Management is looking to do at least 2,000m of diamond drilling at their fully owned flagship Haldane Silver project this year. A C$750k financing, funding US work and general G&A was a first step as part of an intended C$2M raise in total, with another round, sufficient to fund the Haldane program, to follow in this autumn. The current sentiment in mining and the stockmarkets in general isn’t very positive because of all the recent developments around shortages and following inflation, as a fallout from the COVID ordeal, intensely hampering supply chains around the world for over a year. The Russia-Ukraine conflict doesn’t help either with lots of commodities like grain, corn, pig iron, natural gas and nickel prevented from being exported for various reasons. The Federal Reserve does everything in its powers with rate hikes to calm things down, but with huge debts piling up this is not without risk. Luckily the US Dollar took a breather after the Euro gained strength on EU rate hikes, so the gold price seems to recover a bit, causing a few green days now. Maybe this might help Alianza with raising more money. Being a hybrid prospect generator, they have other projects in the works as well, paid for by JV partners.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

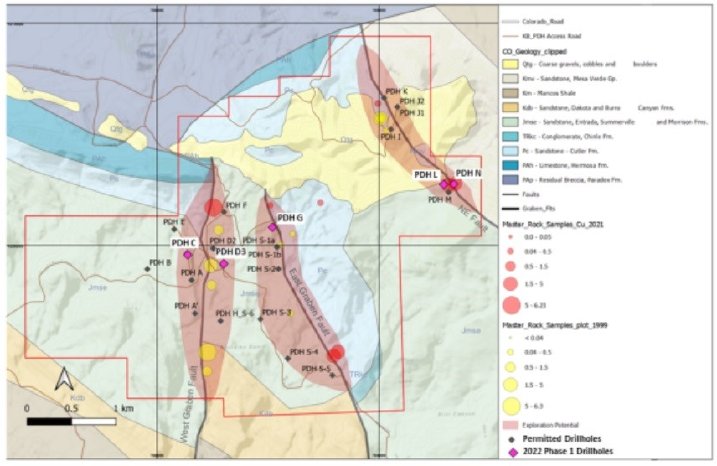

It was good to hear permitting went as planned, not interfering with the original planning of drilling in July at Klondike, as contemplated in my last update on the company in May. The exploration concept revolves around finding disseminated copper-silver mineralization, amenable to open pit mining with Solvent Extraction Electrowinning (SXEW) processing, which is also used in the nearby Lisbon Valley Mining Complex. Management hopes to find a sediment hosted copper deposit here, a type of deposit accounting for over 20% of current copper production globally.

VP Exploration Rob Duncan can’t wait to see results: “We are looking forward to testing the targets we have prioritized at Klondike. Three excellent targets exist at the Northeast Fault, West Graben and East Graben areas, each of which shows multi-kilometre strike length potential for copper mineralization. This first phase of drilling is designed to make an initial test of each of the three targets.”

Two holes are planned for the Northeast Fault target to test its potential at depth to follow up a 4.6 m chip sample that averaged 1.56% copper and 1.4 g/t silver in 2021 sampling. One hole will test the East Graben Fault at depth, where surface sampling returned 2.8% copper with 37.8 g/t silver and 1.5% copper with 24.3 g/t silver. Two holes will test the West Graben Fault, following up 2021 sampling that returned 6.23% copper and 127 g/t silver from a grab sample.

Despite the excellent sampling results, management is anticipating on hitting mineralized structures at the fault lines here. I’m looking forward to the drill results, which can be expected around October at the earliest according to CEO Weber. I can’t stress enough what a profitable deal this is for Alianza and the Alliance, as they paid just C$105k for the Klondike property, and earn-in partner stands to pay C$2.6M in cash and shares plus a royalty for 100% ownership in 3 years. Here are the terms again as a reminder:

- Allied will incur an aggregate of C$4.75M in exploration expenditures on the property, with at least C$500K to be spent prior to the first anniversary of the closing date.

- Allied will issue 7M common shares and make an aggregate of C$400k in cash payments to the Alliance over a three-year period.

- Upon completion of these option agreement obligations, the Alliance will transfer 100% interest in the Klondike Property to Allied. Allied will also issue 3M warrants exercisable for a three year term at a price equal to the 10-day VWAP of Allied’s common shares at the time of the issuance.

So even if Allied doesn’t find anything, Alianza stands to profit very well from their earn-in. On top of this Alianza also receives a management fee as the operator of the project on a per hour basis.

Klondike isn’t the only project seeing action this summer, as Alianza was eying potentially up to 5 different drill programs this year at their various projects, with the current focus on the Klondike and Stateline copper projects in Colorado for now. As a reminder, under the terms of the Alliance, either Cloudbreak Discovery PLC or Alianza Minerals Ltd can introduce projects to the Alliance. Projects accepted into the Alliance will be held 50/50 but funding of the initial acquisition and any preliminary work programs will be funded 40% by the introducing partner and 60% by the other party. Project expenditures are determined by committee, consisting of two senior management personnel from each party. Alianza is the operator of Alliance projects unless the Alliance steering committee determines, on a case-by-case basis, that Cloudbreak would be a more suitable operator. The initial term of the Alliance runs for two years and may be extended for an additional two years.

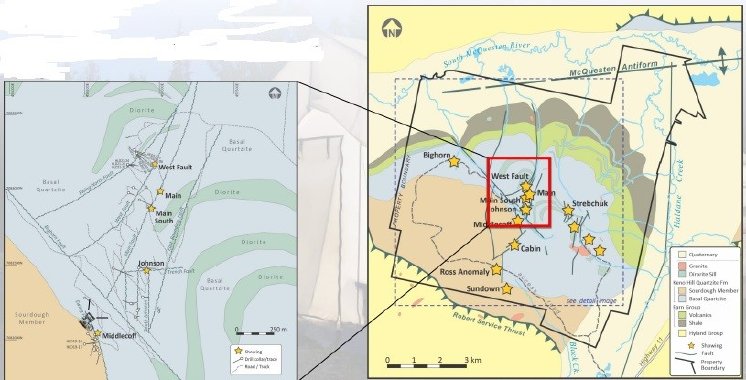

Depending on additional financing, Alianza will continue to work at their flagship Haldane Silver project as soon as possible again at Keno Hill, Yukon. Recent exploration of the past few years by Alianza has focused on the Mount Haldane Vein System (MHVS), and considering high grade results (HLD20-19: 1.78m @ 818g/t Ag and HLD21-24: 1.26m @ 3,267g/t Ag) at the West Fault target, management is narrowing its focus at this specific target even more, with drill targets defined.

CEO Weber expects to drill further stepouts at the West Fault, Middlecoff and Bighorn targets this fall, depending on available financing, and available drill rigs. A trenching program will commence in August to upgrade new target areas to drill-ready status.

Coeur Mining, which has optioned the Tim Silver project in the Yukon, has notified Alianza Minerals that results of the 2021 program have been compiled and once management has reviewed the data, a news release will detail the results of that work. Alianza expects to hear more about 2022 activities early summer. Site preparation for drilling will commence this summer.

The Twin Canyon gold project in Colorado also has seen its fair share of prioritizing drill targets, and a drill permit for a 10 hole RC drill program is still in the works. Alianza is actively seeking a partner to conduct the first drill program at Twin Canyon.

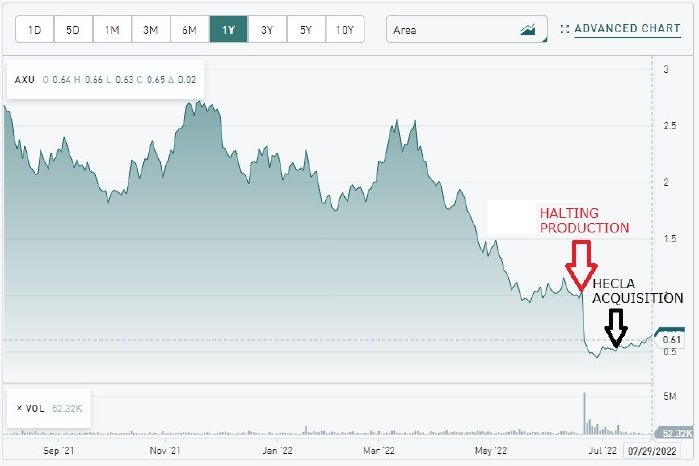

Another interesting development happening very close to Alianza’s Haldane Silver project in Keno Hill is the recently announced acquisition of Alexco Resource (AXU.TO) by Hecla Mining (HL.US) for C$74M, or C$0.60 per share. As Alexco was experiencing lots of difficulties ramping up their Keno Hill mine, Hecla timed their acquisition well right after Alexco announced further delays, crashing their share price.

s such a buyout isn’t decided and due diligenced in two weeks, it might be tempting to see all sorts of backroom dealings here, to the detriment of Alexco shareholders. Notwithstanding this, as Hecla also managed to persuade Wheaton Precious Metals (WPM) to extinguish the heavy burden of a large royalty stream by issuing no less than US$135M in Hecla common stock to WPM, it will be clear Alexco was probably saved by Hecla, and this obviously comes at a price. Hecla Mining, the largest US silver producer around, comes in with lots of expertise and a strong capital position, and will likely be able to iron out the mining/milling issues that plagued Alexco at Keno Hill. Establishing the Keno Hill Mine as a profitable silver mine backed by a large producer is a very favourable development for the district and thus also for Alianza according to CEO Weber.

Conclusion

It will be interesting to see what kind of drill results will come out from Alianza’s Klondike Copper Project around October of this year, after drilling will commence in the first week of August. In the mean time, the company will also commence a trenching program next month at their flagship Haldane Silver project, to further define additional drill targets. With a separate financing coming up for Haldane in the autumn, drilling will start shortly after closing. The Tim Silver project may also see drilling this year by JV partner Coeur Mining, as they are preparing drill sites this summer. So lots of moving parts with Alianza Minerals these days, but a little patience is warranted before new drill results are being announced. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Alianza Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.alianzaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.