On the macro side of things, it seems the world economy will be suffering from high inflation for at least a few more aggressive rate hikes by central banks worldwide, until inflation is contained at 3-4% annual levels. As a recession is widely expected to take place in Q1 2023, it is anticipated that demand will falter and prices will go down as a consequence, potentially invoking a pivot from the central banks, with the Fed leading the pack. As interest rates are anticipated to peak around 5%, a period with no rate hikes will probably send the USD lower, which in turn will likely have a positive effect on metal prices, which are all quoted in USD of course. Although I don’t consider the USD a fundamental inverse driver of the gold price, it might very well prove to be a powerful sentiment driver this time, as we might encounter an interesting combination of a lower USD, negative real interest rates and gold as a fear trade, with geopolitical tensions ongoing and lots of bubbles about to collapse. Time will tell.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Banyan Gold’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Banyan or Banyan’s management. Banyan Gold has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

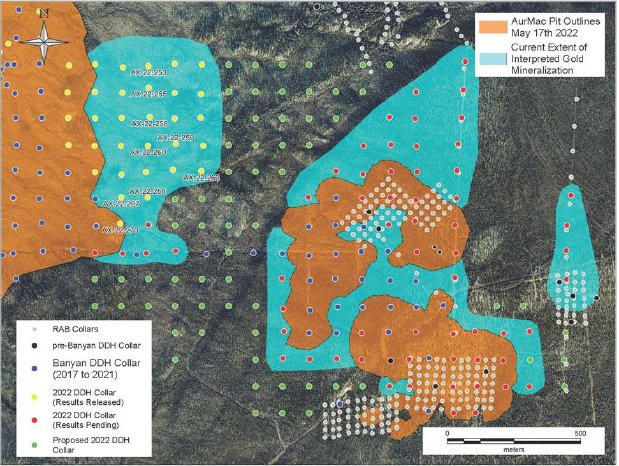

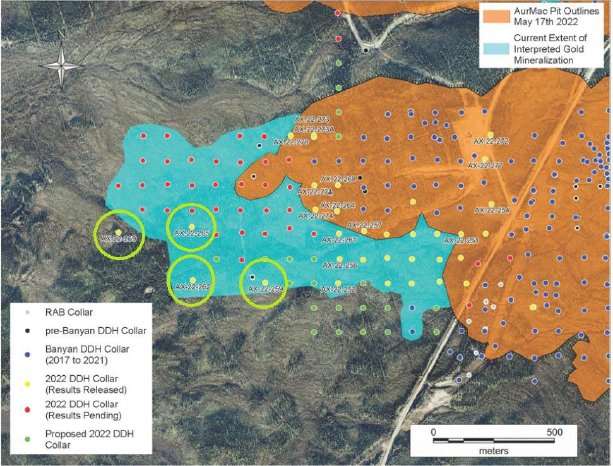

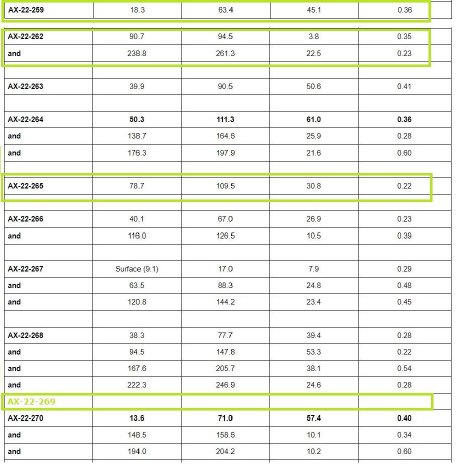

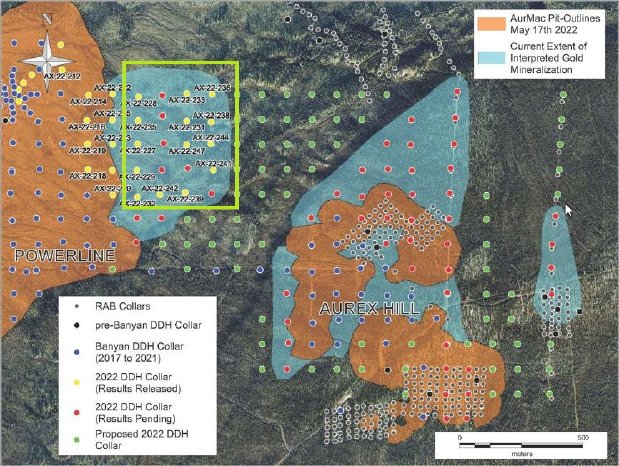

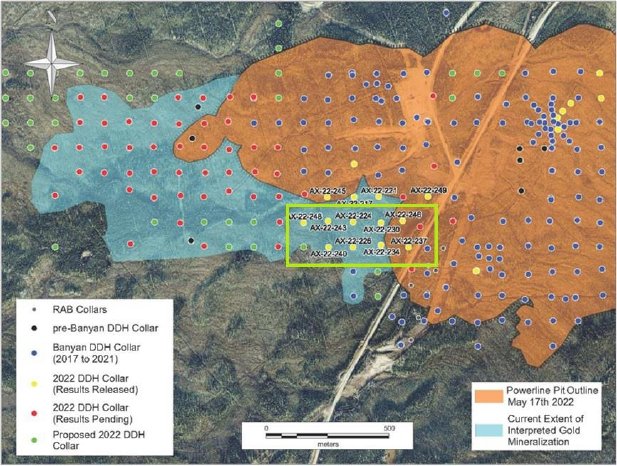

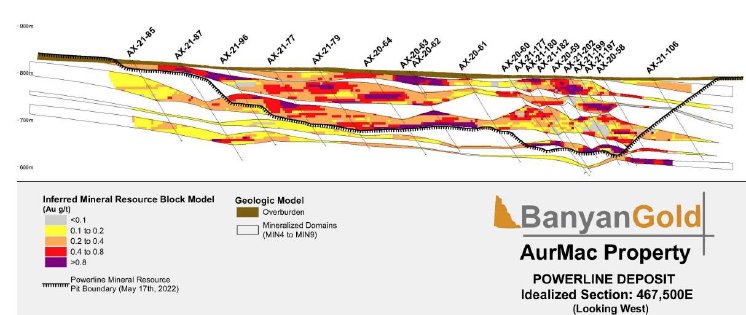

Banyan started its 2022 exploration program on January 26, 2022, and is aiming for 60,000m in total (240holes). 200 drill holes and over 49,000 m of drilling has been completed so far, with a focus on expansion of the near surface mineralization around the Powerline and Aurex Hill Zones, also testing the potential to connect the mineralization footprint of both.

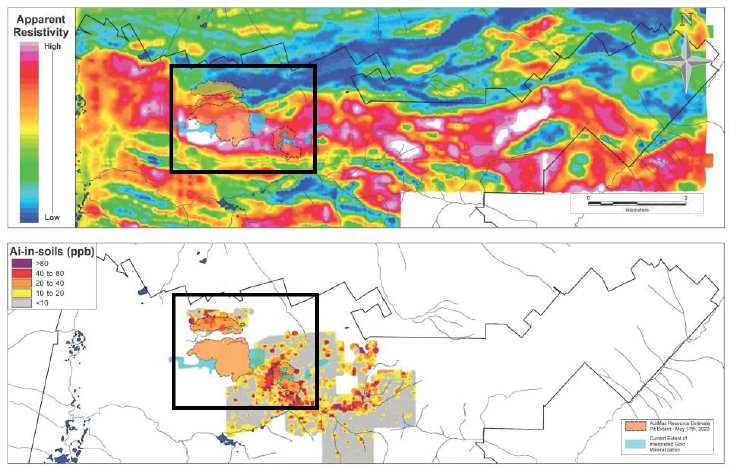

Approximately 10% of the overall 2022 drilling will be focused on high priority regional targets on the AurMac Property and Nitra Property, outside of the Airstrip, Powerline and Aurex Hill Deposits, which will be designed to highlight the larger gold mineralization potential of the AurMac Property. Airstrip, Powerline and Aurex Hill are localized in the black square below, but soil sampling and surveys imply a much larger target.

Weitere Informationtn im Anhang.