As we know, the silver price is volatile and sideways phases can be long. In the medium term, many analysts see the price target at 50 US dollars. In the long term, the price could also rise higher. In a survey of 25 analysts at the beginning of the year by the London Bullion Market Association on the development of the silver price, almost all of them predicted prices below 30 US dollars. Only one respondent predicted more than 30 US dollars per ounce of silver. The price rally probably took them by surprise.

Interest rate cuts by the Fed are imminent, silver is in demand in more and more areas and the economy is performing better than expected. In 2022, silver was in particularly high demand from India, but this demand declined in 2023. Now demand from India seems to be picking up again. As silver is traded in US dollars, the price is also influenced by a weakening or strengthening of the US dollar. As with its big brother gold, political events and geopolitical tensions can prompt investors to invest in silver. Industrial demand and a possible shortage can drive up the price of silver. It would also be nice if demand for silver from China were to increase. This could happen simply due to the strong expansion of the photovoltaic sector.

In view of the fact that industrial demand for silver has reached new heights and silver is benefiting greatly from technological development and environmentally friendly solutions (renewable energy, electromobility), a higher silver price should not really come as a surprise. The outlook should therefore be good for companies with silver in their projects.

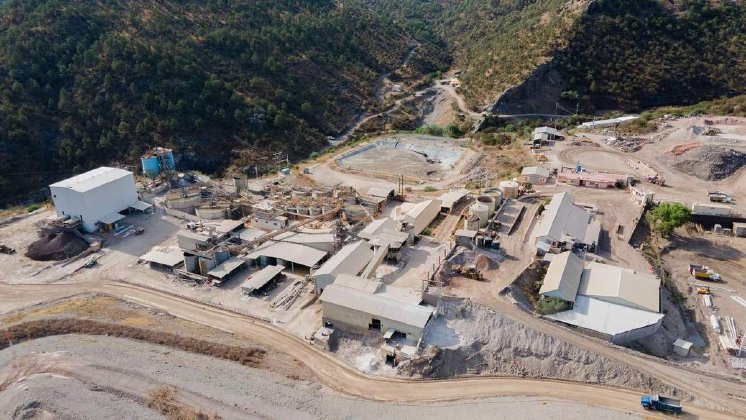

There is Endeavour Silver - https://www.commodity-tv.com/ondemand/companies/profil/endeavour-silver-corp/ -, a successful silver producer with silver projects in Mexico, Nevada and Chile.

Discovery Silver - https://www.commodity-tv.com/ondemand/companies/profil/discovery-silver-corp/ - has silver-zinc-lead projects in northern Mexico, including the highly prospective Codero project, a world-leading silver project.

Current company information and press releases from Discovery Silver (- https://www.resource-capital.ch/en/companies/discovery-silver-corp/ -) and Endeavour Silver (- https://www.resource-capital.ch/en/companies/endeavour-silver-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/