As a matter of fact, enterprises’ investment decisions are impacted by the trends in the overall economy, which determines whether companies have available budget and access to credit to replace their existing solutions. And, in this situation, vendors with a large “historical” market share indeed have an advantage. If the client is overall satisfied with the vendor, there is a high probability that vendor will not be replaced with another one as switching the vendor can lead to complex — and therefore costly — compatibility and interoperability issues.

Nevertheless, side by side to historical vendors, in several markets regional and local champions show a significant presence. Some are originally local and, later, became global companies, for instance Alcatel-Lucent in France, Siemens in Germany, NEC in Japan, or Samsung in South Korea. But quite a number of other vendors are either only active in their home country — such as Tadiran in Israel or Platan in Poland — or are positioned in a region, such as Karel in MEA.

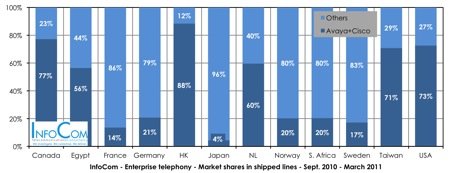

As a matter of fact, there are many markets where Avaya and Cisco, the otherwise two global enterprise telephony leaders, are small or indeed very small players. In Japan, for instance, the cumulated market share of Avaya and Cisco is under 5% as the market is literally dominated by domestic players. Avaya is extremely strong in Hong Kong and together with Cisco, the two vendors virtually control the local market. Not unexpectedly, in the US Cisco holds the largest market share. Other vendors have a strong presence in their country of origin, for instance Aastra (former Ericsson) in Sweden, Alcatel-Lucent in France or Siemens in Germany.

A side note is necessary about Microsoft. Microsoft’s voice offer is still quite in its infancy but Microsoft strategy is clearly to leverage its very strong position in the e-mail arena (MS-Exchange, Outlook and Communicator) to sell also voice solutions. Despite currently such deployments seem indeed quite limited, however, there is no denying that Microsoft has significantly improved its offer (Lync) and that the US software giant has indeed the technical and commercial resources to push it. Although most PBX vendors do not consider Microsoft as a competitor, many of the vendors’ channel partners are actually considering Microsoft as a future, potential player and are seeking to become Microsoft partners or intensify their existing partnership.

About this extract: This extract in based on InfoCom recent study of enterprise markets worldwide. This large-scale research identified major trends regarding IP telephony systems, Unified Communications and cloud services. The study presents major vendors in each country, with market share and positioning by country and region. If you are interested in this report, do not hesitate to get in contact with us. Talk to us. We listen.