All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Dolly Varden Silver's NPV and resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Dolly Varden Silver or Dolly Varden Silver's management. Dolly Varden Silver has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

First let’s have a closer look at the recent financing. Hecla Mining subscribed for 15.38M shares @ C$0.65 for gross proceeds of C$10M. The financing didn’t consist of warrants, and C$6M will be earmarked for exploration, the balance going to G&A and working capital. With Hecla going to 15.7%, it only trails Fury Gold Mines with 23% being the largest shareholder.

“In connection with the Offering, Dolly Varden has agreed with Hecla that the Company will not complete any further debt or equity financings for the remainder of 2023. Additionally, Dolly Varden has agreed that between January 1, 2024 and September 1, 2024, without the prior consent of Hecla, it will not complete any debt or equity financings other than equity financings for net proceeds to the Company of up to $15 million and provided that the issue price under such financing is greater than $0.65 per security. These restrictions do not capture customary exceptions such as the issuances of securities related to the Company’s equity based incentive compensation, the exercise of existing convertible securities and strategic transactions for non-cash consideration.”

It is remarkable that Dolly Varden has to ask for consent of Hecla to raise more than C$15M, but also has to raise at a minimum price of C$0.65, the price of the current financing. One could think that Hecla wants to control or rather limit dilution regarding their position.

Normally when a strategic investor acquires a 15.7% position, people start wondering about takeover potential/intentions, often without anything happening for a long time. However, in this case it could be different, as Hecla has been pretty aggressive in the past towards Dolly Varden, including a lawsuit in order to force the tiny junior into a hostile buyout in 2016, which didn’t work out.

Hecla Mining has been a shareholder in Dolly Varden since 2012, when it took a 19.9% position. A few years later, Dolly Varden saw interim CEO Rosie Moore (2015-2016) taking over the reins, as she was placed in that role as a consultant working for none other than, you guessed it, Hecla Mining. Rosie is a very experienced geologist and mining executive, and had accomplished some major feats in the past. Among many things she was the first one to recognize the geological potential of Voisey’s Bay for Diamond Fields Resources in 1994. Moore did much more than just looking after Hecla's interest, as she saved and completely revitalized the company, as will be explained later on.

During the final days of June, Hecla surprised many when it announced it would make an unsolicited takeover bid for Dolly Varden. Hecla probably felt the need to do ‘something’ as its grip on the company was slipping away after Dolly Varden announced its intention to repay a loan to Hecla Mining. The bid was a generous cash offer at a 97% premium (C$0.69 per share).

Before this, Dolly Varden originally entered into a loan agreement with its two largest shareholders, Hecla Mining and Robert Gipson, to meet the working capital requirements in September 2015, when the entire mining sector was going down the drain. The loan originally had a one-year term, and as the original creditors didn’t want to consent to a prepayment on this loan, Dolly Varden decided to re-finance the Hecla/Gipson debt with erasing all debt from its balance sheet as ultimate goal.

So why was Hecla playing hardball with regards to the original loan agreement? Hecla might have been counting on Dolly Varden not being able to meet its commitments to service the debt, and upon defaulting on the loan, Hecla would have been allowed to take the asset away from Dolly Varden, considering it was a senior secured loan.

In a first step, Dolly Varden refinanced the Hecla loan with the proceeds of a short-term loan issued by Sprott and K2. This could be seen as some sort of bridge financing, as the Sprott/K2 loan was maturing just six months later, and carried an interest rate of just 4%. This allowed Dolly Varden to immediately repay Hecla, and raise the funds to repay Sprott/K2 in a private placement.

Hecla Mining was not amused by this financing, and promptly launched the aforementioned offer of C$0.69 per share in cash to acquire all of Dolly Varden’s shares it didn’t already own. This caught Dolly Varden somewhat off-guard, but Moore immediately mobilized an expert lawyer team, and the company was successful in claiming Hecla’s offer to be an ‘insider bid’, which has to be subject to an independent formal valuation.

At the end of July 2016 when the Ontario Securities Commission sided with Dolly Varden, causing Hecla to withdraw its hostile bid, Dolly Varden was able to close the financing. A total of C$7.2M was raised, consisting of 9.1M shares priced at C$0.62/share (hard dollar) and an additional 2.14M flow-through shares priced at C$0.70/share. The highly dilutive (43%, including the overallotment option 57%) financing averaged out at C$0.60 per share, so actually not that much under the bidding price. The flow-through funds were immediately put to work right after the summer when Dolly Varden mobilized its field crews to complete a small drill program and sampling/mapping.

After this ordeal, thanks to Moore Dolly Varden ended up in a much better shape than just six months ago. Not only was the working capital deficit (-C$2.3M as of at the end of June 2016) converted into a positive working capital position, the company became now completely debt-free, and more importantly, the assets became unencumbered as collateral. Unfortunately, Moore had to step down as the Board had different views on strategy, but considering interim developments (or lack thereof) until the current CEO Khunkhun took over in 2020, I’m not convinced this was in the best interest of shareholders at the time. After years of virtual stand-still, Khunkhun seems to be firmly on his way to position Dolly Varden as an important player in the Golden Triangle.

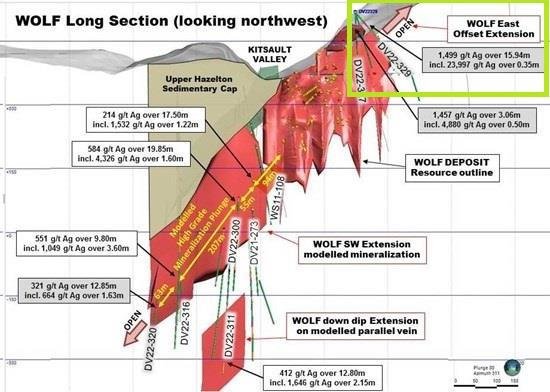

As a reminder, the 2019 NI43-101 compliant resource estimate for Dolly Varden stands at 32.9Moz @ 299.8g/t Ag Indicated and 11.4Moz at 277g/t Ag Inferred. Homestake Ridge’s 2022 NI43-101 compliant resources includes 0.16Moz gold with 1.8Moz silver Indicated and 0.81Moz gold with 17.8Moz silver Inferred. I do believe Dolly Varden might have added another 32-34Moz Ag after 2022-2023 drilling, which could mean an estimated increase of 72-77% of their silver resources. As management told me in our interview earlier this year, they are aiming at a 100% increase of silver resources before the cut-off will be determined for a resource update, so it sure looks they are closing in on this target. When asking management about timelines for a resource update they answered:

”We may very well hold off on a resource update because we think the best value for the exploration money spent is to see how large the system is, and we will more than likely do another year of drilling to define the new discoveries we found that can then be included in an update. The drilling to date has added mineralization and we will be doing internal estimates this winter to see where the best value can be added in next year’s drilling.”

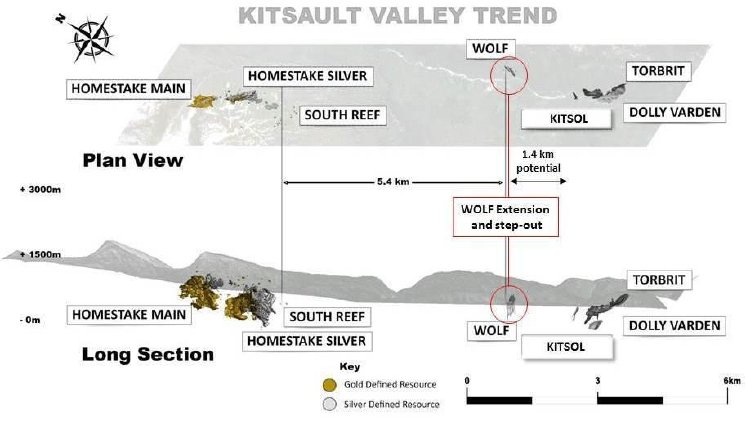

According to VP Ex Van Egmond, an updated mineral resource estimate for the combined project may still be possible for Q2 of 2024, and then can be used in a consolidated PEA for the Kitsault Valley project, which in that case may be completed for H2, 2024. However, the discoveries and continued step out success seen in 2023 may likely dictate that one more year of drilling would benefit the estimate by the addition of new zones that stll need better definition drilling. Such a program would cost another C$15-20M, and the recent Hecla investment certainly helped in this regard. They will probably start in May 2024 with the next phase of drilling due to the upcoming winter break.

As another reminder, I estimated a Kitsault Valley after-tax NPV8 at an estimated C$550M-600M at US$1850 gold and US$22 silver, and even further past C$700-800M when drilling continues to be successful and we could see the projected silver resource target becoming a reality. It will take a full year from now before the consolidated PEA comes out, and it usually is discounted because of the high PEA margin for error, but the future potential for Dolly Varden, with a current market cap of C$191M is significant for sure. There aren’t too many substantial primary silver deposits in Canada, and in my view Dolly Varden Silver has the grade and size to make it into production.

Conclusion

With gold breaking the US$2,000/oz threshold again, with the classic fear trade on caused by Middle East turmoil among other things, it seems Hecla has woken up again to former darling and take over target Dolly Varden, as it increased their holdings from 10.6% to 15.7%, making them the second largest holder after Fury with 23%. Fury doesn’t seem to have plans to take over Dolly Varden as there are no synergies and its market cap is much too small (C$63.3M) at the moment for such attempts. Hecla on the other hand has a history with Dolly Varden, and is actively looking for M&A in North America. Time will tell if Hecla wants to make a move before or after the resource update for Kitsault Valley comes out. Since Dolly Varden management now aims at determining size first and because of this wants to follow up on new discoveries, it will likely take another year of drilling before a resource update comes out, so if Hecla still has enough patience and wants to see this update first, it could take a while. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Dolly Varden Silver is a sponsoring company. All facts are to be checked by the reader. For more information go to www.dollyvardensilver.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.