There are 17 different rare earth elements. These elements are important for achieving the goals of the energy transition. An immense increase in demand is expected. The applications for rare earths vary greatly. The most common is cerium, which is used for polishing LCD screens. Erbium can amplify network signals. Scandium is as strong as titanium, as light as aluminum and as hard as ceramics. It is therefore used in automotive and aircraft parts. Some rare earths are often used in certain magnets. Neodymium magnets, for example, are the strongest magnets and are found in wind turbines and the motors of electric vehicles. The rare earth sector is likely to have long-term potential due to the growing number of technological applications.

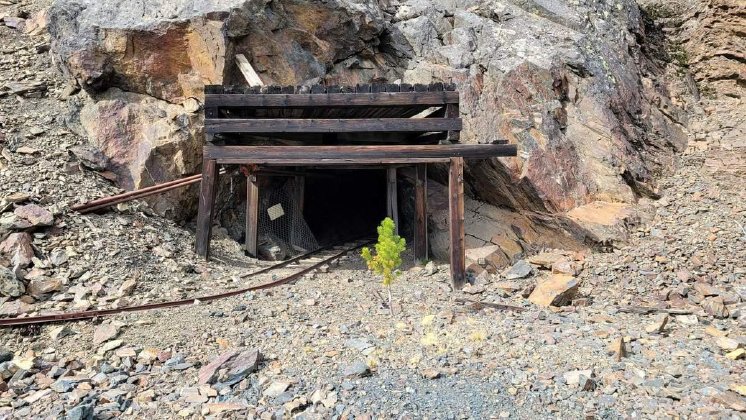

This is attracting investors who are backing US Critical Metals - https://www.commodity-tv.com/ondemand/companies/profil/us-critical-metals-corp/ -, for example. The company owns projects in Montana, Nevada and Idaho. They contain rare earths, cobalt and lithium.

Climate protection requires investment, and industry is part of this. In 2021, 49% of climate protection investments were made in the use of renewable energies. In 2021, for example, around 74% more investment was made in climate protection by industry in Germany than ten years ago. Mining companies also usually need a lot of capital to develop their projects.

There are financing companies (which investors can also rely on) such as Queen's Road Capital Investment - https://www.commodity-tv.com/ondemand/companies/profil/queens-road-capital-investment-ltd/ -. This company specializes in gold companies that are either already producing or are close to production maturity. Given the current high gold price, this is certainly an option for investors.

Current company information and press releases from Queen's Road Capital Investment (- https://www.resource-capital.ch/en/companies/queens-road-capital-investment-ltd/ -) and US Critical Metals (- https://www.resource-capital.ch/en/companies/us-critical-metals-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 - 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/