In recent years, the tin market has been characterized by rising demand and a supply deficit.

Tin is a metal used to coat other metals. It is an alloying metal, used for soldering and for the production of superconducting rare earth magnets. Thus, the electronics sector has great demand for tin. The fundamentals are good. There are or have been concerns about supply shortages. The largest tin producers include China, Indonesia, Burma and Myanmar. The latter has now banned mining activities. Indonesia, another major producing country, could also see a supply ban. But because the fundamentals are so good, investor interest in investing in tin is growing.

After tin has been in deficit mode for about ten years, and there are many important applications for the metal, a tight supply of tin is also expected for the coming years. Tin scores with various advantages, it is malleable, does not oxidize easily in air, is durable and light. The metal belongs to the conflict minerals, it is produced for example in the Congo. Investors should keep an eye on exchange-traded products in tin. Besides futures, there are the big producers in the industry. But smaller tin companies could bring a lot of joy. That's because companies in the exploration and development phase can be particularly lucrative.

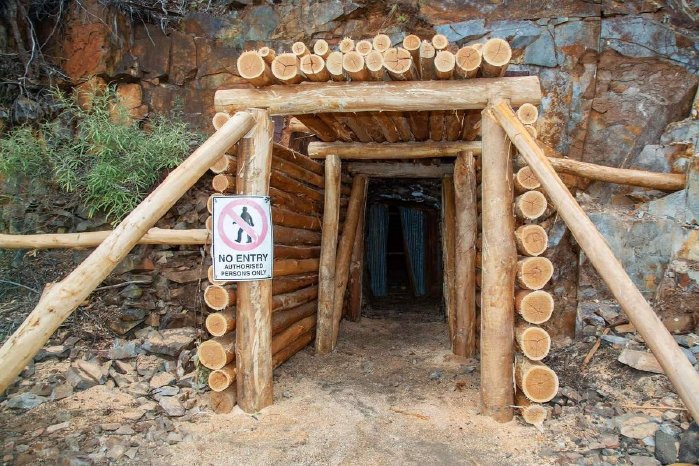

First Tin - https://www.commodity-tv.com/ondemand/companies/profil/first-tin-ltd/ - has one project in Australia and one in the Saxon Tin District in Germany (Tellerhäuser). The projects are advanced and involve low capital expenditure in both countries.

Tin One Resources - https://www.commodity-tv.com/ondemand/companies/profil/tinone-resources-inc/ -, for example, is still represented with tin projects in Australia. In addition to two gold projects, the company has three tin projects in its portfolio (Great Pyramid, Aberfoyle, NSW Tin Projects).

Corporate information and press releases from First Tin (- https://www.resource-capital.ch/en/companies/first-tin-plc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/