PRELIMINARY Q4 2021 RESULTS

Osisko earned approximately 19,830 attributable gold equivalent ounces1 (“GEOs”) in the fourth quarter of 2021, for a total of approximately 80,000 GEOs in 2021, in line with its annual guidance of 78,000 – 82,000 GEOs. These figures exclude 3,042 GEOs earned in the fourth quarter (and 9,210 GEOs earned in 2021) from the Renard diamond stream.

Osisko recorded preliminary revenues of C$50.7 million during the fourth quarter and preliminary cost of sales (excluding depletion) of C$3.7 million resulting in a cash margin2 of approximately C$47.0 million, a quarterly record from the royalty and stream interests. Osisko’s cash margin2 was approximately 93% during the fourth quarter of 2021 (97% excluding the Renard diamond stream).

Osisko will provide full production and financial details with the release of its fourth quarter and full year 2021 results after market close on Thursday, February 24th, 2022 followed by a conference call on Friday, February 25th at 10am EST.

Sandeep Singh, President and CEO of Osisko commented: “I am extremely proud of what Osisko and our partners accomplished in 2021. We are pleased to have achieved the midpoint of our annual GEO guidance, despite ongoing supply chain disruptions, workforce turnover and safety issues, and other challenges currently facing the mining sector.

We had substantial catalysts across a number of our most important assets last year and expect further significant strengthening of our asset base in 2022, with our partners unlocking value through exploration success, mine life extensions and expansions. We also saw many of our assets end up in larger, better capitalized companies and expect this trend to continue given the quality of our portfolio.

We added quality growth assets while remaining disciplined in our capital allocation. We prioritized returns to shareholders by increasing our dividend in the midst of a weakening gold market and took advantage of further market volatility to buy back 2.1 million common shares of the Corporation for C$30.8 million. In summary, it was a great year for Osisko and our asset base, and we look forward to continuing that momentum.”

2021 ASSET ADVANCEMENTS AND UPCOMING CATALYSTS

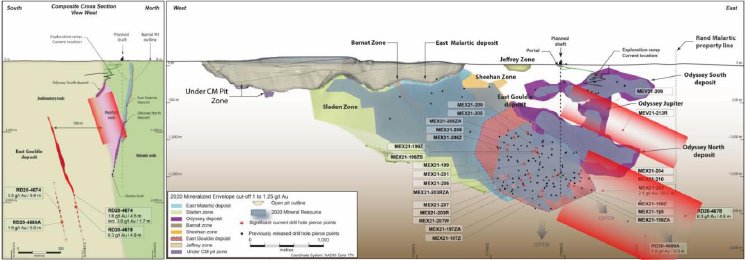

Malartic Exploration Continues to Unlock Value

Since making the underground investment decision in February 2021, Yamana Gold Inc. (“Yamana”) and Agnico Eagle Mines Limited (“Agnico”) have continued at an accelerated pace on the Malartic property. Up to 13 drill rigs have been active, focused on confirming the extent, thickness and grade of the East Gouldie deposit as well as several other deposits that will be accessed via ramps and the shaft. The East Gouldie zone was expanded by at least 1.5 kilometers to the east and infill drilling continued to return excellent results in the core of the East Gouldie deposit.

In October 2021, the Canadian Malartic exploration team was presented with the "Discovery of the Year" Award at the Quebec Mineral Exploration Association annual convention, in recognition for the discovery of the East Gouldie deposit. The discovery has significantly changed the Odyssey project by improving its economic viability and leading to a fast-track development process.

On November 2nd, 2021, Agnico Eagle reported positive exploration results for the Odyssey Underground Project. Infill drilling returned wide, high-grade intersections in the core of the East Gouldie deposit, with results of 6.8 g/t gold over 41.4 meters at 1,069 meters depth, including 10.2 g/t gold over 21.7 meters at 1,064 meters depth. The eastern extension of the deposit was tested further, with the eastern most hole returning 6.3 g/t gold over 4.8 meters at 1,989 meters depth, 1.5 kilometers east of the current mineral resource, further demonstrating the excellent potential to significantly grow the size of the East Gouldie deposit.

Malartic has the potential to deliver production beyond what was described in the 2020 Preliminary Economic Assessment, as highlighted in Yamana’s statement from their December 1st press release: “Exploration is continuing to deliver exciting results at Odyssey and we believe that exploration successes will in time allow the Partnership to take advantage of the excess plant capacity in order to maximize underground production above currently planned levels. The possible addition of a second shaft and further production from upper ore bodies accessed by ramp are additional opportunities that merit continuing investigation and assessment.”

Osisko holds a 5% net smelter return (“NSR”) royalty on East Gouldie, Odyssey South, East Amphi and the western half of East Malartic and a 3% NSR royalty on Odyssey North and the eastern half of East Malartic. For more information, refer to Yamana’s press releases dated September 7th and December 1st, 2021 and Agnico’s press releases dated July 8th and November 2nd, 2021 filed on www.sedar.com.

Further information is attached.