It was a turbulent autumn in Europe. First, speculation about Greek insolvency became increasingly fervent and Greece required a new billion-euro bailout from the European Union in order to reach its budget targets. At the same time, the decline of the Greek economy was deeper than initially anticipated. Italy was also drawn into the depths of the debt crisis. As a result, new international rescue packages were drawn up at an ever greater pace to come into effect if the overly indebted countries were to default. Following lengthy discussions, Greece will be granted a haircut of at least 50% of its debts pertinent to the private sector. Next, attention was focused on Italy, especially by the financial markets. Following immense international pressure, Prime Minister Silvio Berlusconi resigned and was replaced by Mario Monti and a coalition of Italy's three largest political parties. Uncertainty in the financial markets, governments and the entire population once again increased when rating agency Standard & Poor's threatened to downgrade Germany and 14 additional European countries at the beginning of December. Moreover, economists in most countries carried out downward revisions of their growth forecasts for the coming year.

This turbulence did not go unnoticed by consumers throughout the European Union. Quite the opposite, as uncertainty as to whether more countries such as Italy would need to fall back on rescue package and the prediction that economic growth in 2012 would fall well below initial expectations severely affected both the mood and bank accounts of European consumers. In the course of this development, economic expectations, income expectations and willingness to buy decreased in almost all countries included in the survey.

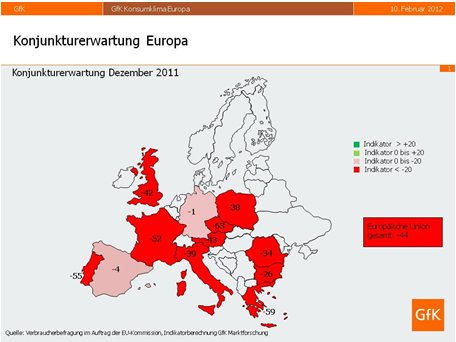

Economic expectations: Spaniards surprise with slight optimism Economic expectations markedly fell in most countries of the European Union in the last quarter of 2011. The escalation of the debt crisis, loss of trust in Berlusconi's Italian government and fears of a Europewide recession in 2012 have all contributed to major unease among consumers and on the markets. Forecasts for economic growth were revised downwards in almost all EU countries. Spain was the exception and the only country in which economic expectations actually improved slightly. The best indicator values are currently in Germany (-0.9 points) and Spain (-3.6 points). Third, with a considerably lower value, is Bulgaria with -25.5 points. Bringing up the rear are Portugal (-54.7 points), Greece (-58.6 points) and the Czech Republic (-63 points).

In Portugal, economic performance has fallen noticeably over the past year. In the third quarter of 2011, it was -0.9% in comparison with the previous year and the decline in the fourth quarter is expected to be even greater. According to economic experts, growth will deteriorate further in 2012. The Portuguese government has once again cut its budget for this year. It primarily affects ministry and public authority employees and includes the loss of the 13th and 14th month in the salary packages of all officials and government employees and spending cuts in most ministries. However, despite, or perhaps in light of, these drastic measures, the population seems to be cautiously optimistic that the country will emerge from the crisis in the medium term. Although remaining at a low level, economic expectations recovered slightly in the last quarter of 2011, rising from -60.9 points in October to -54.7 points in December.

In Spain, over the past year, the economic development fluctuated. The restrained upswing at the start of 2011 gradually shifted to negative growth over the course of year. In the third quarter, economic growth still stood at 0.7%, but estimates suggest it fell to between -0.3 and -0.4% in the fourth quarter. Economic experts predict similar figures for the first half of 2012 and unemployment is also expected to rise further. In the foreseeable future, it is unlikely that there will be any easing on the labor market, which is Spain's greatest problem. Consumers are assuming that the crisis has not yet reached halfway. However, the repeated praise from the European Commission for the severe but successful measures has given the Spanish population greater optimism that they will be able to overcome the crisis through their own efforts. Economic expectations registered the lowest level in September with -14.4 points, and have since risen to -3.6 points, placing Spain second in value of all countries in the survey.

The local and presidential elections were the overriding issue in Bulgaria in the last quarter of 2011, influencing not only the political debate, but also economic policy. Two major strikes - train operators and the largest grain producer - dominated the political arena for almost a month and caused considerably greater losses than originally thought. These events stimulated debate about the future development of some of the country's older economic sectors which have not yet been restructured. The government has set itself the target of reforming all these sectors in 2012 so that the country will become robust and competitive in these areas too. However, the population is extremely unsettled about the economic and financial situation in Bulgaria. Economic growth is primarily driven by export to the European Union, which has suffered significantly under the recent broadening of the debt and financial crisis. In order to meet the demands for budgetary discipline, the government is trying to keep the budget deficit as low as possible and reduce debt. In addition, despite huge protests, the government has carried out a pension reform which will raise the retirement age. Consumers do not believe that the Bulgarian economy can distance itself from European developments and therefore expect growth rates to continue falling in the coming months. Economic expectations currently stand at -25.5 points, which is the lowest value since May 2009.

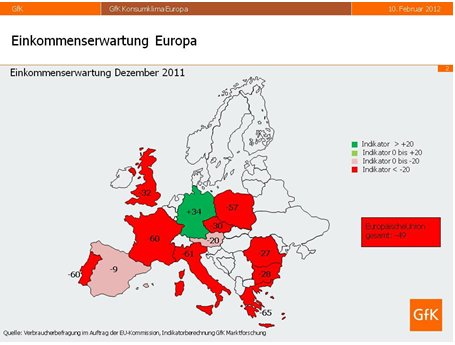

Income expectations: unemployment and rising taxes cause indicator to drop Germany has completely set itself apart from developments in other European countries when it comes to income expectations, recording a value of 34 points. On account of the extremely pleasing economic growth, consumers believe that salaries and wages will also continue to rise markedly in 2012. Spain once again has the second highest indicator value, at -8.6 points, followed by Austria with -19.7 points. Significant declines in income are still anticipated by Greeks (-65 points), Italians (-60.7 points) and the French (-60.4 points).

In Greece, unemployment remained the principal topic in the fourth quarter, as it has continuously risen over the last year and currently stands at around 18%. Economic analysts have predicted that it will climb above 20% in 2012. The atmosphere amongst the population remains at rock bottom due to the stream of new austerity measures, salary and pension cuts and further tax increases. Most Greeks only have sufficient money to pay for essentials. In order for consumers' hope of economic recovery to be rebuilt, first there have to be signs of improvement on both the labor market and with wages and salaries. Currently the chances of this happening are extremely low and consequently, confidence in Greece is also low. The indicator for income expectations stands at -65 points at present.

According to the population, the economic situation in Austria has also worsened over the last few months, but this is not mirrored in the figures. Although unemployment has risen, at 8.2% in December it was actually lower than in the same month of the prior year. However, the majority of consumers think that more people will lose their jobs over the coming months. Consumer sentiment is also dampened by the ongoing debate concerning euro rescue packages, the decision to anchor a debt brake and the subsequent public budgetary savings that have to be made. In December, income expectations recorded a value of -19.7 points.

In Spain, unemployment will also continue to rise in 2012 and is expected to top 25%. The number of individuals making social security contributions has fallen by 2,700 every day since last August. The new government has an-nounced that a series of direct and indirect taxes will be raised by the middle of this year. Added to this are stringent saving measures and extensive cuts. The government hopes to boost the economy in the medium term through these reform measures. Spain has been commended by the European Union on several occasions for the measures it has implemented to overcome the crisis. This has evidently also had a slight positive impact on the mood of consumers, who are slowly beginning to believe that their efforts will help the country through the crisis. There is also greater hope that the labor market situation will again begin to improve a little over the next few months. This will certainly be bolstered by the upcoming start of the tourist season. Income expectations increased from -17 points in October to -8.6 points in December.

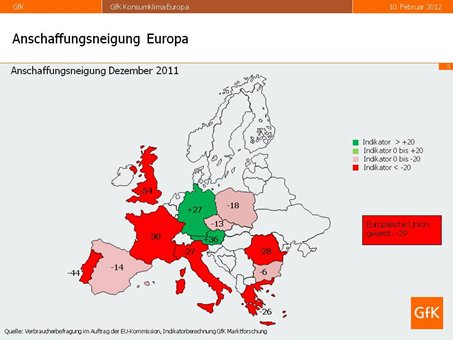

Willingness to buy: Italians are sitting tight in preparation for harder times For the first time since September 2008, Germany is in second place in a willingness to buy comparison across all countries in the European Union. Back then it was Bulgaria that registered a higher value, and now Austria precedes Germany, with indicator values of 35.6 points and 27.4 points respectively. Purse strings are being held tightest in France (-29.8 points), Portugal (-44.1 points) and the United Kingdom (-54.8 points).

The situation on the labor market in the United Kingdom is becoming ever more difficult. In the fourth quarter of 2011, unemployment stood at 8.3%, which is the highest rate since 1996. The general poor state of the economy, especially high inflation and deep fears of unemployment, are putting a dampener on consumer spending. The government is trying to lift the mood in the medium term by focusing on growth rather than austerity measures, hoping that an improvement in consumer sentiment will help stimulate the economy again. It remains to be seen in the coming months whether this strategy will bear fruit. At present, British consumers are certainly keeping a tight hold on their purse strings and are only making major purchases when they are essential. Accordingly, willingness to buy is very low, registering -53.8 points in December, which is the lowest value since November 2008.

Economic figures in the Czech Republic are relatively good at present. In December, inflation stood at 2.4% and the average for the year was 1.9%. The marked increase is primarily attributable to food, drink and energy, as price rises on these products were expected due to an increase in VAT in January 2012. Unemployment has fallen 0.5 percentage points year-on-year to 6.6%, which is the lowest rate in Europe. However, as a result of the government's austerity measures and tax increases, the reality is that more and more households are barely able to cover the costs of everyday life. The money for major purchases simply is not there. Furthermore, economic researchers predict a hike in unemployment for 2012, which is impacting consumer spending. Willingness to buy has remained relatively consistent at a low level, registering a value of -13.1 points in December 2011.

As in most European countries, unemployment was also one of the issues dominating in Italy in the fourth quarter. Although 8.6% unemployment in December 2011 is relatively good in comparison with other countries, youth unemployment in Italy is one of the highest in Europe. At 29%, it has reached a record high. In the third quarter, economic growth year-on-year was 0 and a slightly negative value is expected for the fourth quarter. Economic analysts forecast growth of between -0.3% and -0.5% for the first halfyear. Moreover, there will be additional tough austerity measures introduced by Monti's new government. Italians are still fearful of a complete collapse in Greece and the crash of the euro, which would also clearly have a negative effect on their country. Until these factors of uncertainty are addressed and the economy develops positively once again, consumers will try to put their money aside in anticipation of harder times rather than spending. Correspondingly, the willingness to buy indicator stood at -27 points in December.

The survey

These findings are taken from the GfK Consumer Climate MAXX survey, which is based on consumer interviews conducted in all European Union countries each month on behalf of the EU Commission.

The monthly interviews are distributed as follows among the countries observed:

Austria 1,500

Bulgaria 1,000

Czech Republic 1,000

France 3,300

Germany 2,000

Greece 1,500

Italy 2,000

Poland 1,000

Portugal 2,100

Romania 1,000

Spain 2,000

United Kingdom 2,000

Overview of the individual indicators:

Economic expectations : This index is based on the following question to consumers: "How do you think the general economic situation will develop in the next 12 months?" (improve considerably - improve somewhat - remain approximately the same - deteriorate somewhat - deteriorate considerably - don't know)

Income expectations: This index is based on the following question to consumers: "How do you think the financial situation of your household will develop in the next 12 months?" (improve considerably - improve somewhat - remain approximately the same - deteriorate somewhat - deteriorate considerably - don't know)

Consumption and buying willingness : This index is based on the following question to consumers: "Do you think it is advisable to make major purchases at the moment?" (Yes, it's a good time to do so - now is neither a particularly good nor a particularly bad time - no, it is a bad time to do so - don't know)