Climate policy goals are being pursued more ambitiously today than ever before, not least of which is independence from other countries, for example Russia. In the EU, it is the REPowerEU plan that provides for high investments in energy infrastructure. The climate policy goals of many countries have reached a turning point, so to speak. China's power with regard to critical raw materials in particular is to be reduced. The world has recognized the energy turnaround as an important goal, and demand for raw materials should be boosted by it. In the U.S., the Inflation Reduction Act is providing a boost to green infrastructure. This is because the importance of resource and energy security has been recognized.

In recent years, commodities have been in strong demand. The impact of the global pandemic shock was contained by monetary and fiscal policy countermeasures. The second shock, Russia's invasion of Ukraine, further supported commodity prices. This was because energy and agricultural products were suddenly available in limited quantities. The high inflation that then occurred again demonstrates that commodities are an excellent asset class to diversify a portfolio and counterbalance inflationary trends. Even though a weaker economy weighed on metal prices last year, the outlook for commodities, which are important for the energy transition, should be very good. In addition, China's opening up to Covid should increasingly create demand for raw materials.

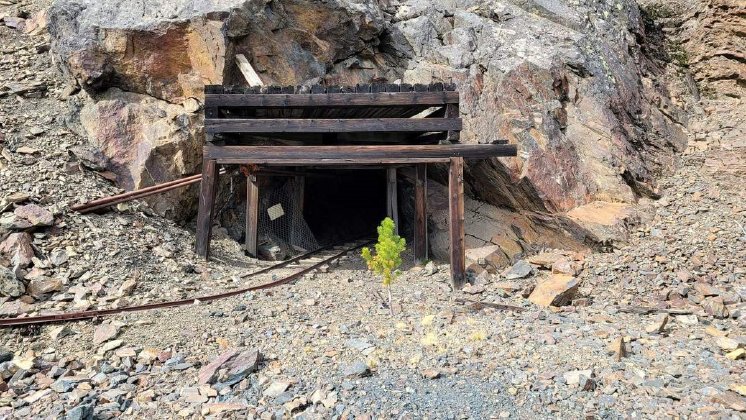

Companies such as U.S. Critical Metals - https://www.commodity-tv.com/play/us-critical-metals-exploring-a-lithium-a-rare-earths-and-a-cobalt-project-in-the-united-states/ - should not have to worry about a lack of customers for their raw materials. The company's portfolio includes a lithium project in Nevada, a cobalt project, a uranium project and two rare earth projects in Montana and Idaho.

In addition to uranium, Green Shift Commodities - https://www.commodity-tv.com/play/green-shift-commodities-advancing-uranium-project-and-closing-on-acquisition-of-lithium-project/ - owns raw materials needed in electric motors and storage batteries, such as vanadium, nickel, phosphates and rare earths (neodymium) at its Berlin project in Colombia.

Current corporate information and press releases from US Critical Metals (- https://www.resource-capital.ch/en/companies/us-critical-metals-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/