The DFS is now well advanced, with completion due in Q1 2024. The deposit is amenable to low-cost mining and processing techniques as a result of the below.

- The resource is significantly larger than previous workers have estimated due to a combination of, a lower cut-off grade (based on lower mining and processing costs as noted below) and newly identified mineralisation to the southwest. As a result, a higher throughput of 5Mtpa has been decided on for the DFS, resulting in economies of scale.

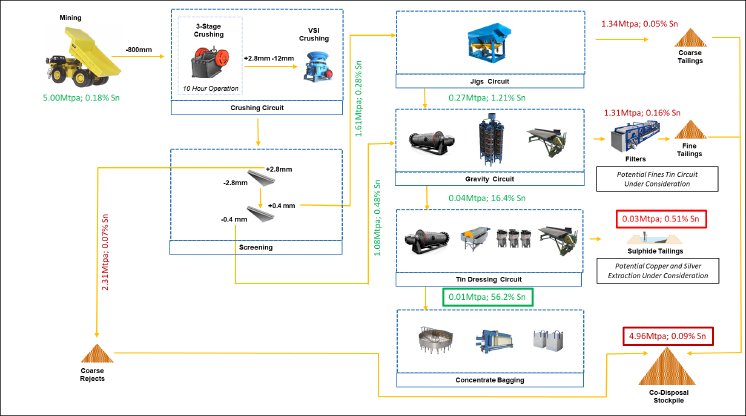

- Further modifications have been made to the gravity circuit in the mineral processing flowsheet which has further simplified the mineral processing characteristics as shown in Figure 1:

- 46% of mass can be rejected after coarse crushing to 12mm.

- 27% of mass can be rejected after jigging the minus 12mm, plus 0.4mm fraction.

- Therefore, the coarse gravity processing facilities (after jigging) only need to handle 27% of the total run of mine mass, resulting in low capital and operating costs.

- This coarse gravity circuit, consisting mainly of spirals, re-grind mills and clean-up tables, rejects a further 26% of the mass, meaning less than 1% progresses to the tin dressing circuit for clean-up.

- We expect these simplifications will improve CAPEX, OPEX and recovery rates when the DFS is published in Q1 2024.

- The above simple circuit upgrades a 0.18% Sn head grade sample to 0.36% after crushing and screening, 0.63% after jigging and before spirals and 16.4% Sn after the spirals and tables (Figure 1). This final 1% can be cleaned up into a 56% or higher tin concentrate in the tin dressing circuit.

- The deposit is mineable by open pit techniques, is located on a hill and has a very low stripping ratio of between 1.1:1 and 1.2:1, making mining costs low.

First Tin CEO Thomas Buenger said: “We are pleased with the DFS outcomes at our flagship Taronga tin deposit, which have validated our assumptions held prior to the study. The simple mineralogy and subsequent mineral processing characteristics, combined with the low strip ratio and open pit mineability of the deposit, make it one of the most straightforward hard rock tin deposits in the world.

The Company has looked at ore sorting, the “go to” technology for most hard rock tin deposits, and we have confirmed that this is not required at our Taronga asset. As a result, the process flow sheet has been simplified, significantly improving CAPEX, OPEX and recovery rates. Due to the large increase in the resource base, economies of scale come into play, and we are currently looking at a throughput of up to 5Mtpa.

We eagerly await the final DFS results in Q1 next year and we look forward to updating shareholders once we have received these.”

Technical Discussion

In summary, the DFS results to date indicate:

- The tin resource has been increased by 240% to 133Mt @ 0.10% Sn containing 138,000t tin using a 0.05% Sn cut-off, as previously reported according to JORC guidelines on 14th September 2023. This includes a maiden measured resource category.

- It has been shown that the deposit contains higher grades and could potentially be mined to a higher-grade cut-off if tin price conditions are such that it becomes necessary. For example, at a cut-off of 0.1% Sn (as previously reported by Aus Tin) the resource is 53Mt @ 0.16% Sn containing 84,000t tin (an increase of 40% over the Aus Tin resource) and at a cut-off of 0.15% Sn, the resource is 22Mt @ 0.21% Sn containing 46,000t tin.

- Results of mineral processing test work have confirmed First Tin’s previous hypothesis that much of the tin is liberated at, and can be concentrated at, a very early stage in comparison to most other hard rock tin deposits.

- In order to keep capital and operating costs as low as possible, it has been decided to focus solely on recovering the coarse tin for the current study, although preliminary work has shown that between 3% and 8% more tin can be recovered if a fine tin circuit is included. This will be examined as a potential add-on once the coarse circuit is operational.

- The process flow diagram (PFD) is therefore very simple and consists of (Figure 1):

- Conventional 3-stage crushing during daylight hours only (in order to reduce nighttime noise and potentially use solar power). This will reduce the run of mine ore to around 12mm in size.

- A 24-hour circuit for the rest of the processing facility consisting of:

- Single pass VSI crushing to scavenge additional tin not previously liberated.

- Screening at 2.8mm and 0.4mm, with all plus 2.8mm material sent to a co-disposal facility, minus 2.8mm to plus 0.4mm material sent to a jigging circuit and minus 0.4mm material sent to a spiral circuit. Jig tailings are also sent directly to the co-disposal facility.

- Grinding of jig con to minus 0.4mm, which is then sent to the spiral circuit.

- Spirals followed by shaking table and cyclone de-sliming, producing concentrates, middlings which are ground to minus 0.15mm and re-circulated, and tailings which are filtered and then sent to the co-disposal facility.

- Clean-up of combined concentrates in a tin dressing circuit consisting of magnetic separation, sulphide flotation and fine tabling. The sulphide tailings are sent to a dedicated storage facility and will be tested for the extraction of silver and copper at a later stage.

- A simplified PFD with approximate annual tonnages is shown in Figure 1.

- Preliminary pit optimisations have shown that a 5Mtpa mining operation is viable producing between 26,000 and 29,000 tonnes of tin metal over a 7-8 year producing mine life.

- Average tin production is expected to be around 3,500tpa during full operation.

- The mining will be by open pit and will have a very low strip ratio of between 1.1:1 and 1.2:1 and will thus have a low cost of production.

- Detailed economics will be published when the DFS is completed, this is currently estimated to be in Q1, 2024.

First Tin is an ethical, reliable, and sustainable tin production company led by a team of renowned tin specialists. The Company is focused on becoming a tin supplier in conflict-free, low political risk jurisdictions through the rapid development of high value, low capex tin assets in Germany and Australia.

Tin is a critical metal, vital in any plan to decarbonise and electrify the world, yet Europe has very little supply. Rising demand, together with shortages, is expected to lead tin to experience sustained deficit markets for the foreseeable future. Its assets have been de-risked significantly, with extensive work undertaken to date.

First Tin's goal is to use best-in-class environmental standards to bring two tin mines into production in three years, providing provenance of supply to support the current global clean energy and technological revolutions.