Transaction highlights:

- Agreement entered into with ASX-listed Australian gold miner Kalamazoo whereby at IPO, Karora will vend into Kali its highly prospective lithium mineral rights across an extensive range of projects located south of Kalgoorlie, Western Australia (“Higginsville Lithium Project”) and Kalamazoo will vend into Kali its Australian lithium projects, including Marble Bar and DOM’s Hill located in the Pilbara and Jingellic and Tallangatta projects located in the Lachlan Fold Belt (New South Wales and Victoria)

- At listing, Kali will be a leading Australian critical minerals exploration company, having consolidated significant lithium and critical minerals tenure totaling ~3,833km2

- Kali’s extensive exploration portfolio is adjacent to world-class lithium mines and deposits in the Eastern Yilgarn (1,607km2) and Pilbara (199km2) WA, and prospective greenfields lithium exploration projects in the Lachlan Fold Belt (2,027km2) in NSW and VIC

- Kali to raise a minimum of A$10 million, up to a maximum of A$12 million at IPO to fund its exploration and drilling plans across the combined Australian lithium portfolio

- Kalamazoo to own 55% of Kali, with Karora owning the remaining 45% (prior to the proposed capital raise)

- Kali will be led by Managing Director Graeme Sloan and Non-Executive Chairman Luke Reinehr, both bringing significant existing understanding of the newly combined Kali lithium tenements as well as strong track records of value creation in Australia’s mining sector.

The creation of a separate lithium-focused vehicle allows Karora’s management team to remain laser-focused on our existing gold and nickel production growth strategy, while giving Karora shareholders near-term exposure to the lithium exploration potential on our Higginsville tenements in combination with Kalamazoo’s tremendous lithium projects in Western Australia, New South Wales and Victoria. Under the Kali Metals banner these assets form a new large, highly prospective exploration vehicle in the exciting Australian lithium sector that is playing a leading role in the global energy transition. We look forward to participating in the enhanced combined success of the newly formed Kali Metals.”

Luke Reinehr, Chairman and CEO of Kalamazoo commented “With Kalamazoo's primary focus on gold, we have contemplated alternatives for our Pilbara and Lachlan Fold Belt lithium projects for quite some time. When the opportunity arose to join with Karora, into what we consider will be a significant critical minerals exploration company in Australia, the rationale was compelling. We are delighted to have reached an agreement with Karora that will see our lithium portfolio combined with its highly prospective tenement package located in a Tier 1 lithium mining jurisdiction. The transaction will result in the establishment of Kali as a well-funded ASX-listed lithium explorer, with an unrivalled portfolio of assets located in the hottest hard-rock lithium regions, not just in Australia, but globally. The spin-out of Kali will provide our shareholders with ongoing exposure to these expanded assets and strategy.”

Overview

Karora has entered into a Shareholders Agreement (“the Agreement”) with Kalamazoo under which Kalamazoo will vend its non-gold exploration projects and mineral rights into Kali, followed by the undertaking of an IPO pursuant to the agreement. The proposed transaction will see the establishment of a new ASX-listed exploration company, Kali Metals Limited (proposed ASX Code ASX: KM1), with its own highly experienced board and management team.

Kali’s lithium exploration tenure at IPO will comprise:

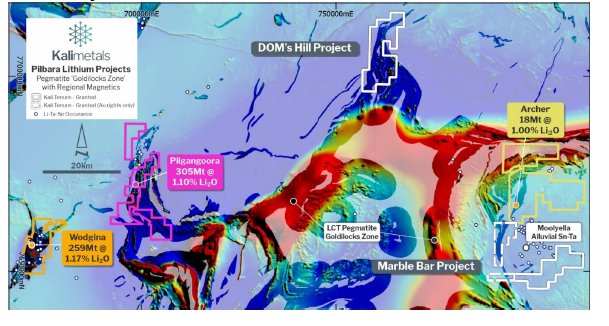

- Kalamazoo’s Marble Bar and DOM’s Hill Lithium Projects in the Pilbara, WA (199km2) which hosts the world-class Pilgangoora and Wodgina lithium mines. Exploration across these lithium projects is currently being undertaken in Joint Venture with Chilean lithium producer Sociedad Química y Minera de Chile S.A. (“SQM”) (NYSE: SQM).

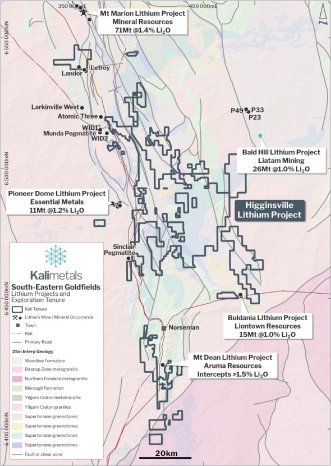

- Lithium mineral rights granted across a substantial portion of Karora’s Higginsville gold tenement package (~1,607km2) located south of Kalgoorlie, in the Eastern Yilgarn, WA, which hosts the nearby Mt Marion and Bald Hill lithium mines and the Pioneer, Manna and Buldania lithium deposits.

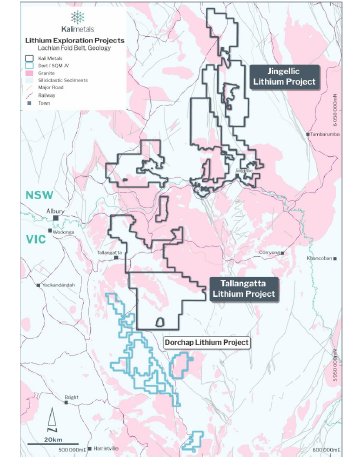

- Lithium mineral rights granted across Kalamazoo’s Jingellic and Tallangatta Lithium Projects (2,027km2) located in the Lachlan Fold Belt, NSW, and Victoria.

Board and Management

Graeme Sloan has been appointed as Managing Director of Kali with Kalamazoo’s Chairman/CEO Luke Reinehr as Non-Executive Chairman. Graeme Sloan is a highly qualified Mining Engineer with over 35 years’ experience including as previous Managing Director of Karora. Paul Adams, John Leddy, and Simon Coyle have been appointed as Non-Executive Directors. Assisting the Board during the IPO process is Luke Mortimer as Exploration Manager, Bernard Crawford as CFO, and Nick Madders as Company Secretary/Legal Counsel. These appointments will provide a high degree of continuity and understanding of Kali’s exploration portfolio. Kali has appointed Grant Samuel as Corporate Advisor and Gilbert + Tobin as legal advisor.

Next Steps

As part of the proposed IPO listing on the ASX, Kali is targeting to raise approximately A$10 million to A$12 million (prior to fees). The closing of the proposed transaction is subject to final Board, regulatory and other conditions precedent.

Kali Projects Overview

Eastern Yilgarn Lithium Projects, WA

The Higginsville Lithium Project is located south of Kalgoorlie within the Eastern Yilgarn, a leading hard-rock lithium region containing major mines and deposits including the Mt Marion Lithium Mine (71Mt @ 1.4% Li2O), Bald Hill Lithium Mine (26Mt @ 1.0% Li2O), Pioneer Dome Lithium Project (11Mt @ 1.2% Li2O), Buldania Lithium Project (15Mt @ 1.0% Li2O) and Manna Lithium Project (33Mt @ 1.0% Li2O) (Figure 2). Within the Higginsville Lithium Project area, highly prospective lithium targets have already been identified from outcrop and historical reports at Spargos, Mt Henry, Buldania North and East and the Chalice/Sinclair prospects.

Pilbara Lithium Projects, WA

The Marble Bar Lithium Project is located along the margin of the Moolyella tin and tantalum alluvial field and contains numerous local occurrences of mapped lithium-enriched pegmatites (Figure 3). Located approximately 25km to the north is Global Lithium Resources Limited’s (ASX: GL1) Archer Lithium Deposit, also on the margin of the Moolyella tin and tantalum field, with a reported Inferred Resource of 18Mt @ 1.0% Li202. Recent mapping and surface sampling at the Marble Bar Lithium Project, has discovered outcropping spodumene-bearing pegmatite dykes associated with high-grade rock chip samples assaying up to 2.8% Li2O.

The DOM’s Hill Lithium Project, East Pilbara, contains a similar geological setting and target host rocks strongly analogous to that of the nearby world class Pilgangoora (Pilbara Minerals, ASX: PLS) and Wodgina (Albemarle, NYSE: ALB/Mineral Resources, ASX: MIN) pegmatite-hosted lithium deposits. The project covers significant strike extent of Archaean granite-greenstone contact zone, or “Goldilocks Zone” considered highly prospective for Lithium-Caesium-Tantalum (“LCT”) pegmatites.

The Marble Bar and DOM’s Hill Lithium Projects are part of an exploration Joint Venture (“JV”) agreement originally between Kalamazoo and major Chilean lithium producer SQM. Kalamazoo has, with SQM’s consent, assigned its interest in the JV to Kali. SQM has been granted the right to earn an initial 30% interest (to a maximum of 70%) in all mineral rights at the Marble Bar and DOM’s Hill Lithium Projects, by sole funding a minimum of A$12 million of exploration and development activities over the next four years. SQM is one of the world’s leading lithium producers with its main asset in Australia being its 50% joint venture interest in the Mt Holland Lithium Project.

Lachlan Fold Belt, NSW/VIC

The Jingellic and Tallangatta Lithium Projects are an “early mover” play, covering geology considered highly prospective for both LCT-pegmatites as well as hard-rock tin mineralization (Figure 4). Both projects host highly fractionated S-type granites and related pegmatite dykes that are closely associated with numerous alluvial and hard rock tin-tungsten and tantalum occurrences and mine-workings. These are all critical, favourable features of the LCT-pegmatite exploration model. Additionally, both projects lie within the extension of the same Lachlan Fold Belt geology that hosts known LCT mineralization (including spodumene) at the Dorchap LCT Pegmatite Project located nearby in NE Victoria as reported by Dart Mining NL (ASX: DTM).

About Kalamazoo Resources Limited

Kalamazoo Resources Limited (ASX: KZR) is an ASX-listed exploration company with a portfolio of high-quality gold and lithium projects in Victoria and the Pilbara, WA. In Victoria Kalamazoo is exploring its 100% owned projects in the Castlemaine (historical production of ~5.6Moz Au), Maldon (historical production of ~2Moz), and Tarnagulla Goldfields as well as its Myrtle and Mt Piper Projects near the world class Fosterville gold mine in Victoria. In the Pilbara, Kalamazoo’s extensive exploration program is advancing the 100% owned Ashburton Gold Project to further increase the 1.44Moz Au resource as well as the 100% owned Mallina West Project along strike from De Grey’s 10Moz Hemi discovery.

Kalamazoo’s lithium projects include DOM’s Hill and Marble Bar Lithium Projects in an exploration joint venture with the major Chilean lithium producer Sociedad Química y Minera de Chile S.A. (SQM) (NYSE: SQM) and the 100% owned Pear Creek Lithium Project. Kalamazoo also has the 100% owned “Jingellic” and “Tallangatta” lithium exploration projects in the Lachlan Fold Belt of southern NSW/NE Victoria.

Kalamazoo has become the first gold and lithium explorer operating in Australia to be certified carbon neutral for its business operations under the Federal Government’s Climate Active Program, with projected 2022 emissions fully offset achieved with a verified environmental reforestation program in Western Australia.

About Karora Resources

Karora is focused on increasing gold production to a targeted range of 170,000-195,000 ounces by 2024 at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations ("HGO") in Western Australia. The Higginsville treatment facility is a low-cost 1.6 Mtpa processing plant, which is fed at capacity from Karora's underground Beta Hunt mine and Higginsville mines. In July 2022, Karora acquired the 1.0 Mtpa Lakewood Mill in Western Australia. At Beta Hunt, a robust gold Mineral Resource and Reserve are hosted in multiple gold shears, with gold intersections along a 5 km strike length remaining open in multiple directions. HGO has a substantial Mineral gold Resource and Reserve and prospective land package totaling approximately 1,900 square kilometers. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora's commitment to reducing emissions across its operations. Karora's common shares trade on the TSX under the symbol KRR and on the OTCQX market under the symbol KRRGF.

Compliance Statement (JORC 2012 and NI 43-101)

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Stephen Devlin, FAusIMM, Group Geologist, Karora Resources Inc., a Qualified Person for the purposes of NI 43-101.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to production guidance, full year consolidated 2023 and longer-term production guidance and the potential of the Beta Hunt Mine and Higginsville Gold Operation.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora 's filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

For more information, please contact:

Rob Buchanan

Director, Investor Relations

T: (416) 363-0649

www.karoraresources.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch