All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Inomin Mines’ resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Inomin or Inomin’s management. Inomin Mines has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

Inomin Mines announced the non-brokered private placement on May 2, 2023, and intends to raise up to C$600k, consisting of a combination of hard dollar shares (C$0.075) and flow-through (FT) shares (C$0.10). Both have a full 2 year warrant with an exercise price of C$0.15 per share. The FT proceeds will be entirely spent on exploration expenditures at Beaver-Lynx. If drilling is as successful as the last program, and metal prices and market sentiment cooperates, the idea is raise more at better prices right after drill results, in order to keep drilling this time at Beaver-Lynx, and start exploration at La Gitana and/or Pena Blanca at a later stage to provide more or less continuous news flow.

The goal for now is to emulate at least part of the dramatic jump on the last drill results on Beaver-Lynx, as the results of the first five drill holes at the Beaver area last year sent the share price from C$0.105 to C$0.72 in just three trading days late March, 2022, on colossal volume (20.8M shares changed hands, or the company’s entire free float).

Since my last article about Inomin Mines, magnesium prices seem to have bottomed now around 23,000Y/t after the 2021-2022 peak, and already saw a brief spike towards 30,000Y/t which is about US$4400/t.

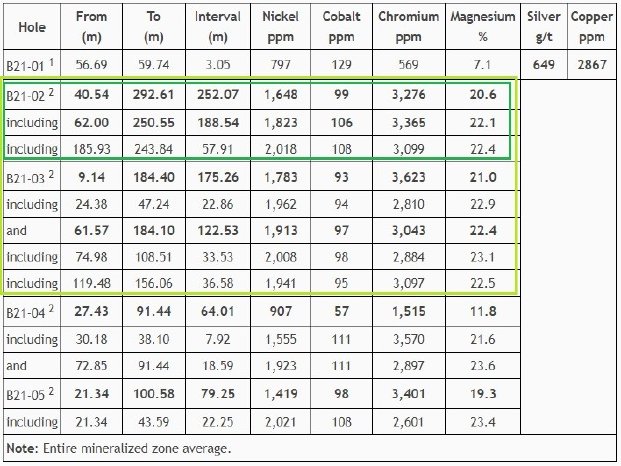

The current magnesium prices would generate a gross metal value of US$707/t at the drilled grades of about 20% Mg, which is equivalent to 8% copper for example, so pretty impressive, especially when 4 out of the 5 drill intercepts at Beaver were ranging from 64 to 252m in length.

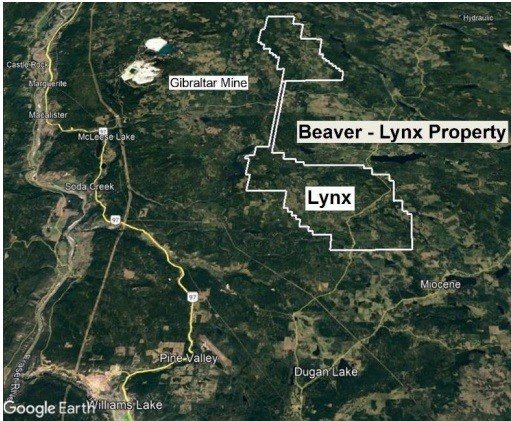

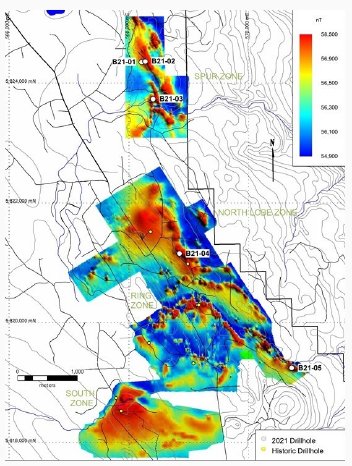

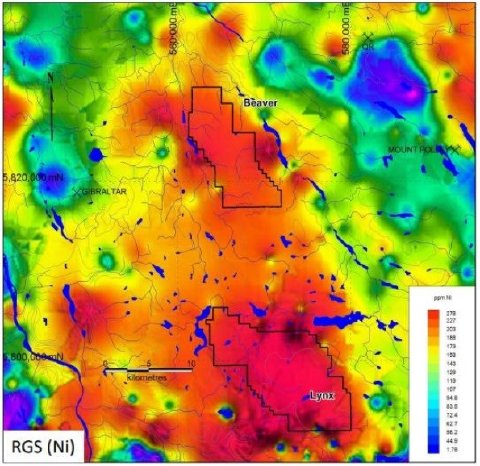

Historic drill holes collared 1-4km to the west confirmed more near surface magnesium and nickel at similar grades, with intercepts varying from 9 to 100.6m in length, indicating large scale mineralized potential. The nearby Lynx area is geologically similar to the Beaver discoveries, with even larger targets.

It is easy to understand that if Lynx could return the same kind of results Beaver showed us or with even better nickel figures, Inomin Mines could be sitting on a monster deposit. Imagine if Lynx could return say a hypothetical 400Mt @ 0.25%Ni, then Beaver and Lynx combined might even provide 1.7-2.0Mt contained nickel, which would put it not too far from Decar (2.4Mt contained nickel @ 013% awaruite DTR nickel (0.21% total Ni), FPX Nickel has a C$114.6M market cap) Or Crawford (3.5Mt contained nickel @ 0.24% sulfides, Canada Nickel has a C$202M market cap). With high-grade magnesium, large volumes of nickel, plus chromium and cobalt credits, Beaver-Lynx already seems to be shaping up as a potentially pretty economic deposit, although it is still very early days of course.

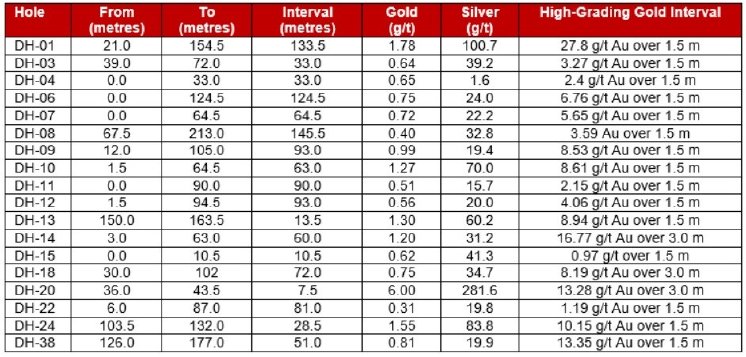

As a reminder, the second flagship project of Inomin Mines is the 100% owned 494 hectare La Gitana project in Oaxaca State in southwestern Mexico with 8,230m of drilling over 38 holes completed in 2005-2006 on the property by former co-owners Chesapeake Gold and Goldcorp. About half of the holes hit significant gold and silver mineralization, most starting close to surface, including the first hole that intersected an impressive 133.5m of 1.78 g/t gold and 100.7 g/t silver. Given available drilling data, just 20% verification drilling (about 6 holes) would be needed for a NI43-101 compliant resource.

I estimated the mineralized potential at 500-600koz Au for now, and management thinks there is even potential for 1Moz Au as the deposit is open to expansion in all directions. As Inomin management is busy renewing the discussions with the local communities, it is hoping to reach an agreement soon in order to resume exploration.

Conclusion

Fortunately, Inomin Mines seems to have found the right partners to raise up to C$600k soon, likely in time to start drilling at Beaver-Lynx soon, when the season is optimal for exploration in the south-central region of BC. The discovery holes for Beaver in 2022 were already impressive, but management thinks the adjacent Lynx target has all the hallmarks for at least the same type of mineralized potential, so I’m definitely looking forward to the drill program. Besides this, it would be good for Inomin to get La Gitana out of hibernation soon, in order to profit from the all-time high gold price. Lots to look out for, so stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a position in this stock. Inomin Mines is a sponsoring company. All facts are to be checked by the reader. For more information go to www.inominmines.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.