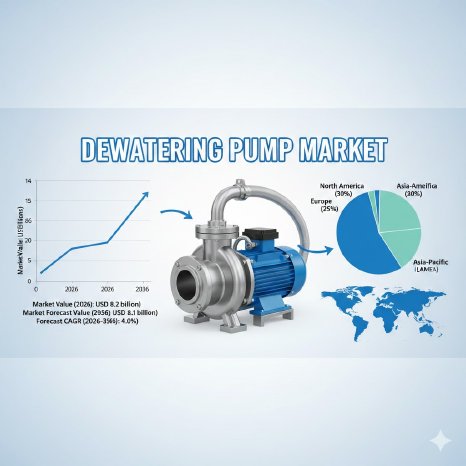

The Dewatering Pump Market is on a robust growth trajectory, forecasted to reach USD 8.2 billion in 2026 and expand to USD 12.1 billion by 2036 at a CAGR of 4.0%. Rising construction activity across residential, commercial, and infrastructure projects has increased the need for reliable groundwater removal to ensure safe excavation practices. Simultaneously, expansion in mining operations is intensifying the adoption of dewatering pumps for pit dewatering and water management in both surface and underground mines.

Urbanization trends are fueling investments in drainage systems, tunnels, subways, and basement construction, further supporting the steady demand for dewatering pumps. Industrial facilities require these systems for wastewater handling, process water control, and routine maintenance.

Key Highlights:

- Market size (2026): USD 8.2 billion

- Market forecast (2036): USD 12.1 billion

- CAGR (2026–2036): 4.0%

- Major growth drivers: construction projects, mining expansion, urbanization

Trade Dynamics: Exporters and Importers

Global trade in dewatering pumps is shaped by major manufacturing hubs in Europe, North America, and Asia. Exporting countries supply advanced, precision-engineered pumps, while importing countries focus on supporting growing construction and mining sectors.

Trade Insights:

- Leading Exporters: Germany, U.S., China, UK

- Top Importers: India, U.S., China, UK, Germany

- German pumps valued for precision engineering; UK focuses on niche technologies

- India imports for construction and infrastructure projects

Submersible pumps dominate the market due to their efficiency and reliability in construction and mining operations. Centrifugal and diaphragm pumps serve general industrial and specialized applications. Equipment selection depends on flow requirements, contamination levels, and operational conditions.

Pump Type Distribution:

- Submersible Pumps: 52.1% – construction, mining, municipal use

- Centrifugal Pumps: 31.4% – general dewatering and industrial processes

- Diaphragm Pumps: 10.8% – contaminated water and chemical handling

- Others: 5.7% – niche applications

Dewatering pump adoption varies by industry, with construction projects and mining operations requiring heavy-duty, continuous operation solutions. Municipalities and industrial facilities use pumps for flood control, sewage, and process water management.

Application Insights:

- Construction: 38.7% – excavation safety and water removal

- Mining: 29.3% – continuous operation and high flow capacity

- Municipal: 18.2% – flood control, sewage treatment

- Industrial: 10.1% – manufacturing and facility dewatering

- Other Applications: 3.7% – specialized uses

Government regulations drive demand by enforcing safe groundwater removal, proper discharge quality, and sediment control. Urban construction regulations encourage flood prevention and stormwater management, increasing the need for high-efficiency pumps. Compliance requirements ensure pumps meet operational and environmental standards.

Regulatory Highlights:

- Permits required for groundwater abstraction

- Discharge limits for turbidity, chemical residues, oil

- Occupational safety: stable trenches, tunnels, and foundations

- Urban focus on flood prevention and stormwater management

Dewatering pump adoption varies across countries depending on construction, mining, and municipal needs. India leads growth with high infrastructure expansion, while China and the U.S. focus on urban and industrial applications. Europe emphasizes environmental compliance and energy efficiency.

Country CAGR (2026–2036):

- India: 5.8% – construction and mining expansion

- China: 4.7% – industrial operations and municipal applications

- USA: 4.1% – infrastructure and municipal pumping projects

- Germany: 3.8% – flow optimization and compliance

- UK: 3.5% – mining and performance-driven equipment adoption

Companies differentiate themselves through operational reliability, energy efficiency, and technical support. Manufacturers provide solutions that integrate with Industry 4.0 systems and ensure continuous operational performance across sectors.

Key Players:

- Grundfos

- Xylem Inc.

- KSB Group

- Sulzer Ltd.

- Wacker Neuson SE

- Pentair plc

- Ebara Corporation

- Tsurumi Pump

- Gorman-Rupp Company

- Flygt (Xylem brand)

The market is expected to sustain growth driven by urbanization, industrial expansion, and environmental compliance. Submersible and centrifugal pumps dominate, while energy-efficient and smart solutions offer opportunities for project developers prioritizing operational reliability and cost-effective performance.

Get data that aligns with your strategic priorities — ask for report customization today: https://www.futuremarketinsights.com/customization-available/rep-gb-6685

Related Reports

Stair Lift Motors Market- https://www.futuremarketinsights.com/reports/stair-lift-motors-market

Plate Heat Exchanger Market- https://www.futuremarketinsights.com/reports/plate-heat-exchanger-market

Solar Inverter Market- https://www.futuremarketinsights.com/reports/solar-inverter-market

Have a specific Requirements and Need Assistant on Report Pricing or Limited Budget please contact us - sales@futuremarketinsights.com