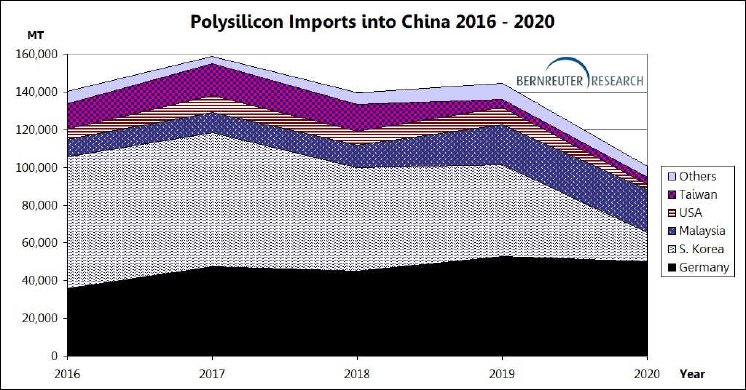

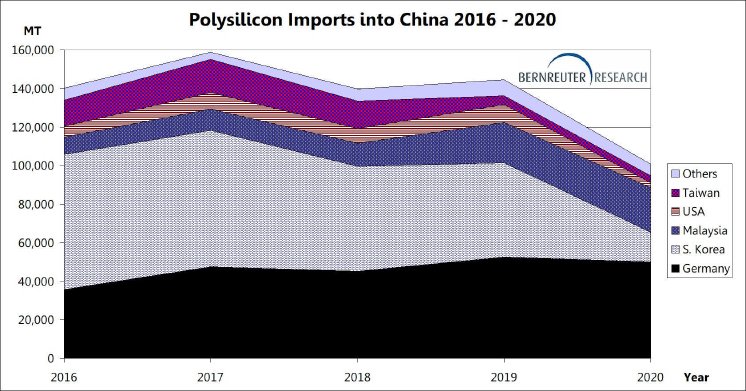

“Although South Korea still exported sizeable volumes from inventories to China throughout the year, the shutdown of a production capacity of 60,500 tons – at OCI and Hanwha in the first quarter – has left its trace,” says Johannes Bernreuter, head of Bernreuter Research and author of the Polysilicon Market Outlook 2024, the new report from the polysilicon market expert.

High industrial electricity rates in South Korea forced both OCI and Hanwha Solutions to announce in February 2020 that they would terminate the power-hungry production of solar-grade polysilicon in the country. As a result, South Korean polysilicon exports to China plummeted from 48,881 MT in 2019 to 15,331 MT in 2020. They had still been above 70,000 MT at the height in 2016 and 2017 before the country’s third polysilicon manufacturer, Hankook Silicon, became insolvent in 2018.

“South Korea’s polysilicon industry was outcompeted by Chinese producers who enjoy extremely low and subsidized electricity rates from coal-fired power plants in the western regions of Xinjiang and Inner Mongolia,” says Bernreuter. Inverse to South Korea’s demise, China’s share in the global output of solar-grade polysilicon rose from 55% in 2017 to 80% in 2020.

Polysilicon imports from the USA into China, already weighed down by prohibitive duty rates since a loophole was closed in 2015, also fell sharply from 9,227 MT in 2019 to 2,659 MT in 2020. The steep decline obviously reflects the shutdown of REC Silicon’s plant in Moses Lake, Washington in July 2019.

Although the German polysilicon plants of Wacker ran at a reduced utilization rate of 70% from May through July 2020, imports from Germany receded only slightly from 52,667 MT in 2019 to 50,061 MT in 2020 as the company drew down inventories in the second half of the year. Wacker’s share in total polysilicon imports into China increased to 50% – the same share South Korea had at its peak in 2016.

Besides Wacker, only OCI’s subsidiary in Malaysia is still a substantial importer; its share climbed to 23% in 2020. “We expect that the combined import share of Wacker and OCI Malaysia will approach 90% in 2021,” predicts Bernreuter.

Chinese import data since 2010 and in-depth analysis of the impact of duties on the polysilicon market are provided in The Polysilicon Market Outlook 2024. The 76-page report contains sophisticated scenarios of supply and demand, detailed forecasts of polysilicon prices and cash production costs through 2024 as well as the latest developments of the dominant Siemens process, fluidized bed reactor (FBR) technology and upgraded metallurgical-grade (UMG) silicon. For more information on the report, please go to:

https://www.bernreuter.com/polysilicon/industry-reports/polysilicon-market-outlook-2024/