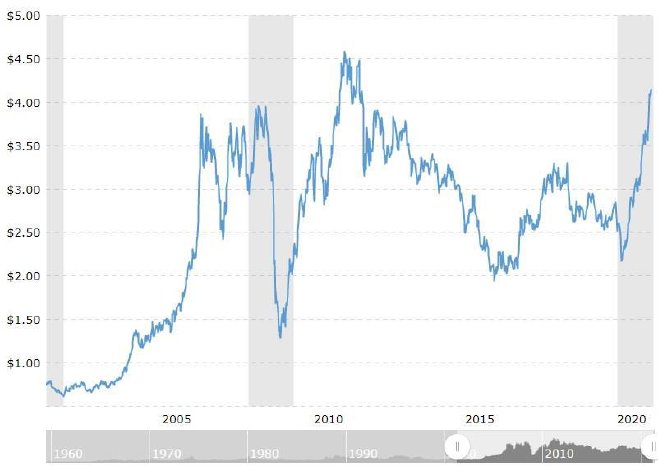

After reaching US$4.30/lb Cu in February of this year, copper prices took a bit of a breather amidst inflation concerns, rising interest rates and a rebound in the US Dollar. This correction appeared to be shortlived, neutralized by expectations of increasing industrial demand on the back of a strong economic revival in 2021, and as governments are increasingly aimed at EVs and green projects, this all favors long term outlooks for copper. The US House approved Biden’s $1.9T COVID-19 stimulus package, job numbers surprised and other important figures like new bank lending in China fell less than expected in February. Adding further pressure, copper production in top producers Chile and Peru have been declining since mid-2020 due to COVID-19 measures, and a possible strike at Antofagasta's Los Pelambres mine further threatens supply.

This is combined with increasing Chinese imports and increasing Chinese copper smelter output, as Chinese manufacturing activities has fully rebounded, and decreasing copper scrap collection and processing. When COVID-19 is over worldwide, and the world economy as a whole shifts gears, it seems a return to normal capacity from Chilean and Peruvian mines will not be enough to bring down copper prices to pre-COVID-19 levels again (US$2,75-3.25/lb Cu), and the mining industry could be enjoying levels over US$3,50/lb Cu for quite some time, as a long time deficit is looming according to experts.

With this background, Golden Arrow management’s decision seems to be justified, and the first thing they did was optioning out the Caballos Copper-Gold project in Argentina to a private Argentinian company called Hanaq Argentina SA. The Caballos project is one of the more early stage projects of Golden Arrow, and this JV deal provides Hanaq with earn-in potential up to 70% of the project, by spending US$4M on exploration in the next 6 years. President and CEO Joseph Grosso was clear on the objective to farm Caballos out:

“This allows us to build value at those properties while freeing our team to concentrate on our core-focus precious metal projects in Argentina and Paraguay and on copper assets that we believe we can advance faster and more efficiently, such as our Rosales copper project in Chile.”

If Hanaq finds something of interest, Golden Arrow is getting a cost- and risk-free ride to a still substantial 30% interest.

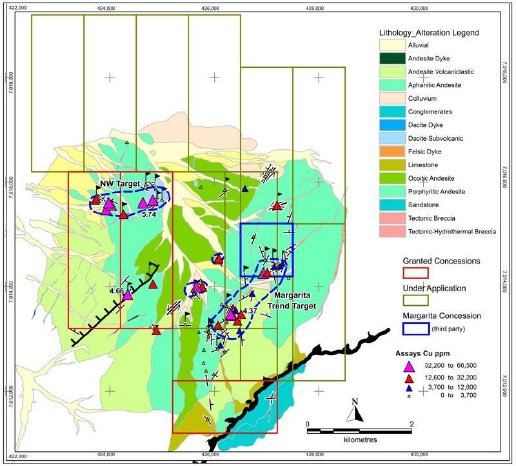

As mentioned, the Rosales copper project will get more focus now, and an exploration program is underway. The Rosales Project has several priority target areas with zones of near-surface copper mineralization, including the Margarita Trend target.

The Margarita Trend is a structural trend that continues from the adjacent operating Margarita mine southwest onto the Rosales Project, where mineralized occurrences were sampled and returned very high values from five rock chip samples in a target area. The company completed the first pass of sampling in February, and planned to follow up with a trenching program.

The environmental work for the full exploration permit for trenching and drilling has been submitted and is awaiting approval. McEwen anticipates geophysics can start by the end of April and trenching by May if things work out with the permit.

In the meantime, a new detailed geophysical survey is being commissioned to map structures related to mineralization, and once completed, its interpretation will be combined with results from the sampling program in order to delineate targets for future drilling.

Besides Rosales, management is also busy with the Tierra Dorada flagship project in Paraguay. As a reminder, recent highlights of the last drill program were DHTD18 returning 0.5m @143.5g/t Au from 3m, and DHTD35 returning 3.16m @11.8g/t Au from 1.7m.

The company is now planning a second, more detailed, drilling program to both test the new geophysical anomalies and to step-out holes around the best recent intercepts. As a minimum of 2,000 metres of drilling has been planned to be commencing by the end of the first quarter of 2021, and the company had applied for a full exploration permit to allow deeper drilling for up to 100m depth, I wondered what the current status is. McEwen answered that it is still in the approval process but the plan is to move ahead with drilling of shallow holes.

With regards to the projects in Argentina, their Flecha de Oro project is currently the most important one. The most recent exploration program commenced on December 7, 2020, and is focusing on the Puzzle property, and involved a trenching program, including approximately 18 trenches totaling 2,500 metres, excavated across a vein corridor along 6.2 kilometres of strike length, to delineate targets for a potential 2021 drilling program. The program was completed in January, and the crew is now trenching the La Esperanza target.

Drilling permits have been applied for in December. According to McEwen, sampling at Puzzle brought a lot of surprises they need to figure out, and at Esperanza they should start getting results in the coming weeks.

It will be clear Golden Arrow is very busy at the moment, and a lot of news flow is expected in the coming months. As the company is all cashed up, fundraising and dilution will be out of the question for the next 2 years.

As of the last financials the company owns 676k shares of SSR Mining (SSRM.TO), this equity being worth C$12.84M at the moment (March 16, 2021, share price C$19.01) as well as C$8.6M in cash. As such it is clearly fully funded for upcoming exploration programs. Also keep in mind the current market cap is C$21.36M, which is close to the value of the SSR shares and cash, which is very rare for explorers, and assigning almost no value to the various projects.

Conclusion

As copper is performing very well and likely will do so for an extended period of time, it is good to see Golden Arrow paying more attention to their copper project Rosales in Chile, top country for copper mining. By optioning out Caballos, management gets a free opportunity to own 30% of potential copper-gold findings. The company is aiming at drilling at not only Rosales, but also their gold projects Tierra Dorada and Flecha de Oro before year end, with lots of other exploration news in between, so it seems the company is in an ideal situation to profit from renewed enthusiasm for copper and precious metals, and mining in general. If management is successful in their upcoming drill programs, the summer of 2021 could prove to be a real gamechanger for Golden Arrow.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, currently has a long position in this stock, and Golden Arrow Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldenarrowresources.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.