- The Swiss Payment Monitor of Zurich’s University of Applied Sciences and the University of St. Gallen shows a strong growth rate for credit card usage and contactless payments in 2019

- Neobanks are accelerating this trend

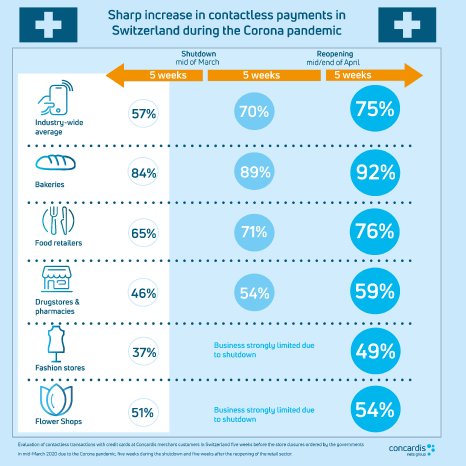

- Concardis merchant transactions also confirm this development in 2020, particularly as a result of the Covid-19 pandemic: across all sectors, 75 percent of credit card payments in Switzerland are currently contactless

- Before the shutdown the proportion of contactless credit card payments was still 57 percent

The data of the representative study was collected at the end of 2019 and thus before the Covid-19 pandemic. As one of the leading payment service providers in Switzerland and the entire DACH region, Concardis has analysed the transaction figures of its affiliated merchants before, during and after the state-ordered shutdown.

Three out of four credit card payments contactless

The analysis shows that the results of the Swiss Payment Monitor survey are not only reflected in practice, but that the contactless rate there has reached a completely new level since the pandemic: "The trend towards more contactless credit card payments, which has been continuing for years, was rapidly accelerated by the Covid pandemic: within only three months the proportion of contactless credit card transactions in Switzerland rose from 57 percent to just under 75 percent," says Marianne Bregenzer, Country Manager Concardis Schweiz AG.

This means that three out of four credit card payments are now implemented contactlessly. Individual sectors such as food retailing or bakeries even exceed this rate (76 percent and 92 percent respectively).

Contactless rate continues to rise even after easing

During the shutdown imposed in Switzerland in mid-March due to the Covid pandemic, in those stores that remained open the proportion of contactless payments rose rapidly. The figures after the shutdown show that this is not a short-term precautionary measure on the part of consumers: "After the retail trade was allowed to gradually reopen from the end of April, the figures show that this behaviour has become a habit and the proportion of contactless transactions is even rising further," says Bregenzer.

Even in those sectors where contactless payment tended to be less common over many years, frequently the sole method of payment is now the smartphone or card held in front of a card reader: in clothes shops, for example, around half of all credit card payments are currently processed contactlessly – before the state-ordered closures the figure was only 37 percent.

New payment behaviour is already normal everyday life

"In the Nets Group, we are familiar with such a level of contactless transactions from the Nordic countries, where this has been part of everyday life for years," says Bregenzer and adds: "Now this payment behavior is also becoming more firmly established in Switzerland and the entire DACH region and is part of the New Normal," says Bregenzer.

The results of the Swiss Payment Monitor survey show that even before the pandemic, the image of the credit card was already on the rise and reservations about contactless payment were decreasing. However, it is already becoming apparent that in 2020 this process has moved forward by leaps and bounds – exactly how will be shown by the results of next year’s Swiss Payment Monitor.