Within Africa, Egypt and South Africa posted the largest year-on-year handset shipment growth, at 37% and 32%, respectively. In the Middle East, that honor was taken by the UAE and Qatar, with respective growth of 27% and 32%. "The growth seen in countries like Egypt is due to ongoing economic and political recovery, while for countries like the UAE and Qatar that are still benefiting from successful bids to host Expo 2020 and FIFA 2022, it is simply the result of increased consumer demand stemming from economic growth and tourism," says Nabila Popal, research manager with IDC's Systems and Infrastructure Systems Group.

The remaining MEA countries also posted growth over the same quarter in 2013, despite some - such as Iraq and Syria - experiencing extreme levels of instability. "This universal growth is unique to this technology segment," continues Popal. "This is because phones are no longer simply a means of communication between people. Indeed, smartphones are becoming a way of expression and a window to the rest of the world, and this aspect is proving particularly important in lesser developed countries that are suffering from unrelenting political turmoil."

The Q2 2014 IDC Handsets Quarterly Tracker shows that the UAE, Saudi Arabia, Turkey, and Kuwait are leading the smartphone migration trend, with smartphone share in each country surpassing 75%. But even for countries with lower smartphone penetration levels like Nigeria and Kenya, the share has doubled since this time last year and continues to grow at a rapid pace. "This massive and widespread growth is primarily due to the availability of extremely low-cost smartphones from various Chinese and Indian vendors, while vendors like Samsung, Huawei, and Lenovo have also launched models in the low to midrange price bands," says Popal. "Another factor driving smartphone growth is telecom operators in the region offering better data plans and subsidized phones."

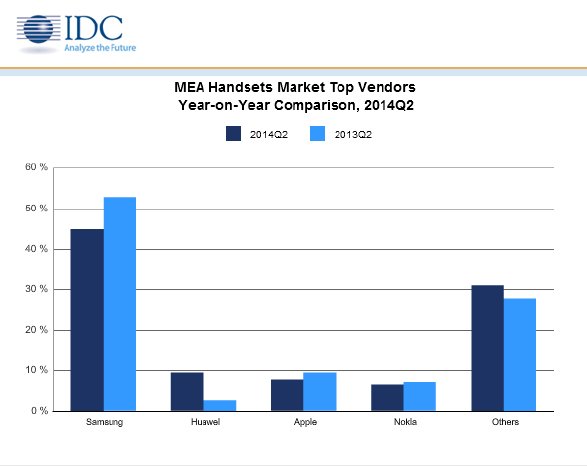

Analyzing the vendor rankings by device type yields an interesting picture. In the smartphone class, Samsung remains the comfortable leader with 45% of the MEA market, but its share is down 8 points from a year ago. At the same time, Huawei's share has jumped from 2% to 10%, putting the vendor in second place, ahead of Apple (8%) and Nokia (6%). BlackBerry continues to suffer, enduring the biggest drop in smartphone market share of all vendors, from over 12% in 2013 to just under 2% this year. In the feature phone segment, Nokia is still top with 35% share, although this is down from 47% in Q2 2013. Techno, Samsung, and Qmobile (a brand from Pakistan) follow in that order, with shares of 11.5%, 10.7%, and 7.3% respectively, all of which also refect year-on-year share declines.

"Samsung's performance can be attributed to the poorer-than-expected performance of its flagship S5 device and overall increase in competition," says Popal. "There are simply more vendors, big and small, this year than there were last year; the market has evolved so fast that it's a completely different ball game now. As more vendors enter the space with better phones and features at ever-decreasing prices, the battle to lead the market will become increasingly fierce."

About the Research

IDC's Europe, Middle East and Africa Quarterly Mobile Phone Tracker® provides a unique insight into the forces shaping the handset and smartphone markets in Western Europe, Central and Eastern Europe, and the Middle East and Africa. The smartphone market is growing rapidly across the region, but while it already takes the lion's share of mobile phone sales in more developed markets, in poorer countries and where mobile operators do not subsidize phone purchases on usage contracts, feature phones are still the majority of sales in units sold. This tracker service will quantify for clients the trends impacting the mobile phone market, and provides, on a quarterly basis, vendor shares, technology trends, and a host of technical breakouts that help vendors and industry players define strategies for tracking the future wireless device market.