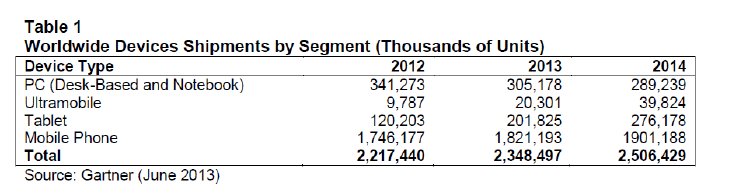

Worldwide traditional PC (desk-based and notebook) shipments are forecast to total 305 million units in 2013, a 10.6 per cent decline from 2012 , while the PC market including ultramobiles is forecast to decline 7.3 per cent in 2013 (see Table 1). Tablet shipments are expected to grow 67.9 per cent, with shipments reaching 202 million units, while the mobile phone market will grow 4.3 per cent, with volume of more than 1.8 billion units. The sharp decline in PC sales recorded in the first quarter was the result of a change in preferences in consumers' wants and needs, but also an adjustment in the channel to make room for new products hitting the market in the second half of 2013.

"Consumers want anytime-anywhere computing that allows them to consume and create content with ease, but also share and access that content from a different portfolio of products. Mobility is paramount in both mature and emerging markets," said Carolina Milanesi, research vice president at Gartner.

Demand for ultramobiles (which includes Chromebooks, thin and light clamshell designs, and slate and hybrid devices running Windows 8) will come from upgrades of both notebooks and premium tablets, such as the Apple iPad or Galaxy Tab10.1. Analysts said ultramobile devices are gaining in attractiveness and drawing demand away from other devices. This will be even more evident in the fourth quarter of 2013 when the combination of new design based on Intel processors Bay Trail and Haswell running on Windows 8.1 will hit the market. Although these devices will only marginally help overall sales volumes initially, they are expected to help vendors increase average selling prices (ASPs) and margins.

The tablet and smartphone markets are facing some challenges as these devices gain longer life cycles. There has also been a shift as many consumers go from premium tablets to basic tablets. The share of basic tablets is expected to increase faster than anticipated, as sales of the iPad Mini already represented 60 per cent of overall iOS sales in the first quarter of 2013.

"The increased availability of lower priced basic tablets, plus the value add shifting to software rather than hardware will result in the lifetimes of premium tablets extending as they remain active in the household for longer. We will also see consumer preferences split between basic tablets and ultramobile devices," said Ranjit Atwal, research director at Gartner. "With mobile phones, volume expectations for 2013 have been brought down as the life cycles lengthen as consumers wait for new models and lower prices to hit the market in the Autumn and holiday season. The challenge in the smartphone market is also that, as penetration moves more and more to the mass market, price points are lowering and in most cases so do margins."

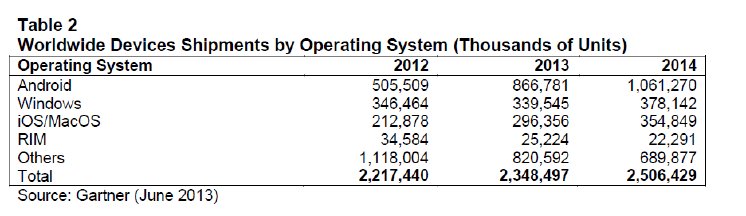

"Although the numbers seem to paint a clear picture of who the winner will be when it comes to operating systems (OS) in the device market (see Table 2), the reality is that today ecosystem owners are challenged in having the same relevance in all segments," said Ms. Milanesi. "Apple is currently the more homogeneous presence across all device segments, while 90 per cent of Android sales are currently in the mobile phone market and 85 per cent of Microsoft sales are in the PC market."

Additionally, with enterprises' growing acceptance of bring your own device (BYOD), there is an increase in consumer-owned devices in the computing world. Gartner forecasts that computing devices bought by consumers will grow from 65 per cent in 2013 to 72 per cent in 2017. This signifies the growing importance of designing for the consumer inside the enterprise.

Gartner's detailed market forecast data is available in the report, "Forecast: Devices by Operating System and User Type, Worldwide, 2010-2017, 2Q13 Update." The report is on Gartner's web site at http://www.gartner.com/resId=2524916.