By the Critical Investor - https://www.criticalinvestor.eu/... -

- Introduction

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

[*] General update

Before I will discuss MineHub, a brief overview of the current state of affairs seems appropriate. Drilling at Kutcho commenced in the first week of June with 2 rigs, and the company has a crew of 45 men stationed on site now. This drilling has predominantly a metallurgical and geotechnical nature and less of resource expansion at the moment, and is meant to provide necessary information for the upcoming Feasibility Study (FS) planned for Q2, 2019. This program also has priority over the upcoming resource expansion drill program, which will start mid August, and will be completed in September/October of this year. Also environmental data is being collected at the moment, needed for the ongoing permitting process. The FS data collection is expected to be completed mid October.

As a reminder, Kutcho Copper management has planned the scale of the upcoming field program such that they can achieve all the technical data collection for the feasibility in one field season. The easy field season up there is May 21 to October 31. Outside this window, things are not impossible, just more expensive, and therefore the company is looking to complete all drilling requirements within this period.

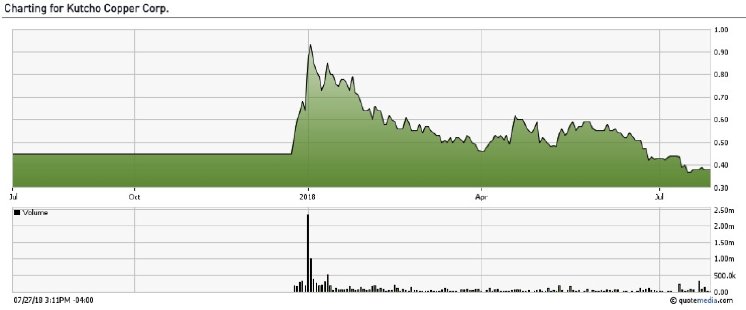

The proceedings of the ongoing C$4M financing (flow through at C$0.45 and no warrants) will be used towards completing the FS, permitting and for the resource expansion drill program. The good thing is that the money is raised at a premium of today's share price of C$0.38, with no warrants:

Share price over 1 year period

I am not a big fan of a short form offering as these shares can be sold immediately without the usual 4 month hold period, but since Kutcho seems to be bottoming in the summer doldrums with low base metal prices and slightly negative commodity (stocks) sentiment, this is a long term play on copper and not some trading vehicle, with strong backers, and there is no warrant attached, I don't see much downside and therefore not a lot of reasons for participants to sell off soon. Wheaton Precious Metals (WPM) likes Kutcho Copper to proceed asap to the FS, and is supportive here.

On a sidenote but an important one, CEO Sorace told me that changes are coming up soon in BC legislation, causing the company to move a lot of CSR (Corporate Social Responsibility) consultation work upfront of the permitting process. This will create more certainty later on in the process, but it also causes additional costs earlier on

When looking at the staff, it definitely caught my eye that a high profile permitting expert like Allison Rippin Armstrong (she handled permitting at Kaminak's Coffee project in Yukon, Canada) left the company in the middle of gathering environmental data and talks to First Nations. It turned out to be for personal reasons unfortunately, and had nothing to do with the company or project. Continuing as an advisor, Armstrong has beenreplaced by another very accomplished expert in the field of environmental assessments, permitting and local communities, the acclaimed Sue Graig. She is probably known best for her accomplishments with NovaGold and Aurico Gold, both involvements were awarded by awards addressing her excellence.

More specific, for NovaGold she also played a key role in establishing the participation agreement with the Tahltan Nation (First Nations), and this is the same First Nations group that Kutcho is dealing with now, so this is a strong advantage. In addition she is also the President of the Yukon Chamber of Mines and a Director of Yukon Energy Corp, and has served as the Chair of AME Mineral Exploration Roundup, as well as a board member of the AME. AME stands for Association for Mineral Exploration British Columbia, and is a pretty influential body in mining in Canada. In my view it is clear that the Kutcho Copper project still is in good hands on the environmental/community/permitting front. This pretty much sums up the status on the Kutcho Copper project, now it is time to proceed with MineHub, a project Sorace seems just as exited about as he is about the Kutcho project.

[*] Minehub

MineHub Technologies is one of the first, if not the first, serious application attempts of blockchain in mining. Blockchain in short is a system that allows information to be coded in a decentralized way. Besides the numerous initiatives around with bogus stories on blockchain just to ride the hype, there really is nothing blockchain related working at the moment in the mining industry. Blockchain tech is being developed everywhere now, with a large base in the financial industry, but Sorace noticed about 6 months ago that certain blockchain applications were also making its way into the energy industry. New developments usually get adopted in finance and high tech industries first, and it trickles down to lower tech industries afterwards. Mining can be considered pretty low tech, and behind the curve.

Sorace saw opportunities there, as he was tech-oriented earlier on in his career, for example setting up solutions for grid storage for almost a decade. He thinks blockchain will be the most disruptive tech since the internet, and he is certainly not alone in this, as the world's largest companies have all set up departments to incorporate this in their organisation processes. It is everywhere now, and it is just a matter of time when it becomes mainstream, not if. Sorace was thinking how to apply this in mining. Soon he came up with supply chain management, as the industry is perfect for it. The current system is antiquated, and would love improvements on costs and efficiencies.

Copper cathodes

A lot of time- and cost savings can be realized here in the vision of Sorace, such as visibility and speed through the supply chain, by using smart contracts for transactional requirements and compliance with regulations across multiple jurisdictions and reducing in house personnel responsible for back office processes and data security For example, one shipment of concentrate has a binder full of documents, there is no uniform system as well. Loads of emails go back and forth, spreadsheets need to be compared etc etc. Sorace is taking the holistic approach here, essentially he wants an approach for the whole industry as he sees possibilities for a fully integrated system of various applications through MineHub. He quickly realized he couldn't do this alone, and approached some of the biggest players in the industry. To his surprise, everybody he talked to was very interested, and he was able to quickly assemble a syndicate of very high profile companies.

He wasn't allowed to mention names yet (a news release will come out in the near future addressing this subject), but according to the news release handling this subject, the syndicate consists of a senior mining company, one of the world's largest streaming companies, an international base and precious metals and concentrates trading company that specializes in providing trading and financing solutions for miners and smelters, and a global financial institution offering banking services in the metals and mining industry. At least about one name I'm fairly certain when guessing, as it seems to make sense that "one of the world's largest streaming companies" is no other than financing partner Wheaton Precious Metals. Sorace assured me these were all multi-billion dollar outfits and are considered to belong to the top of their fields. This all sounded very promising, but the story continues.

Sorace also hired a big name in tech to become the CEO of MineHub, which is a private company at the moment. MineHub will self-finance and will not need Kutcho Copper money. He is also looking for a big blockchain company which could provide the necessary technology, to set up the needed applications. The syndicate partners will provide knowledge/experience, which needs to be baked into the future applications. Sorace took care of the intellectual property (IP) first when negotiating with the syndication partners, which I found to be a smart move, as tech is all about IP. The central idea is to license out the applications to parties outside the syndicate. The syndicate members will become shareholders of MineHub, but they will have to pay for using the applications as well

Beside all this, Sorace is also talking to others regarding strategic relationships to help with adoption and deployment of the technology within the mining space. It isn't clear yet if MineHub will be a spin-out of Kutcho, or Kutcho remains a large shareholder, but it seems likely that MineHub will be listed at some point on the Venture Exchange. Their first goal is achieving a pilot of a supply chain application in 6 months, and a commercial application shortly after this.

At this point it is hard to provide any insights on future cash flows and value for Kutcho Copper shareholders in any shape or form, but if it works out the way Sorace is envisioning, with MineHub taking over/participating in a substantial part of mining industry software, things could get pretty interesting a year from now.

After discussing MineHub at some length, I would like to rehash the valuation scenarios again, as a reminder about how undervalued to NAV this stock really is at the moment.

[*] Indications of valuation

Although the Kutcho project already has a much higher NPV8 compared to the current market cap (C$265M vs C$18.2M), there is clear appeal in doubling the resource and improving economics. There are several ways like

lowering the cut-off from 1.5% to 1% for the Main zone (which could add up to 5Mt to the mine plan), convert Inferred to M&I or later on to Reserves for the Sumac Zone, as this would add about 4Mt, and add tonnage through drilling at depth, which could add another 1.3-3.6Mt. This could definitely generate tonnage in the realm of 20Mt. Other opportunities are improving recoveries of copper and zinc, FX rates, higher metal prices and further optimization of for example mine plan and opex. On the longer term there is a lot of exploration potential, and even further out there is potential for new discoveries at the newly optioned TCS property not too far away.

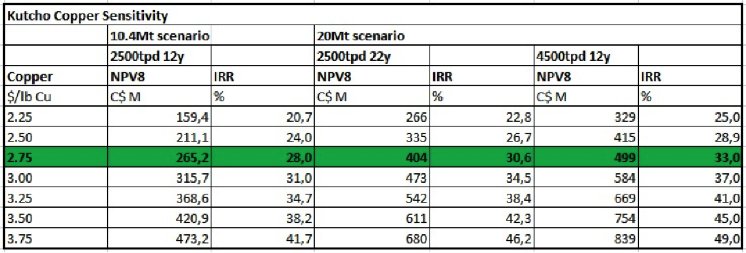

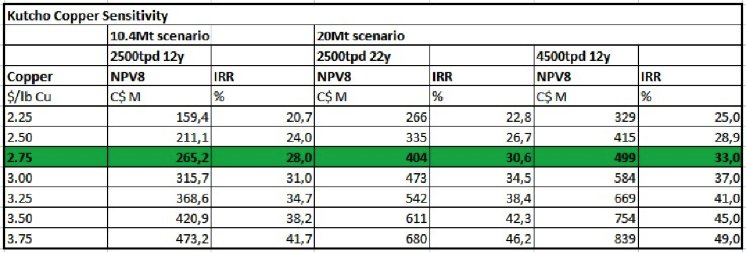

All opportunities considered, when I would use a 20Mt scenario, an 80% Zn recovery rate, a 1.25 exchange rate, a US$2.75 base case copper price and a fixed US$1.10 Zn price, a 2,500tpd throughput scenario for a LOM of 22 years, and a 4,500tpd throughput scenario for a LOM of 12 years, this would be the resulting, familiar, hypothetical sensitivity table:

By running the numbers it shows why developing the 4,500tpd scenario probably is the most economic scenario, followed by potential delineation of more resources (and eventually into reserves) for a longer LOM through exploration.

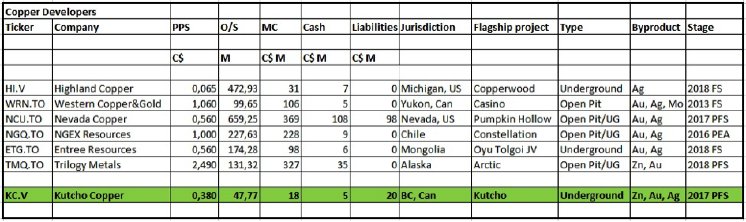

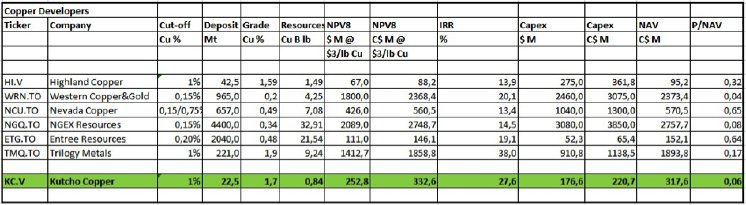

I updated the peer comparison again, despite incredible variation in typical metrics, notwithstanding stage or jurisdiction, at least it represents a brief overview of copper projects:

And:

As a rule of thumb and always the case with peer comparisons, every company has its own story with very specific details, causing valuations the way they are, therefore making it impossible to take comparison results at face value. With the current base case NPV8 of C$265M @US$2.75/lb Cu, and the expanded scenario coming out with the FS in Q2, 2019, I expect the share price to re-rate as a pretty profitable C$400-500M NPV8 at FS level should be reflected more than the current market cap of C$18.2M in my view.

It is again hard to pinpoint to a certain valuation, as I didn't foresee the current, pretty low share price as well. But keep in mind that at some point, the market cap has to make up for the difference between the current market cap and 0.8-1 times NPV8 when commencing commercial production as a rule of thumb. A double when the FS comes out in Q2, 2018 shouldn't be unrealistic at all, maybe depending on sentiment improving by then.

[*] Conclusion

Kutcho Copper has started drilling, is collecting data for the environmental assessment and permitting process, is raising C$4M and is launching MineHub Technologies, together with a powerful syndicate, which could have the potential to disrupt mining industry software. Clearly the company isn't sitting on its hands, and supported by Wheaton Precious Metals the profitable Kutcho Copper project is fast-tracked towards the FS. With the expected estimated resource expansion coming up which in turn will strongly improve economics, it seems a bottom is forming at the moment, and could be setting up Kutcho for a healthy re-rating when the FS comes out next year.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, currently has a long position in this stock, and Kutcho Copper is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kutcho.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.