Surprisingly, the September-October dip seems to be behind us now, although many market experts have been forecasting a recession coming up, with inflation still raging at record levels despite some easing of late. As inflation seems to be cooling off as for example housing and energy price spikes have corrected significantly, the Federal Reserve is anticipating a soft landing for the economy despite the recession fundamentals firmly lined up, and is plotting a more moderate rate increase of 0.25-0.50% for December. The stockmarkets interpreted this as the beginning of the end of the rate hiking, and reacted positively since October, and as the US Dollar lost strength and in turn metals gained, mining stocks appreciated and Dolly Varden certainly followed suit. A syndicate lead by Eventus Capital and Research Capital is raising C$18M @C$0.90(FT) and C$1.05 (charity FT) in a flow-through brokered financing, making the most of the recent upswing in the share price.

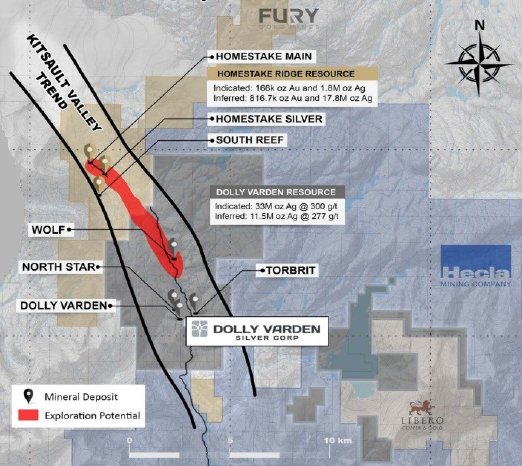

The company is busy exploring and growing their Kitsault Valley project, after integrating Homestake. Earlier on, I estimated a combined hypothetical after-tax NPV5 of US300M (=C$400M) at US$1620/oz gold and US$14.40/oz silver in earlier analysis, which didn’t take into account the more recent strong drill results at Dolly Varden. More on the growing economic potential later on in this article.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Dolly Varden Silver's NPV and resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Dolly Varden Silver or Dolly Varden Silver's management. Dolly Varden Silver has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

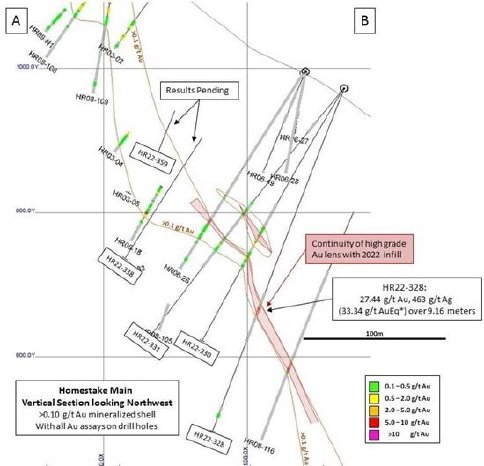

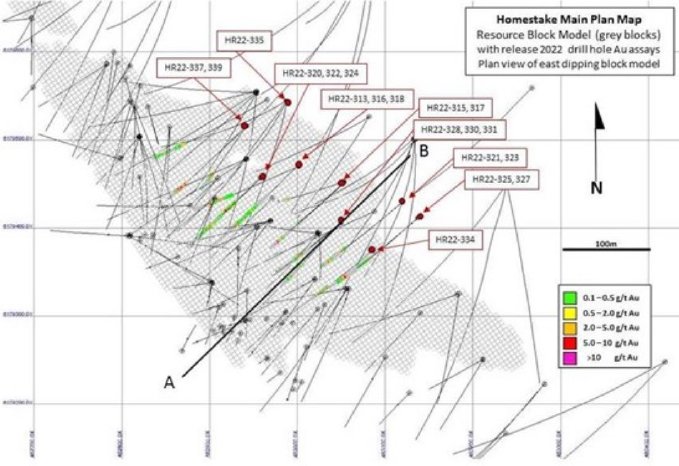

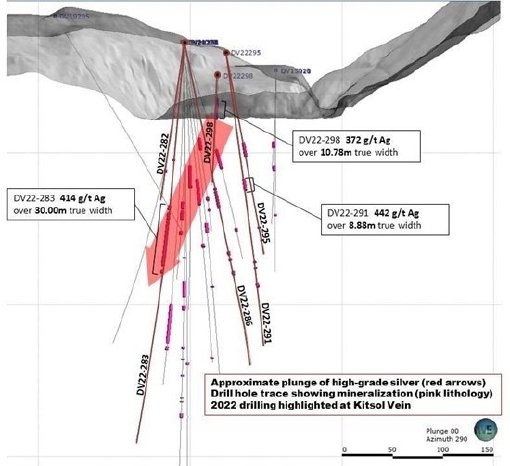

After drilling all year at the Wolf and Torbrit deposits, the adjacent Kitsol Vein and at the recently acquired Homestake Ridge deposit, Dolly Varden completed their 108 hole Kitsault Valley drill program for 2022 in mid-October, drilling 37,061m. Assays for 55 holes (approximately 18,000m) have been reported so far. On November 29, the first batch of results was announced for the Homestake Main deposit drilling, with the following highlights:

- HR22-314: 4.27 g/t Au and 64 g/t Ag (5.10 g/t AuEq*) over 16.06 meters including 18.76 g/t Au and 193 g/t Ag (21.49 g/t AuEq*) over 3.08 meters

- HR22-322: 6.47 g/t Au and 27 g/t Ag (5.83 g/t AuEq*) over 6.00 meters

- HR22-325: 7.18g/t Au and 30 g/t Ag, 0.49% Cu (8.26 g/t AuEq*) over 10.00 meters including 20.20 g/t Au and 68 g/t Ag (21.13 g/t AuEq*) over 1.47 meters

- HR22-328: 27.44 g/t Au and 463 g/t Ag (33.34 g/t AuEq*) over 9.16 meters including 0.50 meters 216.00 g/t Au and 113 g/t Ag, 0.48% Cu (218.06 AuEq*) over 0.50 meters

- HR22-330: 5.68 g/t Au and 147 g/t Ag (7.48 g/t AuEq*) over 15.00 meters, including 54.10 g/t Au, 4,890 g/t Ag and 0.11% Cu (113.25 g/t AuEq*) over 0.39 meters

- HR22-337: 3.79 g/t Au and 2 g/t Ag (3.84 g/t AuEq*) over 21.00 meters including 11.15 g/t Au and 5.00 g/t Ag (11.22 AuEq*) over 2.00 meters

- HR22-339: 14.56 g/t Au and 4.00 g/t Ag (14.63 g/t AuEq*) over 2.50 meters

CEO Shawn Khunkhun was pleased with this of course:

"Our 2022 drill program has truly been exceptional. The recently acquired Homestake Ridge Deposit has delivered more high-grade gold and silver values, commonly with strong copper mineralization. These intercepts demonstrate strong continuity of mineralization over wide intervals, similar to the recently announced high-grade results at the Wolf and Kitsol Deposits, located six kilometers to the south. We eagerly anticipate additional assays from all of Dolly Varden's Deposits, as well as new exploration targets drilled during the 2022 program."

These lenses are quite substantial already, as can be seen here.

If such a lense can be extended continuously for example 100m to depth, and over a strike length of 400m as estimated on the map above, with an average thickness of 10m and a density of 2.75t/m3, then tonnage would be 1Mt, at an average estimated grade of 8g/t AuEq this would mean an additional hypothetical 260koz AuEq. To assume a continuous extension is probably a bit much, as veins usually pinch and swell, but a 200koz addition doesn’t seem unrealistic at Homestake Main.

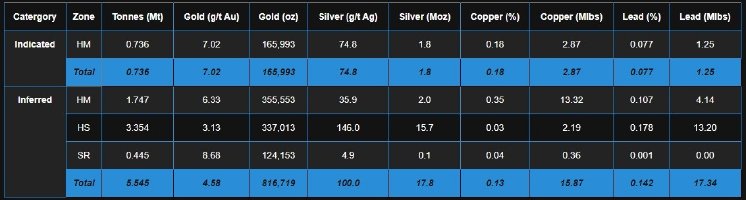

As a reminder, the Kitsault Valley project consists of two areas, Dolly Varden and Homestake Ridge. The 2019 NI43-101 compliant resource estimate for Dolly Varden stands at 32.9Moz @ 299.8g/t Ag Indicated and 11.4Moz at 277g/t Ag Inferred.

Homestake Ridge is an advanced stage precious metal project, and its 2022 NI43-101 compliant resources include 1.8Moz gold with 1.8Moz silver Indicated and 17.8Moz gold with 17.8Moz silver Inferred.

The objective of drilling during 2022 at the Homestake Main and Homestake Silver deposits was to expanded multiple, subparallel mineralized zones and to upgrade Inferred Resources in areas where the current model shows the thickest and highest grades. The Homestake Ridge target will see approximately 20,000m of drilling in total. Once higher grade ore shoots are defined, the down plunge extention can then be tested for continuity to depth. For now, the assays of 30 holes (approximately 8,000m) for Homestake Main and Homestake Silver are expected back from the labs around the end of 2022, and will probably be announced in batches according to project areas over the next few months into March 2023.

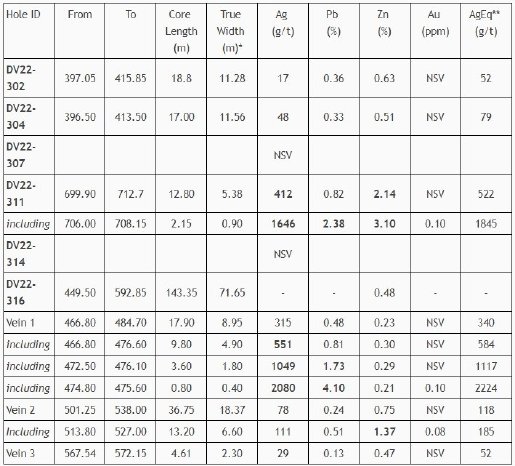

Dolly Varden came out with even better drill results on November 21, 2022, when it released assays of wide step-out drilling at the Wolf Vein. The company not only managed to double the strike length of the Wolf deposit, but also extended the mineralization to over 750m in dip extent. The grades were excellent too, as these highlights show:

- DV22-311: 412 g/t Ag over 12.80 meters (5.38 meters true width) including 2.15 meters (0.90 meters true width) grading 1,646 g/t Ag, 2.38% Pb, 3.10% Zn and 0.10 g/t Au

- DV22-316: 551 g/t Ag over 9.80 meters (4.90 meters true width) including 3.60 meters (1.8m true width) grading 1,049 g/t Ag, 1.19% Pb and 0.29% Zn

Earlier reported drill holes from September reported strong mineralization as well:

- DV22-300 intersected 19.85m (13.90m true width) averaging 584 g/t Ag, 0.92 %Pb, 0.56% Zn and 0.19 g/t Au

I wondered why the geologists didn’t opt for a more perpendicular approach, as for now the drill almost seems to follow the direction of the vein itself, with a relatively higher chance of missing. VP Exploration Rob van Egmond explained: “Due to the topography the drill pad locations can only be placed in certain locations and too far of a step back to get a more perpendicular intersect would mean drilling a very long hole. All holes are planned for optimal efficiency but as one drills deeper it is enevitable that the intersect angle gets more acute on steep structures.”

That made sense for sure. Adding additional ounces for Wolf isn’t easy, as only a few holes intercepted the modelled plane of veining. Assuming a 200m width of the extension so far, and a 400m length and 6m thickness on average (note that I am trying to average the high grade, longer intercepts with the misses etc), additional tonnage would come in at 1.32Mt, the average grade estimated at 300g/t Ag would indicate a hypothetical additional 12.8Moz Ag which is substantial.

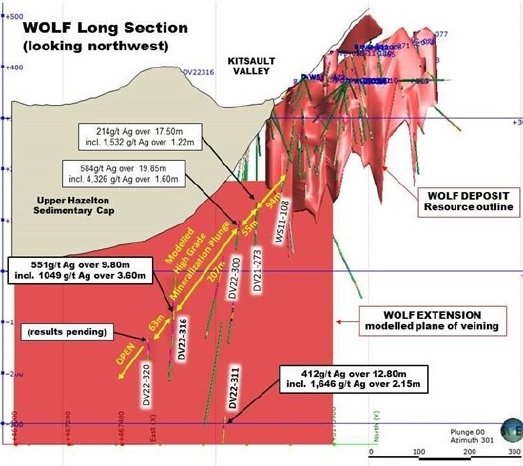

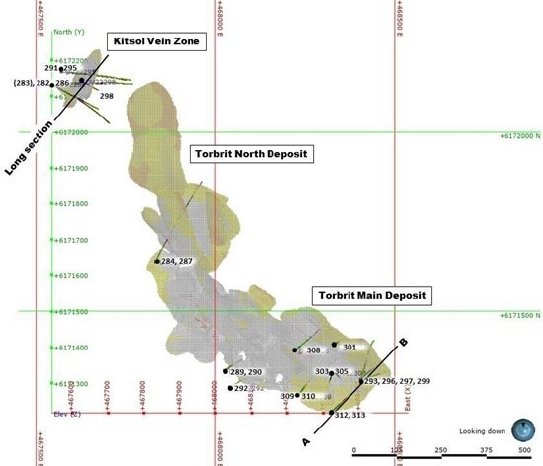

But Wolf isn’t the only target, as Dolly Varden also drilled the Torbrit deposit, and the Kitsol Vein, a parallel structure adjacent to the Torbrit deposit. Highlights were decent, although the vein width wasn’t as impressive as at Wolf:

- DV22-289: 979 g/t Ag over 0.49 meters true width, step out at Torbrit Main

- DV22-291: 442 g/t Ag over 8.88 meters true width, infill at Kitsol

- DV22-298: 372 g/t Ag over 10.78 meters true width, up-dip extension at Kitsol

- DV22-308: 297 g/t Ag over 6.59 meters true width, step out at Torbrit Main

- DV22-312: 585 g/t Ag over 3.30 meters true width, step out at Torbrit Main

The following 3D graphic shows the steep orientation of the Kitsol Vein (pink intercepts), almost perpendicular on the Torbrit Main deposit (grey).

If this Kitsol Vein indeed dips very steeply, I wondered why hole DV22-283 has been reported at “true width”, as I view true width as being perpendicular to the orebody, providing the smallest diameter. VP Ex Van Egmond had this to explain: “Because we have structural data through oriented core drilling we can estimate the true width perpendicular to the dip of the vein. Whenever we report true width we state it. In this case true width was reported in the section with intercect core lengths reported in the data table for full disclosure as required by the Canadian securities comissions. For this particular intersect the “core length” is 50.18m.” A few diagrams of mineralized conceptual sections might help here. For an estimate on this mineralized envelope I tend to be a bit more conservative for thickness, and assume a 300x150x8x2.75 = 990kt envelope, containing 9.6Moz Ag at an average estimated grade of 300g/t Ag, which is slightly more than my earlier estimate of 7.4Moz @ 280g/t Ag.

All in all, including the Torbrit infill drilling, I do believe Dolly Varden might have added another 20-25Moz Ag after 2022 drilling, which could mean an estimated increase of 30-40% of their silver resources.

As the 2022 drill program has been completed, the company is still awaiting the results of 50 drill holes, the majority of them collared at Homestake Ridge, undoubtedly adding gold ounces there. The upcoming programs for Kitsault Valley will start around the first week of May, 2023, with a focus on Homestake Ridge exploration expansion an exploration for discovery of additional mineralization at Dolly Varden. Due to the discovery success at Wolf and other exploration targets in 2023, the focus will shift to seeing how large this system is and infilling the new discoveries to get them into the next resource update. Current large step out spacing at Wolf is too wide for even Inferred Resource classification. The current cash position stands at C$7.5M, and the recently announced C$18M raise is anticipated to close in the week of December 21, 2022, so well before the next program starts in 2023. An updated Mineral Resource estimate for the combined project is planned for Q2 of 2024, and will be used in a consolidated PEA for the Kitsault Valley project, which is scheduled for 2024. As I viewed waiting for 1.5 years for an updated resource as quite a long period, I asked Van Egmond about it. He replied:

“The majority shareholders, like Fury, Hecla and Eric Sprott as well as institutions are in it for the long run to gain maximum return upon a sale. To interested companies, they do not look at resources as they usually do their own internally as due diligence. So, the shift has been to see how big this is because that is what is going to add much more value for the shareholder than putting out a updated resource. With markets the way they are these days there is not a real incentive to publish a updated resource either, there is a much better reaction to good intercepts on new discoveries it seems. But ultimately we are not ready to do a update because the spacing on a number of our new discoveries is not sufficient to get those zones in to an updated resource. In terms of material change reporting, that is only really if one has 100% increase in resource would that be triggered. We are not quite there yet.”

Maybe their strategy will change somewhat when the markets turn eventually and PM prices start rising. Where does Dolly Varden stand nowadays when comparing it to competitors you might wonder? Since Dolly Varden is a gold and silver explorer/developer in BC, it isn’t very easy to find solid matching peers for a comparison, as almost all Golden Triangle plays are gold plays. I managed to find a few Nevada plays, but the majority is Latin American, and especially Mexico, the number one jurisdiction regarding silver production worldwide. As Mexico is much cheaper to work in as a jurisdiction compared to BC, keep this in mind when comparing average grades and costs whenever possible.

In general as a continuous reminder for investors, a peer comparison as a valuation method isn't perfect as every single company has a unique set of parameters and should actually be analyzed in full and normalized as far as this is possible of course, and for example EV/oz doesn't say much about profitability of the project yet, potential high capex, potential permitting issues, capability of management etc, but with some comments to go with such a peer comparison it provides at least an indication, which is my intention. The main intent for peer comparisons is a basic valuation tool by trying to find the most equal companies regarding quality and size of projects, jurisdictions, financial situation, backing, management, permitting, in short everything that makes every project and company so unique in this space. The better the resemblance, the more useful the company for a comparison.

I picked quite a bit of silver plays in various stages, so you can compare metrics in that regard as well, or have a bit of an impression what later stages can do for valuations. The first table is mentioning basics like structure, stage, enterprise value and jurisdiction.

Please note Blende Silver was a zinc play for a long time, but got rebranded not too long ago. Also a few open pit heap leach projects are included (the low grade ones) to represent those as well, as this is more or less a small sector comparison. The second table shows resource figures, and the only available metric EV/oz for developers (which does state nothing about profitability of ounces).

The extremely low EV/oz valuation for Blende Silver is due to the involvement of Frank Callaghan of Barkerville “fame”, who still is a major shareholder but doesn’t seem to be very popular anymore. It’s a shame really as Blende is a top notch asset. Btw it is interesting to see that the companies with a high EV/oz metric almost all have big gold components in their resources, which makes sense as gold is trading much higher compared to silver historically speaking. Dolly Varden isn’t very cheap either, but Homestake Ridge is a quality high grade gold deposit, and Kitsault Valley as a whole has significant exploration potential, increasing the future combined economics even further. Talking about economics, here is the third and last table, handling the P/NAV metric.

The economics of Dolly Varden are solely represented here by the (historic) Homestake Ridge 2020 PEA, but these numbers will likely improve a lot when the Torbrit/Wolf/Dolly Varden deposits are added, including all drill results from Kitsault Valley. As a reminder, at higher gold prices the NPV5 is estimated by me to exceed C$350M. After adding the Dolly Varden resources, I estimate an after-tax NPV5 of US$300M is within reach (= C$380M) at US$1620/oz gold and US$14.40/oz silver. At current precious metals prices this could even increase to an estimated C$610M-650M, and even further past C$750-850M when drilling continues to be successful. Keep in mind it will take a while before the consolidated PEA comes out, and it usually is discounted because of the high margin for error, but the future potential for Dolly Varden is significant for sure.

Conclusion

It was good to see Dolly Varden putting to work the raised C$13M from esteemed backers like Eric Sprott, Jeff Zicherman and Hecla Mining, resulting in exciting drill results with lots more to come. The same parties are involved in the ongoing C$18M round so Dolly Varden will be cashed up for 2023. The company completed their 2022 drill program, and awaits assays of 50 holes on Kitsault Valley, which could increase resources by quite a bit, besides conversion into higher confidence categories. It will be very interesting to see if connecting mineralized trends between the Homestake and Dolly Varden/Torbrit deposits can be delineated, besides growing the individual deposits and finding new deposits. The value of the project seems to have a good chance on improving before the consolidated PEA comes out in H2, 2023, through exploration potential, and potential leverage to precious metal prices, as the US Dollar is losing strength as the Fed is contemplating a more dovish interest rate policy.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a position in this stock. Dolly Varden Silver is a sponsoring company. All facts are to be checked by the reader. For more information go to www.dollyvardensilver.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.