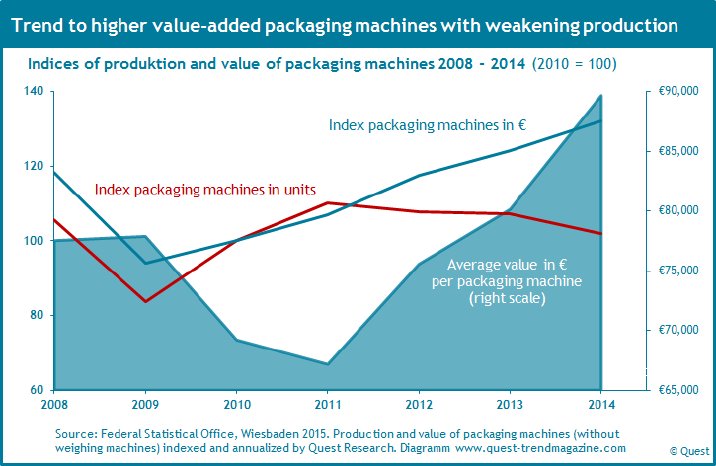

In particular, sales of packaging machines have been surging since 2012 exceeding those of the entire mechanical engineering since 2013. So their sales rose from 2012 to 2014 by 23.5%, that of the mechanical engineering only by 5.3% turning the packaging machines industry to a growth industry in the German mechanical engineering.

This development of production and sales establishes the trend to value-added packaging machines. The average value per packaging machine rises by 34% from €67,000 to €89,000 € from 2012 to 2014.

The report concretizes this trend for cold or warm deep-drawing machines, cartoners and cleaning machines for the beverage industry.

The export markets for packaging machines are more strongly trimmed on growth in the comparison to the mechanical engineering. The export share to the growth-weak European Union clearly lies lower with 28% than that of the machinery industry with 46% and that to the BRIC countries is higher with 20% compared to the mechanical engineering (17%).

The growth expectations of the packaging machine-builders until 2017 are twice as high with 11% per year until 2017 as the average value in the machinery industry with 5.3% per year. These data are based on a representative market survey by Quest TechnoMarketing about the engineering of the machine automation until 2017 in the German mechanical engineering.

The essence of these expectations is not so much their absolute amount, rather than their strong variation. A fifth of the packaging machine-builder does not expect any production growth until 2017. A further fifth sees only an annual growth of fewer than 5%. Over half the packaging machine-builders expects an above average growth of 5% and more.

These non-uniform growth expectations reflect the non-uniform development of the worldwide export markets.

The new Quest report is to support automation manufacturers to consider the current characteristics of this industry for their market processing.

The link to the new report is http://www.quest-trendmagazine.com/...