Gerard Bond, President and CEO of OceanaGold said, “Our Reserves and Resources continue to provide a solid foundation for OceanaGold, underpinning our growth in gold production over the coming years. In 2022, we continued to have success delineating the underground potential at Haile, as evidenced by resource additions at both Horseshoe and Palomino. We also successfully added resource ounces at Didipio, with limited drilling, and Golden Point Underground at Macraes. While resource conversion drilling at Wharekirauponga was impacted by restrictions associated with drought conditions in 2022, we expect to continue delineating this deposit in 2023.

We are excited about our continued resource conversion and growth opportunities at Haile Underground, Didipio, Martha Underground and Wharekirauponga, and have increased our near-mine exploration budgets by over 35% for 2023.”

Highlights

- Increased Indicated Resources by 0.18 Moz at Palomino Underground, Haile, USA.

- Increased Inferred Resources by 0.16 Moz at Horseshoe Underground, Haile, USA.

- Increased Inferred Resources by 0.16 Moz at Golden Point Underground, Macraes, New Zealand.

- 05 Moz increase in Indicated Resources in Panel 2, Didipio, Philippines.

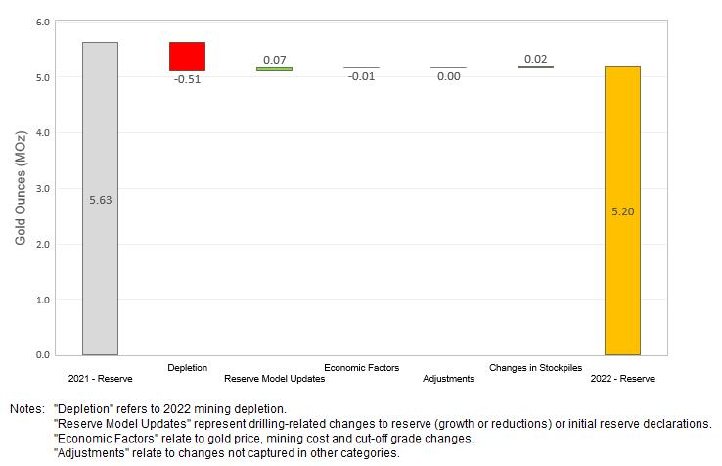

- Total Proven and Probable Reserves stood at 5.20 Moz gold (124 Mt at 1.30 g/t gold), including 7.4 Moz silver and 0.15 Mt copper.

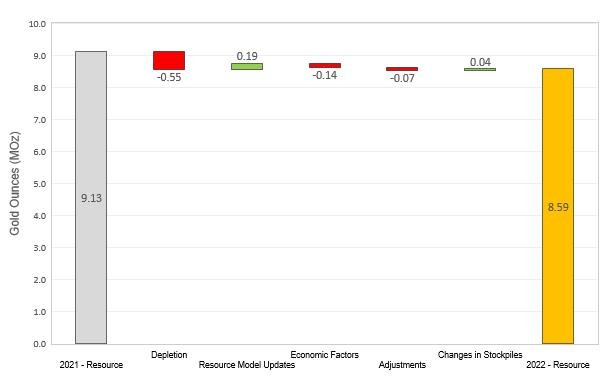

- Total Measured and Indicated Resources, inclusive of Mineral Reserves, stood at 8.59 Moz gold (186 Mt at 1.44 g/t gold), including 13 Moz silver and 0.17 Mt copper.

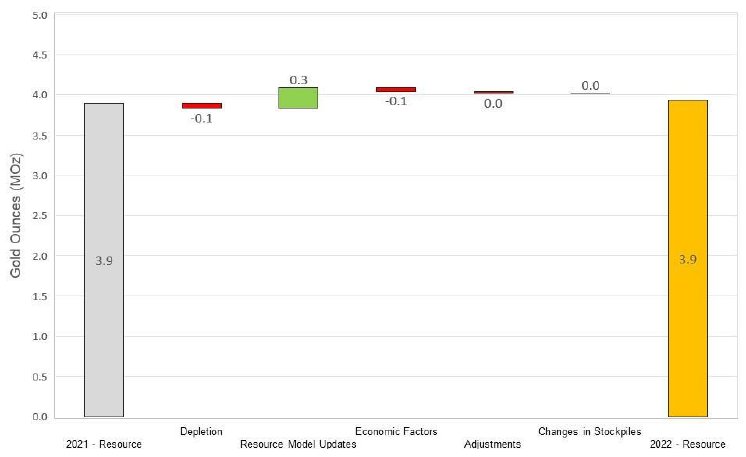

- Total Inferred Resources stood at 3.9 Moz of gold (59 Mt at 2.1 g/t gold), largely un-changed year-over-year as increases at Golden Point Underground, Horseshoe Underground, and Martha Underground offset conversion to Indicated Resources success at Palomino.

Total Mineral Reserves

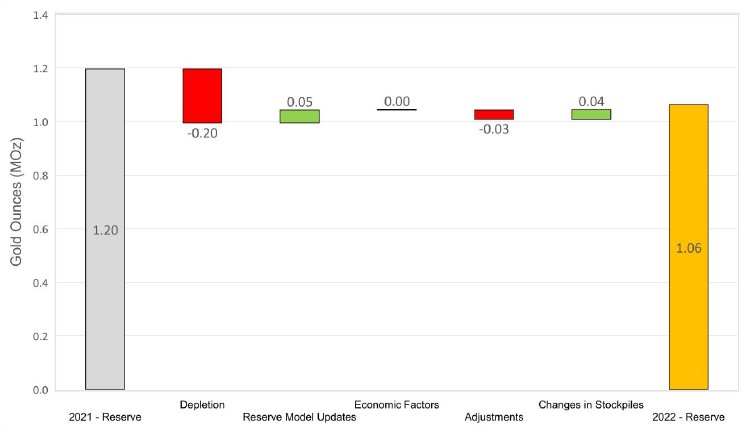

As at December 31, 2022, OceanaGold’s Proven and Probable (“P&P”) Reserves stood at 124 Mt at 1.30 g/t gold for 5.20 Moz of gold, including 7.4 Moz of silver and 0.15 Mt of copper, representing a 0.43 Moz decrease in gold Reserves year-over-year (see Table 1), largely due to mining depletion.

Total Mineral Resources

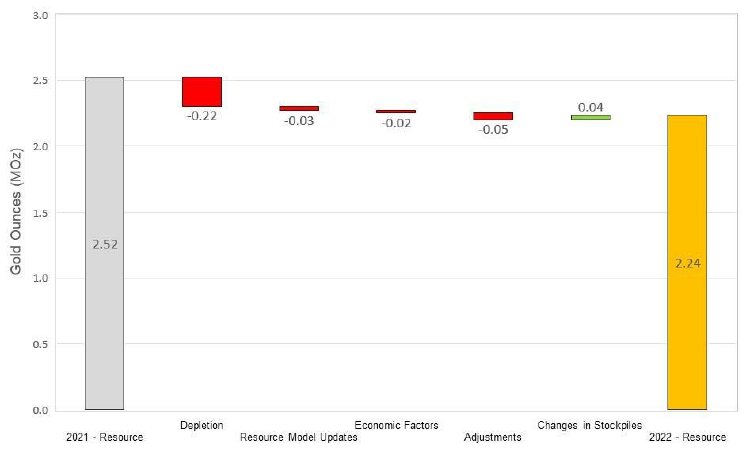

As at December 31, 2022, OceanaGold’s Measured and Indicated (“M&I”) Resources stood at 186 Mt at 1.44 g/t gold for 8.59 Moz of gold, including 13 Moz of silver and 0.17 Mt of copper (Table 2). Mineral Resources are reported inclusive of Mineral Reserves.

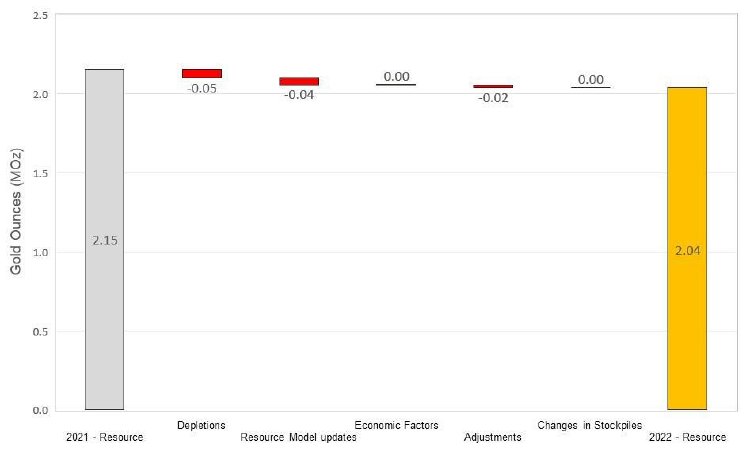

On a consolidated basis, M&I Resources decreased by 0.54 Moz relative to year-end 2021 (Figure 2). Decreases were due to mining depletion across the Company’s operations, as well as revised resource classification and mining assumptions at Martha Underground and slight reduction in the open pit resource due to increased cost inputs at Haile. The decreases were partially offset by gains due to resource conversion drilling at Palomino, Golden Point Underground, and Didipio.

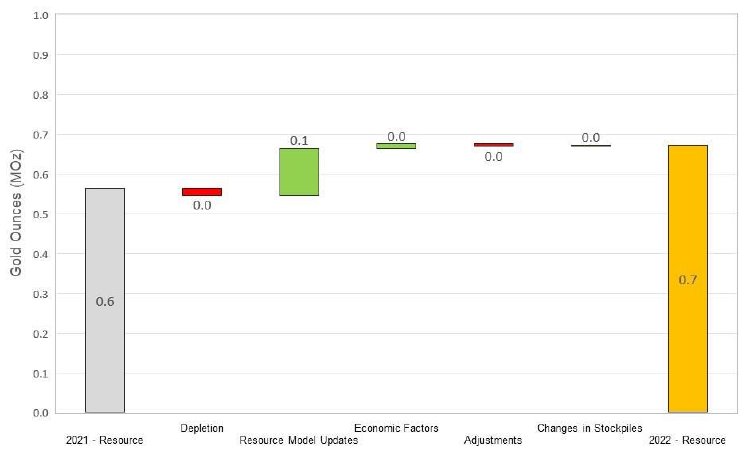

As at December 31, 2022, Inferred Resources stood at 59 Mt at 2.1 g/t gold for 3.9 Moz of gold, including 7.3 Moz of silver and 0.04 Mt of copper (Table 3). No net change year-over-year. Increases in Inferred Resources for Golden Point Underground, Horseshoe Underground, and Martha Underground were offset by decreases for Palomino. The Palomino decreases in Inferred Resources resulted from conversion to Indicated Resources.

Haile, USA

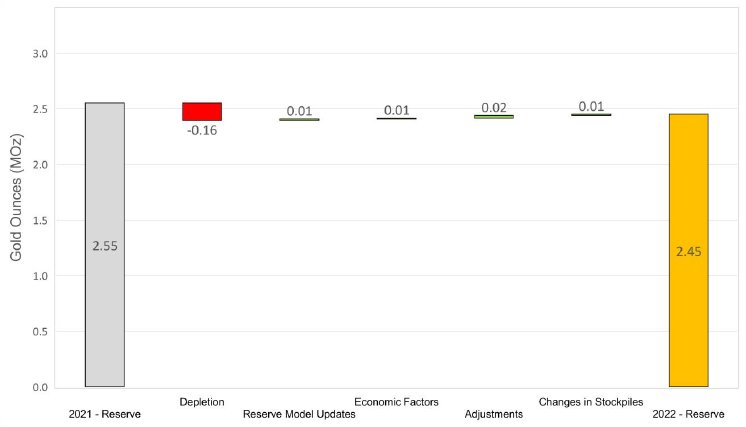

P&P Reserves at Haile totalled 43.8 Mt at 1.74 g/t gold for 2.45 Moz of gold, including 3.0 Moz of silver. Year-over-year, P&P Reserves have decreased 0.11 Moz due to mining depletion (Figure 4). Of the 2.45 Moz of gold, the Horseshoe Underground contributes 0.42 Moz (3.4 Mt at 3.9 g/t gold).

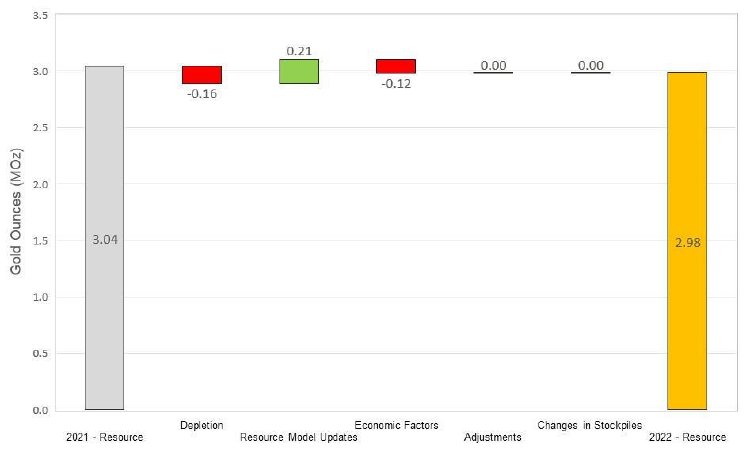

Total Haile M&I Resources stood at 49.9 Mt at 1.86 g/t gold for 2.98 Moz of gold, including 3.3 Moz of silver. A slight 0.06 Moz decrease relative to 2021 year-end, which is largely due to open pit depletion and increased operating costs (Figure 5), offset by resource growth at Palomino and Mill Zone Stage 2 open pit.

Of the 2.98 Moz of gold, underground contributes 0.90 Moz which includes both Horseshoe and Palomino deposits. Resource conversion drilling during 2022 at Palomino increased Indicated Resources by 0.18 Moz, delivering an updated Indicated Resource of 3.7 Mt at 3.15 g/t for 0.38 Moz. Resource conversion drilling at Palomino planned for 2023 continues to target the remaining 0.15 Moz of Inferred Resource. An economic study for Palomino is planned for 2023 with the objective being to convert this material to reserves around year-end.

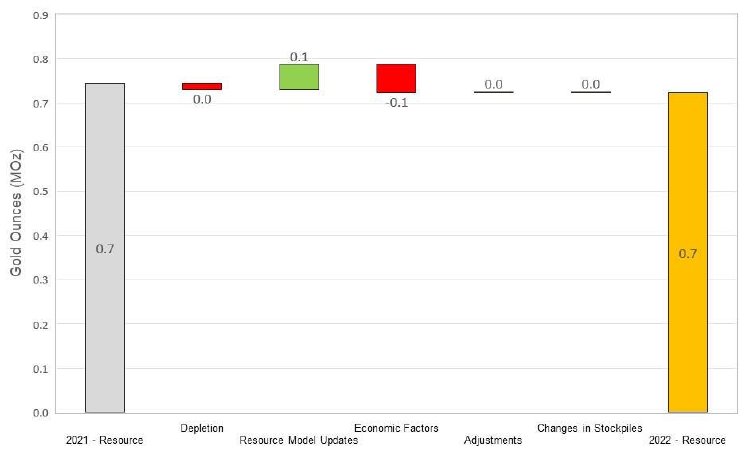

Haile Inferred Resources remained at 9 Mt at 2.6 g/t gold for 0.7 Moz gold. Decreases due to conversion of Inferred Resources at Palomino and Mill Zone were offset by resource growth at Horseshoe (Figure 6).

Haile Resource Model Performance

Table 4 summarizes the Haile open pit resource model reconciliations from 2018 to 2022. The resource model to mill-adjusted mine reconciliation data shows variable performance from year to year, albeit the long term five-year average performance is reasonable; +11% for tonnes, 0% for grade and +11% for contained gold. The positive reconciliation for 2022 was largely due to realizing more gold within, and adjacent to, historically mined areas within the Haile Stage 1 open pit cut-back. Mining of this pit stage was completed in September 2022. Open pit mining continues in the Mill Zone and Ledbetter areas.

While annual reconciliation fluctuations are expected to continue, the Haile open pit resource estimates are believed to provide an acceptable basis for medium to long term mine planning purposes.

Didipio, Philippines

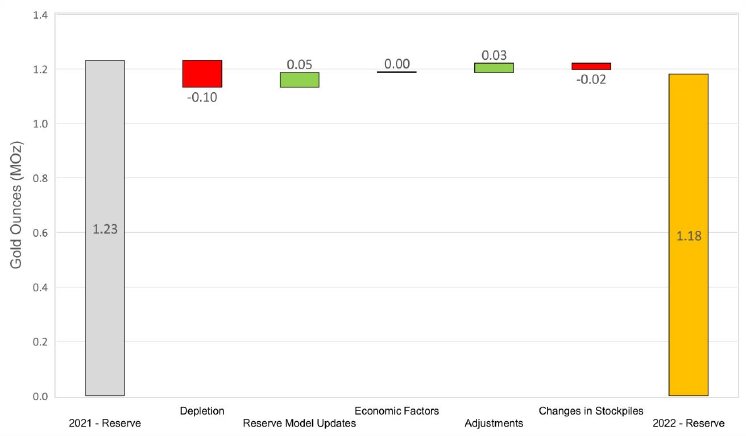

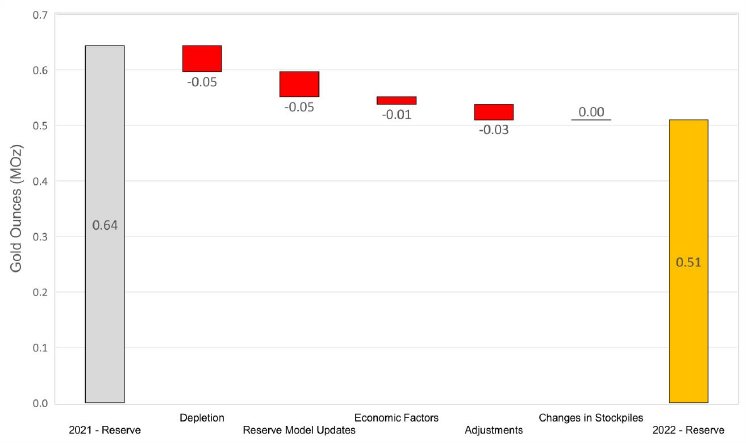

Didipio P&P Reserves stood at 41.0 Mt at 0.90 g/t gold for 1.18 Moz of gold, including 2.5 Moz of silver and 0.15 Mt of copper, a slight year-over-year 0.05 Moz decrease due to 2022 mining depletion (Figure 7), partially offset by resource growth in the underground.

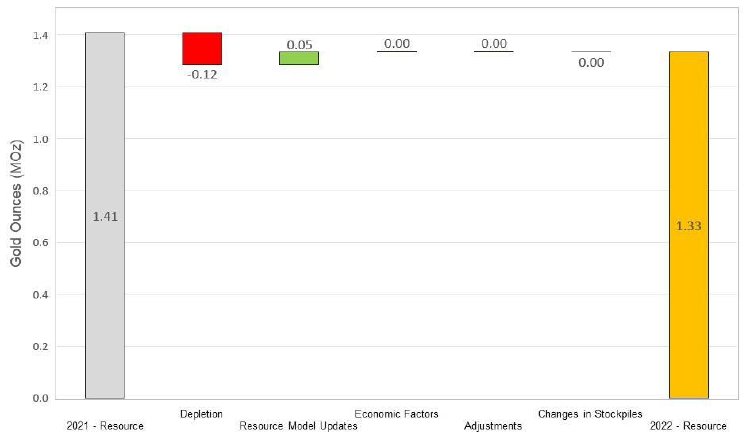

Didipio M&I Resources stood at 45.0 Mt at 0.92 g/t gold for 1.33 Moz of gold, including 2.8 Moz of silver and 0.17 Mt of copper, a 0.08 Moz year-over-year decrease due to 2022 mining depletion partially offset by resource growth (Figure 8).

At Didipio a total of 15.5 Mt at 0.38 g/t gold and 0.36% copper remains in stockpiles (mined to a 0.4 g/t AuEq cut-off) with an additional stockpile of 5.3 Mt at 0.18 g/t gold and 0.15% copper (mined to an approximate 0.27 g/t AuEq cut-off).

Didipio Inferred Resources stood at 0.4 Moz of gold, 0.6 Moz of silver and 0.04 Mt of copper, with no change year-over-year.

Didipio Resource Model Performance

The reconciliation in Table 5 includes mining at Didipio from May 2018 to December 2022, covering the period of FTAA renewal (during which mining was suspended) and the subsequent ramp up, initially with the processing of surface stockpiles and subsequently including underground mining. While the four years of mining (no mining between July 2019 and November 2021) show some variations in performance from year to year, the long-term average performance for this period is reasonable.

While annual reconciliation fluctuations are expected to continue, the Didipio open pit and underground resource estimates are believed to provide an acceptable basis for medium to long term mine planning purposes.

Macraes, New Zealand

The P&P Reserves for Macraes stood at 35.7 Mt at 0.93 g/t gold for 1.06 Moz gold which consists of 0.88 Moz in the open pits and 0.19 Moz in the Frasers and Golden Point Underground mines. The consolidated year-over-year 0.14 Moz decrease reflects 2022 mining depletion.

The Macraes P&P Reserves include the Round Hill and Southern Pit open pits (collectively “RHOP”), containing approximately 0.42 Moz.

During 2022, several technical risks associated with the RHOP were investigated due to its location adjacent to the Mixed Tailings Impoundment (“MTI”) embankment wall and the requirement, should it be mined, to relocate another ‘in-pit’ tailings facility.

Significant data collection and test work has progressed and recent analysis indicates the risk profile of mining RHOP is higher than previously understood. Risks identified to date include geotechnical, operational and scheduling risks; the latter associated with the previously assumed re-mining of tailings using hydraulic mining, a method that has not been previously used at Macraes.

A RHOP options study is in progress and planned for completion in 2023. The result of this study will provide guidance as to the most appropriate RHOP development scenario based on projected cash flow, safety, environment, and closure criteria considerations. The potential options under investigation include not mining RHOP, in which case it may have to be removed from P&P Reserve.

To reflect this increased risk, the Mineral Reserves have been downgraded from approximately 40% Proven / 60% Probable (based on the underlying geological classification) to 100% Probable.

The Macraes M&I Resources stood at 76.2 Mt at 0.91 g/t gold for 2.24 Moz of gold, including 7.0 Mt at 2.35 g/t gold for 0.53 Moz of gold for the Frasers Underground and Golden Point Underground mines. The year-over-year net decrease in M&I Resources of 0.28 Moz is largely due to mining depletion (Figure 10). Decreases were also due to a model update and smaller reporting pit shell at Innes Mills, as well as a change in the Gay Tan open pit final pit design (reduction of 0.05 Moz M&I Resources) as a result of a localised failure in the adjacent highwall of the Gay Tan pit.

Macraes Inferred Resources stood at 23 Mt at 0.9 g/t gold for 0.7 Moz of gold, an increase of 0.1 Moz largely due to increases at Golden Point Underground (Figure 11).

Macraes Resource Model Performance

Table 6 summarizes the combined Macraes open pit and underground resource model reconciliations for 2018 to 2022. The resource model to mill-adjusted mine reconciliation for the five years to 2022 shows variable performance from year to year, albeit the long-term average performance for this period has been reasonable; + 15% for tonnes, - 5% for grade and + 10% for contained gold at a 0.5 g/t cut-off.

2022 saw a 39% positive ore tonnage and 7% negative grade reconciliation. This is attributed to the complex mineralization styles, additional low-grade mineralization identified through grade control drilling, and lower model confidence based on the challenge in obtaining optimal drilling coverage at Gay Tan open pit where drill rig access is limited. The tonnage and grade reconciliation significantly improves if mined Inferred Resources are considered.

While annual reconciliation fluctuations are expected to continue, the Macraes open pit and underground resource estimates are believed to provide an acceptable basis for medium to long term mine planning purposes.