All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

For a C$10M market cap, Platinex did well to raise such an amount, as a very early stage explorer in a market that only seems to favor lithium or high profile gold/copper plays nowadays, and I am not even talking about current developments with banks getting into trouble, like SVB or very recently Credit Suisse. Because Platinex has been trading at all-time lows in December, exactly when the financing was priced, the company couldn’t avoid serious dilution. As Platinex raised C$2,119,540 @ C$0.04 by issuing 52,19M non-flow through shares, and also raised C$581,300 @ C$0.045 by issuing 13,64M FT shares, there is quite a bit of dilution, taking outstanding shares from 231.81M to 297.64M. Fancamp took up C$1M of non-FT shares, and is now a 9.5% shareholder of Platinex.

Since both categories (FT and non-FT) have 5 year C$5.5c half warrants, this adds more to the structure of course. This is not ideal, and this is the reason Platinex already mentioned in an earlier news release it is contemplating a roll-back in case of a material deal. CEO Ferron commented that he agreed with the Board and major shareholders not to pursue this for at least one year, as a lot can happen in such a period.

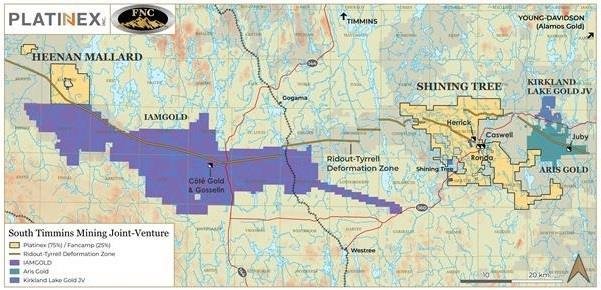

It was good to see CEO Ferron buying another 555,556 FT shares, bringing his total at 5.85M shares, and CFO Graham Warren buying 200k FT shares, going to 300k shares in total. This incoming fresh cash enables Platinex to accelerate exploration at Shining Tree Gold Project. The newly acquired Heenan Mallard Gold project which borders IAMGOLD’s Côté Gold Project, and the Shining Tree Gold Property are expected to be the first projects to be drilled. The transaction provides a clear strategy for the enhanced gold portfolio while retaining a 100% ownership of the W2 Ni-Cu project and the recently acquired Muskrat Dam Critical Minerals Project.

As a reminder, Platinex will be the operator until Fancamp exercises its option to acquire another 25%, and has no shortage of its own geological expertise in the region, it is clear for me that the main reason was the capital Fancamp was willing to invest here. Besides the 25% ownership in Goldco, Fancamp will also be granted a 1% NSR royalty on the Heenan Mallard gold properties, which will decrease to 0.5% when Fancamp elects to exercise its option for 50% ownership.

- Goldco will engage in an initial exploration program of C$1.1M (the "Initial Exploration Program") to be funded by the Platinex Financings (as described below) and an additional sum of $130,000 to be advanced to Goldco by Fancamp. Platinex shall contribute a minimum of $940,000 to Goldco in respect of Goldco’s operation.

- Within 60 days from the completion of the Initial Exploration Program, Platinex as Operator shall prepare an exploration program (the "Phase II Exploration Program") to be approved by all of the members of the Technical Committee and the board of Goldco

- Fancamp will have the right and option (the "Option") to increase its ownership interest in Goldco to own up to 50%, which may be exercised over a two-year period commencing on the date of approval of a Phase II Exploration Program by making staged cash payments to Goldco in the aggregate amount of C$1,500,000 to be used for exploration activities of Goldco

The exploration plans for Shining Tree consist of a completion of the program announced in the summer of last year. The new technical committee will then determine what targets to drill and the size of the program. The estimated budget for this is about C$1.25M according to CEO Ferron. The drill program will consist of two phases: 1) new targets in the new areas based on results from the work done the last two years, and 2) expanding the Herrick resource and possibly drilling the former Ronda mine located in the central area of the project. For now, Ferron has a 1,000m drill program for Heenan Mallard in mind, and 2,000m for Shining Tree.

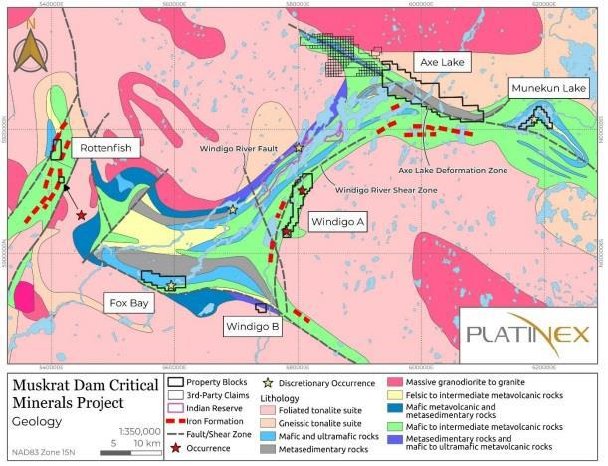

Exploration for Muskrat Dam will start in April, mapping and sampling the white pegmatites on the Axe Lake property to confirm the presence and grade of lithium mineralization. According to CEO Ferron, a budget for this should be about C$200-300k. The program will start with a large sampling program covering the outcrops. After assays the team will begin trenching where the best grades are found and in certain other prospective locations.

The third project is the W2 Copper-Nickel-PGE project, also in Ontario. Planned exploration consists of infill drilling to establish the continuity of the historically-defined 7.5 km long widely-spaced CuNi-PGE mineralization corridor, and drill testing several high conductance-high magnetic susceptibility geophysical anomalies identified in a 2008 VTEM survey over the eastern portion of W2. Platinex also plans to carry out a ground gravity survey over the ultramafic intrusion to detect potential chromite mineralization in the northeast part of the western W2 claims, and conducting petrographic and/or preliminary bench-scale metallurgical studies to justify additional drilling along strike of the Fe-Ti-V mineralization in the northwestern part of the W2 claims. According to Ferron, the phase 1 drill program is 2,500m to infill around the historic resources area and infill drill holes along the 5-7km mineralized trend. Please keep in mind the program is fully ready with all the historical work allowing Platinex to drill, even things like IP are completed. They also have key members organized that worked in the last drill program.

More exact details and timelines will be provided in an upcoming news release, being published soon.

Conclusion

Although it took more time than anticipated for the Fancamp deal to close, CEO Ferron did a good job to close it during PDAC, raising an oversubscribed C$2.7M. This kind of money goes a long way for Platinex, as it expects to be busy with exploration programs on its 3 different projects for the remainder of this year. The focus will be on its Shining Tree gold project, now put into a JV with Fancamp, and personally I am very interested in Muskrat Dam, as it could hold lithium-bearing pegmatites. The W2 project could also provide interesting newsflow. Stay tuned for lots of action this year!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock, including stock options. Platinex is a sponsoring company. All facts are to be checked by the reader. For more information go to www.platinex.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.