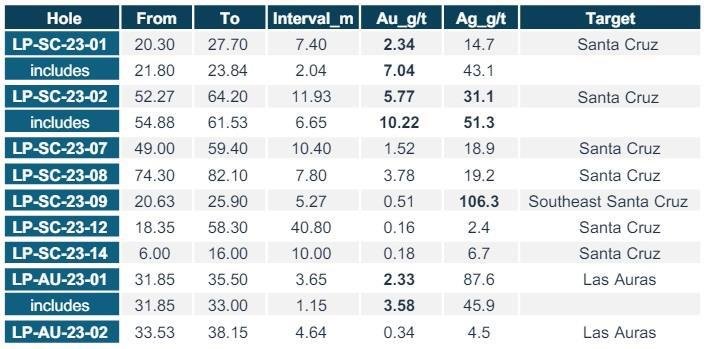

The company is also earning into the 5,289-hectare Los Pavitos gold project located in southern Sonora, Mexico, in an almost completed 5 year earn-in agreement (ending in October 2024) with Minera Cascabel (private, Mexican), for C$1.5M in exploration expenditures, C$500k in cash and 2M Prismo shares.

According to CEO Lambert they probably need to spend an additional $300k to meet their requirements. So far, the company has completed 2,370m in 25 holes, with the following highlights:

These are decent results, and warrants follow-up exploration. For now, the focus is on Hot Breccia and Palos Verdes.

- Exploration

Historic drilling, regional mapping and other information at Hot Breccia clearly show a vertical displacement of the Christmas mineralized stratigraphy that hosts high grade mineralization on the other side of a porphyry intrusion nearby Christmas mine. These vertically displaced layers are covered by a 400m thick volcanic layer (see below in green), which in turn is penetrated in many locations by a swarm of dikes and several mineralized structures including breccia bodies in some locations.

A mineralized fragment brought up from depth by brecciation millions of years ago within the intrusion assayed 5.7% Cu, 32.8 g/t Ag and 0.24 g/t Au, a clear indication of a strong mineralized event going on at depth according to Prismo management.

President Steve Robertson was happy to elaborate some more: “The Christmas mine is a key element to our story. Much like the small, but high-grade Magma mine was critical to the discovery story at Resolution, the near surface expression of our mineralizing system may be the Christmas mine. By tracking that mineralization to depth we hope to encounter the (much) larger system at depth.

Judging from some of the brecciated rock types that we find, they appear to be units that would had to have come from at least 1,000 metres depth. This tells us that there was A LOT of energy in the system. Big systems, carrying a lot of heat, with a lot of fluids, with a lot of metal, are the ones with a lot of energy. This is encouraging to us regarding the potential “size of the prize”.”

In addition, the historic drilling by Kennecott and Phelps Dodge also cut high grade mineralization in the favorable stratigraphy underneath the volcanic rocks, including: 26m @ 0.54%Cu, 20m @ 1.4%Cu, 8m @ 1.73% Cu plus 5m @ 1.4% Cu., of which samples contained up to 1.28% Cu and 3.75g/t Au. This wasn’t followed up at the time as the grade wasn’t considered economic enough, with a copper price of US$0.55/lb Cu, and the neighboring Christmas mine was permanently closed in 1982. Things have changed now obviously, with a copper price of US$4.55/lb Cu at the time of writing, although costs have inflated considerably as well. The other major influencing factor is the discovery of the Resolution deposit, long after the last historic exploration was completed at Hot Breccia.

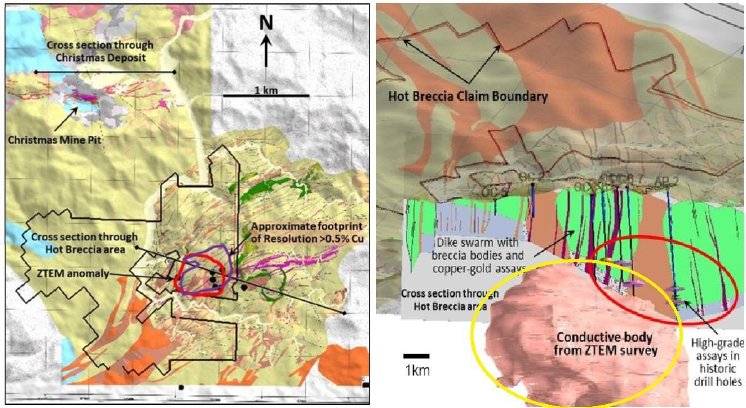

A ZTEM survey completed by Prismo last year showed a large conductive anomaly at depth below a dike swarm and namesake breccia and copper surface mineralization. The size of this geophysical anomaly is also drawing parallels with Resolution as it is comparable with this giant deposit:

Prismo is awaiting the exploration drill permit for Hot Breccia at the moment, which can be granted any day now (beginning of June), and drilling is planned to start at the end of June, commencing with 5 widely spaced holes of 1,000m deep each, although some of the historic holes could be extended as well instead. Assays are expected to be back from the labs starting in October.

Regarding Palos Verdes: Prismo Metals will be aiming to find the off-set or displacement of the high grade shoot in their upcoming drill program together with Vizsla, planning to drill approximately 3,600m in 10 holes, to be completed in two phases. These holes will be drilled from adjacent Vizsla ground:

- Catalysts

- Closing of first C$1,1M PP (expected June 18)

- Exploration permit for Hot Breccia (any day now)

- Start of drilling at Palos Verdes (July)

- Raising C$3M in July-August

- Start of 5 months of drilling at Hot Breccia drill program of 5,000m after the C$3M raise

- Drill results from Palos Verdes (end of August until end of the year)

- Drill results Hot Breccia over 6 months, starting in October

- Follow-up drill program Hot Breccia, estimated at 10,000-15,000m, commencing likely in 2025

- Conclusion

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Prismo Metals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.prismometals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.