The latest report from the World Gold Council contains encouraging news for gold investors.

Right up front, gold demand in the third quarter of 2022 was firmer. It has reached pre-Corona levels again thanks to central banks and consumers. 1,181 tons of gold were demanded, 28 percent more than in the prior-year quarter. In the jewelry sector, the increase accounted for around ten percent. In India in particular, a lot of gold jewelry crossed the counter. Demand for jewelry also picked up again in China, particularly following the easing of the lockdown. By contrast, investment demand was lower (47 percent). ETFs saw outflows, while coins and bars were up 36 percent. Central banks even set a quarterly record with their gold purchases in the third quarter of 2022, adding almost 400 tons to their gold holdings.

As the global economy has weakened, gold demand from the technology sector has declined somewhat. In terms of global gold supply, there was an increase of one percent compared to the same quarter last year. In terms of price, gold lost around three percent as the strong U.S. dollar created headwinds. Private investors were happy to grab the precious metal, while ETFs reduced holdings. If this changes, then the way should be clear for the gold price to move upwards. Overall, gold demand in Q3 2022 was more of a positive surprise, both from central banks and the jewelry sector. Investors who want to bet on gold as a safe haven can take a look at companies like Caledonia Mining or Fury Gold Mines.

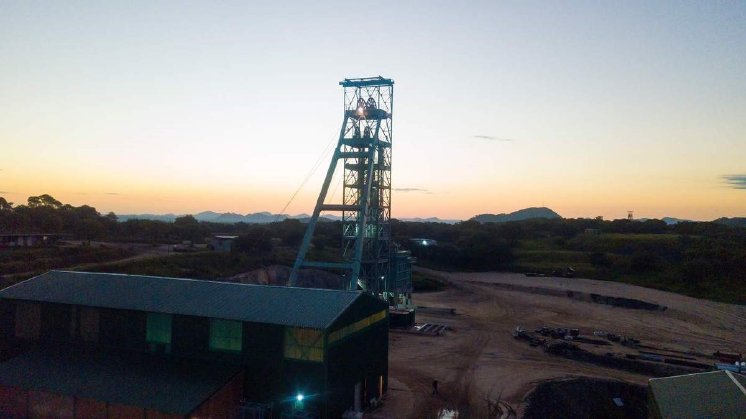

Caledonia Mining - https://www.youtube.com/watch?v=UYCCTD_R_oE - is producing successfully with participation from local investors in Zimbabwe. The Blanket gold mine was able to produce almost 60,000 ounces of gold in the first nine months of 2022, 22 percent more than in the same period last year.

Fury Gold Mines - https://www.youtube.com/watch?v=Omw4Pw5pyr4 - scores with promising gold projects in Nunavut and Quebec. At the Eau Claire gold project in Quebec, very good drill results were recently announced.

Current corporate information and press releases from Caledonia Mining (- https://www.resource-capital.ch/en/companies/caledonia-mining-corp/ -) and Fury Gold Mines (- https://www.resource-capital.ch/en/companies/fury-gold-mines-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/