1. Introduction

There are lots and lots of interesting gold projects to be found in Nevada these days, and most of them are in the hands of large entities like Nevada Gold Mines, Kinross, Coeur, Waterton etc. Once in a while, much smaller parties manage to dig up interesting projects, and one of those is optioned by tiny junior Golden Independence Mining (CSE: IGLD, OTCQB:GIDMF, FRA:6NN). This company managed to arrange an earn-in deal last year to own up to 75% of the Independence project in Nevada, which contains a historic 1.07Moz gold resource with the usual hallmarks of a typical Nevada deposit: near surface, heap leachable oxides and deeper, higher grade sulfides.

Historic resources need to be proven up under Canadian market regulations before you can assign any value to them, and this is exactly what management has been doing since October of last year, after a name change, management change and capital raise. It already has been a busy last 9 months or so for the company to set everything up perfectly, and the rewards seem to be pouring in now in the form of excellent drill results.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. The company

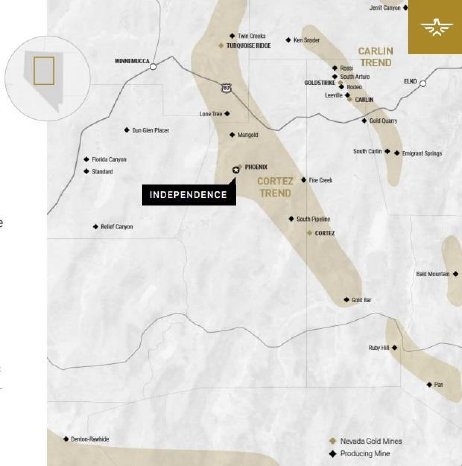

Golden Independence Mining is a gold focused exploration and development company earning a 75% interest in its flagship Independence project located in the Battle Mountain area of central part of Nevada, a region with prolific and ongoing gold production.

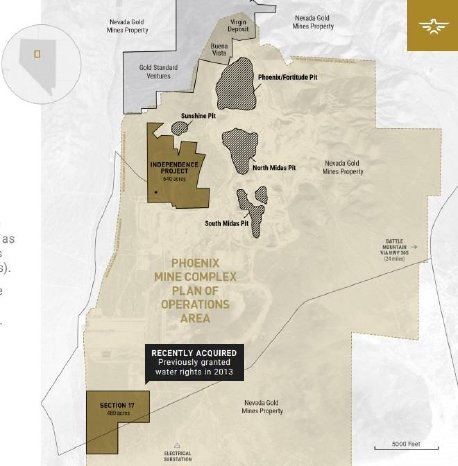

The project is located 800m southwest of the Phoenix Mine, owned by Nevada Gold Mines (Barrick-Newmont JV, producing 2.2Moz Au per annum), and is also completely surrounded by claims owned by Nevada Gold Mines. As such Golden Independence has first class infrastructure at its fingertips.

A historic resource estimate of 1.15Moz AuEq (1.07Moz Au) was completed in 2010, outlining near surface oxide gold mineralization with high grade sulfide mineralization at depth. The Independence project was optioned by predecessor 66 Resources from arm’s length vendor America’s Gold Exploration on August 28, 2020. The original terms differed markedly, but the current agreement was negotiated down to lower amounts, the most important one being a reduction of a cash payment of US$4M (due end of 2021) to US$1.7M and 4,9M shares of IGLD on or before January 29, 2021(payment in cash and shares completed) to own 51% of the project. The following remaining terms also have to be satisfied: the company can earn an initial 51% interest by spending US$1.75M of exploration expenditures by December 31, 2021. An additional 24% interest can be earned by incurring another US$10M of work expenditures over three years.

I view this as an excellent deal, as no further cash payments are required and the expenditures have to be paid anyway to advance the project. Ultimately Golden Independence ends up as a solid 75% majority holder, and the vendor gets a participating 25% interest.

Speaking of permitting, in the most recent Fraser Institute Survey of Mining Companies (2020), Nevada is ranked number 5 of 77 jurisdictions regarding the Policy Perception Index, which is the most important index for me as it handles permitting and the mining friendly policies of a jurisdiction in general. Nevada is even ranked number 1 overall according to the Investment Attractiveness Index, taking things like mineral potential into consideration, confirming its place as a top jurisdiction in the mining industry.

Golden Independence Mining is led by CEO Christos Doulis and President Tim Henneberry. Mr. Doulis has an extensive background in mining research and investment banking, having worked for Stonecap Securities, PI Financial, Gryphon and TD Securities, and the last few years served as CEO for several exploration companies in Canada. Mr. Henneberry is a very experienced geoscientist, and has founded and/or led several Venture/CSE exploration companies. He also was the CEO of 66 Resources before Mr. Doulis came in. The Board and advisors are filled with people with lots of experience, like Don McDowell (Timberline Resources), Robert Mintak (Standard Lithium) and Duane Andersen (permitting manager for Rosemont/Hycroft Mine).

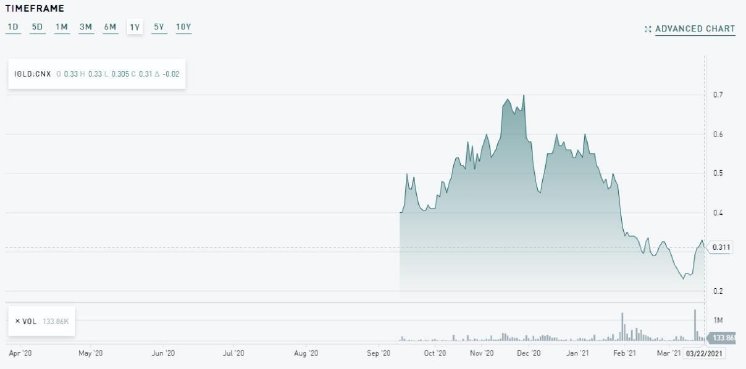

Golden Independence has its main listing on the CSE, where it’s trading with IGLD as its ticker symbol. The company has no direct plans to uplist to the TSX Venture, but management told me they are going to evaluate at the end of 2021. I do favor an uplisting if a company owns a serious project, as access to capital will be much easier, and it sure looks like the Independence project is no moose pasture by any means. To be continued. With an average volume of about 231.818 shares per day, the company’s trading pattern is liquid at the moment, and I expect this to improve further when the company manages to verify the 1.07Moz Au historic resource soon.

The company currently has a very tight 48.24M shares outstanding (fully diluted 53.66M), just 1.89M warrants and several option series to the tune of just 3.53M options in total. Despite most warrants and options being in the money, such low warrant overhang is a positive for existing shareholders.

A current share price of C$0.31 results in a market cap of C$14.95M. Management has some skin in the game, as Doulis and Henneberry hold 2.6% of the shares together. The company is widely held with no significant institutional shareholders but as the Independence project advances it could attract more institutional interest. Similarly, the company has yet to be followed by any brokerage firms but this could change as the Independence project advances.

The company currently has about C$1M in the treasury. Golden Independence received C$2.63M in warrant proceeds on January 5, 2021, and is financed to the end of 2021, which will see a maiden resource estimate and a PEA.

The share price of the company suffered a lot due to the soft gold price in the first months of this year. It seems to have bottomed out at C$0.23 levels, and management timed the last set of drill results to perfection, as sentiment is turning again on the back of the US$1.9T stimulus package from the Biden administration, a weaker US Dollar and a Fed which refuses to increase interest rates.

3. Independence project

The Independence project is a gold exploration/development project located in the central part of Nevada, and consists of 640 acres within the Battle Mountain mining district of Northern Nevada. The state of Nevada produces the most gold worldwide, with a current annual gold production of about 5.5Moz Au, having produced about 215Moz Au in total. If it was a country, it would rank sixth overall, behind the likes of China, Russia and Australia, and these figures clearly indicate the extremely rich gold endowment of Nevada. The project has excellent access to infrastructure, and is located about one kilometer away from several mining pits which are part of the Phoenix Mine Complex, owned and operated by Nevada Gold Mines (JV company owned by Barrick and Newmont).

The Independence project is located completely within the permitted Plan of Operations for the Phoenix mine (operated by Nevada Gold Mines). As a consequence, the project can be permitted under the much less stringent and faster Environmental Assessment (EA) regime as opposed to a new project which would be permitted under an Environmental Impact Statement (EIS). Management believes this will save about one year in the permitting process and that it can fast track the project to a production decision in 2023.

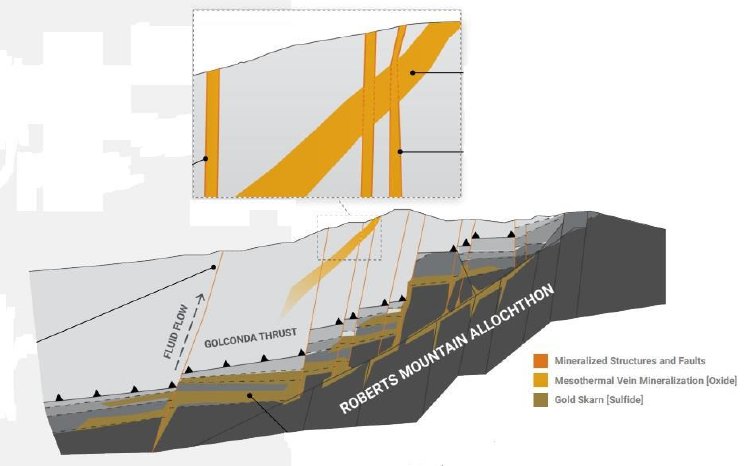

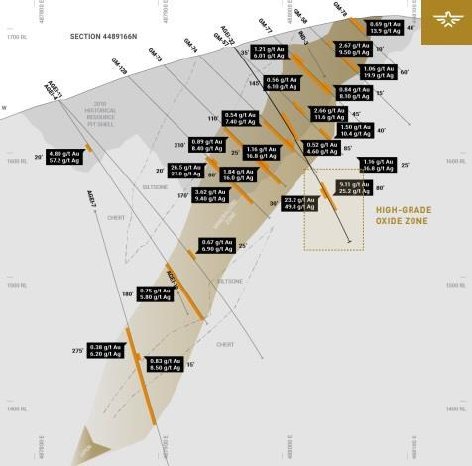

The Independence project has relatively simple mineralization, and is similar to other Nevada projects in the area. A low grade (0.5 g/t Au), near surface, heap leach amenable oxide resource is underlain by a transitional (mixed oxide sulfide) zone and below this much higher (6.5 g/t Au) sulfides. Alongside faults there are also vein structures running almost vertically.

The shape of the oxide deposit is a 1500m long, up to 300m wide, flat, north-south oriented mineralized envelope, that starts at surface and slopes downwards to the west. The thickness varies from 10 to 60m real width, continuing at depth at often even larger widths. The grades from the main envelope don’t increase below 200m at most sections, so I consider drilling along strike of this envelope not useful. However, the company is hitting all sorts of parallel structures to the envelope, sometimes with high grade intercepts in the oxides.

A historic resource was completed in 2010, based on 131 drill holes, which didn’t go deeper than just 130m, well within open pit boundaries of standard projects (200m). Preliminary metallurgical testwork on bulk samples indicated over 80% gold recovery for oxide mineralization, in-line with similar Nevada heap leach operations.

The used cut-off grade was 0.008oz/t AuEq, or 0.25g/t AuEq, set on a much lower gold price of US$850/oz, and silver price of US$13/oz at the time. The average gold grade for the oxide part is good to excellent, the grade for the underground sulfide part is often good, and the combination of the two is excellent, as the project could have a solid open pit operation for starters followed by a higher grade underground operation.

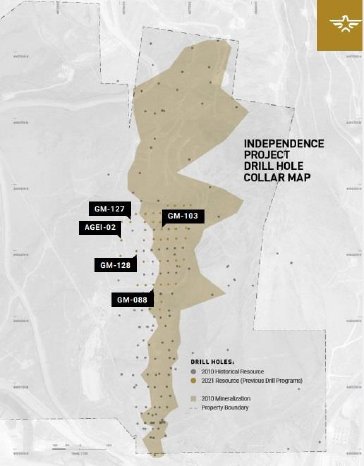

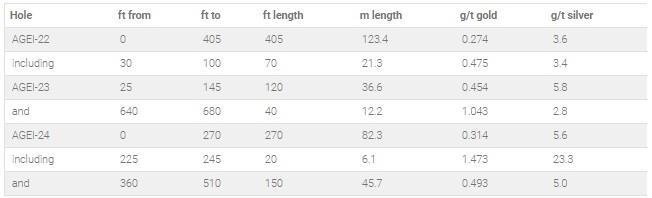

Historic drilling provided the following highlights (see the map above this section with the oxide deposit shape plus drillholes on it for the locations):

- GM-128: 50m grading 3.94 g/t Au including 1.7m grading 99.33 g/t Au

- GM-127: 15m grading 9.52 g/t Au including 3.3m grading 33.84 g/t Au

- GM-088: 60m grading 1.20 g/t Au including 3.3m grading 7.65 g/t Au

- GM-103: 33m grading 1.63 g/t Au including 3.3m grading 8.52 g/t Au

- AGEI-02: 90m grading 1.10 g/t Au including 1.7m grading 10.00 g/t Au

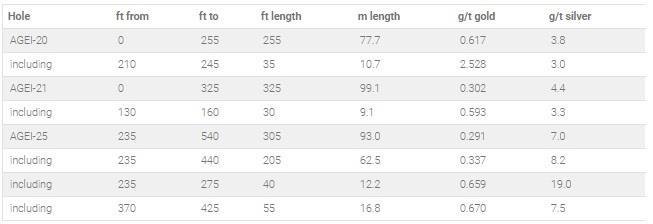

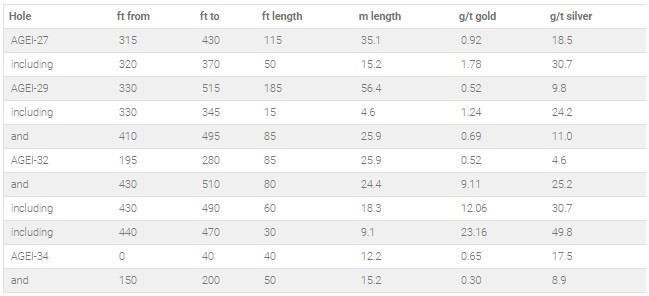

These higher grade results don’t stop with historic drilling. The recently completed reverse circulation (RC) drill program not only returned excellent results for infill (verification of historic resource) drill holes, but also higher grade oxides outside of the known mineralization and at a relatively shallow depth. Hole AGEI-32 returned 24.4m grading 9.11 g/t Au and 25.2 g/t Ag just beyond the footwall (boundary below) of the oxide deposit. These results are excellent for an oxide gold project and this mineralization could potentially be captured in an open pit project. If a significant amount of higher grade material could be delineated at these depths it could significantly enhance the economics of this project. The company intends to resume drilling in this area in late April.

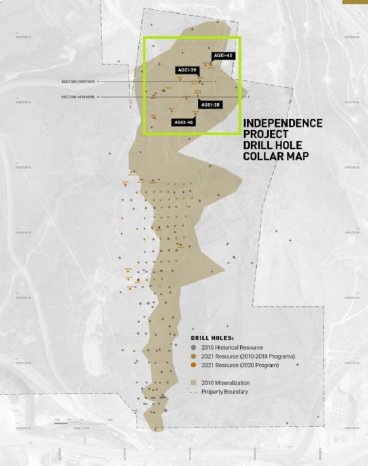

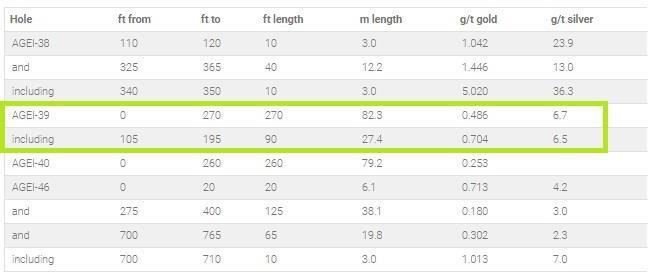

The company is also looking at a significant resource expansion in the north of the project, which has seen little previous drilling but is now returning significant lengths of good grade material such as hole AGEI-39 which returned 82.3m grading 0.486 g/t Au and 6.7 g/t Ag from surface.

Golden Independence has a goal of tabling at least 500koz Au of oxide resource in the upcoming (April 2021) NI43-101 compliant resource estimate. First let’s have an arm waving gamble myself. When looking at the map and the sections, and the mineralized intercepts, my assumption for the oxide mineralized envelope in the northern part of the Independence project would be a 400m long, 200m wide, and on average 35m thick body, at a specific gravity of 2.75t/m3 this generates 7.7Mt. Assuming an average grade of 0.5g/t AuEq, this results in 124koz AuEq. Combined with a hypothetically verified 1.15 Moz AuEq from the historic resource, the upcoming maiden resource estimate could result in a 1.3-1.5 Moz Au resource according to management, of which roughly 1/3 could be oxides. Management’s goal for 2021 is to prove up about 1.8Moz AuEq, of which 600koz AuEq hopefully will be economic oxides, to be used for the upcoming PEA.

Step out holes before this also returned good holes, at often long intercepts, two of four holes still had lower grades (around 0.30g/t Au) which should still be enough to remain above an estimated new cut-off grade. Keep in mind the cut-off of the historic estimate was 0.25g/t AuEq, which was set at a much lower gold and silver price. With both metals currently trading at a double, my expectation is that the cut-off could be lowered to at least 0.20g/t AuEq and probably even to 0.20g/t Au,, providing room to include even more ounces compared to the historic resource. It seemed management was vectoring in on the high grade mineralization, as the last batch was the best.

These intercepts are actually world class, as they are all well within open pit limits (300ft is 100m), and the grade is excellent no matter what the host material is. Management doesn’t know yet exactly to which extent the intercepts are oxide, transitional or sulphide, but given the shallow depth these are likely oxides, and following metallurgical testwork during Q2 2021 will verify this. Things look good to support the case for oxides, as CEO Doulis had this to comment: “These results support our model that higher grade areas within the oxide zone are the result of vertical fracture structures linked to the deeper sulfide mineralization”. If the company really hit oxides at these grades, then this could be a game changer for the open pit portion of the project, with an increase in not only total ounces but also an enhancement of the project’s economics due to the higher grade material.

4. Peer comparison

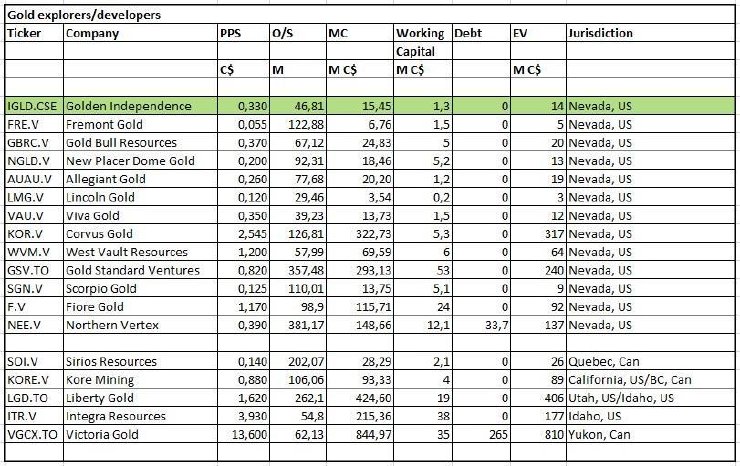

As Golden Independence is a gold developer in Nevada working on their heap leachable Independence project, it is relatively easy to find good peers for the peer comparison, as Nevada is a very crowded place due to the huge amount of mineralized potential and mining friendly policies. It surprised me to what extent there are even small (0.25-0.5Moz Au) projects being advanced towards production, but this can be explained by the relatively high gold price, making various parties scramble for smaller projects as well, relatively low capex demands for heap leach projects, and often high internal rates of return (IRR), something which would be much more difficult to achieve with conventional open pit/underground hard rock projects.

In general as a continuous reminder for investors, a peer comparison as a valuation method isn't perfect as every single company has a unique set of parameters and should actually be analyzed in full and normalized as far as this is possible of course, and for example EV/oz doesn't say anything about profitability of the project yet, potential high capex, potential permitting issues, capability of management etc, but with some comments to go with such a peer comparison it provides at least an indication, which is my intention. The main intent for peer comparisons is a basic valuation tool by trying to find the most equal companies regarding quality and size of projects, jurisdictions, financial situation, backing, management, permitting, in short everything that makes every project and company so unique in this space. The better the resemblance, the more useful the company for a comparison.

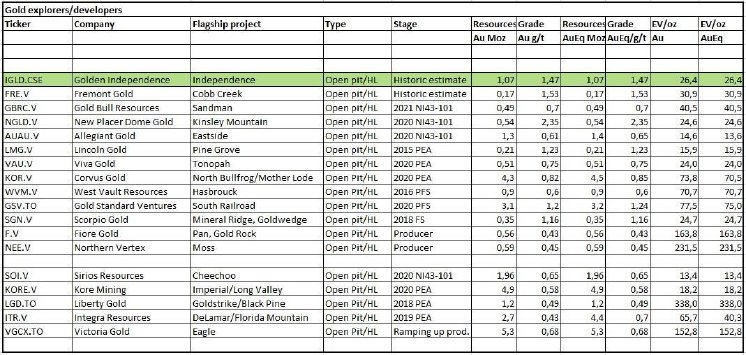

I picked a number of companies with one or at most two flagship assets, all having at least a historic resource, all of them in Nevada, and some additional ones in Canada or other states in the USA, gold-focused, and as Golden Independence is aiming at completing a PEA on just the open pit oxide component for now, this is the single category in this comparison.

It is obvious that no other state or jurisdiction comes close to Nevada regarding the amount of heap leach projects. The beauty of this set of peers is that it also contains lots of tiny marketcaps and small resources, improving the comparison even more.

I adjusted the EV/oz metric for Golden Independence for a 51% interest they are earning into. As can be seen, the 500koz oxide resource the company is aiming at, isn’t that small at all, as most peers in Nevada have comparable resources. There is a wide variety in EV/oz valuation metrics, with only the more widely established names with long histories (Corvus, Gold Standard, Liberty and Victoria) or new producers with relatively small resources (Fiore, Northern Vertex) having relatively higher EV/oz figures. It seems small-scale developers aren’t highly valued across all different stages, UNTIL they commence production. This is the reason management isn’t aiming at growing the resource as large as possible (1.5-2Moz Au seems possible) before doing the first economic study (usually a Preliminary Economic Assessment or PEA), but is streamlining everything in order to advance from resource to production based on a +500koz Au oxide only resource.

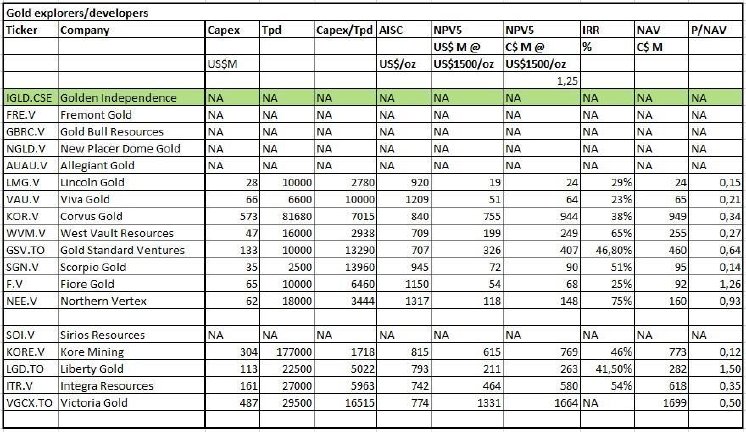

The next table shows basic figures of economic studies, including a metric developed by myself: the capex/throughput ratio, which indicates the amount of capex needed per tonne of throughput capacity. This figure enables me to estimate average capex on a project, when a throughput number has been estimated. To my surprise there is a wide variety in this ratio, independent of scale (usually economies of scale kick in at larger projects), so especially the low end ratios deserve additional attention if they are relevant or not for your own estimates.

Liberty is a clear outlier, but has the benefit of high quality C-suite guys like Mark O’Dea and his team, with the backing of some big names, which usually provides a hefty premium to his ventures.

I was curious to see where a conservative estimate on economics could take the Independence project.

A quick back of the envelope calculation on the 500koz oxide scenario for Golden Independence assumes a 50,000oz Au for 8 year production, based on an average grade of 0.65g/t AuEq, with recovery of 80% for gold, 50% for silver. Based on 350 producing days per annum, this requires a 9,000 tonne per day operation, which, when using an average capex/tpd ratio of US$8,000/tpd, generates a capex of US$72M. Using an average AISC of US$1000/oz Au, and an average combined (federal and state) corporate tax of 25% for Nevada, this results in a very decent after tax NPV5 of US$92M @US$1500/oz Au, and an after-tax IRR of 34.7%. At a current market cap of C$15M, this means the stock would be trading at just 10% of hypothetical NPV5, meaning a future hypothetical P/NAV in that case of 0.10. The table shows that there isn’t a company trading at a lower multiple, so if these hypothetical figures can be proven eventually, precious metals remain at current levels and markets stay positive, a re-rating seems inevitable.

But this is all hypothetical and very forward-looking for the time being, as Golden Independence first has to complete a maiden NI 43-101 compliant resource estimate, which is scheduled for release in the next weeks and which will likely be updated in Q4, 2021, and a PEA which is expected at the end of Q4, 2021, but the idea is simply to give you a hypothetical impression of future valuation potential. For now, management is focused on proving up and expanding the historic oxide resource as much as possible, and the only way to prove up resources is to delineate them by lots of successful drilling, and this is exactly what is happening now.

5. Conclusion

Gold juniors starting out with a historic resource estimate are among my favorite multi-bagger candidates, as usually not much value is assigned to such assets, but the potential is already much more de-risked compared to greenfield explorers. In case of Golden Independence, the resource estimate seems to be of high quality, and the incoming drill results, whether verifying infill drilling or expansion, are consistently ranging from solid to excellent.

The company is earning an initial 51% interest and later on for a 75% majority ownership, by having to spend just exploration dollars. Mr. Doulis and Mr. Henneberry aren’t wasting much time, as the maiden resource is expected within weeks, and the remainder of 2021 is filled with other major catalysts. Golden Independence is shaping up to be an interesting Nevada gold play, and not only deserves attention for their oxide potential, as the entire resource including sulphides could grow towards 1.5-2Moz.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Independence Gold is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldenindependence.co and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.