- Drill results identify a Parallel Panel target located ~50 metres north of the High Grade Panel with mutiple high grade intercepts:

- 38.0m grading 6.95 grams per tonne (‘g/t’) gold including 6.0m grading 23.3 g/t gold

- 4.0m grading 10.7 g/t gold

- 2.0m grading 13.6 g/t gold - Deep Expansion Zone beneath the High Grade Panel with open intercepts:

- 13.5m grading 29.1 g/t gold

- 40.0m grading 6.30 g/t gold - New West Breccia target with gold mineralization and a pathfinder element signature as strong as the High Grade Panel

- San Luis Target, a large jasperiod/vein zone with open gold drill intercepts and untested high gold grades (0 m grading 11.35 g/t gold) on surface

- Drilling to test new targets commencing in September, 2023

- Amended Ana Paula acquisition agreement deferring next payment to earlier of Feasibility Study or 2025

Heliostar CEO, Charles Funk, commented, “To date in 2023, the team has been focussed on delivering the re-scope goals set out by the Company for the High Grade Panel at Ana Paula. We have made significant progress so far. Now the Company can build on this foundation to demonstrate the resource growth potential of the Ana Paula project. That starts with the significant recognition of a Parallel Panel just fifty meters north of the High Grade Panel. It opens a well mineralized new target for expansion drilling. In addition, the West Breccia, Expansion Zone, and San Luis targets are the highest priorities from a pipeline of growth targets at Ana Paula. The team will prioritize the Parallel Panel and the West Breccia targets for drilling this month.”

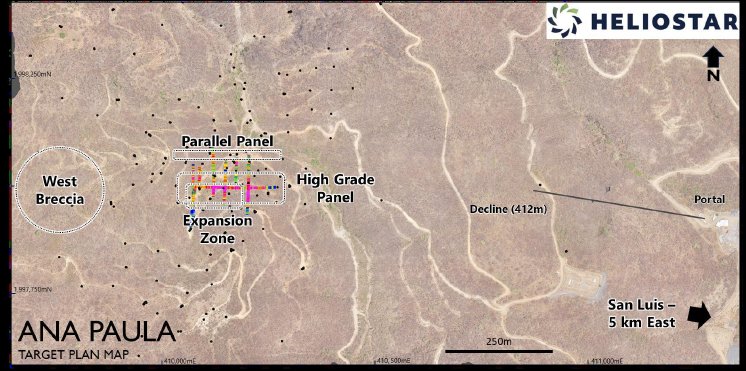

Growth Target Identification

The Company’s understanding of Ana Paula has built on the work of previous operators. This process led to an evolution in the understanding of controls on gold mineralization. Most of the high-grade gold is hosted in a diatreme breccia rock unit. This was the focus of exploration in the project’s recent history. The Company recognized that the breccia makes a great host rock and that it predates the mineralization however structural controls play a far greater role in focusing gold mineralization.

Broad east-west faulting controls the earlier diatreme breccia emplacement and created excellent gold pathways at Ana Paula. The results from the recent drill program at the High Grade Panel reinforce this observation. Because the historic target was the breccia rather than the east-west fault structure, very few holes in the current PFS resource are drilled in the best orientation to find these structures.

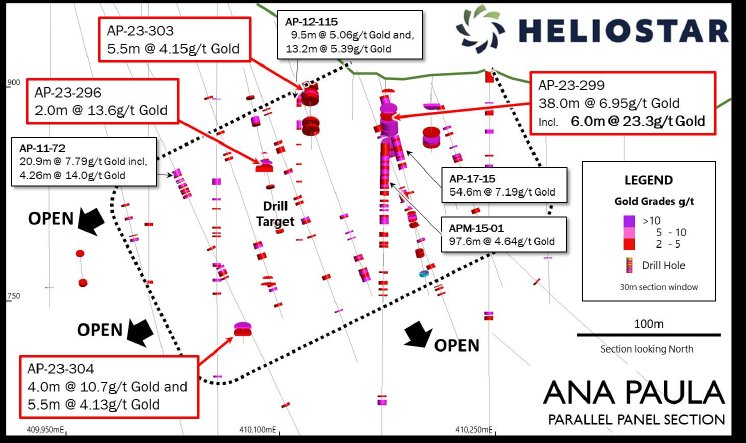

New Parallel Panel

As the recent drill program advanced, five Heliostar holes have probed the footwall of the High Grade Panel. Completion of these drill hole on a more effective drill orientation began to define a new Parallel Panel to the north of the existing High Grade Panel. The Parallel Panel target currently has dimensions of 200 metres long by 150 metres wide and remains open in all directions (Figure 2). The width is not well defined as most historic holes intersected the Parallel Panel at a high angle. However, it appears to vary from 2 to over 15 metres wide. Those holes returned long, high-grade intervals including.

- APM-17-15: 6 m grading 7.19 g/t gold

- APM-15-01: 6 m grading 4.64 g/t gold

- AP-11-72: 9 m grading 7.79 g/t gold

- AP-12-115: 5 m grading 5.06 g/t gold and 13.2m grading 5.39 g/t gold

- AP-23-299: 0m grading 6.95 g/t gold including 6.0m grading 23.3 g/t gold

- AP-23-304: 0m grading 10.7 g/t gold and 5.5m grading 4.13 g/t gold

- AP-23-296: 0m grading 13.6 g/t gold

- AP-23-303: 5m grading 4.15 g/t gold

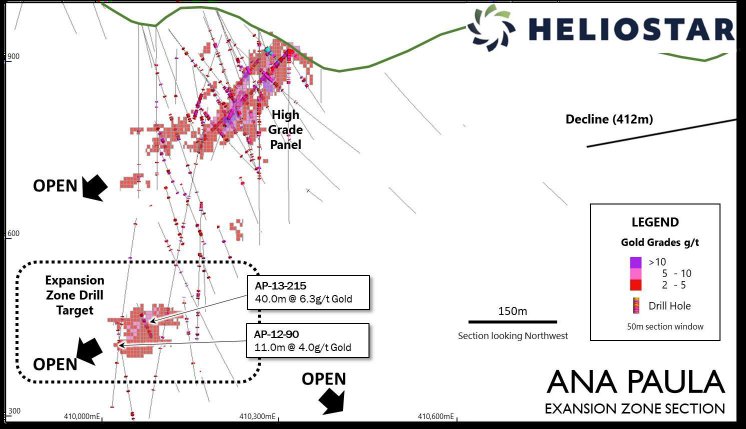

Deep Expansion Zone

The Ana Paula resource is open at depth. The Expansion Zone sits beneath the High Grade Panel. The previous owner recognized the potential of this zone and commenced a decline to better access the zone for drilling. Drill results include.

- AP-11-70: 5m grading 29.1 g/t gold

- AP-13-215: 0m grading 6.3 g/t gold

- AP-12-86: 5m grading 6.0 g/t gold

- AP-12-90: 0m grading 4.0g/t gold

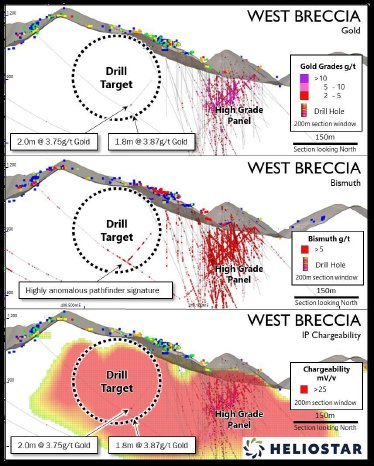

West Breccia – A High Grade Panel Lookalike

The gold mineralization in the High Grade Panel at the core of Ana Paula has distinctive pathfinder elements associated with it, including bismuth. Two deep drill holes, 300 metres west of the High Grade Panel, intersected pathfinder anomalies as strong as those within the High Grade Panel (Figure 4; next page). These holes also have narrow gold intercepts. However, there has not been any follow-up drilling to chase potential gold mineralization similar to the High Grade Panel at the West Breccia.

Surface rock chips above the West Breccia target define multiple areas of gold anomalism with up to 2.77 g/t gold. Geophysics shows a similar chargeability anomaly as the area of the High Grade Panel. As a shallow target, the West Breccia will be tested in in the next phase of exploration drilling.

San Luis

San Luis is a hybrid epithermal vein/skarn gold target with high gold grades sampled across a large area of alteration. The target is located 5.5 kilometres east of Ana Paula. It begins at the property boundary with Torex Gold and extends for over 2.5 kilometres of strike on the Company’s lands. The target is a zone of intense silicification with gold and pathfinder elements that have epithermal quartz veins in the silicified structures. Surface samples include.

- 0 m grading 11.35 g/t gold (Undrilled)

- 15 m grading 8.83 g/t gold (Undrilled)

- 5 m grading 16.7 g/t gold (Undrilled)

San Luis is one of several regional targets that will be the focus of a new drill permit. Heliostar will target them in 2024 once the permit has been received.

Amended Purchase Agreement

Heliostar and Argonaut Gold have amended the terms of the Ana Paula purchase agreement.

Argonaut Gold has agreed to defer the outside date of the US$2,000,000 cash payment associated with the Feasibility Study to January 1st, 2025. This is an extension of six months and represents the earliest cash obligation Heliostar must meet.

In return, Heliostar agreed to re-imburse to Argonaut Gold US$150,000 in Ana Paula claim fees from the closing of the transaction to June 30, 2023. Additionally, Heliostar will cover certain transition services and administration costs incurred during the handover of the asset.

Also, the open pit mine permit extension/new underground mine permit granting milestone was also modified to clarify that the issuance of US$5,000,000 in shares will be divided by the VWAP of Heliostar’s shares for the ten trading days ending on the last trading day immediately prior to the date of award of the permits.

Webinar Invitation

The Company is hosting a webinar today (September 7th) at 11am Pacific/2pm Eastern time to provide an update on the progress made over the summer at Ana Paula. The company will provide a detailed review of the progress made with the re-scope to date, the catalysts for the remainder of 2023 and the options ahead to rapidly bring Ana Paula into production.

Please use the link here to register for the webinar:

https://us02web.zoom.us/webinar/register/WN_JfM07_7USW-yZZmaVAS5tg

Statement of Qualified Person

Stewart Harris, P.Geo., a Qualified Person, as such term is defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), has reviewed the scientific and technical information that forms the basis for this news release and has approved the disclosure herein.

About Heliostar Metals Ltd.

Heliostar is a junior mining company with a portfolio of high-grade gold projects in Mexico and Alaska.

The Company is focused on developing the 100% owned Ana Paula Project in Guerrero, Mexico. In addition, Heliostar is working with the Mexican federal and local government to permit the San Antonio Gold Project in Baja Sur, Mexico. The Company continues to explore the Unga Gold Project in Alaska, United States of America.

The Ana Paula Project deposit contains proven and probable mineral reserves of 1,081,000 ounces of gold (630,000 proven and 451,000 probable ounces) at 2.38 grams per tonne (“g/t”) gold and 2,547,000 ounces of silver (1,322,000 proven and 1,226,000 probable ounces) at 5.61 g/t silver. Ana Paula hosts measured and indicated resources of 1,468,800 ounces of gold (703,800 measured and 765,000 indicated ounces) at 2.16 g/t gold and 3,600,000 ounces of silver (1,637,000 measured and 1,963,000 indicated ounces) at 5.3 g/t silver. The asset is permitted for open-pit mining and contains significant existing infrastructure including a portal and a 412-metre-long decline.

References

1 An updated prefeasibility study titled “Ana Paula Project NI 43-101 Technical Report Preliminary Feasibility Study Update” was filed on SEDAR on April 6, 2023, with an effective date of February 28, 2023, prepared for the Company by Daniel H. Neff, PE, Art S. Ibrado, PhD, PE, Richard K. Zimmerman, RG, SME-RM, Craig Gibson, PhD, CPG, Andrew Kelly, P.Eng., Gordon Zurowski, P.Eng., Paul Daigle, P.Geo., Gilberto Dominguez, PE and James A. Cremeens, PE, PG.

For additional information please contact:

Charles Funk

Chief Executive Officer

Heliostar Metals Limited

Email: charles.funk@heliostarmetals.com

Rob Grey

Investor Relations Manager

Heliostar Metals Limited

Email: rob.grey@heliostarmetals.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes certain "Forward–Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward–looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward–looking statements or information. These forward–looking statements or information relate to, among other things: the exploration, development, and production at the Company’s properties; permitting at the San Antonio project; the release of exploration results; and future resource and reserve estimates. Forward–looking statements and forward–looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of the Company, future growth potential for the Company and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of metals; no escalation in the severity of public health crises or ongoing military conflicts; costs of exploration and development; the estimated costs of development of exploration projects; and the Company's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect the Company's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political, and social uncertainties, and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward–looking statements or forward-looking information and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: precious metals price volatility; risks associated with the conduct of the Company's mining activities in foreign jurisdictions; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding exploration and mining activities; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of public health crises; the economic and financial implications of public health crises, ongoing military conflicts and general economic factors to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in the Company’s public disclosure documents. Readers are cautioned against attributing undue certainty to forward–looking statements or forward-looking information. Although the Company has attempted to identify key factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward–looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.