Environmentally friendly technologies and the photovoltaic sector are driving up the price of silver.

The photovoltaic sector is growing, almost worldwide and especially massively in China. There can be no energy transition without silver. And the demand for silver in the photovoltaic sector continues to rise. In 2022, the solar industry was responsible for 15 percent of global silver consumption. In addition to the solar industry, automotive electrification and the expansion of power grids are leading to rising silver consumption. The price of silver has risen by more than 20 percent since the beginning of the year. In 2023, the average silver price rose by seven percent. Experts expect the supply of silver to fall this year, resulting in a supply deficit of around 215 million ounces of silver.

The transformation to a green economy will continue to demand large quantities of silver in the coming years. The gold-silver ratio (gold price divided by silver price) is currently a good 76, which is low compared to the last twelve months. Many analysts are positive about the silver price. For example, experts at UBS are forecasting a silver price of up to USD 36 per troy ounce by the end of the year.

Commodities, including silver in its function as an industrial metal, are essential. According to the vbw (Bavarian Industry Association) commodity price index, this rose for the second month in a row in May compared to the previous month. Commodities are becoming more expensive, including silver. Since the beginning of the year, commodity prices for the Bavarian economy have risen by twelve percent. Compared to 2019 (before the pandemic), prices are almost 40 percent higher. Anyone looking to invest in the efficient use of raw materials and silver can familiarize themselves with Endeavour Silver or Discovery Silver.

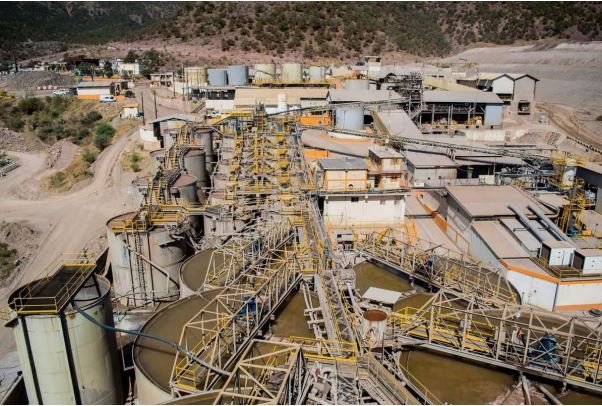

Endeavour Silver - https://www.commodity-tv.com/ondemand/companies/profil/endeavour-silver-corp/ - is a successful silver producer with silver projects in Mexico, Nevada and Chile (production in the second quarter of 2024 approx. 2.2 million ounces of silver equivalent).

Discovery Silver - https://www.commodity-tv.com/ondemand/companies/profil/discovery-silver-corp/ - has silver-zinc-lead projects in northern Mexico, including the highly prospective Codero project, a world-leading silver project.

Current company information and press releases from Discovery Silver (- https://www.resource-capital.ch/en/companies/discovery-silver-corp/ -) and Endeavour Silver (- https://www.resource-capital.ch/en/companies/endeavour-silver-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/