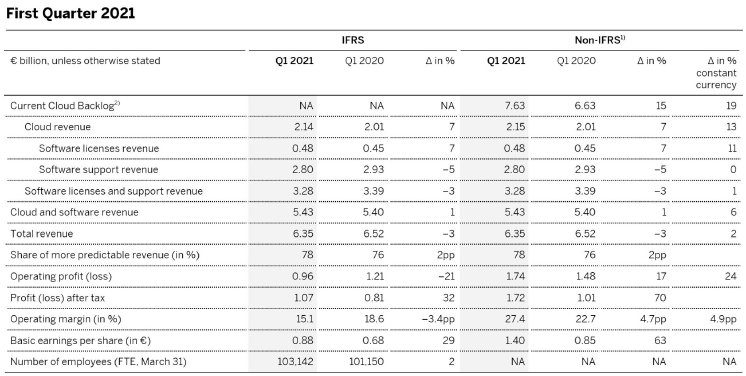

- •IFRS Cloud Revenue Up 7%; Non-IFRS Cloud Revenue Up 13% At Constant Currencies

• IFRS Software Licenses Revenue Up 7%; Non-IFRS Software Licenses Revenue Up 11% At Constant Currencies, Fastest Growth in Five Years

• IFRS Cloud & Software Revenue Up 1%; Non-IFRS Cloud & Software Revenue Up 6% At Constant Currencies

• IFRS Operating Profit Down 21%; Non-IFRS Operating Profit Sharply Up 24% At Constant Currencies

• IFRS Operating Margin Down 3.4pp; Non-IFRS Operating Margin Up 4.9pp At Constant Currencies

• IFRS EPS Up 29%; Non-IFRS EPS Up 63%

• Raises Full-Year Outlook

Christian Klein, CEO

“The first quarter of 2021 was unique in many ways. We had the highest order entry growth across cloud and software in five years while posting the strongest increase in Non-IFRS operating profit and margin in a decade. In the mid term SAP’s expedited shift to the cloud will accelerate topline growth and significantly increase the resiliency and predictability of our business.”

Luka Mucic, CFO

First Quarter Business Update

After an initial review of its first quarter 2021 performance, SAP SE (NYSE: SAP) today announced its preliminary financial results for the first quarter ended March 31, 2021. All 2021 figures in this release are approximate due to the preliminary nature of the announcement.

SAP saw a sharp acceleration in new cloud business across its cloud portfolio, as well as a strong start for ‘RISE with SAP’ which is driving customers’ business transformation in the cloud. Software licenses had strong, double-digit growth at constant currencies. SAP had significant competitive wins in ERP, digital supply chain and across its broader cloud solution portfolio.

Despite the continued impact of global travel restrictions on Concur’s business, SAP’s cloud revenue growth was resilient in the first quarter, up 13% at constant currencies. SaaS/PaaS cloud revenue outside the Intelligent Spend business was up 24% at constant currencies. Looking forward, SAP’s strong new cloud business performance is expected to reaccelerate cloud revenue growth.

Throughout the COVID-19 crisis, SAP continues to serve its customers effectively with an embedded virtual sales and remote implementation strategy. The company retains a disciplined approach to hiring and discretionary spend while capturing natural savings e.g. from lower travel, facility-related costs and virtual events. The prior year included a cost of approximately €36 million in relation to the cancellation of its in-person annual SAPPHIRE NOW and other customer events, as well as normal travel behavior. These factors in combination with the strong topline performance drove materially higher operating profit (non-IFRS at constant currencies) and operating margin both of which were significantly above market expectations.

First Quarter Financial Performance

Current cloud backlog was up 15% to €7.63 billion and up 19% (at constant currencies). Cloud revenue was up 7% year over year to €2.14 billion (IFRS), up 7% to €2.15 billion (non-IFRS) and up 13% (non-IFRS at constant currencies). Software licenses revenue was up 7% year over year to €0.48 billion (IFRS and non-IFRS) and up 11% (non-IFRS at constant currencies). Cloud and software revenue was up 1% to €5.43 billion (IFRS and non-IFRS) and up 6% (non-IFRS at constant currencies). Services revenue was down 18% year over year to €0.9 billion (IFRS and non-IFRS) and down 14% (non-IFRS at constant currencies). This revenue decline reflects the November 2020 divestiture of SAP Digital Interconnect, which contributed approximately €90 million of services revenue (IFRS and non-IFRS) in the first quarter of 2020. Total revenue was down 3% year over year to €6.35 billion (IFRS and non-IFRS) and up 2% (non-IFRS at constant currencies).

The share of more predictable revenue[1] grew by approximately 2 percentage points year over year to approximately 78% in the first quarter.

IFRS operating profit decreased 21% to €0.96 billion and IFRS operating margin decreased by 3.4 percentage points to 15.1% due to higher share-based compensation expenses (primarily related to Qualtrics IPO awards) and restructuring expenses related to the accelerated harmonization of SAP’s cloud delivery infrastructure. Non-IFRS operating profit increased 17% to €1.74 billion, up 24% (non-IFRS at constant currencies) and operating margin increased by 4.7 percentage points to 27.4%, up 4.9 percentage points (non-IFRS at constant currencies).

Earnings per share increased 29% to €0.88 (IFRS) and increased 63% to €1.40 (non-IFRS) reflecting another strong contribution from Sapphire Ventures.

Non-IFRS Adjustments

The total difference between non-IFRS revenue metrics and the respective IFRS revenue metrics results from adjusting the impact of business combination fair value accounting. In the first quarter, the difference between non-IFRS operating profit and IFRS operating profit includes, in addition to the revenue adjustments of €0.00 billion (Q1 2020: €0.00 billion),

- adjustments for acquisition-related charges of €0.15 billion (Q1 2020: €0.16 billion),

- adjustments for share-based payment expenses of €0.47 billion (Q1 2020: €0.09 billion) and

- adjustments for restructuring expenses of €0.16 billion (Q1 2020: €0.02 billion).

Business Outlook

SAP raises its full-year 2021 outlook reflecting the strong new cloud business performance which is expected to reaccelerate cloud revenue growth. The Company continues to expect a software licenses revenue decline for the full year as more customers turn to the “RISE with SAP” subscription offering for their mission-critical core processes. This outlook also continues to assume the COVID-19 crisis will begin to recede as vaccine programs roll out globally, leading to a gradually improving global demand environment in the second half of 2021.

SAP now expects:

- €9.2 – 9.5 billion non-IFRS cloud revenue at constant currencies (2020: €8.09 billion), up 14% to 18% at constant currencies. The previous range was €9.1 – 9.5 billion at constant currencies.

- €23.4 – 23.8 billion non-IFRS cloud and software revenue at constant currencies (2020: €23.23 billion), up 1% to 2% at constant currencies. The previous range was €23.3 – 23.8 billion at constant currencies.

- €7.8 – 8.2 billion non-IFRS operating profit at constant currencies (2020: €8.28 billion), down 1% to 6% at constant currencies.

- The share of more predictable revenue (defined as the total of cloud revenue and software support revenue) to reach approximately 75% (2020: 72%).

This press release and all information therein is preliminary and unaudited.

First Quarter 2021 Quarterly Statement

SAP’s first quarter 2021 quarterly statement will be published on April 22, 2021 and will be available for download at www.sap.com/investor.

Webcast

SAP senior management will host a financial analyst conference call on Thursday, April 22nd at 2:00 PM (CET) / 1:00 PM (GMT) / 8:00 AM (Eastern) / 5:00 AM (Pacific), The conference will be webcast live on the Company’s website at www.sap.com/investor and will be available for replay. Supplementary financial information pertaining to the first quarter results can be found at www.sap.com/investor.

Note to editors:

To preview and download broadcast-standard stock footage and press photos digitally, please visit www.sap.com/photos. On this platform, you can find high resolution material for your media channels. To view video stories on diverse topics, visit www.sap-tv.com. From this site, you can embed videos into your own Web pages, share video via e-mail links and subscribe to RSS feeds from SAP TV.

Any statements contained in this document that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “project,” “predict,” “should” and “will” and similar expressions as they relate to SAP are intended to identify such forward-looking statements. SAP undertakes no obligation to publicly update or revise any forward-looking statements. All forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from expectations. The factors that could affect SAP’s future financial results are discussed more fully in SAP’s filings with the U.S. Securities and Exchange Commission (“SEC”), including SAP’s most recent Annual Report on Form 20-F filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates.

© 2021 SAP SE. All rights reserved.

No part of this publication may be reproduced or transmitted in any form or for any purpose without the express permission of SAP SE. The information contained herein may be changed without prior notice.

Some software products marketed by SAP SE and its distributors contain proprietary software components of other software vendors. National product specifications may vary.

These materials are provided by SAP SE and its affiliated companies (“SAP Group”) for informational purposes only, without representation or warranty of any kind, and SAP Group shall not be liable for errors or omissions with respect to the materials. The only warranties for SAP Group products and services are those that are set forth in the express warranty statements accompanying such products and services, if any. Nothing herein should be construed as constituting an additional warranty.

SAP and other SAP products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of SAP SE (or an SAP affiliate company) in Germany and other countries. All other product and service names mentioned are the trademarks of their respective companies. Please see www.sap.com/about/legal/copyright.html for additional trademark information and notice.

[1] Share of more predictable revenue is the total of non-IFRS cloud revenue and non-IFRS software support revenue as a percentage of total revenue.

1) For a detailed description of SAP’s non-IFRS measures Explanation of Non-IFRS Measures online.

2) As this is an order entry metric, there is no IFRS equivalent.

All figures are preliminary and unaudited. Due to rounding, numbers may not add up precisely.