Highlights

- RC drilling has returned several shallow gold intersections from the first of six targets to be drilled including:

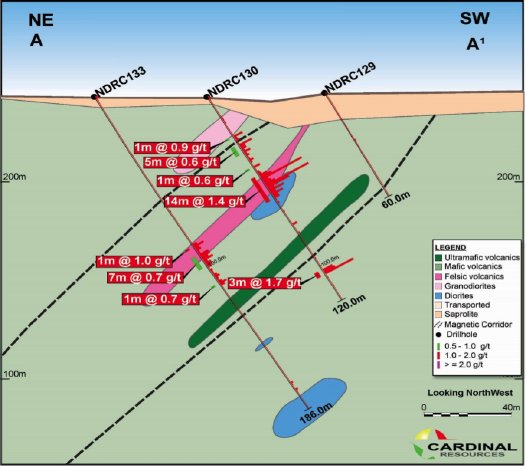

- NDRC130: 24m at 1.2 g/t Au from 2m, and 14m at 1.4 g/t Au from 46m

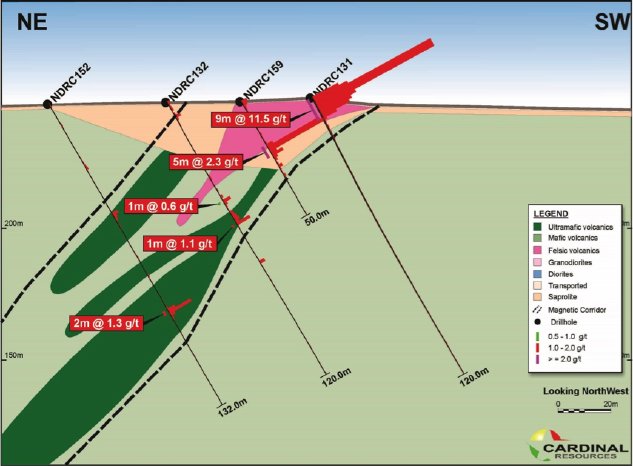

- NDRC131: 9m at 11.5 g/t Au from surface (includes 3m at 29.8 g/t Au)

- NDRC134: 4m at 1.2 g/t Au from 20m

- NDRC137: 8m at 1.4 g/t Au from 1m

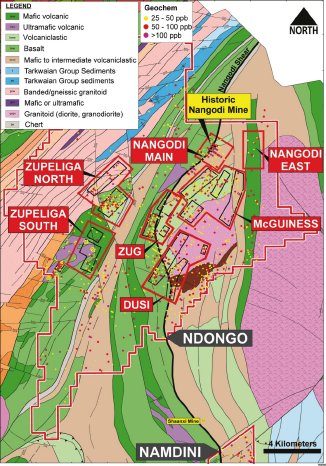

- Prospectivity of the area is enhanced due to its proximity to the prolific Nangodi Shear Zone which is known to host major economic gold mineralisation in northeast Ghana and Burkina Faso

- Field crews are currently undertaking geological mapping, surface rock sampling, trenching and geophysical surveys to help identify new targets and refine existing targets

Cardinal’s Chief Executive Officer / Managing Director, Archie Koimtsidis stated:

“We are highly encouraged with these early promising results at Target A – Prospect Zupeliga South (Figures 3, 4 and 5) particularly given the strong grades we are seeing near surface. These results strengthen our resolve that the Ndongo License is highly prospective with several untested drill targets which could deliver another significant gold discovery.

We are planning infill and extensional drilling with both RC and DD rigs to target the strike and dip extensions of the mineralisation which remains open.

Gold mineralisation has initially been located within an area of ~200m strike length by ~100m width within the larger Target A area which has a strike length of ~12km and a width of ~1.5km. At this early stage, mineralisation appears to be open along strike and at depth with further drilling planned.

Drill rigs will also be mobilised across the Ndongo License to test other target areas (Figures 3, 4 and 5)”.

The target area was originally highlighted following a soil sampling programme by AfricWest in 1997 and Etruscan Resources in 2007. A number of shallow high-grade gold intersections were returned from RAB drilling completed by Etruscan Resources in 2008. The results from the historical Etruscan Resources RAB drilling include:

- NRB-08-399: 7.5m at 1.8 g/t Au from 33m

- NRB-08-400: 19.5m at 1.2 g/t Au from 6m

- NRB-08-404: 21.0m at 2.3 g/t Au from 6m

- NRB-08-409: 18.0m at 3.4 g/t Au from surface

Ndongo Prospecting License

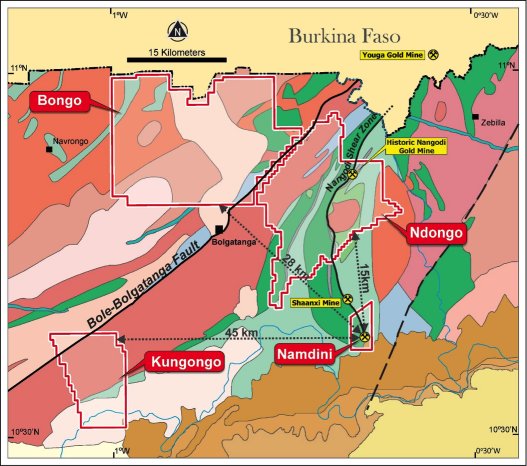

The Ndongo Prospecting License covers an area of 295 km2, having been recently expanded by the purchase of two exploration licence areas from Kinross Gold in August 2017 (Figure 2).

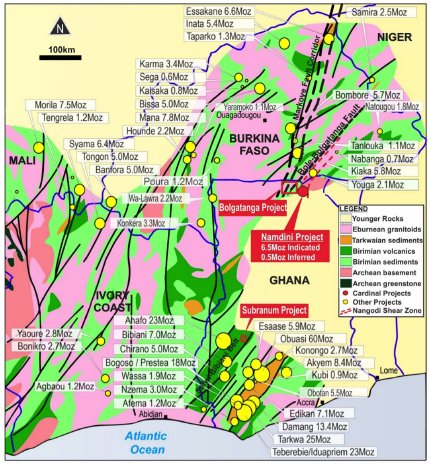

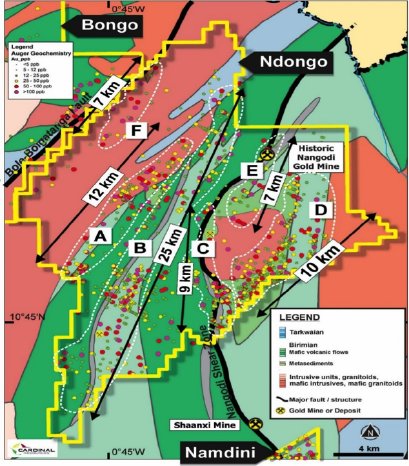

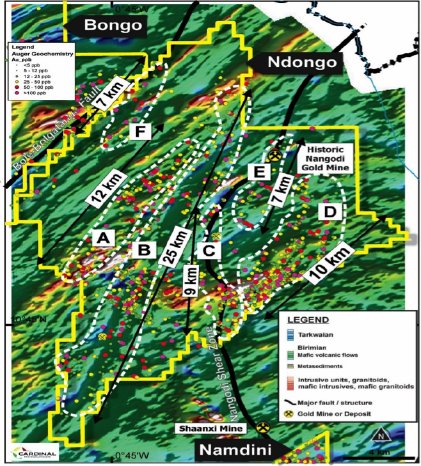

The license area is considered highly prospective for the discovery of economic gold mineralisation associated with the prolific Nangodi Shear Zone, a splay fault off the main regional-scale Bole-Bolgatanga Shear. Elsewhere, the Nangodi Shear Zone is spatially related to no fewer than four major gold discoveries, including the Company’s Namdini Gold Project with 6.5 Moz Au Indicated and 0.5 Moz Au Inferred Mineral Resources, the Shaanxi Mine, the historic Nangodi Gold Mine and the 2.1 Moz Youga Gold Mine in Burkina Faso, adjacent to the Ghana border (Figures 1, 2 and 3). In addition, there are numerous historic shallow artisanal workings along many parts of this shear zone ~15 km north of the Namdini Gold Project (Figure 3).

Six exploration target areas totalling 70 km in strike length ~15 km north of the Namdini Gold Project have been initially identified for more detailed investigations through assessing geophysical, geochemical and geological data relevant to this Prospecting License (Figures 3 and 4).

Ndongo Prospecting License - Target A – Prospect Zupeliga South

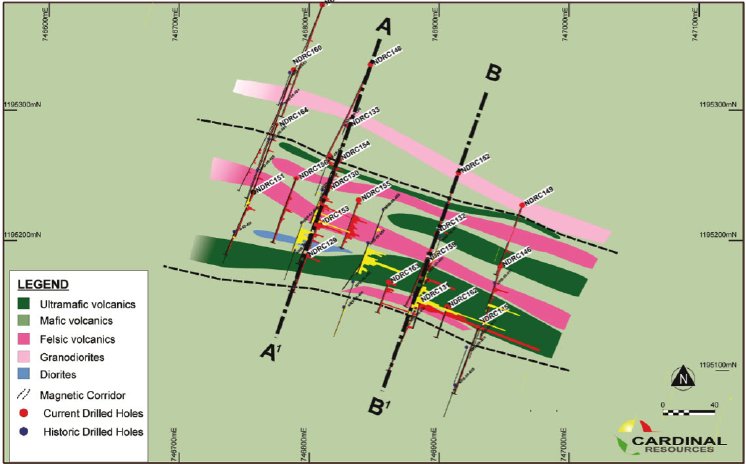

Target A was previously named Ndongo West prior to the acquisition of the surrounding Kinross ground. Numerous gold-in-soil anomalies, RAB drilling, shallow artisanal diggings and several deeper artisanal shafts all indicated the gold-bearing potential of this recently acquired area (Figures 3 and 4).

At Ndongo West, Gradient Array IP (“GAIP”) and ground magnetic surveys identified a very well-developed contact zone between conductive and resistive units, along which the artisanal shafts are located.

Once the former Kinross ground was added to Ndongo West, this extended the Target A strike length to 12 km and 1.5 km width and is now called Zupeliga South Prospect (Figure 5).

The prospect is underlain by weak to strongly magnetic mafic-ultramafic volcanic units which are intruded locally by granodiorite. The volcanic units are altered containing pyrite, minor pyrrhotite, magnetite, minor arsenopyrite and silica.

The geology of this prospect is more complex as folding has been identified with the fold axis orientated ~020⁰, and the rock units striking ~300⁰ and dipping north at ~60⁰. The structures imply open anticlinal folds although plunges have yet to be determined.

Gold of variable grades is found within highly magnetised mafic volcanic horizons with disseminated sulphides and cross-cutting pyrite and smoky quartz veinlets. Higher gold grades occur within a sheared, less magnetic and siliceous altered inner zone within the magnetic corridor which also has cross-cutting pyrite and quartz veinlets.

Gold mineralisation has initially been located within an area of ~200 m strike length by ~100 m width within the larger Target A area which has a strike length of ~12 km and a width of ~1.5 km. At this early stage, mineralisation appears to be open along strike, especially along the fold axes, and at depth with further drilling planned to evaluate the two limbs of the anticlines.

ABOUT CARDINAL

Cardinal Resources Limited (ASX/TSX: CDV) is a gold-focused exploration and development Company which holds interests in tenements within Ghana, West Africa.

The Company’s Namdini Project has an Indicated Mineral Resource of 6.5 Moz of gold contained in 180 Mt at 1.1 g/t Au at a cut-off of 0.5 g/t Au and an Inferred Mineral Resource of 0.5 Moz of gold contained in 13 Mt @ 1.2 g/t Au at a cut-off of 0.5g/t Au.

The Company is focused on the development of the Namdini Project through advancing its PFS studies, supported by additional multi-disciplinary engineering and metallurgical activities.

Exploration programmes are also continuing at the Company’s Bolgatanga (Northern Ghana) and Subranum (Southern Ghana) Projects.

Competent Person’s / Qualified Person’s Statement

The information in this press release is based on information prepared by Mr. Paul Abbott, a full-time employee of Cardinal Resources, who is a member of the Geological Society of South Africa. Mr. Abbott has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and the activity which he is undertaking to qualify as a Competent Person, as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”.

The information in this press release has been compiled and reviewed by Mr. Richard Bray, a Registered Professional Geologist with the Australian Institute of Geoscientists and Mr. Ekow Taylor, a Chartered Professional Geologist with the Australasian Institute of Mining and Metallurgy. Mr. Bray and Mr. Taylor have more than five years’ experience relevant to the styles of mineralisation and type of deposits under consideration and to the activity which is being undertaken to qualify as a Competent Person, as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” and as a Qualified Person as defined by the NI43-101 instrument. Mr. Bray and Mr. Taylor are full-time employees of Cardinal and hold equity securities in the Company. Mr. Bray and Mr. Taylor have consented to the inclusion of the matters in this report based on the information in the form and context in which it appears.

Disclaimer

This ASX / TSX press release has been prepared by Cardinal Resources Limited (ABN: 56 147 325 620) (“Cardinal” or “the Company”). Neither the ASX or the TSX, nor their regulation service providers accept responsibility for the adequacy or accuracy of this press release.

This press release contains summary information about Cardinal, its subsidiaries and their activities, which is current as at the date of this press release. The information in this press release is of a general nature and does not purport to be complete nor does it contain all the information, which a prospective investor may require in evaluating a possible investment in Cardinal.

By its very nature exploration for minerals is a high‐risk business and is not suitable for certain investors. Cardinal’s securities are speculative. Potential investors should consult their stockbroker or financial advisor. There are a number of risks, both specific to Cardinal and of a general nature which may affect the future operating and financial performance of Cardinal and the value of an investment in Cardinal including but not limited to economic conditions, stock market fluctuations, gold price movements, regional infrastructure constraints, timing of approvals from relevant authorities, regulatory risks, operational risks and reliance on key personnel and foreign currency fluctuations.

Except for statutory liability which cannot be excluded and subject to applicable law, each of Cardinal’s officers, employees and advisors expressly disclaim any responsibility for the accuracy or completeness of the material contained in this press release and excludes all liability whatsoever (including in negligence) for any loss or damage which may be suffered by any person as a consequence of any information in this Announcement or any error or omission here from. Except as required by applicable law, the Company is under no obligation to update any person regarding any inaccuracy, omission or change in information in this press release or any other information made available to a person nor any obligation to furnish the person with any further information. Recipients of this press release should make their own independent assessment and determination as to the Company’s prospects, its business, assets and liabilities as well as the matters covered in this press release.

Forward‐looking statements

Certain statements contained in this press release, including information as to the future financial or operating performance of Cardinal and its projects may also include statements which are ‘forward‐looking statements’ that may include, amongst other things, statements regarding targets, anticipated timing of the PEA on the Namdini project, estimates and assumptions in respect of mineral resources and anticipated grades and recovery rates, production and prices, recovery costs and results, capital expenditures and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions. These ‘forward – looking statements’ are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Cardinal, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies and involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward‐looking statements.

Cardinal disclaims any intent or obligation to update publicly or release any revisions to any forward‐looking statements, whether as a result of new information, future events, circumstances or results or otherwise after today’s date or to reflect the occurrence of unanticipated events, other than required by the Corporations Act and ASX and TSX Listing Rules. The words ‘believe’, ‘expect’, ‘anticipate’, ‘indicate’, ‘contemplate’, ‘target’, ‘plan’, ‘intends’, ‘continue’, ‘budget’, ‘estimate’, ‘may’, ‘will’, ‘schedule’ and similar expressions identify forward‐looking statements.

All forward‐looking statements made in this press release are qualified by the foregoing cautionary statements. Investors are cautioned that forward‐looking statements are not guarantees of future performance and accordingly investors are cautioned not to put undue reliance on forward‐looking statements due to the inherent uncertainty therein.