Gold investors are watching the Fed decisions. Because these influence the gold price. If interest rates remain high, this puts pressure on the gold price. On the other hand, gold and silver are considered safe havens. Especially in view of the ailing U.S. budget, the immense debts and due to rising yields on government bonds. What's more, there are geopolitical uncertainties. The current example is the war in Israel, where the worst crisis in 50 years is unfolding.

Hamas have attacked Israel and now Israel is fighting at home and carrying out air strikes on Gaza against the Palestinians. For some time now, Gaza has increasingly relied on gold as a means of arming itself against crises. The latest geopolitical crisis shows how quickly such events can occur, which can give both precious metals a boost as crisis metals. Right now, the price of gold has risen significantly. In part, certainly, because a countermovement to the decline was simply announced. On the other hand, about half of the price increase is probably due to the Israel crisis.

From a seasonal perspective, October is the third weakest month for the gold price. After all, the last twelve months brought a gold price increase of about 6.7 percent, calculated in euros. Because a year ago, 1,656 euros had to be paid for an ounce of gold, today it is about 1,755 euros. Thus at least a certain inflation compensation could be booked.

Among the worst October months was October 2008. It was the Lehman bankruptcy, which led at that time for an almost eight percent crash in the gold price. All in all, gold investments are part of a well-balanced portfolio, including gold stocks. There would be OceanaGold or Osisko Gold Development, for example.

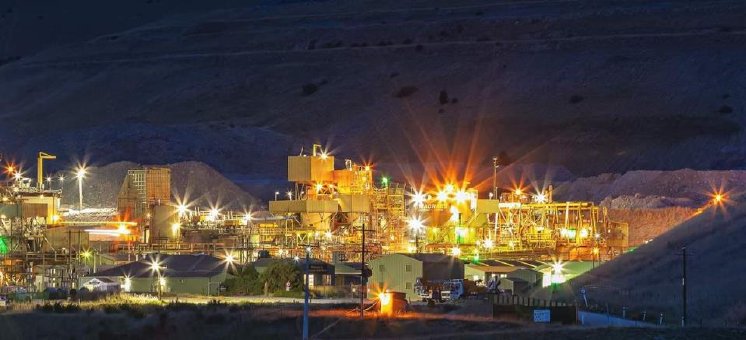

OceanaGold - https://www.commodity-tv.com/ondemand/companies/profil/oceanagold-corp/ - is a producer (gold and copper). The projects are located in the USA and the Philippines. The USA project is expected to deliver the first placer ore this month.

Osisko Development - https://www.commodity-tv.com/ondemand/companies/profil/osisko-development-corp/ - is focused on Mexico, Canada and the USA and is already producing gold. Rock samples from the project in the USA yielded high-grade gold (just under 362 grams of gold per ton of rock).

Current corporate information and press releases from OceanaGold (- https://www.resource-capital.ch/en/companies/oceanagold-corp/ -) and Osisko Development (- https://www.resource-capital.ch/en/companies/osisko-development-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/