Stefan Brandl, CEO of the ebm-papst Group: “We can look back on yet another successful year of growth where we managed to pronouncedly exceed many of our targets.” The reasons behind this achievement sees Brandl in the consistent push for internationalization via “local for local” activities and the successful implementation of the corporate “one ebm-papst” strategy

“Started two years ago, “one ebm-papst” allows us to position ourselves for a sustainable and prosperous future, at the same building a structure which is suitable for and corresponding to our company size. Currently, we are working on about 20 reorganization projects targeting all locations and departments, from Sales to Purchasing and R&D. This is to safeguard jobs now and in future and to do business at a highly competitive level”, explains the ebm-papst CEO.

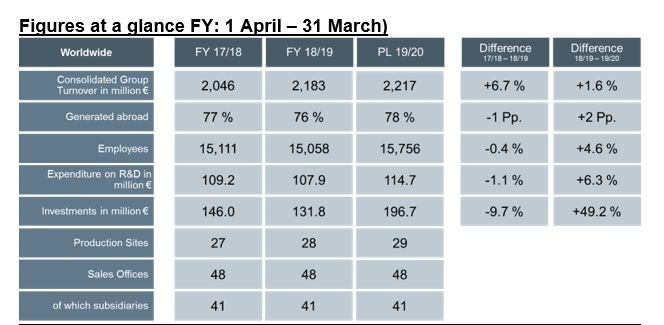

For the present fiscal year, the technology leader plans a moderate 1.6% sales growth to € 2.217 billion.

In total investments, Group planning amounts to about €196.7 million (+49.2% on previous year). In the next few months, ebm-papst will open its third production site in China, this time in Xian, and their second American production site will open in Johnson City, Tennessee. As far as R & D is concerned, the technology leader plans to invest about € 114.7 million to focus and further boost aerodynamics, acoustics, digitalization, and material innovation.

Background information on FY 18/19 as well as on present

FY 19/20:

Regions and divisions: ebm-papst is growing in all markets

Despite a difficult market climate, with political instabilities such as the tariff war between the USA and China, looming Brexit or Russian sanctions and the continuous material shortage particularly with electronics components, the ebm-papst Group managed to achieve strong growth in all their business divisions and throughout all four regions (Germany, Europe, Asia, USA) and sustainably increased their market share.

Throughout Europe (excluding Germany), ebm-papst grew by 7.7% to € 1,020 million (previous year: € 948 million), followed by Asia with 6.8% to € 402 million (previous year: € 377 million) and Germany with 5.7% to € 501 million (previous year: € 474 million). On the American market, the industry leader grew by 4.9% to € 260 million (previous year: € 248 million).

In terms of market segments, the Automotive/Drive segment headed by ebm-papst St. Georgen saw strong growth of 13.1% to € 318 million (previous year: € 281 million). The Household appliances/Heating segment headed by ebm-papst Landshut managed to grow by 3.6% to € 414 million (previous year: € 400 million). And the Industrial Ventilation segment headed by ebm-papst Mulfingen also grew by 6.3% to € 1,451 million (previous year: € 1,365 million).

R & D – Technology leader plans development platform in China and emphasizes digitalization

In fiscal year 2018/19, ebm-papst expenditure for research and development amounted to € 107.9 million (previous year: €109.2 million).

The focus was on digitalization, aerodynamic and acoustics, energy-efficient product concepts and pushing electronics and system capabilities. In the fiscal year, ebm-papst plans to implement a development platform in China, among other things, and projects involving IoT (Internet of Things), investing a total of €114.7 million (+ 6.3%) in R & D.

Investments: ebm-papst investing heavily

ebm-papst is pushing its internationalization strategy “local for local” and, last fiscal year, almost doubled investments abroad at € 41.3 million (previous year: € 22.1 million / +86.5%). In total, the technology leader invested €131.9 million (previous year: € 146.0 million / -9.7%).

In the current year, ebm-papst is going to significantly increase investments by 49.1% to € 196.7 million. Of particular note are the investments abroad which, at € 94.5 million will almost be doubled, with the new production sites in Xian (China) and Johnson City (USA) their main focus. In Germany, this fall will see the start of construction work on the new technology center for R & D in Mulfingen.

Staff: Number is stable

Following the surge in hires in recent years and the restructuring of the ebm-papst Automotive site St. Georgen in the Black Forest, staff numbers remained stable. At the end of fiscal year, the technology leader in fans and motors had a global staff of 15,058 (previous year: 15,111 / -0.4%). In Germany, staff shrank from 6,852 to 6,680 (-172), while there was an increase in staff from 8,259 to 8,378 (+119) abroad.

In 2018/19 and worldwide, ebm-papst also employed a total of 926 temporary workers (previous year: 1,173 / -247), of which number 275 (previous year: 372 / -97) were in Germany and 651 (previous year: 801 / -150) were abroad.

Training opportunities at constant high

ebm-papst still recruits the key part of their specialists and skilled workers from their pool of trainees and students. On 31 March 2019, there were 363 trainees, apprentices and dual students (-2,2%; previous year: 371) with ebm-papst. From these, there were 204 in Mulfingen (previous year: 203), 37 in Landshut (previous year: 43), 97 in St. Georgen, including Herbolzheim and Lauf, (previous year: 95) and 25 outside Germany (previous year: 30).

Background information on ebm-papst locations in Germany

ebm-papst Mulfingen, the Group headquarters, achieved a sales growth by € 61 million to € 1,089 million (previous year: € 1,029 million / +5.9%). The number of staff showed a slightly upward trend of +12 to 3,711 (previous year: 3,699 / +0.3%).

ebm-papst St. Georgen managed to overcome their difficult challenges in the automotive segment and, after painful restructuring, is now back on track and set for successful growth. In terms of sales growth, the subsidiary in the Black Forest with sites in St. Georgen, Herbolzheim (Automotive) and Lauf (Drives) grew by 12.7% to € 501 million (previous year: € 445 million) and, at the end of fiscal year, has a staff of 1,776 (previous year: 1,936 / -8.3%).

ebm-papst Landshut, the Bavarian subsidiary with focus on the segments of household appliances and heating was almost constant in terms of sales and staff. There was a growth in sales of € 337 million (previous year: € 333 million / +1.2%), and the number of staff went down by 24 people to 1,193 (previous year: 1,217 / -2.0%).