The gold price was able to regain ground and the further prospects are good.

According to a survey, two-thirds of private investors expect gold prices to rise. Global economic news is mixed, but most data points to a slowdown in the global economy. In the U.S., jobless claims just went up and the ISM manufacturing index also points to continued weakness in U.S. industry. The end of interest rate hikes in the U.S. has already been priced in by the market and for the price of the precious metal it seems to be going up again. And this opinion is shared not only by most private investors, but also by market analysts. Negative for gold could be if inflation remains strong. Because then interest rate cuts move into the distance, perhaps even to the end of 2024. In a survey by Kitco News Gold Survey expected 360 of 534 respondents that the gold price will rise this week. Whether the gold price rally will continue this week, we shall see. In any case, gold is pretty much unbeatable as a longer-term investment. Interim downtrends are part of it. The odds of a Fed rate hike in November are relatively low and, as mentioned, already priced in. The focus is now likely to be more on the first rate cut. And that is when gold will shine.

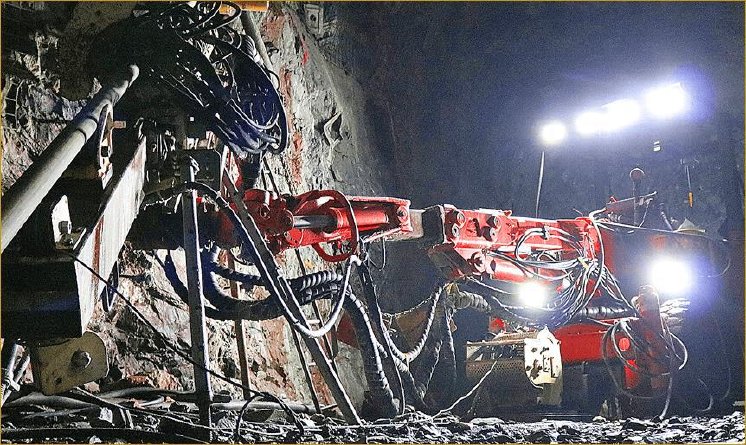

Investors who have already stocked up on physical gold or well-positioned stocks of gold companies are likely to be at an advantage. Among the successful producers, Karora Resources - https://www.commodity-tv.com/ondemand/companies/profil/karora-resources-inc/ - is appealing. The company owns two gold mines in Western Australia.

Maple Gold Mines - https://www.commodity-tv.com/ondemand/companies/profil/maple-gold-mines-ltd/ - is developing two gold projects (Joutel and Douay) in Quebec with partner Agnico Eagle Mines. The location of the projects and drill results to date are very good.

Current corporate information and press releases from Maple Gold Mines (- https://www.resource-capital.ch/en/companies/maple-gold-mines-ltd/ -) and Karora Resources (- https://www.resource-capital.ch/en/companies/karora-resources-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/